1. summary and investment thesis

ExlService Holdings, Inc. ($EXLS (-2,29 %) ) has successfully transformed itself from a traditional business process outsourcing (BPO) provider to a specialized "analytics-first" company. This strategic refocus on higher-value, data-driven services in highly regulated segments such as insurance and healthcare is the basis for the company's above-average margin profile, which reached an Adjusted Operating Margin (AOPM) of 19.4% in 2024.

The core investment thesis is based on EXLS' ability to scale proprietary artificial intelligence (AI) and data platforms to generate measurable business outcomes for clients. Historical revenue growth (16.3% CAGR since 2006) is robust, but the stock is already trading at an ambitious price-to-earnings (P/E) ratio of around 30x.

The assessment of whether $EXLS (-2,29 %) is a worthwhile investment with a tenfold upside potential (Tenbagger) must be assessed critically. The current growth momentum, which amounts to expected EPS growth of 15.4% to 15.75%, is not sufficient for a tenbagger in the usual 7 to 10-year horizon. Achieving a 10x target requires a significant and sustainable acceleration of annual growth to over 25%, which is only possible through a successful scaling of the proprietary analytics platforms and an associated reassessment of the multiple (from service provider to technology platform provider).

2. business model: evolution, value creation and the role of AI

EXLS' business model is based on a dual structure comprising operations management (digitalized BPO) and the strategically more important analytics segment. The company focuses primarily on the insurance (Property and Casualty, Life, Disability) and healthcare (Care Management, Payment Integrity, Revenue Optimization) sectors.

The strategic shift of the value chain to the analytics segment is crucial. This segment provides data-driven insights aimed at improving the customer's business results. This includes specialized solutions such as Advanced Analytics, Customer Analytics, Operations Analytics and Risk & Compliance Analytics. By specializing in these complex, data-intensive industries, EXLS creates differentiation from generic BPO providers.

The integration of AI has fundamentally changed the traditional BPO sector by automating repetitive tasks, resulting in significant cost savings, increased accuracy and scalability. EXLS leverages this change through the use of customized AI solutions and so-called "accelerators". These pre-configurations enable rapid implementation and scaling of solutions, allowing customers to see results in a matter of weeks.

An important indicator of the strategic realignment is the development of free cash flow (FCF). Although the FCF margin averaged an impressive 10.9% over five years, it has recently fallen by 4.3 percentage points. This decline signals increased investment requirements and capital intensity. This should be interpreted as a necessary strategic investment in proprietary AI platforms, intellectual property and the retraining of the workforce (>59,500 employees) in order to secure the technological competitive advantage in the long term. The ability to combine in-depth industry knowledge (insurance/healthcare) with advanced technology (AI/analytics) is the core approach of EXLS to fend off the commoditization of pure services through AI tools.

3. leadership, governance and management stability

The management structure of EXLS is characterized by high continuity. Rohit Kapoor, Co-Founder, acts as Chairman and Chief Executive Officer. Kapoor's long tenure ensures consistent implementation of the "analytics-first" strategy that has developed the company into a high-margin provider.

The composition of the Supervisory Board strengthens the company's credibility, particularly in the regulated markets that EXLS serves. Vikram S. Pandit, the former CEO of Citigroup, serves as Lead Independent Director. The presence of such a high profile director signals strong corporate governance and expertise in dealing with complex global financial and regulatory issues. This is a key soft moat, as trust is essential when managing sensitive data for large clients.

Management compensation, including Rohit Kapoor's significant remuneration ($14.17m), is common in the high-growth sector and reflects successful strategic leadership. However, analysts must consider the key risk of founder dependency: Should the co-founder and CEO leave, the continuity of the aggressive growth strategy (16.3% CAGR ) could be jeopardized. The ability of the broader management team to strengthen the strategic leadership (C-level) is important to mitigate this key man risk.

4. the moat

EXLS' competitive advantage lies in a combination of deep domain expertise and technological differentiation, resulting in high switching costs for customers.

The strong specialization in the insurance and healthcare sectors, which are characterized by extremely high regulatory hurdles and complex business processes, creates a natural protective barrier. Once EXLS' analytics and AI platforms are integrated into clients' critical core processes (e.g. risk modeling, population health programs), the cost and risk of switching to a new provider becomes prohibitively high. Clients rely on data-driven insights to make their core business decisions.

The moat is reinforced by EXLS' proprietary technology platforms. The company is recognized by industry analysts such as the Everest Group and IDC as a leader or major player in Data & AI Services. The technology focuses on customized AI solutions such as Conversational AI and Intelligent Document Processing (IDP) that increase efficiency and accuracy by eliminating manual processing of structured and unstructured data.

EXLS uses this technology as a defence strategy against commoditization through general AI. The added value lies not only in automation (AI as a commodity), but in the ability to apply this technology quickly and in a domain-specific manner. The company combines automation with irreplaceable human skills such as strategic thinking, empathy and creativity.

A decisive factor for the long-term valuation is the property of the proprietary "Prebuilt Solutions and Accelerators". These are essentially scalable software modules. If EXLS can repeatedly implement these modules at new customers without significant incremental costs, the business model shifts from a labor-intensive service provider to a Software-as-a-Service (SaaS)-like model. This would further increase the operating margin and justify a significant revaluation of the multiple by the market.

5. financial performance, margins and growth forecasts

EXLS demonstrates strong long-term revenue performance, with a cumulative annual growth rate (CAGR) of 16.3% from 2006 to 2025 (forecast). Sales growth has been robust in recent years, but has slowed slightly from peak levels:

2022: $1.412 billion, year-on-year increase of 25.82%.

2023: $1.631 bn, increase of 15.48% compared to the previous year.

2024: $1.838 billion, increase of 12.74% compared to the previous year.

Analysts forecast sales growth of 10.1% for the next 12 months. The historical momentum shows that EXLS is able to grow significantly above the market average, even if growth rates have been slightly below the 5-year trend in the last two years.

The profitability of EXLS is a clear sign of the quality of the business model and the successful shift towards analytics. The Adjusted Operating Margin (AOPM) amounted to a solid 19.4% ($356.1M) in 2024.

Earnings growth (EPS) outpaced revenue growth, indicating successful operating leverage and margin expansion. Historical EPS growth was 21.2%. Adjusted EPS growth of 15.4% is expected for the current year, which significantly exceeds the industry average of 10.2%. EPS growth of 15.75% is forecast for the coming year.

Free cash flow (FCF) is an important quality indicator in the services sector. The average FCF margin of 10.9% over the last five years is impressive. However, the recent decline in this margin by 4.3 percentage points signals the need for increased investment in technology to ensure future scalability. The company does not currently pay dividends and does not plan to do so, which is common for companies that finance growth through reinvestment and strategic capital allocation.

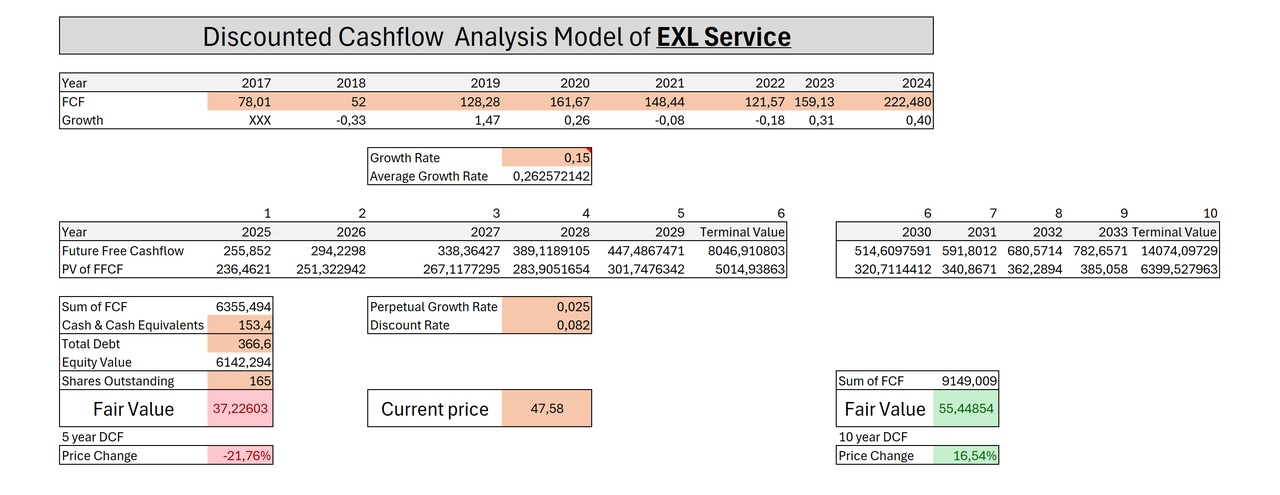

6. valuation and scenario analysis of the 10x potential

EXLS' price-to-earnings (P/E) ratio is currently around 30, implying that the market already values EXLS as a premium growth company with a significant market position in data analytics and AI. Compared to the broader market, whose average P/E ratio is significantly higher according to some indices, EXLS appears cheaper, but high future growth is already priced in.

For the investor aiming for a 10x potential, the already high valuation is a considerable hurdle. In order to achieve a tenfold increase, an annual growth rate (CAGR) in earnings or market capitalization of around 25.9% is required over a period of ten years (assumption: constant multiple).

Given the expected EPS growth of around 15.5% and the required growth of 25.9% for the 10x scenario, EXLS is missing an acceleration of over 10 percentage points in the growth rate.

Achieving this target is only possible if EXLS successfully makes the transition from a service company (even with a high margin) to a technology platform provider.

The necessary acceleration must be achieved through two main mechanisms:

Platform monetization and economies of scale: Proprietary "accelerators" need to move beyond a traditional time & material model into recurring, high-margin license or subscription models typical of SaaS companies. This would improve revenue quality, drive the operating margin above 20% and justify a higher valuation (multiple expansion) in the market.

EXLS needs to massively expand its position in Healthcare and Insurance and win large transformation projects that generate billions in revenue over years. The credibility of the management (strengthened by figures such as Vikram Pandit ) is strategically valuable here.

7 Conclusion and risk assessment

EXLS is a worthwhile investment for investors looking for above-average growth in the technology services sector. The company is well managed, strategically focused on analytics and consistently delivers a high margin profile (19.4% AOPM). The expected EPS growth of over 15% is well above the industry average.

The tenfold growth potential (Tenbagger) can be classified as low to moderate at the current projected growth rates. EXLS is already highly valued. To reach the 10x target, the company needs to increase its annual earnings growth rate from 15% to over 25%. This will require aggressive and successful scaling of its proprietary AI/analytics platforms, which will require a re-rating as a technology company and continued margin expansion. Without this successful transformation, EXLS is more likely to remain a strong 3x to 5x performer over ten years.

The key challenge will be to cast domain expertise into proprietary, scalable software faster than generic AI tools commoditize margins in the operations management segment.

The decline in the FCF margin must be monitored. If increased investment in analytics and technology fails to translate into accelerated revenue growth, margins could come under sustained pressure.

Talent and implementation risk: The workforce needs to be successfully retrained from traditional BPO roles to AI supervisors and highly skilled data analysts, which is a massive challenge in a competitive environment.

The strong dependence on co-founder Rohit Kapoor for strategic leadership poses a medium to long-term continuity risk.