Today again $BATS (-0,17 %) / $BTI (+0 %) bought more. What was on your menu?

British American Tobacco ADR Representing

Price

Debate sobre BTI

Puestos

35PT Update

I closed two historical positions:

- $BTI (+0 %) with a gain of +66%

- $MMM (-1,74 %) with a gain of +50%

With the freed capital I opened new positions on Target ($TGT (-0,47 %) ) and Merck ($MRK (+0,33 %) ), to continue diversifying and target sectors that I see as solid in the medium to long term.

📈 Always with the idea of growing the portfolio in a balanced and sustainable way.

👀

What could be better than dividends exempt from withholding tax? $BATS (-0,17 %)

$BTI (+0 %) Arrived today🚀 Who's in too?

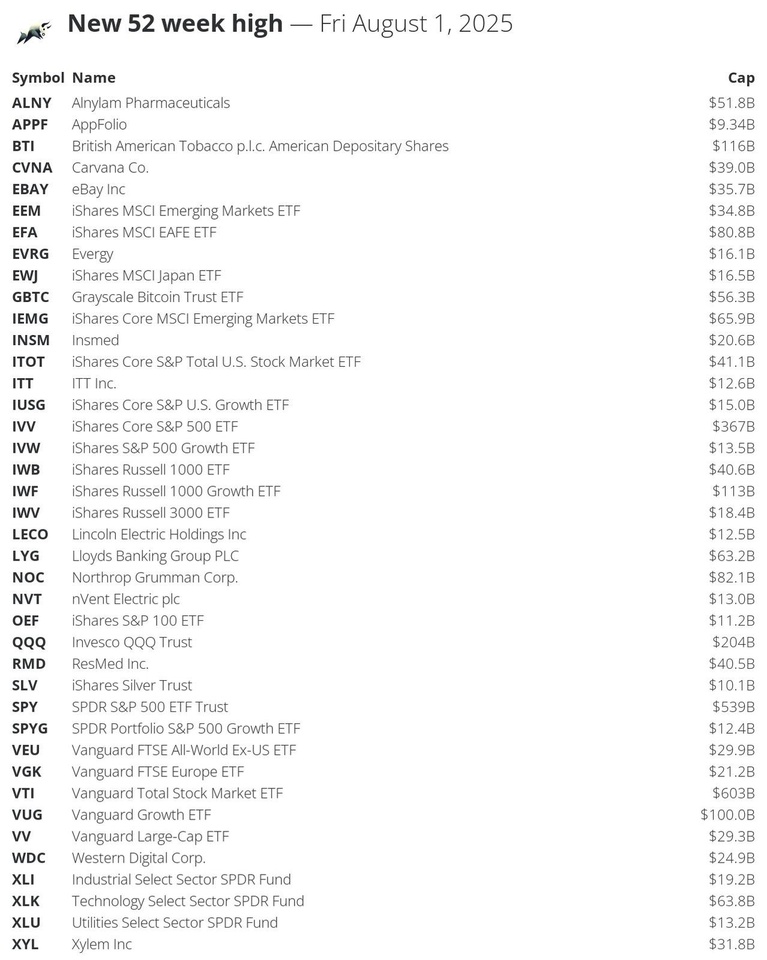

Market News

🔝 Stocks that made a new 52-week high today: $VTI (+0,68 %)

$SPY (+0,67 %)

$IVV (+0,69 %)

$QQQ

$BTI (+0 %)

$IWF (+0,77 %)

$VUG (+0,85 %)

$NOC (-0,1 %)

$EFA

$IEMG (+0,52 %)

$XLK

$LYG

$GBTC

$ALNY (-0,18 %)

$ITOT (+0,71 %)

$IWB (+0,65 %)

$RMD (-2,32 %)

$CVNA (+3,03 %)

$EBAY (+1,83 %)

$EEM

$XYL (+0,1 %)

$VEU (+0,29 %)

$VV (+0,7 %)

$WDC (+3,12 %)

$VGK (+0 %)

$INSM (-0,36 %)

$XLI

$IWV (+0,68 %)

$EWJ (+0,25 %)

$EVRG (+0,94 %)

$IUSG

$IVW

$XLU

$NVT

$ITT (+0,33 %)

$LECO (+0 %)

$SPYG

$OEF (+0,83 %)

$SLV

$APPF (+1,26 %)

#52weekHigh

Top up

Today I topped up a little on the following titles:

What's currently on your buy list? Have you bought anything recently?

Top up🚀

Stocked up a little again today with:

- $BATS (-0,17 %) / $BTI (+0 %) - Dividend machine in the tobacco sector

- $SCHD - solid US dividend ETF

- $SPYI - Premium strategy on top 💸

Goal: further increase cash flow, expand dividends & options step by step.

What was on your list today? 📈👇

Dividend

Thank you $BTI (+0 %) for the dividend

keep stacking the dividend

D stands for dividends

$BTI (+0 %) / $BATS (-0,17 %) Will be stocked up soon🚀 Do you have them in your luggage too?

Valores en tendencia

Principales creadores de la semana