$NDAQ (-0,14 %)

$RTX (+0,1 %)

$KO (-0,37 %)

$MMM (-1,74 %)

$NOC (-0,1 %)

$LMTB34

$OR (-0,56 %)

$TXN (-1,56 %)

$NFLX (-1,61 %)

$HEIA (-2,16 %)

$SAAB B (+5,28 %)

$UCG (-2 %)

$BARC (+0,23 %)

$GEV (-1,56 %)

$TMO (+0,74 %)

$T (+2,17 %)

$MCO (+2,02 %)

$IBM (+8,06 %)

$SAP (-3,22 %)

$TSLA (-3,07 %)

$AAL (+8,03 %)

$FCX (+0,06 %)

$HON (-2,23 %)

$DOW (+1,43 %)

$NOKIA (+1,13 %)

$TMUS (-1,05 %)

$INTC (-7,3 %)

$NEM (-4,95 %)

$F (+6,36 %)

$PG (-0,4 %)

$GD (+2,31 %)

Debate sobre GD

Puestos

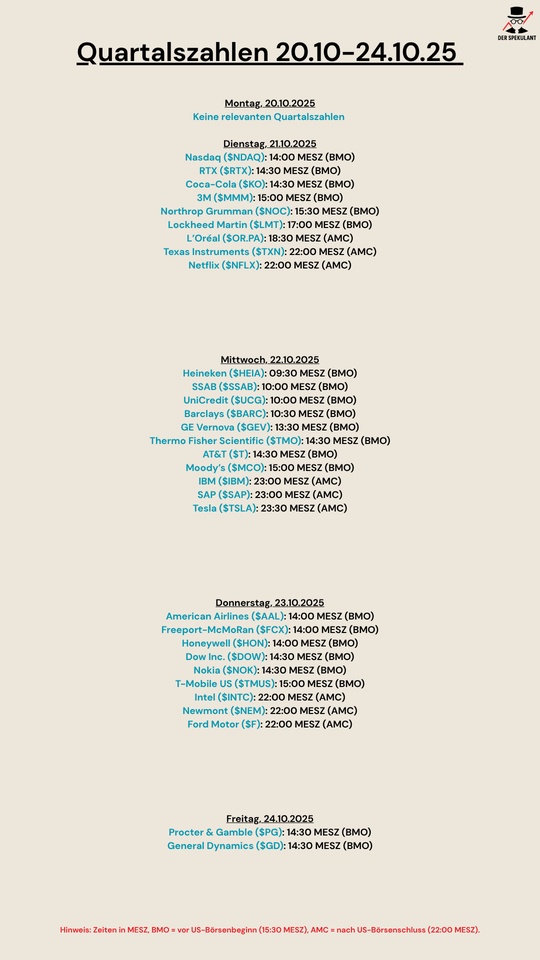

16Quartalsberichte 21.10-24.10.25

Shares for life - dividend champions for long-term investments

Even in uncertain times like these, there are reliable stocks: with strong growth and stable dividends. Here are the best stocks from the Stoxx Global 1800.

Excluded were:

1. liabilities/total capital > 70%

2. negative EPS development in the last 5 years and those where analysts see a negative development in the next few years

3. KCV > 20

4. p/e/earnings growth > 5

5. companies that have canceled or cut dividends in the last 25 years

I'll name a few of the remaining companies here and maybe there are some that you don't know yet. Of course, these include companies such as Caterpillar, Chevron, Henkel, Munich Re, Merck and Union Pacific. They are well known. The following stocks are stable, established companies, so please don't expect any tenbagger opportunities in the next 10 months ;)

Armaments:

BAE Systems $BA. (-1,42 %)

If Europe wants to build a missile defense shield, there is no way around BAE Systems: the British armaments group was formed 26 years ago from the merger of British Aerospace and telecommunications supplier Marconi. BAE is building the Eurofighter Typhoon fighter aircraft with Airbus, and the company is also developing a new nuclear submarine for the Royal Navy. Since Russia's attack on Ukraine, the British company's order backlog has been growing and CEO Woodburn has raised the profit outlook for this year.

General Dynamics $GD (+2,31 %)

The German Armed Forces are receiving new ambulances: 80 so-called Eagle V 6x6s from the US armaments company General Dynamics. However, the Virginia-based company is best known for its Fighting Falcon F-16 fighter aircraft, which was launched in 1978 and is one of the most widely used military jets in the world. However, the fact that General Dynamics has recently surprised with positive sales and profit figures is due to its submarine division: the US Department of Defense significantly increased an existing order.

Construction

Ackermans & van Haaren $ACKB (-0,55 %)

The deepening of the Elbe near Hamburg is controversial, but the marine technology company Deme, the highest-revenue subsidiary of the Belgian conglomerate Ackermans & van Haaren, continues to dig. Deme is also involved in the construction of offshore wind farms and gas pipelines. Ackermans & van Haaren is also active in banking and the energy sector. The company's coffers are well filled and the profit prospects are intact.

Assa Abloy $ASSA B (-0,42 %)

If you have never heard of Assa Abloy, you should look out for the manufacturer of security doors. It often bears the name of the Swedish company, which claims to be the world market leader for security and access systems. Assa Abloy regularly strengthens its position with acquisitions - twelve in the past few years. The Group can afford this, as can the rising dividend.

Idex $IEX (-0,24 %)

Without water pumps from Godiva, many firefighters would quickly be left high and dry. The pumps from the US company Idex are installed in fire engines worldwide, but also in aircraft, for example. With the purchase of Micro-Lam, Idex is strengthening its optical systems division in order to win the defense industry as a customer. The share has recently been under pressure.

Pharmaceuticals

Novartis $NOVN (-0,92 %)

At the beginning of September, things went from strength to strength at the Swiss pharmaceutical group: first the healthcare giant from Basel secured the worldwide license for a new Parkinson's drug, then access to several new cardiovascular drugs from China. Both therapies have the potential to generate billions in sales in the near future. Novartis can also be satisfied with its own developments: according to initial studies, the Swiss company is on the trail of an active ingredient that should help against Sjögren's syndrome, a common rheumatic disease. But Novartis is also under the threat of US tariffs. Novartis generates around 40 percent of its total sales, approximately 17 billion euros, in the USA. To avoid the additional burden, the company is investing in seven new production facilities there.

Industry

Kurita Water $6370 (+3,67 %)

The fact that astronauts on the ISS space station have clean water is mainly thanks to the Japanese company Kurita Water. The company specializes in water treatment, develops systems and chemicals for this purpose and uses them to build self-sufficient water systems - a business with good prospects. Kurita Water also scores with stable finances and a rising dividend.

SGH $SGH (+1,09 %)

Under the umbrella of the Australian conglomerate SGH (formerly Seven Group Holdings), there is a strange mix: on the one hand, SGH sells construction machinery, building materials and energy. On the other hand, the Chairman of the Supervisory Board, Kerry Stokes, is something of a second Rupert Murdoch thanks to his shares in the media group Seven West Media. SGH has doubled both its profit and turnover since 2020.

Spirax $SPX (+0 %)

The highly upgraded steam systems from Spirax (formerly Spirax-Sarco) are used in almost all industries and sectors. However, the most promising segment is "electrical heating solutions". Here, Spirax is developing CO2-free systems for gas-powered steam power plants, for example. Spurred on by the business prospects, the share price jumped - but the price is still below the value targeted by analysts.

Source: Capital Magazine

Cyber security - the armor of the future

Hello dear Getquin Community,

Over the past few days, I have been working intensively on the topic of cyber security and its fundamental importance in various sectors such as healthcare, technology, energy, armaments & defense, e-commerce, software, insurance, industry, utilities, commodities, banks, fintech, holdings, crypto and blockchain. I took a closer look at the big players, the hidden champions and the essential blade manufacturers in the industry. My aim was to gain as comprehensive a picture as possible of the different levels of this industry.

If I have overlooked any important aspects or have not categorized something correctly, I look forward to your comments and interesting additions @Tenbagger2024

@Multibagger

@Simpson

@Vegasrobaina . Together we can understand the topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

At the request of @Multibagger I have subsequently added my personal favorites in each sector. I have an investment horizon of five to ten years. In addition to the quarterly figures, my main focus was on the long-term competitive advantages and the strength of the respective moat.

Contribution:

Cybersecurity is evolving from a peripheral topic to the foundation of global markets. Whether healthcare, banking, utilities, armaments & defense, energy, industry or the digital infrastructure for artificial intelligence and blockchain, the need for protection mechanisms is increasing everywhere. While the big players such as $PANW (+1,3 %) Palo Alto Networks, $CRWD (+0,86 %) CrowdStrike or $ZS (+1,56 %) Zscaler are in the spotlight, more and more specialized providers are emerging that are essential in their niches and often have disproportionately high growth potential. Hidden champions such as $SECT B (+0,64 %) Sectra in the healthcare sector, $NCNO (+0,9 %) nCino in the banking sector or $ESTC (+0,93 %) Elastic in the data center show that cyber security has long been a diversified ecosystem. In addition, we must not overlook the blade manufacturers, i.e. the companies that provide the technological basis. These include chip manufacturers such as $NVDA (+2,31 %) , $INTC (-7,3 %) Intel or $AMD (+6,32 %) AMD, data center operators such as $EQIX (+0,56 %) Equin$DLR (+2,14 %) Digital Realty as well as software and infrastructure providers such as $ESTC (+0,93 %) Elastic, $DDOG (-0,63 %) Datadog or $ANET (-0,02 %) Arista Networks, without whose technology the security providers' solutions would not be scalable. The capital markets are reacting to this with valuation premiums, as the dependence on secure infrastructures is comparable to electrification in the 20th century. Investors are now faced with the question of whether to favor the established market leaders or invest in smaller companies that fly under the radar but could potentially be the real winners of tomorrow.

🔑Takeaway:

Cybersecurity is not an isolated trend, but a key investment factor across all industries from hospitals to data centers from payments to crypto platforms.

Healthcare

Major players:

$PANW (+1,3 %) Palo Alto Networks (PANW), $FTNT (+0,84 %) Fortinet (FTNT), $CHKP (-0,87 %) Check Point (CHKP), $CRWD (+0,86 %) CrowdStrike (CRWD), $S (+0,83 %) SentinelOne (S), $CYBR (+0,7 %) CyberArk (CYBR), $ZS (+1,56 %) Zscaler (ZS), $NET (+0,22 %) Cloudflare (NET), $AKAM (-0,14 %) Akamai Tech. (AKAM)

- Core provider for firewalls, zero trust, endpoint and web security

My top 2 recommendation in this sector are $ZS (+1,56 %) Zscaler global Zero Trust Exchange, huge barrier to entry as infrastructure is built globally and $PANW (+1,3 %) All-in-one platform, extremely high customer retention, hard to replace + acquisition of the company $CYBR (+0,7 %)

Hidden champions:

$SECT B (+0,64 %) Sectra (SECT-B.ST) - secure imaging & healthcare security

$VRNS (+0 %) Varonis Systems (VRNS) - protection of sensitive patient data

Imprivata (private, partnerships with listed players) - identity management for clinics

My top recommendation

$SECT B (+0,64 %) Niche leadership in healthcare security & medical technology

Blade manufacturer:

$NVDA (+2,31 %) Nvidia (NVDA), $INTC (-7,3 %) Intel (INTC), $AMD (+6,32 %) AMD (AMD) - Chips & computing power for security appliances

$EQIX (+0,56 %) Equinix (EQIX), $DLR (+2,14 %) Digital Realty (DLR) - Data center infrastructure for clinical data

$ESTC (+0,93 %) Elastic (ESTC), $DDOG (-0,63 %) Datadog (DDOG) - basic software for monitoring & analytics

My top 2 recommendations are $NVDA (+2,31 %) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,56 %) - largest global colocation provider, enormous switching costs

🔑 Takeaway healthcare

Healthcare data is highly sensitive and clinics are at high risk of ransomware. In addition to large security providers, hidden champions such as Sectra and Varonis are gaining in importance as they secure directly at the interface between patient data and medical devices.

Technology, Data centers & AI, Telecommunications

Major players:

$ZS (+1,56 %) Zscaler (ZS), $S (+0,83 %) SentinelOne (S), $CHKP (-0,87 %) Check Point (CHKP)

- Protection for cloud and AI environments

My top recommendation $ZS (+1,56 %) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$ESTC (+0,93 %) Elastic (ESTC) - Security-Analytics

$ANET (-0,02 %) Arista Networks (ANET)

- Network switches for data centers

My top recommendation $ANET (-0,02 %) - High-end switches, hyperscaler customers

Shovel manufacturer:

$EQIX (+0,56 %) Equinix (EQIX), $DLR (+2,14 %) Digital Realty (DLR)

- Data center infrastructure

$NVDA (+2,31 %) Nvidia (NVDA), $INTC (-7,3 %) Intel (INTC), $MRVL (+4,17 %) Marvell Tech. (MRVL)

- Chips & computing power for AI and security

My top 2 recommendation $NVDA (+2,31 %) - GPUs, quasi-monopoly in high-end compute and $EQIX (+0,56 %) - largest global colocation provider, enormous switching costs

Special players Telecommunications

$AKAM (-0,14 %) Akamai Tech. (AKAM) & Cloudflare (NET) - secure traffic and mobile data

$RDWR (+0,89 %) Radware (RDWR) - DDoS protection for telcos

$CSCO (+0,2 %) Cisco (CSCO) - network security for carriers

$CLAV (-0,15 %) Clavister Holding AB (CLAV) - through SD-WAN and carrier security

My top recommendation $AKAM (-0,14 %) - Established CDN + Security

🔑 Takeaway technology, data centers & AI

Data centers and AI platforms are the backbone of the digital economy. Zero Trust and cloud security from Zscaler or SentinelOne meet shovel manufacturers such as Equinix or Nvidia, who are indispensable with infrastructure and chips.

Energy

Major players:

$FTNT (+0,84 %) Fortinet (FTNT, NASDAQ) - OT/ICS security for power grids and power plants

$PANW (+1,3 %) Palo Alto Networks (PANW, NASDAQ) - Zero Trust & network protection for energy suppliers

$CHKP (-0,87 %) Check Point (CHKP, NASDAQ) - Critical infrastructure protection, gas and oil industry

My top recommendation $FTNT (+0,84 %) - ASIC hardware + software, cost advantage

Hidden champions:

Dragos (private, IPO candidate) - leader in OT security, specialized in energy infrastructures

$RDWR (+0,89 %) Radware (RDWR, NASDAQ) - DDoS defense for energy networks

$NCC (-2,22 %) NCC Group (NCC.L, London) - penetration tests & audits for utilities

$CLAV (-0,15 %) Clavister Holding AB (CLAV) - OT/ICS and infrastructure security

My top recommendation $CLAV (-0,15 %) - small niche player (carrier security)

Shovel manufacturer:

$SBGSY (+1,81 %) Schneider Electric (SBGSY, OTC) - OT/ICS hardware with security components

$ENR (+4,35 %) Siemens Energy (ENR, Frankfurt) - Energy infrastructure with embedded security solutions

$AVGO (+1,78 %) Broadcom (AVGO, NASDAQ) - Security chips for networks in energy environments

My top recommendation $AVGO (+1,78 %) - Chip giant + Symantec Enterprise Security

E-Commerce

Major players:

$NET (+0,22 %) Cloudflare (NET, NYSE) - DDoS and API protection for online stores & payment platforms

$AKAM (-0,14 %) Akamai (AKAM, NASDAQ) - Application security & bot management in e-commerce

$FFIV (-1,87 %) F5 Networks (FFIV, NASDAQ) - API & payment security for digital platforms

My top recommendation $NET (+0,22 %) - worldwide network for DDoS/API, network effects

Hidden Champions:

$RSKD (+2,42 %) Riskified (RSKD, NYSE) - Fraud prevention in online trading

$VRNS (+0 %) Varonis Systems (VRNS, NASDAQ) - Protection of customer data

$CYBR (+0,7 %) CyberArk (CYBR, NASDAQ) - Identity & access protection for payment processes

My top recommendation $CYBR (+0,7 %) - Standard for Privileged Access

Shovel manufacturer:

$V (+0,08 %) Visa (V, NYSE) & $MA (-0,34 %) Mastercard (MA, NYSE) - not classic cybersecurity, but operators of secure payment networks

$ESTC (+0,93 %) Elastic (ESTC, NYSE) - fraud analytics for e-commerce platforms

$DDOG (-0,63 %) Datadog (DDOG, NASDAQ) - monitoring & security analytics for retail infrastructure

My top recommendation $V (+0,08 %) - Global payment network, enormous network effect

🔑 Takeaway:

Energy is particularly vulnerable due to OT/ICS systems, specialists such as Dragos are emerging here.

E-commerce needs fraud prevention in addition to traditional web security, which is why players such as Riskified are occupying a niche.

Armaments & Defense

Major players:

$NOC (-0,1 %) Northrop Grumman (NOC, NYSE) - leader in cyberdefense for military & intelligence agencies, also developing offensive cyber capabilities

$BAESY (-1,18 %) BAE Systems (BAESY, OTC) - strong cyber intelligence division, protects critical military and government networks

$RTX (+0,1 %) Raytheon Technologies (RTX, NYSE) - defense company with growing cybersecurity portfolio for military communications & satellites

My top recommendation $NOC (-0,1 %) - Top defense contractor with cyber dominance

Hidden champions:

$PLTR (+2,29 %) Palantir Technologies (PLTR, NYSE) - Data and analytics platform with strong cybersecurity component, often for defense contractors

$CACI (+0,09 %) CACI International (CACI, NYSE) - specializes in cyber intelligence, network protection and military IT services

$LDOS (-1,66 %) Leidos Holdings (LDOS, NYSE) - IT and cybersecurity service provider for US defense and NATO

$CLAV (-0,15 %) Clavister Holding AB (CLAV) - used by government and military organizations

$ADVE Advenica (ADVE) - Specialized security, relevant for government agencies and national infrastructure

My top recommendation $CACI (+0,09 %) - Cyber intelligence, deep roots in the defense sector

Shovel manufacturer:

$LHX (-0,08 %) L3Harris Technologies (LHX, NYSE) - provides communications and cyber hardware for military networks

$GD (+2,31 %) General Dynamics (GD, NYSE) - with its IT division GDIT also a provider of cyber defense infrastructure

$KTOS (+1,77 %) Kratos Defense (KTOS, NASDAQ) - specializes in drones, satellite systems and cyber hardening of defense communications

My top recommendation $GD (+2,31 %) - strong role in defense cyber with GDIT

🔑 Takeaway:

In the defence sector, the boundaries between traditional defense and cybersecurity are becoming blurred. Alongside the large defense contractors, hidden champions such as Palantir, CACI and Leidos are emerging to provide pure cyber and data expertise. Shovel manufacturers such as L3Harris and Kratos secure the technical infrastructure.

Software & insurance

Big players:

$OKTA (+0,87 %) Okta (OKTA), $CYBR (+0,7 %) CyberArk (CYBR), $CRWD (+0,86 %) CrowdStrike (CRWD)

- Identity, endpoint and cloud security

My top recommendation $CRWD (+0,86 %) - Network effect through Falcon & Threat Graph

Hidden champions:

$VRNS (+0 %) Varonis (VRNS) - Data Security

SailPoint (private, formerly NYSE) - Identity Governance

$FROG (-0 %) JFrog (FROG) - DevSecOps & Supply-Chain-Security

$CYBE CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0 %) Gen Digital (GEN) - one of the largest consumer cybersecurity providers worldwide (Norton, Avast, LifeLock), strong in identity protection and data protection for consumers & small businesses

$RBRK (+1,14 %) Rubrik (RBRK) - data compliance and security in the area of cloud data security

My top recommendation $GEN (+0 %) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$MSFT (+0,63 %) (MSFT), $GOOG (+1,83 %) Alphabet (GOOGL), $AMZN (+1,56 %) Amazon (AMZN)

- Cloud security base

$FFIV (-1,87 %) F5 Networks (FFIV) - API protection for SaaS & insurance platforms

My top recommendation $GOOG (+1,83 %) - global cloud security + Mandiant, strong moat through infrastructure & Threat Intel

🔑 Takeaway Software & Insurance

Data and identity protection take center stage. Major players such as Okta and CyberArk secure access, while hidden champions such as Varonis and JFrog provide specialist solutions. Cloud providers such as Microsoft and Amazon are both platform operators and security suppliers.

Industry, supply & raw materials

Major players:

$FTNT (+0,84 %) Fortinet (FTNT), $CSCO (+0,2 %) Cisco (CSCO), $PANW (+1,3 %) Palo Alto Networks (PANW)

- Network protection for critical infrastructures

My top recommendation $FTNT (+0,84 %) - ASIC hardware + software, cost advantage

Hidden champions:

$RDWR (+0,89 %) Radware (RDWR) - DDoS protection

$NCC (-2,22 %) NCC Group (NCC.L) - OT-Security & Penetration Tests

$SECT B (+0,64 %) Sectra (SECT-B.ST) - secure infrastructure in the OT/healthcare intersection

$CLAV (-0,15 %) Holding AB CLAV) - OT/ICS and infrastructure security

$ADVE Advenica (ADVE) - Specialized security, relevant for public authorities and national infrastructure

My top recommendation $ADVE - Specialized Crypto/OT-Security for public authorities

Shovel manufacturer:

$AVGO (+1,78 %) Broadcom (AVGO) - security chips

Juniper Networks (JNPR) - network backbones

$ANET (-0,02 %) Arista Networks (ANET) - high-end switches

My top recommendation $AVGO (+1,78 %) - Chip-Giant + Symantec Enterprise Security

🔑 Takeaway Industry, Utilities & Commodities

OT/ICS systems in production, energy and raw materials are attractive targets. Fortinet and Palo Alto dominate, but hidden champions such as Radware and the NCC Group offer special expertise for attacks on industrial control systems.

Banks, Fintech & Holdings

Big players:

$CRWD (+0,86 %) CrowdStrike (CRWD), $PANW (+1,3 %) Palo Alto Networks (PANW), $ZS (+1,56 %) Zscaler (ZS)

- Core protection for banks & digital platforms

My top recommendation $ZS (+1,56 %) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$NCNO (+0,9 %) nCino (NCNO) - Cloud Banking Security

$NCC (-2,22 %) NCC Group (NCC.L) - Audits & Compliance

$CYBE CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (+0 %) Gen Digital (GEN) - through fraud prevention and identity topics

My top recommendation $GEN (+0 %) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$FFIV (-1,87 %) F5 Networks (FFIV) - API security for payments

$AKAM (-0,14 %) Akamai Tech. (AKAM) - Web & Payment Security

$ESTC (+0,93 %) Elastic (ESTC) - Fraud Analytics

My top recommendation $FFIV (-1,87 %) - Leader in Application & API Security

🔑 Takeaway Banks, Fintech & Holdings

High regulatory pressure makes cybersecurity a mandatory field. In addition to established providers, banks are relying on hidden champions such as nCino or Darktrace for cloud banking and anomaly detection. Shovel manufacturers such as F5 or Akamai secure payment APIs and banking portals.

Crypto & blockchain

Big players:

$PANW (+1,3 %) Palo Alto Networks (PANW), $FTNT (+0,84 %) Fortinet (FTNT), $CRWD (+0,86 %) CrowdStrike (CRWD)

- Core protection for exchanges, wallets and blockchain infrastructure

My top recommendation $FTNT (+0,84 %) - ASIC hardware + software, cost advantage

Hidden champions:

$BBAI (+2,84 %) BigBear.ai (BBAI) - Blockchain Fraud Detection

$RIOT (+5,14 %) Riot Platforms (RIOT) - Mining with a focus on security

$CHKP (-0,87 %) Check Point - the new blockchain firewall initiative (Web3)

My top recommendation $CHKP (-0,87 %) - Strong brand & existing customers, but limited innovative strength

Shovel manufacturer:

$NVDA (+2,31 %) Nvidia (NVDA), AMD (AMD) - chips & mining hardware

$NET (+0,22 %) Cloudflare (NET), $AKAM (-0,14 %) Akamai Tech. (AKAM)

- Network protection for wallets & exchanges

My top recommendation $NVDA (+2,31 %) - GPUs, quasi-monopoly in high-end compute

🔑 Takeaway crypto & blockchain

Crypto ecosystems are heavily affected by attacks on exchanges, wallets and smart contracts. While traditional security players provide protection, niche providers such as BigBear.ai and Riskified are emerging that specialize specifically in fraud and blockchain risks.

Source: Own analysis, image material: schwarz-digits

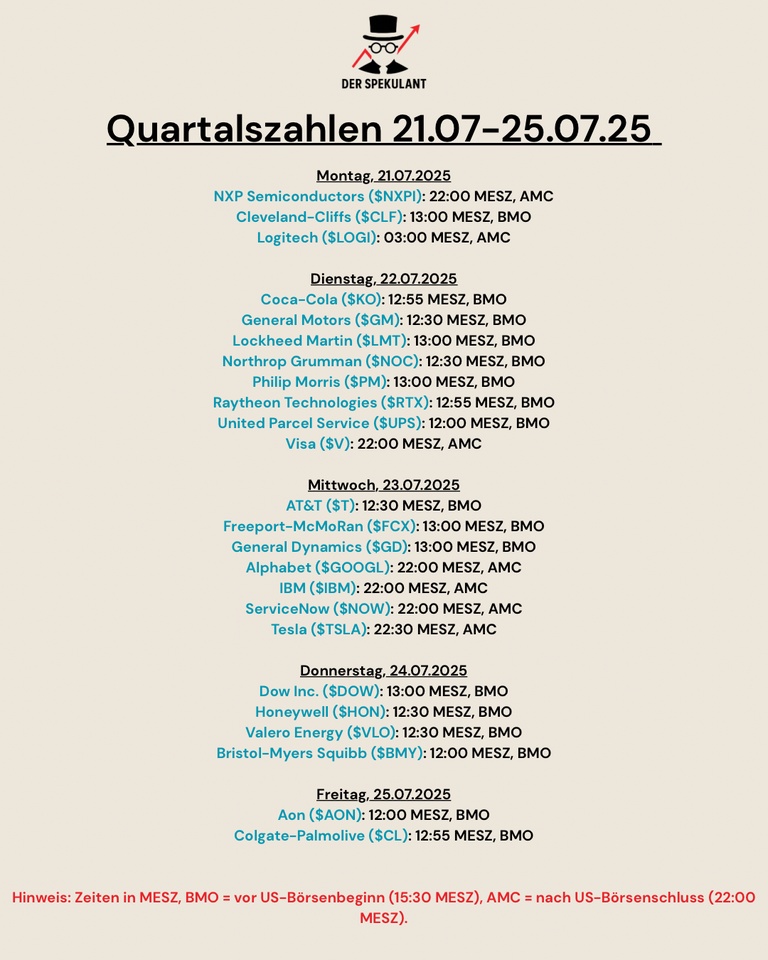

Quarterly figures 21.07-25.07.25

Here is a clear overview of the quarterly figures due next week.

$NXPI (-0,53 %)

$CLF (-0,62 %)

$LOGN (-0,21 %)

$KO (-0,37 %)

$GM (+3,46 %)

$LMT (-0,76 %)

$NOC (-0,1 %)

$PM (+0,09 %)

$RYTT34

$UPS (+0,01 %)

$V (+0,08 %)

$T (+2,17 %)

$FCX (+0,06 %)

$GD (+2,31 %)

$GOOGL (+1,8 %)

$IBM (+8,06 %)

$NOW (-0,5 %)

$TSLA (-3,07 %)

$DOW (+1,43 %)

$HON (-2,23 %)

$VLO (-1,25 %)

$BMY (-0,97 %)

$AON (-1,12 %)

$CL (-0,97 %)

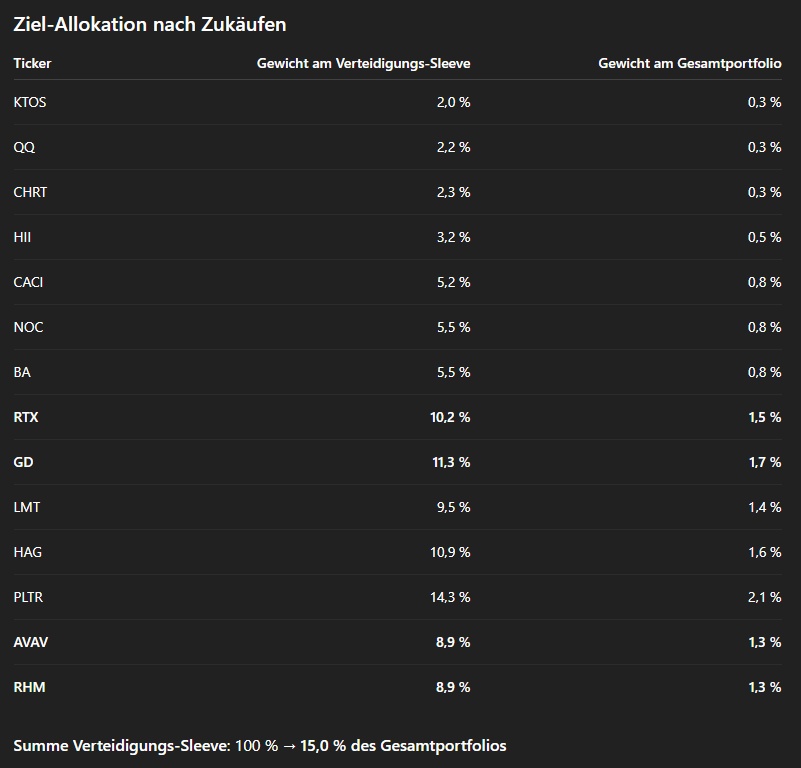

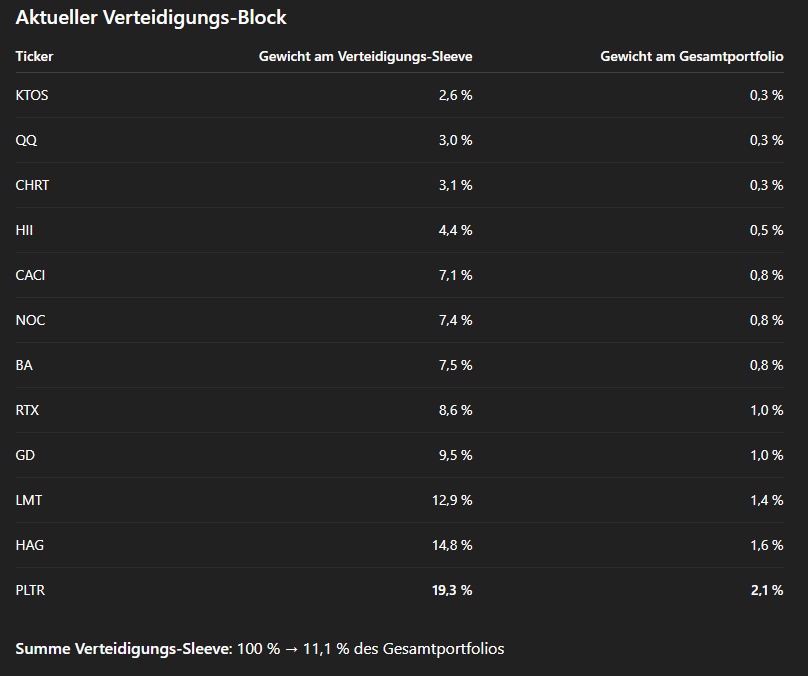

Defense Portfolio Update

I wanted to give you a little update on my current defense portfolio and the planned changes.

📍Status Quo:

📍Capability areas and benefits for the portfolio:

Air & missile defense

Patriot, PAC-3, THAAD - core systems for the protection of cities, bases and fleets

Combat aircraft & air dominance

$LMT (-0,76 %) , $BA. (-1,42 %)

F-35 program (LMT), Eurofighter Typhoon, future Tempest/FCAS

Maritime strike capability

$HII (+3,28 %) , $GD (+2,31 %) , $BA. (-1,42 %)

Nuclear submarines (Virginia, Astute), Type-26 frigates, combat systems

Sensors & electronic reconnaissance

$HAG (-2,02 %) , $QQ. (+1,58 %) , $CHRT (-0,32 %) , $BA. (-1,42 %)

AESA radars, ESM/ECM, BAE Raven ES-05 radar

Autonomous systems & drones

Almost all companies play me here. $KTOS (+1,77 %) as the only drone pure play.

Unmanned jets (XQ-58) and tactical UAS - rapidly growing budget item

Cyber / AI & data fusion

$PLTR (+2,29 %) ,$CACI (+0,09 %)

AI-supported command and control systems (PLTR Gotham/Apollo) and US government IT services

Ground-based large-scale systems

$GD (+2,31 %) ,$NOC (-0,1 %) , $BA. (-1,42 %)

Abrams modernizations, artillery rockets and ground-based sensors, CV90-IFV, M109 howitzers

Multidomain space flight

US nuclear deterrence - from delivery systems to warning and command and control networks

💰Realized partial sales at $HAG and $PLTR

I had already reduced $HAG and $PLTR by 50% each this year with large gains (+651% and +346%):

The valuations of both companies are currently extremely sporty.

PLTR

Trailing P/E ratio (TTM): 580 - 590x

Forward P/E ratio: ~240x

Price-to-sales: >100x

HAG

Trailing P/E ratio (TTM): 120 - 130x

Forward P/E ratio: ~80x

Price-to-sales: >5x

I will nevertheless remain invested in both positions for the time being. Mainly because I currently see no significant change in the underlying investment story.

Position sizes are relativized by new planned purchases and the concentration risk falls from 34% → 25% of the sleeve.

📊Planned adjustments:

❓Why these changes?

New position$AVAV (+3,24 %)

(drones/loitering ammunition):

Covers the fastest growing budget line (attritable UAS), which was previously barely represented.

New position $RHM (-0,79 %)

(Ammunition & Platforms)

Adds the "155 mm grenades" bottleneck and European land systems to the portfolio; beneficiary of EU armament.

Increase $RTX (+0,1 %)

Most favorable US prime (forward P/E ≈ 25), high visibility in air/missile defense systems.

Top-up $GD (+2,31 %)

Diversified towards submarines, ground vehicles and ammunition; reliable free cash flow.

📉Planned, staggered entries:

$AVAV: $220 - $185

$RHM: €1550 - €1450

$RTX: $125 - $120

$GD: $285 - $270

🤔 What does your portfolio look like?

Which defense stocks do you hold and why?

Or smaller companies like $MILDEF.

I myself am also in $AVAV

But then also more with suppliers and companies that only partly cover armaments.

Such as $KIT as a drone contract manufacturer and supplier for Rheinmetall, Kongsberg, Safran etc..

Or $MTX in the consortium for the Eurofighter and maintenance company for the German Armed Forces.

Then $ERJ supplies transport aircraft for NATO countries. And smaller combat aircraft.

$PNG supplies the navy.

$TDG is also a supplier.

$IVG I also have the defense division for sale.

My new addition is $GILT. They have now also entered the defense sector.

Selected US defense stocks in a deep dive

🚨 Disclaimer: This is not investment advice; I am invested in all the stocks discussed here.

These analyses are primarily for my personal decision-making - I am happy if they also offer added value for you 🙂

Here we go already!

-

Europe's defense industry has experienced a boom since the war in Ukraine: in 2024, global military spending rose by 9.4% to a record high of USD 2.72 trillion - the sharpest increase since the Cold War.

Europe in particular increased its budgets (including Russia) by around 17%, driven by the new threat situation.

This rearmament is also benefiting US arms companies, as many European armed forces are increasingly relying on US weapons systems.

🤔 Trump 2.0 - tailwind or risk for US defense stocks?

Since Donald Trump moved back into the White House in January 2025, US defense policy has changed noticeably - with a direct impact on the defense industry and its investors.

📈 Defense spending on record course

Trump has announced a defense budget for fiscal year 2026 of over 1 trillion USD an increase of 13% compared to the previous year.

Of particular note is the ambitious "Golden Dome" project, a space-based missile defense system estimated at USD 175 billion and involving companies such as Lockheed Martin and SpaceX.

📉 Protectionism as a double-edged sword

At the same time, Trump is pursuing an aggressive trade policy:

- 10% base tariff on all imports, with higher "reciprocal" tariffs for countries with trade surpluses with the US.

- Doubling steel and aluminum tariffs to 50%, which will increase the cost of arms production in particular.

These measures could put a strain on supply chains and increase production costs for US defense companies. RTX (formerly Raytheon) expects additional costs of up to USD 850 million in 2025 alone as a result of the new tariffs.

👉 Importance of US weapons systems for Europe's defense:

Many European armed forces rely on US technology. Examples include the procurement of F-35 stealth jets (e.g. by Germany, Poland, Finland), Patriot air defense systems (e.g. by Germany, Poland) or Abrams tanks (Poland).

US systems are considered combat-proven and immediately available, which improves interoperability within NATO in Europe.

Europe benefits from US innovations (e.g. drones, missiles, fighter jets), while the USA receives stable sales markets in return.

Especially against the backdrop of the war in Ukraine and new threats (Russia, terror, unstable regions), Europe's dependence on US armaments continues to grow.

🚨 Even if Europe wants to become more "strategically autonomous" in the long term, US defense systems are irreplaceable for the foreseeable future. Anyone who wants to seriously pursue national or alliance defense needs US technology - both operationally and politically.

-

📍 Stock analysis - Fundamental & Technical

Following this overview, here are six selected US defense stocks in detail.

For each share, we look at the strategic benefits, current business figures including management outlook, key valuation ratios, analyst assessments, the attractiveness of entering the market at the current price and the dividend situation.

ℹ️ My approach to technical analysis:

My entries are usually follow-on purchases as part of a long-term buy-and-hold approach. I do not try to time tops or bottoms, but look for zones where opportunities and risks are well balanced in the long term.

👉 Important here: sometimes "doing nothing" is the best decision.

If the price doesn't reach my buyback zones - then I simply don't buy more. Patience is often a better entry trigger than actionism (especially in the case of highly volatile defense stocks).

📉 I let the market come to me - not the other way around.

-

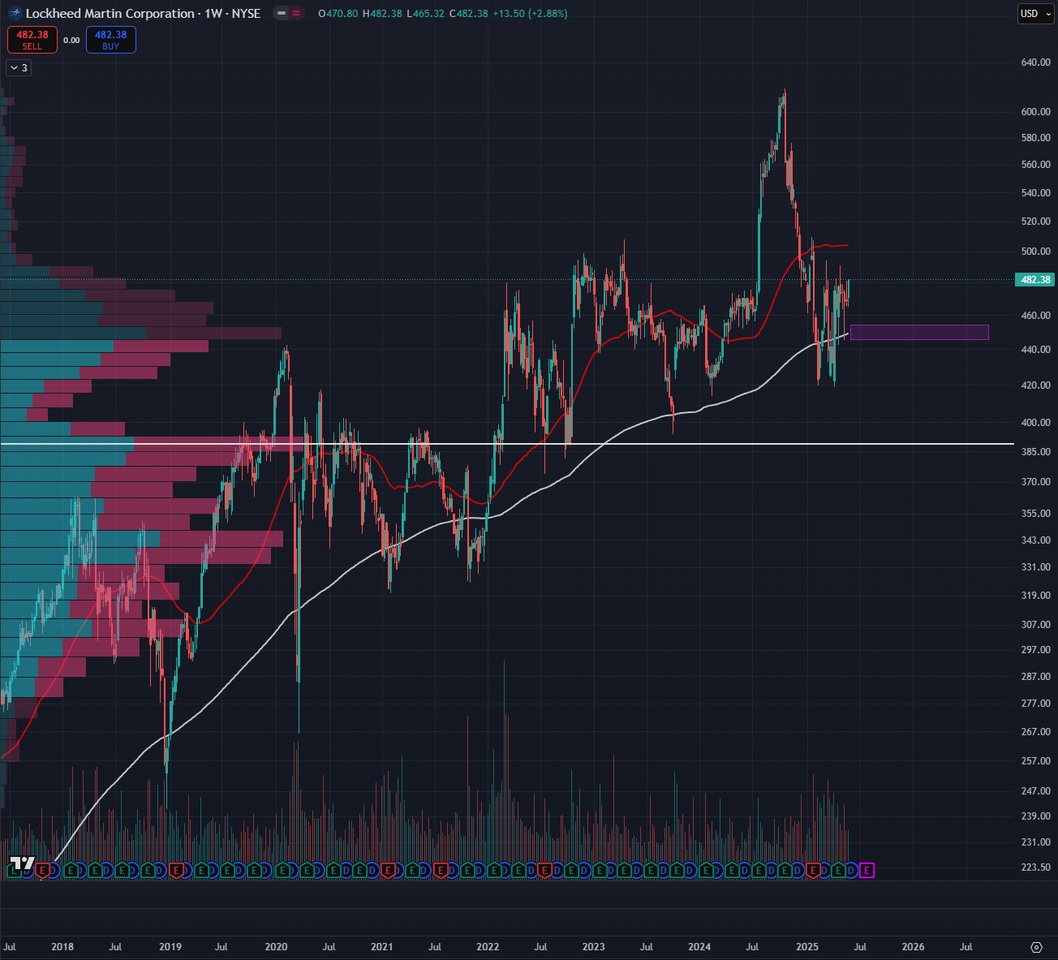

📍 Lockheed Martin $LMT (-0,76 %)

Strategic benefit:

World leader in stealth jets (F-35), missile defense, space - essential for NATO partners.

Key points:

- Q1 2025: revenue +4%, EPS $7.28, order backlog at record level ($173 bn)

- Outlook 2025: EPS $27-27.30, stable growth - focus on F-35, missiles

- Valuation: P/E ~17-18, PEG ~1.6, debt low

- Analysts: 7 Buy / 8 Hold → Moderate Buy, target price ~+8 %

- Dividend: $3.30/Q, increase for 22 years, ~2.7 % yield

- 🟡 Entry from a fundamental perspective: 6/10 - Solid basic investment, but no bargain

📈 LMT weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- Current rebound from strong support zone, supported by 200-SMA and volume profile.

- Momentum slightly positive, but no clear breakout yet

- USD 495-500 zone = key resistance

- Support stable, but risk increases significantly below USD 450

- Currently: technically neutral to slightly bullish - with potential for a breakout if volumes continue to rise

- 👉 My potential long-term post-buy zone: near the 200-SMA (currently approx. USD 450)

-

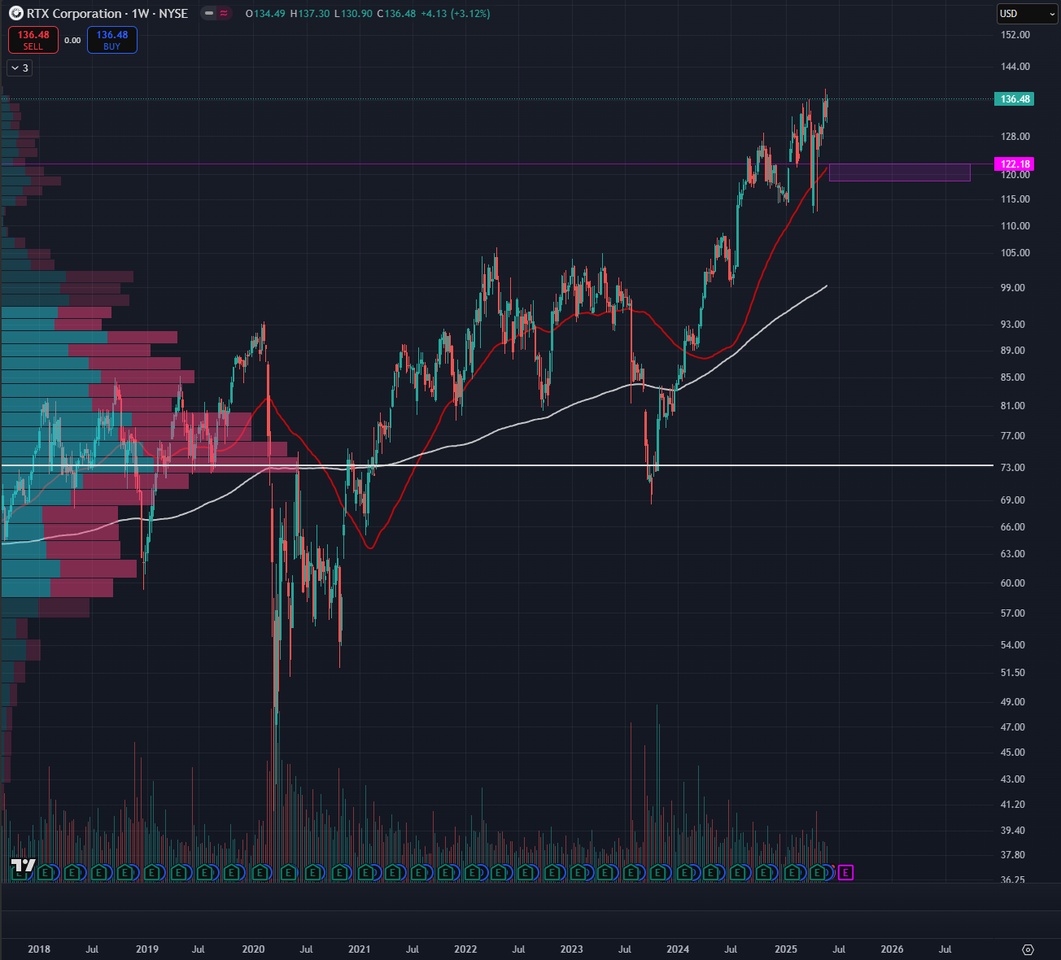

📍 RTX Corporation $RTX (+0,1 %)

Strategic benefit:

Combines military systems (Patriot, missiles) with commercial aviation (Pratt & Whitney).

Key points:

- Q1 2025: revenue +5%, EPS $1.47 - but tariffs weigh $850m.

- Outlook 2025: Sales $83-84 bn, EPS $6.00-6.15 - solid but cautious

- Valuation: P/E ~22, EV/EBITDA ~18, debt increased

- Analysts: majority Buy, target price ~+5-8

- Dividend: $0.68/Q, ~2.1 % yield, >50 years of increases

- 🟢 Entry from a fundamental perspective: 7/10 - turnaround bet with aviation fantasy

📈 RTX weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- RTX is clearly moving in an overarching uptrend since the low at the end of 2023

- Bottom formation 2022-2023 was completed with high volume, breakout above USD 115 was decisive

- Consolidation above the 50-SMA is constructive - pullbacks to the USD 122/115 area would be technically healthy pullbacks

- Trend: Bullish

- Breakout above USD 139 could trigger strong new momentum as there is hardly any volume resistance

- 👉 My potential long-term post-buy zone: in zone around the 50-SMA (122-115 USD)

-

📍 General Dynamics $GD (+2,31 %)

Strategic benefit:

Strong in tanks (Abrams), submarines, naval vessels - broad portfolio + Gulfstream business jets.

Key points:

- Q1 2025: revenue +14%, EPS $3.66, book-to-bill stable

- Outlook: EPS +9-10% in 2025, robust despite weaker order intake

- Valuation: P/E ratio ~15-16, debt low, PEG high

- Analysts: 8 Buy / 13 Hold → Moderate Buy, price target slightly above market

- Dividend: $1.50/Q, 28-year increase, ~2.5% yield

- 🟢 Entry from a fundamental perspective: 8/10 - undervalued, solid basis, little hype

📈 GD weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- GD is technically stabilized, but with limited momentum

- The reversal at the 200-SMA was convincing, but the subsequent rise has so far remained capped below the 50-SMA

- Trend: bullish in the long term, neutral to slightly bearish in the medium term

- Solid support at ~ USD 245 - technical basis intact

- Breakout above USD 280 necessary to spark new momentum

- 👉 My potential long-term post-buy zone: in zone around the 200-SMA (245-250 USD)

-

📍 Northrop Grumman $NOC (-0,1 %)

Strategic benefit:

High-tech focus: B-21, missiles, drones, cyber & space - Key role in future conflicts.

Key points:

- Q1 2025: revenue -6.6%, EPS $6.06 (adjusted), outlook lowered

- Projects: Delays on B-21, but backlog at $92.8 bn.

- Valuation: P/E ~17-18, EV/EBITDA ~13, PEG >2

- Analysts: 12 Buy / 8 Hold, target price ~+15 %

- Dividend: $2.31/Q (+12%), 22-year increase, ~1.9% yield

- 🟡 Entry from a fundamental perspective: 6/10 - technology leader with short-term pressure

📈 NOC weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- NOC has been moving in a broad sideways channel since the end of 2022 (~ USD 440-540)

- Trend: Sideways/Based, within established range

- USD 460-465 zone = central key support, has been confirmed

- Break above USD 510 necessary to release new momentum

- Current: technically neutral with a positive trend if it holds above USD 460 - a good area to hedge

- 👉 My potential long-term post-buy zone: in the zone around the 200-SMA (USD 460-480)

-

📍 Huntington Ingalls $HII (+3,28 %)

Strategic benefit:

Only US aircraft carrier builder; key role in Navy ships & nuclear-powered submarines.

Key points:

- Q1 2025: sales -2.5%, profit -2.6% - production problems (shortage of skilled workers)

- Outlook 2025: conservative, stable navy orders, focus on efficiency

- Valuation: P/E ~14-15, EV/EBITDA ~11, PEG >2

- Analysts: Hold prevails, price target ~+15%

- Dividend: $1.35/Q, ~2.5% yield, 13-year increase

- 🟡 Entry from a fundamental perspective: 5/10 - value case with operational question mark

📈 HII weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- HII is not a trend value, but has been in a large sideways structure for 5 years (approx. USD 180-270)

- The most recent recovery after falling back below USD 200 was dynamic, but there is currently no follow-up buying pressure above the 50-SMA

- The area around USD 223 (currently) has been a pivotal point in recent years - directionless but stable

- Neutral in the long term, weak below the 50-SMA in the short term

- Key zone of USD 208-210 as a technical hedge (with high volume)

- Break above USD 235 necessary to open up space to USD 260

- Currently: range-bound character, with trading opportunities within established range

- → Long-term breakout above USD 270 would be necessary to release new momentum

- 👉 Currently no additional buying planned

-

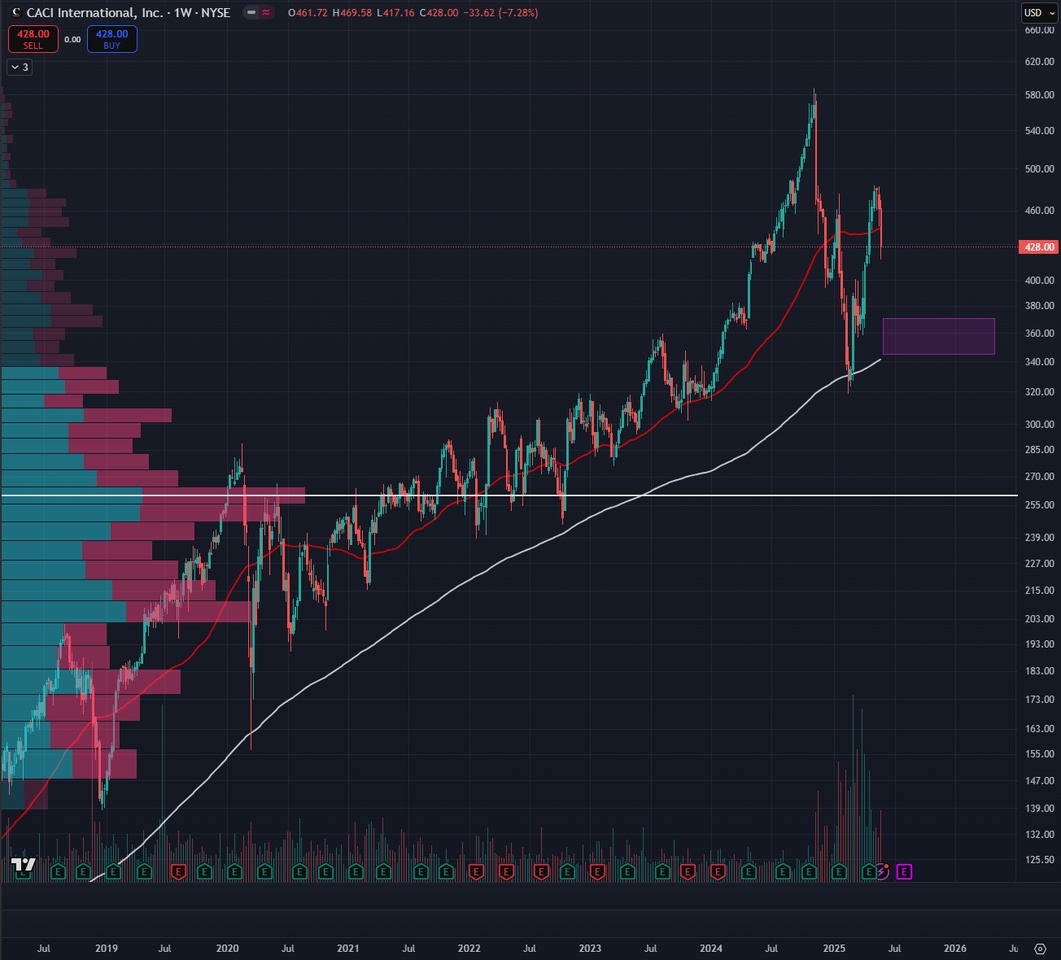

📍 CACI International $CACI (+0,09 %)

Strategic benefit:

Specialist in cybersecurity, intelligence & AI - delivers digital capabilities for the modern military.

Key points:

- Q3 FY25: revenue +11.8%, book-to-bill >1, guidance raised

- Forecast 2025: EPS ~$24, sales ~$8.3 bn, strong organic growth

- Valuation: P/E ~18, EV/EBITDA ~12, PEG ~1, debt moderate

- Analysts: 20 Buy / hardly Hold - target price +20

- Dividend: None - focus on reinvestment & buybacks

- 🟢 Entry from a fundamental perspective: 8/10 - Growth story in defensive sector

📈 CACI weekly chart (logarithmic) - 50 & 200-week SMA, volume profile

- CACI was heavily overbought at the beginning of 2024, followed by a sharp setback to ~340 USD

- Rebound at the 50-SMA did not bring new high momentum → rejection with currently -7.3 %

- The large volume in the sell-off and the recovery indicate institutional activity, but also increased uncertainty

- Structure remains bullish above USD 350but shaky in the short term

- Long-term uptrend still intact, but with increased volatility

- Break above USD 460 would be technically strong - below that rather range behavior

- Current: technically neutral to weak, pullback was too steep to confirm new strength

- 👉 My potential long-term post-buy zone: Above the 200-SMA (350-370 USD)

-

🤔 Now it's your turn:

Which defense stocks do you have in your portfolio - or are you currently looking at?

Would you be interested in an analysis of European defense stocks?

-

📍 Sources:

Charts:

TradingView

- Reuters – World military spending hits $2.7 trillion in record 2024 surge

- Nasdaq/Barchart – Are Wall Street Analysts Predicting RTX Stock Will Climb or Sink?

- GovCon Wire – Lockheed Reports 4% Growth in Q1 2025 Sales

- RTT News/Nasdaq – Lockheed Martin Reaffirms FY25 Outlook

- GovCon Wire – RTX Reports $20.3B in Sales for Q1 2025

- Reuters – Rheinmetall, Lockheed Martin extend cooperation

- GD – Q1 2025 Results Press Release

- Archer/Barchart – Is Wall Street Bullish or Bearish on General Dynamics?

- Zacks/Nasdaq – Northrop Grumman Misses Q1 Earnings

- AINvest – Northrop Grumman’s Dividend Hike

- Reuters – Huntington Ingalls earnings fall on slowing volume

- Dividend.com – HII Dividend History

- Yahoo Finance – CACI Q3 2025 Earnings

- Marketscreener – CACI Analyst Consensus

+ 4

And good luck with your investments.

😘

Gulfstream is back

$GD (+2,31 %) Good Q1 and strong performance from the Aviation segment. G700 deliveries and the promising G800 will give a push to GD's revenue.

Remarkable to see Jet Aviation improving year over year.

I think this is a good and still undervalued stock

Good Company, solid performance.

$GD (+2,31 %) With Gulfstream catching up on deliveries and the US Navy buying submarines, I see a lot of potential for this stock. If you can benefit from the current Euro/Dollar exchange, this stock will provide good mid term returns at a very attractive price.

Possible IPOs of German defense companies 🇩🇪📈

- KNDS (Krauss-Maffei Wegmann, Leopard 2, Boxer 2000 self-propelled howitzer, ammunition, AI)

- Quantum Systems (drones, customers in Ukraine & USA)

- Helsing (drones, AI)

Source: https://www.br.de/nachrichten/wirtschaft/ruestungsboom-bayerische-firmen-vor-boersengang,Uf2aNSq

#rheinmetall

#hensoldt

#renk

$RHM (-0,79 %)

$HAG (-2,02 %)

$R3NK (-0,34 %)

$LMT (-0,76 %)

$BAE (+0 %)

$GD (+2,31 %)

$SAAB B (+5,28 %)

Impact of 2025 Defense Budget Cuts on Top 15 U.S. Defense Contractors

It's time for an article in English!

As many investors questioned the sharp drops in U.S. defense stocks after Trump took office, I decided to dive into what’s happening behind the scenes.

Introduction

The U.S. defense sector is facing a realignment in 2025 due to proposed budget cuts of about 8% per year over the next five years. This initiative, driven by the new administration, aims to reallocate roughly $50 billion in defense spending toward emerging priorities like border security, Asia-Pacific presence, and advanced technologies. Such cuts would cumulatively reduce annual defense outlays from roughly $900 billion to around $600 billion by the end of the period – about the level of 2017. These changes directly affect the nation’s largest defense contractors, which span aerospace, cybersecurity, shipbuilding, and weapons manufacturing.

The top five contractors –

Lockheed Martin $LMT (-0,76 %)

RTX Corporation $RTX (+0,1 %)

Northrop Grumman $NOC (-0,1 %)

General Dynamics $GD (+2,31 %)

and Boeing $BA (+1,5 %)

– alone account for a huge share of Pentagon procurement, with defense revenues ranging from $32–65 billion each. This report examines the top 15 U.S. defense contractors and analyzes how the 2025 budget cuts impact their programs, finances, and strategies.

Top 15 U.S. Defense Contractors (by Defense Revenue)

- Lockheed Martin ($LMT) – Aerospace & defense prime (e.g. military aircraft, missiles, satellites)

- RTX Corporation ($RTX) – Defense systems (missiles, radars, engines)

- Northrop Grumman ($NOC) – Aerospace & defense (stealth bombers, space, missiles)

- General Dynamics ($GD) – Defense (tanks, submarines, IT systems)

- Boeing ($BA) – Aerospace (military and commercial aircraft, space systems)

- L3Harris Technologies ($LHX) – Defense electronics (communications, sensors, rocket motors)

- Huntington Ingalls Industries ($HII) – Shipbuilding (aircraft carriers, destroyers, submarines)

- Leidos ($LDOS) – Defense IT and solutions (cybersecurity, R&D, autonomous systems)

- Booz Allen Hamilton ($BAH) – Defense consulting & analytics (cyber, AI, engineering services)

- Science Applications International Corp ($SAIC) – Defense IT & logistics support

- CACI International ($CACI) – Defense intelligence, IT, and electronics integration

- Textron Inc. ($TXT) – Defense platforms (military helicopters, armored vehicles)

- General Electric Aerospace ($GE) – Aircraft engines and defense power systems

- Oshkosh Corporation ($OSK) – Tactical vehicles and armaments (e.g. military trucks)

- KBR Inc. ($KBR) – Defense services (base operations, logistics, engineering)

These contractors collectively cover all major sectors of defense. The following sections detail the specific program impacts, financial performance, and strategic outlook for these companies in light of the 2025 budget cuts.

Programs and Contracts Most Impacted by Budget Cuts

💥 Major Defense Programs Facing Cuts or Changes

- F-35 Lightning II Joint Strike Fighter ($LMT) – The F-35 program, the Pentagon’s largest, faces slowed procurement. The Air Force’s FY2025 budget request cut its planned F-35A purchase from 48 to 42 jets, and Congress further reduced the total F-35 buy across services (from 68 to 58) in the 2025 defense authorization.

- F-15EX Eagle II Fighter ($BA) – The Air Force is terminating the F-15EX after 2025, capping procurement at 98 jets (down from 104). In FY25 it will buy only 18 F-15EX (vs. 24 planned), reallocating funds to R&D on next-generation air combat.

- Columbia-class Ballistic Missile Submarine ($GD, $HII) – Initially flagged for cuts, this nuclear deterrence priority may see stretched or delayed funding, though Congress is likely to resist major delays.

- Military Satellite and Space Programs ($LMT, $NOC, $LHX) – Some Defense Space Force programs could see reductions, particularly proprietary satellite constellations, as the Pentagon may turn to commercial solutions.

- Surface Ships and Navy Programs ($HII, $LMT) – The Pentagon intends to protect core surface ship programs, but scrutiny may increase on aircraft carriers and large-deck amphibious vessels.

- Missile Defense and Munitions ($RTX, $LMT, $LHX) – Funding is being redirected to missile defense and munitions, benefiting contractors like RTX and Lockheed Martin, which produce Patriot, THAAD, and PAC-3 interceptors.

🚀 Strategic Adaptations and Company Outlooks

- Lockheed Martin ($LMT) – Focusing on missile defense, hypersonic weapons, and nuclear modernization, while expanding in unmanned tech and space.

- RTX Corporation ($RTX) – Strong position in missile defense and hypersonics, with continued demand for Patriot and Stinger missile systems.

- Northrop Grumman ($NOC) – Backed by the B-21 Raider bomber and Sentinel ICBM program, positioning for long-term stability.

- General Dynamics ($GD) – Prioritizing shipbuilding and armored vehicle exports while sustaining its Gulfstream jet division.

- Boeing ($BA) – Emphasizing unmanned aircraft, space, and international fighter sales to offset reduced U.S. fighter jet demand.

- L3Harris ($LHX) – Pivoting toward open-systems, agile solutions, and cost efficiency to stay competitive in the evolving defense landscape.

📊 Financial Impact and Stock Performance Post-Cuts

- Revenue and Backlog Outlook – Many contractors entered 2025 with historic order backlogs, sustaining revenue for several years. For example, RTX cited a $218 billion backlog, and Lockheed Martin expects 2025 sales of ~$74 billion, up ~45% from 2017 levels.

- Stock Market Reaction – Defense stocks initially dipped on budget cut fears but rebounded as investors recognized sector stability. $RTX and $GD have outperformed on strong earnings.

- Congressional Mitigation – Bipartisan resistance to drastic cuts suggests final budgets may be higher than initially proposed, easing contractor concerns.

🔮 Multi-Year Outlook and Conclusions

- Defense Spending Levels – While the proposed 8% annual cuts are significant, political and geopolitical developments may lead to budget adjustments.

- Portfolio Shifts – Contractors are expected to pivot towards emerging technologies like AI, space, cyber, and hypersonics to align with long-term Pentagon priorities.

- Industry Consolidation vs. Competition – Mid-tier players may merge for scale, while Silicon Valley firms continue to disrupt traditional defense primes.

- Global Defense Landscape – Increased tensions with China and Russia may drive international defense spending, benefiting U.S. contractors through foreign military sales.

In conclusion, the 2025 budget cuts introduce challenges, but the U.S. defense-industrial base remains strong. Contractors that adapt to changing priorities – focusing on innovation, efficiency, and global markets – will be best positioned for long-term success.

What do you think—are these budget cuts a short-term setback or a long-term shift for the defense industry?

Share your thoughts and let’s discuss where the best opportunities might be.

Valores en tendencia

Principales creadores de la semana