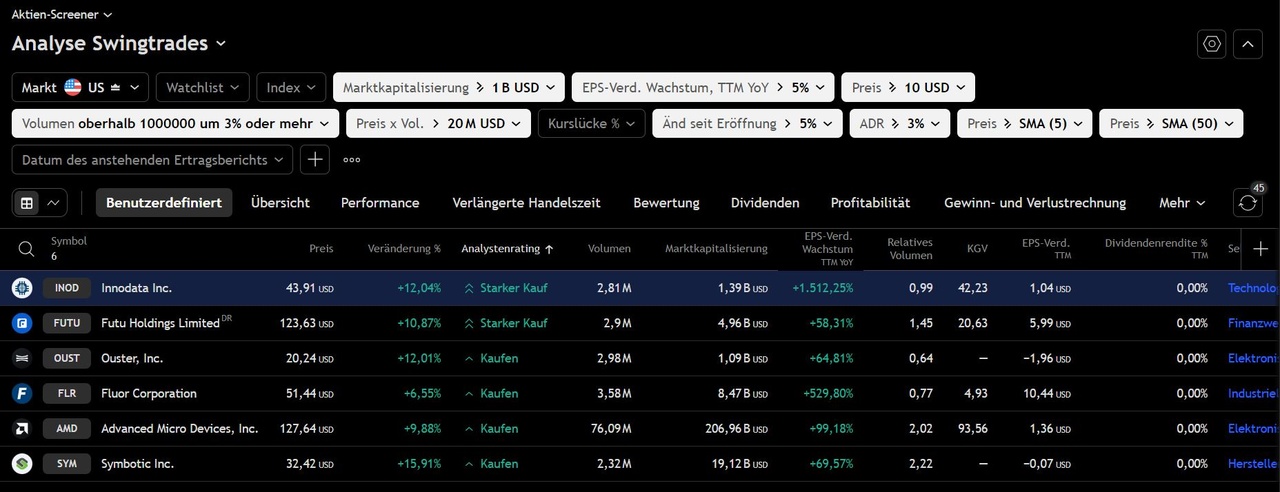

🔹 Revenue: $4.00B (Est. $4.55B) 🔴; -6% YoY

🔹 Adj. EPS: $0.43 (Est. $0.56) 🔴; -49% YoY

FY25 Adj Guidance (Lowered)

🔹 EPS: $1.95–$2.15 (Prior: $2.25–$2.75) 🔴

🔹 EBITDA: $475M–$525M (Prior: $575M–$675M) 🔴

🔹 Tax Rate Assumption: 30%

Segment Highlights

Urban Solutions

🔹 Revenue: $2.1B (vs. $1.8B YoY); Profit: $29M (vs. $105M YoY)

🔹 Impacted by $54M in infra project cost growth (design errors, price escalation)

🔹 New Awards: $856M (vs. $2.4B YoY); Backlog: $20.5B (UP +5% YoY)

Energy Solutions

🔹 Revenue: $1.1B (vs. $1.6B YoY); Profit: $15M (vs. $75M YoY)

🔹 Hit by $31M arbitration loss; work curtailed at JV pending payments

🔹 New Awards: $549M (vs. $582M YoY); Backlog: $5.6B (vs. $8.5B YoY)

Mission Solutions

🔹 Revenue: $762M (vs. $704M YoY)

🔹 Impacted by temporary stop-work on Pacific airfield project

🔹 New Awards: $363M (vs. $63M YoY); Backlog: $2.0B (vs. $3.8B YoY)

Other Key Q2 Metrics:

🔹 Adj. EBITDA: $96M; -42% YoY

🔹 Consolidated Segment Profit: $78M; -60% YoY

🔹 Operating Cash Flow: -$21M (vs. $282M YoY); FY guide: $200–$250M

🔹 Cash & Marketable Securities: $2.3B

Strategic & Project Updates

🔸 First LNG cargo shipped from LNG Canada project

🔸 Reached agreement on COVID-related claims tied to infra projects

🔸 NuScale: Converting 15M Class B shares in August

🔸 Repurchased $153M in shares during Q2

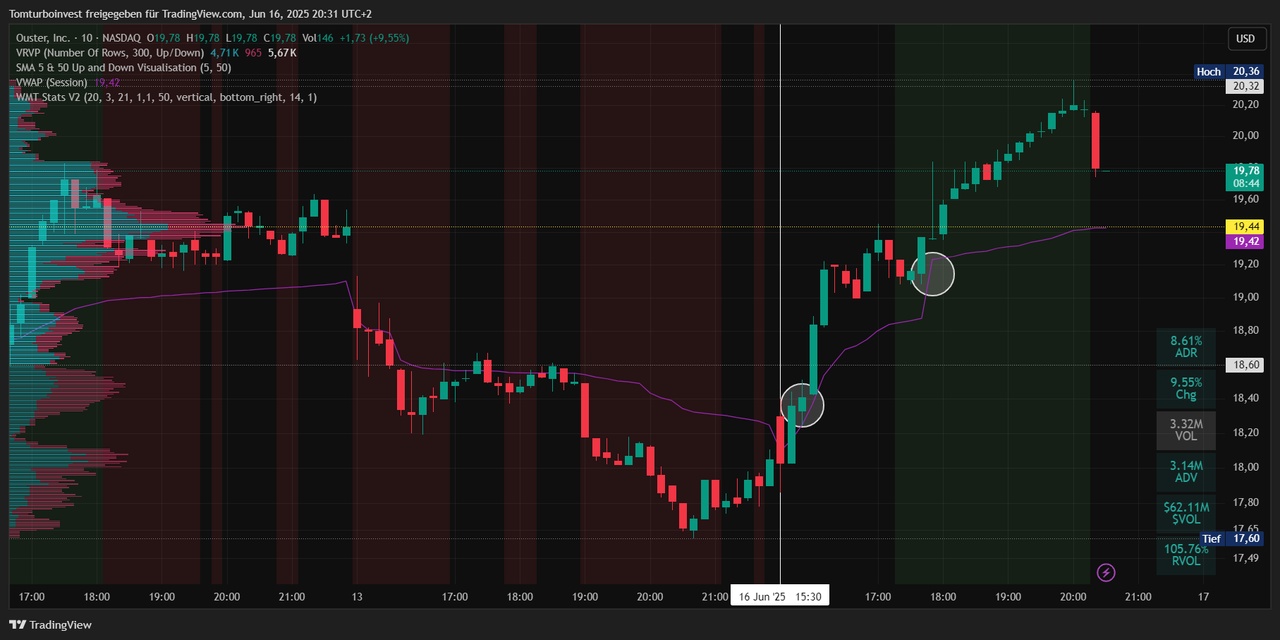

🔸 “Quarter was challenged by legacy infrastructure projects and delayed client capital spend, but long-term strategy remains intact.” – CEO Jim Breuer