Quarterly figures on 02.02.2023...

Apple, Amazon, Google, Starbucks and Co ⤵️

Now the battleships deliver. Let's see how we then go into the weekend in the morning. All gone again, because the companies are not convincing, or there is profit taking, or it rises even further? What do you think? Tomorrow evening even higher than tonight?

$AAPL (-4,63 %)

Apple:

Missed analyst estimates of $1.94 in the first quarter with earnings per share of $1.88. Revenue of $117.2 billion below expectations of $121.88 billion.

$SBUX (-2,43 %)

Starbucks:

Missed analyst estimates of $0.77 in the first quarter with earnings per share of $0.75. Revenue of $8.7 billion below expectations of $8.78 billion.

$AMZN (-5,92 %)

Amazon.com:

Misses analyst estimates of $0.17 in the fourth quarter with earnings per share of $0.03. Revenue of $149.2 billion above expectations of $145.64 billion.

$GOOGL (-3,4 %)

Alphabet:

Missed analyst estimates of $1.18 in the fourth quarter with earnings per share of $1.05. Revenue of $76.05 billion below expectations of $76.07 billion.

$QCOM (-8,32 %)

Qualcomm:

Beats first-quarter analyst estimates of $2.36 with earnings per share of $2.37. Revenue of $9.46 billion below expectations of $9.6 billion.

$MSTR (-7,17 %)

MicroStrategy:

Missed analyst estimates of $0.02 in the fourth quarter with earnings per share of -$21.93. Revenue of $132.6 million exceeded expectations of $131.32 million.

$GPRO (-13,3 %)

GoPro:

Beat analyst estimates of $0.09 in the fourth quarter with earnings per share of $0.12. Revenue of $321.02 million below expectations of $324.68 million.

$GILD (-0,04 %)

Gilead Sciences:

Beat analyst estimates of $1.50 with fourth-quarter earnings per share of $1.67. Revenue of $7.4 billion exceeded expectations of $6.66 billion.

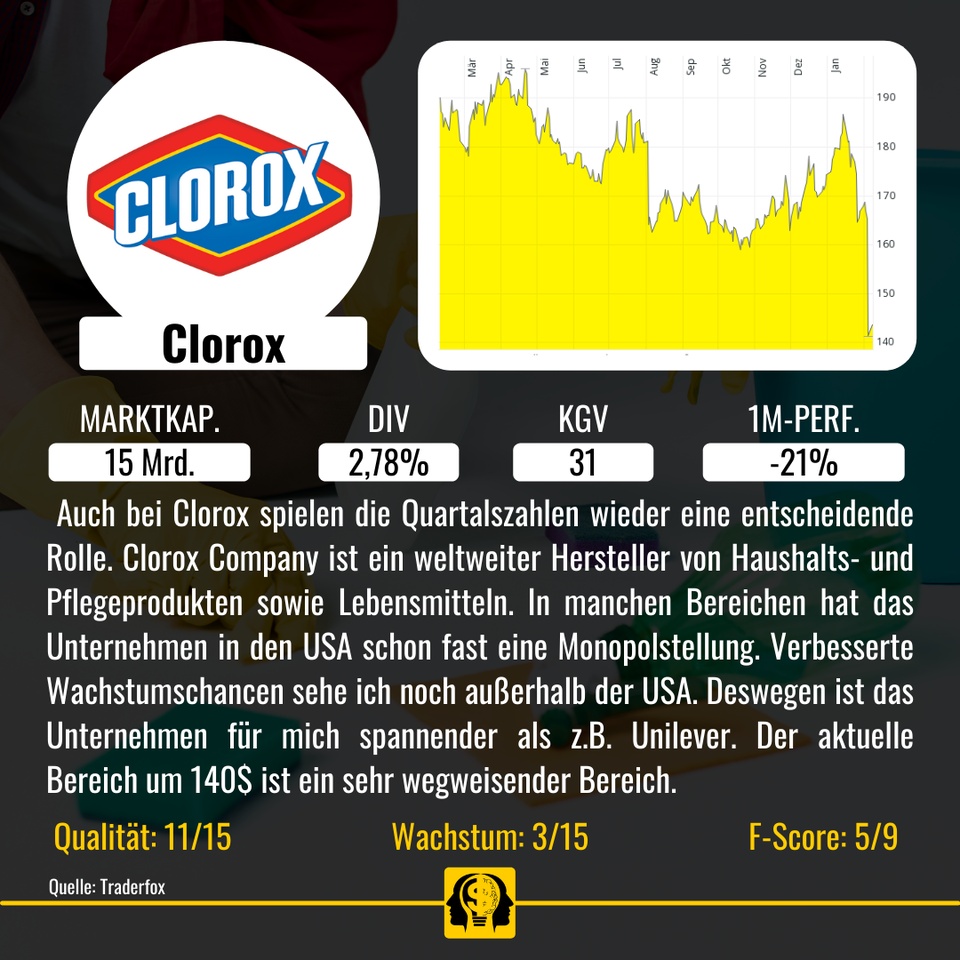

$CLX (+0 %)

Clorox:

Second-quarter earnings per share of $0.98 beat analyst estimates of $0.66. Revenue of $1.72 billion exceeded expectations of $1.66 billion.

$F (-1,41 %)

Ford Motor:

Misses analyst estimates of $0.62 in the fourth quarter with earnings per share of $0.51. Revenue of $44 billion above expectations of $41.87 billion.

$SHEL (-3,05 %)

Shell:

Posts Q4 adjusted profit of $9.81 billion (analyst forecast: $8.26 billion) and adjusted earnings per share of $1.39 (forecast: $1.15). Net debt at the end of Q4 was $44.8 billion (forecast: $42.96 billion), and the Q4 dividend is 28.75 U.S. cents per share. Shell announced a share buyback program of over $4 billion.

$RACE (-3,78 %)

Ferrari:

Traded under the stock symbol "RACE," the company reported 13,221 vehicles delivered in 2022, up 19 percent from a year earlier. Sales also rose by the same amount with to EUR 5,095 billion. Profit and EBITDA increased at a slightly lower rate. The adjusted EBIT margin was 24.1 percent. Net, the company earned EUR 5.11 per share.

$IFX (-4,21 %)

Infineon:

achieved Q4 sales of €3.951 billion (PY: €4.143 billion), a gross margin of 47.2% (PY: 44.4%), income from continuing operations of €729 million (PY: €730 million) and net income of €728 million (PY: €735 million). Sales are still expected to reach €15.5 billion +/- €500 million in fiscal 2023.

$ROG (-0,98 %)

Roche:

Achieves 2022 sales of CHF63.3 billion (analyst forecast: CHF63.3 billion), net income of CHF13.5 billion (PY: CHF14.9 billion) and adjusted earnings per share of CHF20.3 (forecast: CHF20.5). The dividend for 2022 is expected to be CHF 9.50 (PY: CHF 9.30). In the outlook for 2023, Roche expects a low-single-digit percentage decline in sales; solid sales growth expected excluding Covid 19 sales; decline from adjusted net income largely in line with sales decline.

$SHL (-3,21 %)

Siemens Healthineers:

Posts Q1 sales of €5.08 billion (PY: €5.07 billion, analyst forecast: €5.02 billion), Ebit (adjusted) of €647 million (PY: €898 million, forecast: €663 million) and net income of €426 million (PY: €472 million). Outlook for 2022/2023 confirmed.

#apple

#starbucks

#amazon

#google

#alphabet

#qualcomm

#ford

#siemenshealthineers

#ferrari

#shell

#infineon

#quartalszahlen

#aktien

#boerse

#börse

#zahlen

#news

#newsroom

#nachrichten

#wirtschaft

#unternehmen

#gewinn

#verfehlt