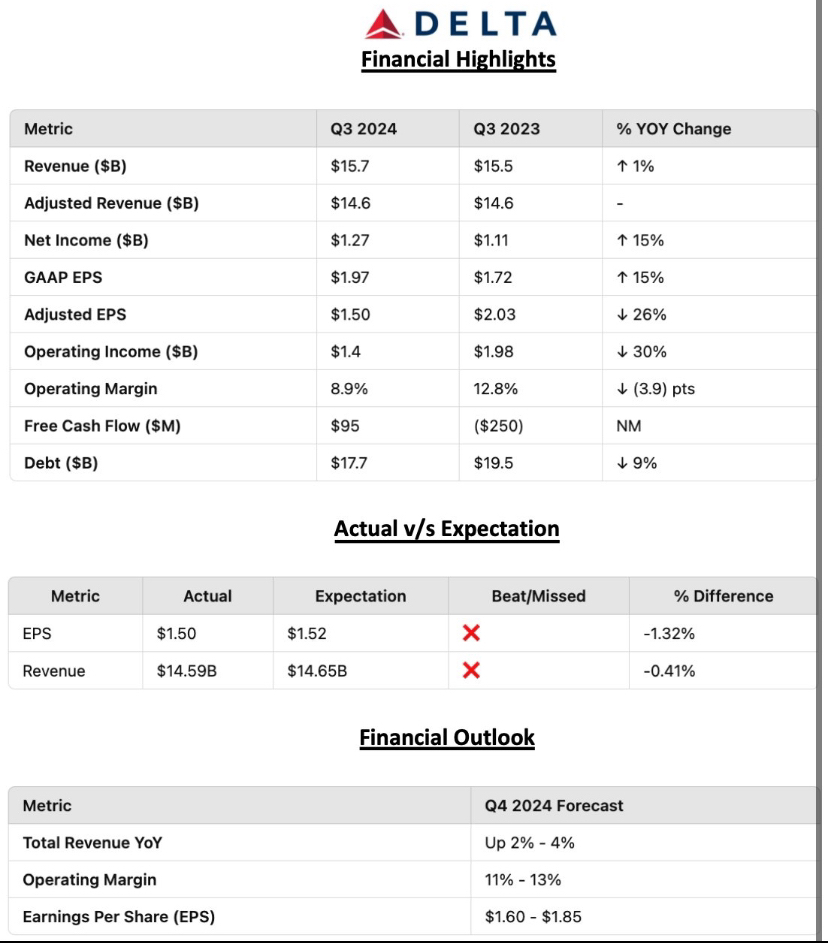

🔹 Revenue: $15.20B (Est. $15.04B) 🟢; UP +4.1% YoY

🔹 EPS: $1.71 (Est. $1.53) 🟢; UP +14% YoY

Raises FY25 Outlook:

🔹 EPS: ≈$6.00 (Est. $5.77) 🟢

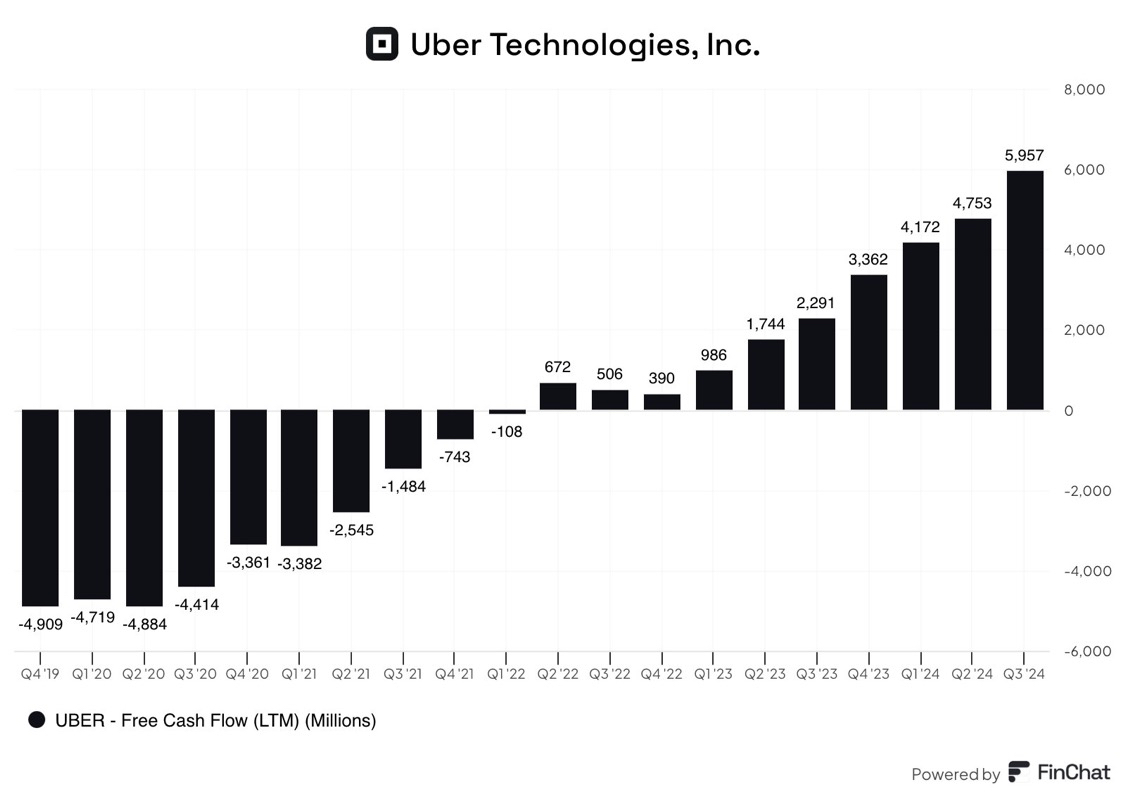

🔹 Free Cash Flow: $3.5–$4.0B

🔹 Gross Leverage: <2.5x

Q4’25 Outlook:

🔹 Revenue: UP +2%–4% YoY

🔹 Operating Margin: 10.5%–12%

🔹 EPS: $1.60–$1.90

Other Metrics:

🔹 Operating Income: $1.70B; UP +23% YoY

🔹 Operating Margin: 11.2%; UP +1.7 pts YoY

🔹 Pre-Tax Income: $1.5B; UP +18% YoY

🔹 Net Income: $1.12B; UP +15% YoY

🔹 Operating Cash Flow: $1.8B; UP +42% YoY

🔹 Free Cash Flow: $833M; vs. $95M last year

🔹 Adjusted Net Debt: $15.6B; DOWN -17% YoY

Segment

🔹 Premium Revenue: UP +9% YoY

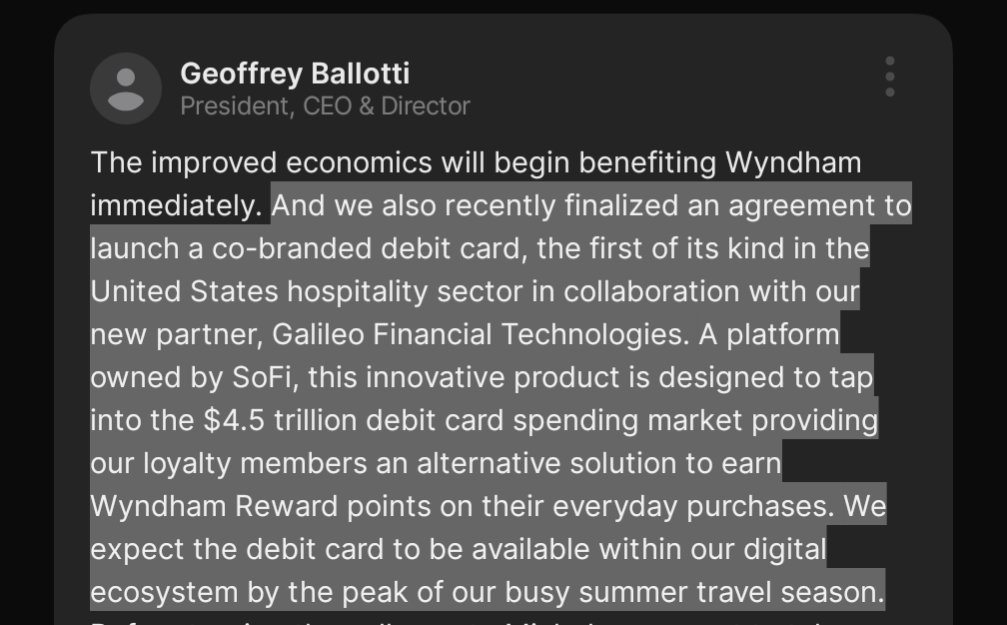

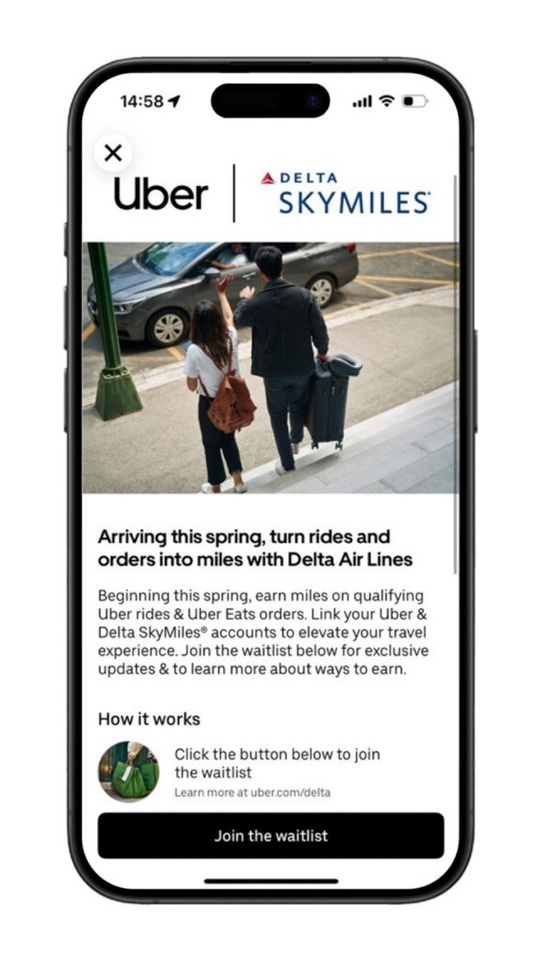

🔹 Loyalty Revenue: UP +9% YoY

🔹 Amex Partnership Revenue: $2.0B; UP +12% YoY

🔹 Domestic Passenger Revenue: UP +5% YoY

🔹 Corporate Sales: UP +8% YoY

🔹 Adjusted TRASM: UP +0.3% YoY

Cost Metrics

🔹 Operating Expense: $13.5B; UP +2% YoY

🔹 Non-Fuel CASM: 13.35¢; UP +0.3% YoY

🔹 Fuel Expense: $2.56B; DOWN -8% YoY

🔹 Avg. Fuel Price: $2.25/gal; DOWN -11% YoY

Balance Sheet & Cash Flow

🔹 Total Debt: $14.9B; DOWN -16% YoY

🔹 Adjusted Net Debt: $15.6B; DOWN -17% YoY

🔹 Operating Cash Flow: $1.8B; UP +42% YoY

🔹 Liquidity: $6.9B (includes $3.1B undrawn revolver)

CEO Commentary — Ed Bastian

🔸 “We delivered September quarter results at the top end of our expectations on strong execution and improving fundamentals.”

🔸 “Momentum is continuing into the final stretch of our Centennial year, positioning us to deliver strong December quarter earnings.”

🔸 “Looking to 2026, Delta is well positioned to deliver top-line growth, margin expansion, and earnings improvement consistent with our long-term framework.”

CFO Commentary — Dan Janki

🔸 “Non-fuel unit cost growth was approximately flat compared to prior year, consistent with our full-year guidance.”

🔸 “We’ve paid down nearly $2B in debt year-to-date, bringing gross leverage to 2.4x.”

🔸 “Full-year free cash flow of $3.5–$4B enables us to reinvest in the business while returning cash to shareholders.”

Operational Highlights

🔹 Led peers in on-time performance YTD

🔹 31 aircraft delivered YTD; 20 retired

🔹 New routes announced to Sardinia, Malta, Madrid, Nice, Porto, Hong Kong

🔹 Accrued $986M in profit sharing YTD

🔹 Named #2 on Forbes World’s Best Employers (2025)