@Multibagger hope this works well and goes to the moon

Debate sobre INOD

Puestos

39Does Innodata have further potential?

I think so. For me, it is $INOD (-11,68 %) one of the most interesting stocks in the AI sector. There are also other assessments that underpin this.

Aktienwelt360 - When people talk about artificial intelligence, many people first think of Nvidia, OpenAI or Microsoft. But while these giants dominate the headlines, there is a company working in the background that is providing the foundation for all their advances: Innodata (WKN: 907651). I've looked at the numbers, the strategy and the risks - and one thing is for sure: if you really want to understand the AI revolution, Innodata is a must-have.

From niche service provider to key AI player

Innodata has been around for over 35 years, but it was only with the rise of generative AI that the company found its place in the spotlight. Today, it provides data engineering services that are essential for training and fine-tuning AI models. It sounds technical - but at its core, it's simple: Innodata transforms huge amounts of raw data (text, images, videos, sensor information) into 'clean', AI-ready datasets.

This work is crucial, because without high-quality training data, even the best algorithms remain blind. This is precisely why five of the Magnificent Seven now rely on Innodata.

The business model is bearing fruit

Turnover rose from 86.8 million US dollars (2023) to 170.5 million US dollars (2024) - a growth of 96%. Even more impressive: a loss of USD 0.9 million turned into a net profit of USD 28.7 million.

This trend will continue in 2025. In the second quarter alone, turnover amounted to USD 58.4 million, an increase of 79% compared to the previous year. Net profit climbed to USD 7.2 million, following losses in the previous year. The EBITDA margin is now over 20% - a strong signal of operational efficiency.

The secret

What makes Innodata special is its human-in-the-loop approach. This combines automated processes with human expertise. More than 6,000 specialists check and correct data to make AI systems more robust, more precise and less prone to error.

This is not an old-fashioned approach - on the contrary. Especially when it comes to bias, ethical issues or highly complex content, human control remains indispensable. Innodata has developed a scalable business model that combines efficiency and quality.

Strategic key accounts and record contracts

Innodata has built up enormous contract volumes in a short space of time. A contract with a volume of USD 8 million began in 2023 - the same customer now generates USD 135 million annually. Further programs worth USD 20 million (April 2024) and USD 44 million (June 2024) were added.

However, this success also harbors risks: The two largest customers together contribute more than half. If one of these tech giants were to drop out, the consequences could be severe.

A market with enormous potential

The market for AI training data is growing rapidly. Current studies estimate annual growth rates (CAGR) of between 20 and 25 % - from just under USD 2.7 billion at present to up to USD 16 billion by 2032. The submarket for synthetic data is particularly exciting and is forecast to grow by over 40 % annually.

Innodata is well positioned in both areas. The company is evolving from a pure data provider into a smart data specialist that analyzes AI models, identifies weaknesses and provides targeted data sets for improvement.

The competition is intense

Scale AI, Appen, Labelbox, SuperAnnotate and iMerit are all vying for market share. Scale AI in particular is considered a powerful rival - the company was recently valued at USD 29 billion and received a USD 14 billion investment from Meta.

Innodata, on the other hand, is pursuing a platform-independent strategy that enables cooperation with various players such as Alphabet, OpenAI and Meta. This reduces the risk of conflicts of interest and increases flexibility.

The next step

While many competitors are still working with traditional training data, Innodata is already preparing for the next generation of AI: Agentic AI. These systems can initiate and execute tasks independently - without constant human intervention.

This creates completely new requirements in terms of data quality, security and control. Innodata wants to play a leading role here - especially in ensuring that AI agents act reliably and ethically.

My conclusion

For me, Innodata is not a classic AI hype title, but a true infrastructure champion in the industry. Without companies like this, neither ChatGPT nor Copilot or Gemini could function reliably.

Anyone who believes in the long-term success of artificial intelligence will find a profitable, agile and intelligently managed company here that is in exactly the right segment.

First tranche of Momentum shares

The trend-following project I mentioned entered its first round today with the following ten stocks:

AeroVironment $AVAV (-2,23 %) , AppLovin $APP (-6,13 %) , Innodata $INOD (-11,68 %) , IREN $IREN (-9,15 %) , Kraken Robotics $PNG (-6,44 %) , Micron Technology $MU (-6,96 %) , Oklo $OKLO , Ondas $ONDS (-12,99 %) , Nebius $NBIS (-5,26 %) and Robinhood $HOOD (-9,88 %) . Each equally weighted, in a Trading212 Pie.

In my opinion, these companies had solid ratios and met the desired technical metrics (mostly beta > 1.5 ; 1M performance > 20% ; price > 50EMA).

Hopes / forecasts:

The model is designed to avoid the severe drawdowns that normally accompany high risk high reward stocks. The stocks have been selected so that all have a distance of about 15% from their 50d EMA.

To explain: the EMA is a moving average that reacts more strongly to trends or trend changes. In my experience, it often serves as support and a downward break may indicate a trend reversal.

This is theoretically perfect for this model: as long as the share is trading above its EMA, it is in a sustained uptrend (which the model wants to "surf" 🏄♂️); if it falls below it, it is sold. This mechanism therefore acts more or less like a dynamic trailing stop loss.

However, this should not happen immediately, as all shares are still above this average.

No investment advice, this is still an experiment. Updates to follow.

Boosting returns with momentum shares?

I would like to start a little experiment: I normally avoid individual stocks as I don't have the expertise to successfully deal with fundamental analysis.

However, as I still want to profit from stocks with strong momentum, I have come up with the following rule:

- About 30 stocks that have strong momentum right now (e.g. >20% over one month & >30% over three months) are bought, larger market cap is preferred.

As a hedge:

- If a stock falls below its 50d-EMA (Exponential Moving Average), the respective capital is shifted back into cash.

Fundamental data is deliberately ignored here, only momentum is taken into account in order to keep the whole thing as simple as possible. What do you think? Especially @Tenbagger2024 from whose posts I got the inspiration for this.

My 10B model: This is how I try to find possible tenbagger candidates

Reading time: approx. 6-8 minutes

The 10B model is my attempt to systematically identify tenbagger candidates. The aim is to find companies that realistically have the potential to grow tenfold over the next few years. Of course, this will only work for very few - but even one hit can shape a portfolio.

The basic rule: size matters. A tenbagger rarely starts at 200 billion market capitalization. The entry hurdle in the model is therefore less than 10 billion euros. Companies in the EUR 1-5 billion corridor are the most exciting because they still have growth potential but are no longer pure early-stage gambles.

I set up the screening with ChatGPT - for data collection, pre-filtering and peer comparisons. Exciting candidates are followed by manual checks: annual reports, management calls, competitive position, balance sheet quality.

Criteria (scoring 0-20 points each, 100 in total):

- Growth & profitability: strong sales growth (ideally > 20% p.a.) and progress in profitability. Ideally, the Rule of 40 (sales growth % + operating margin % > 40) is fulfilled.

- Moat: sustainable competitive advantage (technology, network effects, market access, regulation).

- Market size: addressable market ideally ≥ 10× current market capitalization.

- Financial stability: solid balance sheet, debt ratio < 3× EBITDA, sufficient cash buffer.

- Valuation & momentum: multiples vs. growth, downside scenario, timing (e.g. RSI).

Interpretation: > 80 points = real 10B candidate; 70-79 = watchlist material; < 70 = mostly quality stock without tenbagger potential.

$INOD (-11,68 %) Innodata - ≈ USD 2.7 bn / ≈ EUR 2.28 bn - 74 points (in the portfolio)

Growth & profitability: 15/20 - strong double-digit growth, but still volatile.

Moat: 12/20 - niche IP and data sets, but no insurmountable moat.

Market size: 17/20 - AI data services highly scalable.

Financials: 12/20 - freshly profitable, but still volatile.

Valuation & Momentum: 18/20 - very hot (RSI > 70).

Exciting stock, but the momentum masks the financial fluctuations - watchlist for me, not core.

$AMPX Amprius Technologies - ≈ USD 1.6 bn / ≈ EUR 1.36 bn - 73 points (watchlist)

Growth & profitability: 15/20 - great potential in the battery and aviation sector, still early stage.

Moat: 16/20 - technology clearly differentiated, provides lead in certain segments.

Market size: 18/20 - batteries remain a global multi-billion topic.

Financials: 8/20 - high CapEx, no positive cash flow yet.

Valuation & Momentum: 16/20 - volatile but attractive valuation.

An exciting innovation stock - if the transition from pilot to series production is successful, this could be exciting.

$NXE (-0,58 %) NexGen Energy - ≈ USD 5.0 bn / ≈ EUR 4.26 bn - 76 points (watchlist)

Growth & profitability: 14/20 - no revenues yet, but clear leverage at project start.

Moat: 15/20 - high-quality uranium reserves, strong project know-how.

Market size: 18/20 - uranium is experiencing a global surge in demand.

Financials: 12/20 - good cash, but dilution risks after capital rounds.

Valuation & Momentum: 17/20 - positive sentiment in the uranium sector, clear trend.

NexGen is closely linked to my contribution to the uranium supercycle - for me one of the most exciting levers in the energy sector.

$NICE NICE Ltd - ≈ USD 9.1 bn / ≈ EUR 7.77 bn - 79 points (watchlist)

Growth & Profitability: 18/20 - Cloud & AI drive CX platform, Rule of 40 fulfilled.

Moat: 17/20 - technological depth, high customer loyalty.

Market size: 18/20 - huge CX/AI potential.

Financials: 16/20 - strong cash flow and margins.

Valuation & Momentum: 10/20 - expensive, timing is critical.

Top quality - but I would be patient and wait for better entry windows.

$NU (-3,45 %) Nu Holdings - ≈ 73-75 bn USD / ≈ 62-64 bn EUR - 85 points (in portfolio)

Growth & Profitability: 19/20 - high double-digit customer growth, profitability significantly improved.

Moat: 15/20 - strong brand and network effects, but intense competition.

Market size: 20/20 - Latin America with huge address market; US expansion underway.

Financials: 16/20 - stable margins and high capital ratio.

Valuation & momentum: 15/20 - ambitious, but covered by growth.

A quality stock and good benchmark for the model - but at over EUR 60 bn no longer a classic 10B candidate; a tenfold increase from this level is unlikely.

These examples show how differently candidates perform in the 10B model. INOD, AMPX, NXE and NICE are between 73 and 79 points and are therefore exciting watchlist material with clear triggers. NU stands out with 85 points, but no longer fulfills the original "below 10 billion" rule - here I am more interested in confirmation that the model criteria work and that a company can grow strongly in the long term.

The 10B model is not a promise of returns, but a tool for filtering out the most exciting companies at an early stage and then critically examining them. The combination of systematic screening and manual analysis ensures that fantasy and reality are clearly separated - and in my opinion, this is where the best opportunities arise.

Next, if there is interest, I will introduce my Hidden Quality Radar (HQR) - a framework that attempts to identify "under the radar" quality scores through 100-point scoring and link them to visibility factors.

What do you think of the approach - and which small/mid caps under 10 billion would you currently place in the 10B category?

for your great effort.

I also follow this approach to some extent. However, I only include these stocks in my portfolio as satellites.

NU with almost 50 billion market cap. Of course, it's not a small cap, but it still has the potential.

Have you been able to beat the NASDAQ with your approach so far, and have you been successful?

Shovel manufacturers - why I rely on the enablers

Reading time: 2-3 minutes

On the stock market, the spotlight is usually on the companies that sell their products directly to customers. However, I find the companies in the background more exciting - the shovel manufacturers who make the actual operation possible in the first place. That's where I see the more stable opportunities in the long term.

A prime example is $ASML (-5,06 %) (ASML Holding). Their lithography machines are the backbone of the semiconductor industry. Without them, there would be no chips for smartphones, AI models or e-cars. With a gross margin of over 50% and a virtually unrivaled market position, they are the epitome of a shovel manufacturer for me. Of course, the share price is not cheap, but I see a long-term fundamental investment here.

Then $GOOG (-3,33 %) (Alphabet). Many label Alphabet as an advertising company, but for me they are the digital infrastructure par excellence. Billions of people access Google Search and YouTube every day. What I find even more exciting is the Google Cloud, which is now growing by over 30% and is a key driver for future AI applications. There are also exciting projects and topics such as quantum computing and autonomous mobility. Anyone scaling into the internet or AI can hardly avoid Alphabet - and that's exactly what makes it a shovel manufacturer in the digital age.

And last but not least $INOD (-11,68 %) (Innodata). Much smaller, but interesting for precisely that reason. They supply data processing and training pipelines for AI - the raw material that big tech companies urgently need. The share price has risen massively in the last month, so I have reduced the position. But the story remains exciting: Innodata makes data usable and thus provides the shovels in the AI gold rush.

For me, the pattern is clear: shovel manufacturers benefit from major trends because they provide the tools without having to bear the risks of individual end products themselves. They often have a technological edge that makes them difficult to replace, and it is precisely this combination of stability and growth that makes them attractive in the long term.

How do you see it - do you tend to focus on the enablers in the background or on the companies that are directly at the forefront of new trends?

My way to €100,000! Update!

Good morning community!

I've actually never had so many 100 or more percenters in my portfolio at the same time as I do at the moment. Today there are 2 more. One of them is $INOD (-11,68 %) .

The other is $USA RareEarth. Which strangely enough never works as a link here at GQ.

This run of success means that I reached the magic mark of 100% YTD this morning.

Please note that this is only a snapshot and could be significantly lower again in 2-3 weeks. The risk I am taking should not be underestimated.

Have a fantastic holiday, those of you who have one, with good profits on everything you do today.

I think it is crucial for you to take as much as possible with you as long as the market harmonizes with your strategy and to make the jump as soon as the harmony is over.

I've been through a phase like yours before (99-00), but didn't make the jump. In the end, I was back on track. 😅

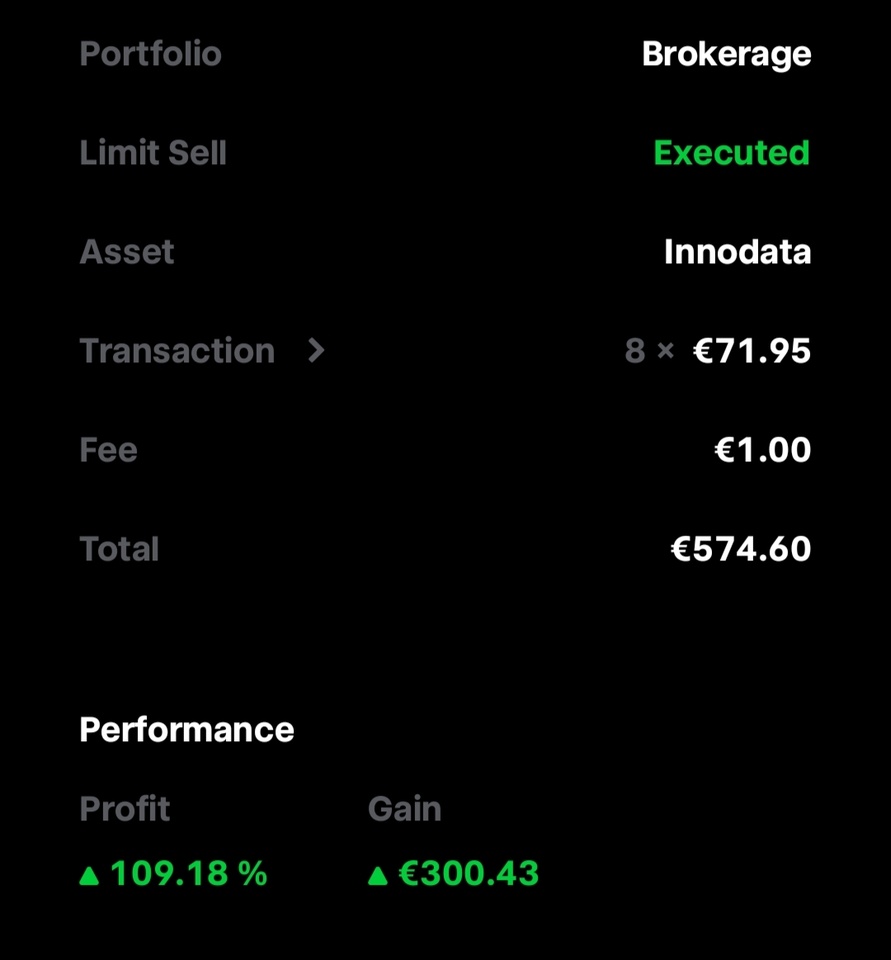

Small win

$INOD (-11,68 %) is running a bit hot, so taking small tax-free profits and letting the rest run.

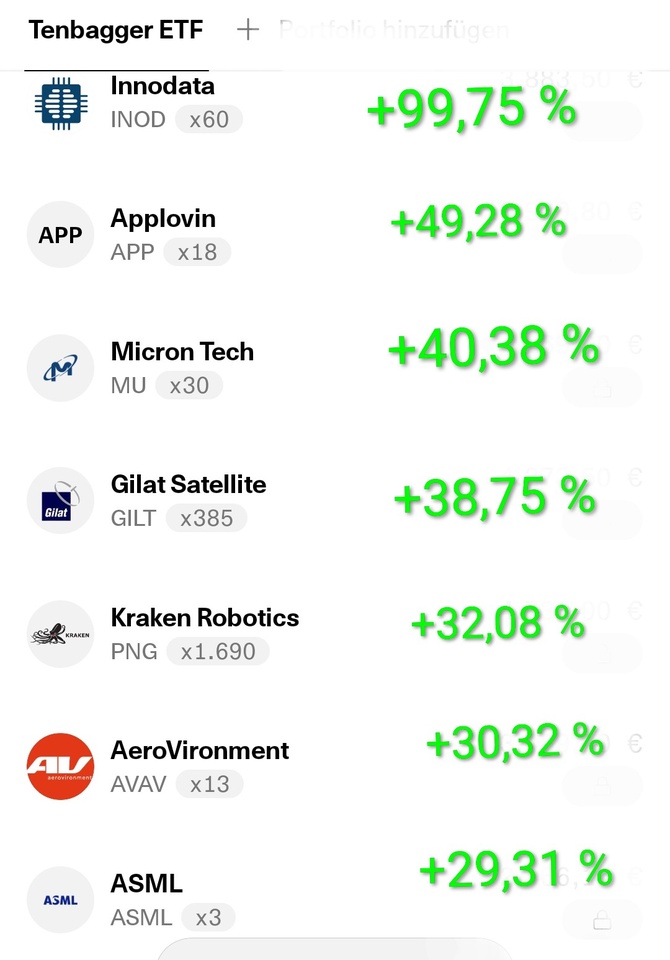

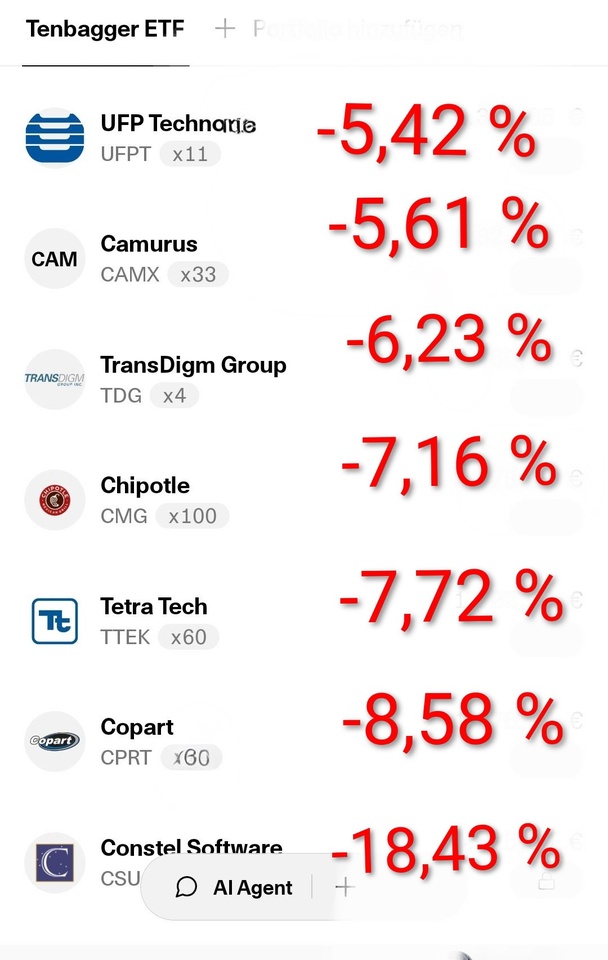

September tops and flops in the Tenbagger ETF

Hello my dears,

September is over.

That's why I'd like to give you a little overview of the month.

Tops: 📉

$INOD (-11,68 %)

$APP (-6,13 %)

$MU (-6,96 %)

$GILT (-4,1 %)

$PNG (-6,44 %)

$AVAV (-2,23 %)

$ASML (-5,06 %)

Flops: 📈

$UFPT (-1,05 %)

$CAMX (-1,75 %)

$TDG (-0,29 %)

$CMG (-3,56 %)

$TTEK (-1,35 %)

$CPRT (-1,21 %)

$CSU (-0,41 %)

It was noticeable in September that there were a lot of long runners and compounders among the flops. For this reason, I am relaxed for the time being and will stick to the values.

📉

My overall portfolio closed the month up 8.64 %.

$EQQQ (-4,82 %) NASDAQ 100. +4.81 %

$IWDA (-3,61 %) MSCI World. +2,62 %

But how do you arrive at "only" +8.6% with the high returns of the winners? Are there so few or so little weighted?

Valores en tendencia

Principales creadores de la semana