🔹 Revenue: $3.12B (Est. $3.02B) 🟢; UP +9% YoY

🔹 EPS: $2.11 (Est. $2.06) 🟢; UP +15% YoY

Guidance

🔹 FY25 EPS: $8.06 (Est. $8.01) 🟢

🔹 Q4’25 EPS: $2.03 (Est. $2.00) 🟢

Puestos

16Following the rebalancing of the S&P Quality Aristocrats last Friday, the following stocks were removed from or added to my two ETF indices (50% weighting):

New additions:

$QDEV (+0,22 %): $NOVN (-0,92 %) , $REL (+1,13 %) , $ITX (+1,51 %) , $LSEG (+4,15 %) , $DB1 (+1,48 %) and more

$QUS5 (+0,53 %): $BKNG (+0,79 %) , $MRK (+0,47 %) , $CRM (-0,2 %) , $UNP (-1,31 %) , $COR (+1,21 %) , $CAH (+3,64 %) and more

Kicked out of both indices and therefore according to S&P no longer Quality Aristocrats are among others: $BATS (-0,17 %) , $7974 (-1,81 %) , $HD (+0,3 %) , $LOW (-0,48 %) , $HLT (+0,89 %)

In addition, the allocation of all individual stocks in the indices was reduced again to max. 5 % was limited.

Thanks to the recent rally of $$HY9H (+7,43 %) my current top 10 weighting (ETFs+shares) is as follows:

3.48% Alphabet

3.04% SK Hynix

3.04% Broadcom

2.93% Meta

2.75% Microsoft

2.71% Apple

2.71% NVIDIA

2.55% Taiwan Semiconductor

2.13% Mastercard

2.08% Visa

New portfolio key figures:

P/E: 27.1 (<30) 🟢

Forward P/E: 21.1 (<25) 🟢

P/Β: 11.5 (<5) 🔴

EV/FCF: 28.7 (<25) 🟡

ROE: 42% (>15%) 🟢

ROIC: 19% (>15%) 🟡

EPS growth for the next 5 years: 15% (>7%) 🟢

Sales growth for the next 5 years: 9% (>5%) 🟡

My internal rate of return is currently 20.19%

The semi-annual rebalancing of the SPDR S&P Developed Quality Aristocrats ETF ($QDEV (+0,22 %) ) has just been completed, bringing notable changes to the composition of this quality-focused investment vehicle.

Outgoing Companies:

Incoming Companies:

This rebalancing aligns QDEV with evolving market conditions while maintaining its focus on quality companies with strong financial foundations. For investors seeking exposure to financially robust global corporations, these changes appear strategically sound, particularly with the inclusion of resilient tech giants and hospitality leaders positioned for growth.

Will this prove to be a winning choice? The fundamentals certainly suggest so.

The following shares reached a new 52-week high in the course of yesterday:

Meta $META (+0,43 %)

Netflix $NFLX (-1,63 %)

Costco $COST (-1,01 %)

Walmart $WMT (-0,72 %)

Crowdstrike $CRWD (+0,86 %) (forgot what happened in the summer)

Spotify $SPOT (-4,01 %)

Hims & Hers $HIMS (+1,06 %) (now the best stock YTD)

Duolingo $DUOL

Hilton $HLT (+0,89 %)

Interactive Brokers $IBKR (+2,32 %)

Moody's $MCO (+0 %)

Sharkninja $SN

Congratulations to all investors and Happy Weekend!

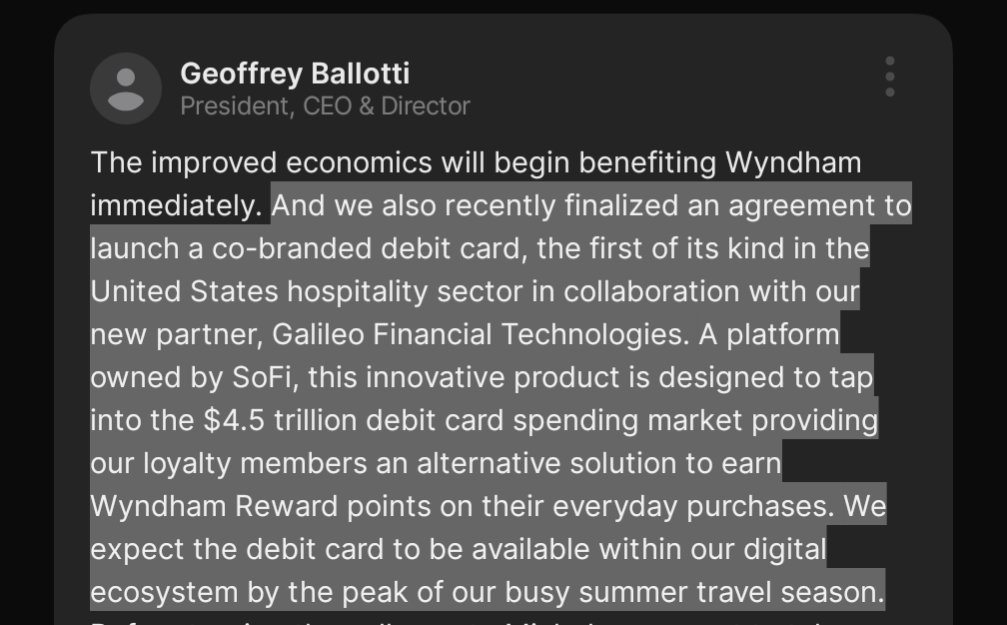

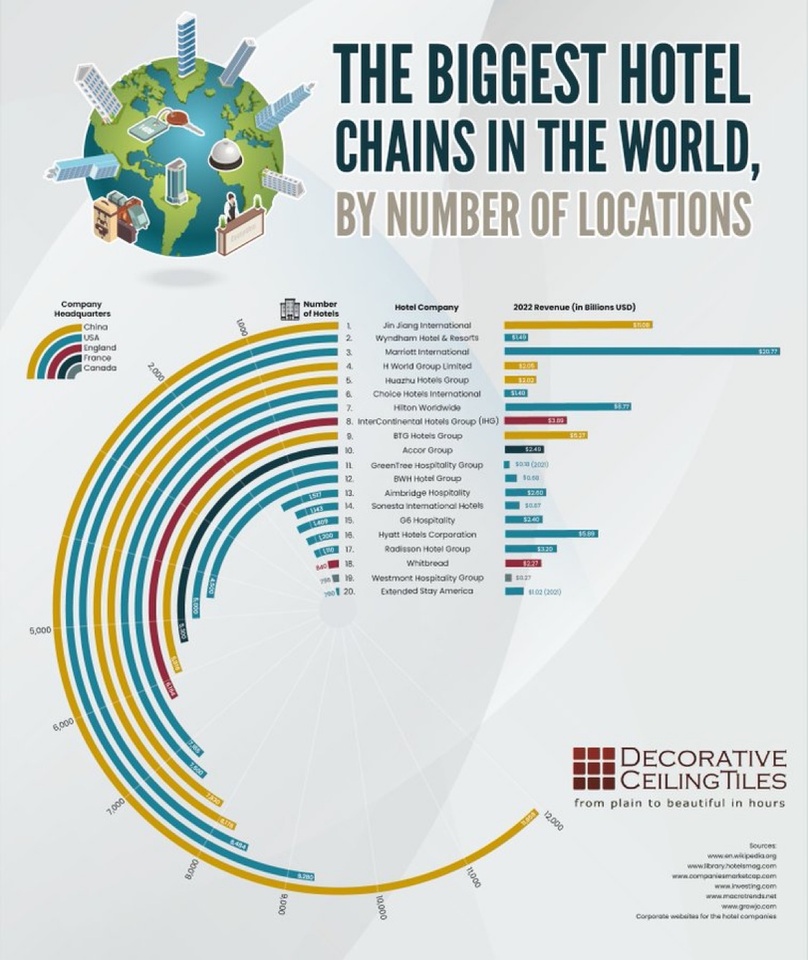

Galileo secures a major partnership with Wyndham Hotels, which has 114 million members worldwide! This is a great success for $SOFI (+2,84 %) & Galileo, extending its reach in the hospitality industry.

Wyndham is the second largest hotel chain in the world (after Jin Jiang) and the largest in North America in terms of number of hotels (although their revenue is lower than other chains).

Geoffrey A. Ballotti

CEO, Wyndham Hotels & Resorts:

$HLT (+0,89 %) Why is nobody talking about this share? If you take a look at the chart - it looks very good.

I will be paying particular attention to the following companies next week when they publish their quarterly figures:

Palantir $PLTR (+2,29 %)

Spotify $SPOT (-4,01 %)

Chipotle $CMG (-1,8 %)

Alphabet $GOOGL (+1,76 %)

Fair Isaac $FICO (+2,1 %)

AMD $AMD (+6,28 %)

Novo Nordisk $NOVO B (+0,18 %)

Roblox $RBLX

Hilton $HLT (+0,89 %)

Amazon $AMZN (+1,57 %)

Do you also take a closer look here or do you have other companies in mind?

I’m thinking about investing around $700 in $HLT (+0,89 %) and $CMG (-1,8 %)

I have a lot of pretty risky stocks like $BA (+1,44 %) and $INTC (-7,42 %) so I’m trying to add some stocks with consistent growth

All of these shares reached new ALL-TIME HIGHS at some point today ⤵️

Nvidia $NVDA (+2,22 %)

Amazon $AMZN (+1,57 %)

Netflix $NFLX (-1,63 %)

Walmart $WMT (-0,72 %)

JPMorgan $JPM (+1,89 %)

Goldman Sachs $GOS0

Palantir $PLTR (+2,29 %)

Blackrock $BLK

American Express $AXP (+0,79 %)

Arista $ANET

Apollo $APO PR A

Blackstone $BX (+0,21 %)

Booking $BKNG (+0,79 %)

Instacart $INSTA (-1,45 %)

Caterpillar $CAT (+0,39 %)

Capital One $COF (+1,84 %)

Discover Financial $DFS

Electronic Arts $EA (+0,05 %)

GE Vernova $GEV (-1,37 %)

Hilton $HLT (+0,89 %)

Howmet $HWM (-0,86 %)

Interactive Brokers $IBKR (+2,32 %)

Cheniere $LNG (-1,14 %)

Morgan Stanley $MS (+2,42 %)

Marriot $MAR (+1,25 %)

Nasdaq $NDAQ (-0,14 %)

News Corp $NWSA (+0 %)

Oracle $ORCL (+0,97 %)

Palo Alto $PANW (+1,28 %)

ServiceNow $NOW (+0,15 %)

Steel Dynamics $STLD (+1,4 %)

Stryker $SYK (-1,03 %)

Royal Caribbean $RCL (-0,74 %)

Reddit $RDDT (-0,02 %)

Trade Desk $TTD (-4,42 %)

Visa $V (+0,29 %)

Wells Fargo $WFC (+2,34 %)

⚠️⚠️⚠️Breaking News⚠️⚠️⚠️

ATTENTION to all who have a deposit with Trade Republic, today more than 100 savings plans will be executed with me, the real offensive starts at 15.30 and can take up to 4 hours, as there may well be "massive" "failures" and "delays" during this time, I ask you to keep calm, take a deep breath and not to bombard Trade Republic customer support with inquiries. Thank you very much 😁

As far as the Ultimate Homer "ETF" is concerned, many new stocks were added in September 😁

In since September 2

🇺🇸Chipotle $CMG (-1,8 %)

🇺🇸Costco $COST (-1,01 %)

🇺🇸Domino's Pizza's $DPZ (-1,67 %)

🇺🇸Texas Roadhouse $TXRH (-0,5 %)

🇺🇸TransDigm $TDG (+0,69 %)

Newly launched today

🇺🇸Booz Allen Hamilton Holding

$BAH (-10,12 %)

🇺🇸Blackstone $BX (+0,21 %)

🇺🇸KKR & Co

$KKR (+0,91 %)

🇺🇸Vulcan Materials

$VMC (+0 %)

🇺🇸CSX $CSX (+1,02 %)

🇺🇸Carrier Global $CARR (+1,01 %)

🇺🇸Hilton Worldwide $HLT (+0,89 %)

🇺🇸Merck & Co $MRK (+0,47 %)

🇺🇸Moodys $MCO (+1,92 %)

🇺🇸Rollins $ROL (-0,41 %)

🇺🇸Toll Brothers $TOL (+1,02 %)

🇺🇸Watsco $WSO (+0,68 %)

🇺🇸Cardinal Health $CAH (+3,64 %)

🇺🇸Colgate Palmolive $CL (-0,96 %)

🇺🇸Emerson Electric $EMR (-0,35 %)

🇺🇸Nordson $NDSN (+0,2 %)

🇬🇧BAE Systems

$BA. (-1,42 %)

🇬🇧RELX

$REL (+1,13 %)

🇬🇧Bunzl

$BNZL (-0,78 %)

Principales creadores de la semana