𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗠𝗶𝗻𝗱𝗲𝘀𝘁𝘀𝘁𝗲𝘂𝗲𝗿, 𝗮𝗯𝗼𝘃𝗲 𝘁𝗵𝗲 𝗰𝗹𝗼𝘂𝗱𝘀 𝘂𝗻𝗱 𝗕𝗶𝘁𝗰𝗼𝗶𝗻

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, AES Corporation ($AES (+0,28 %)), Banner Bank ($BANR), Baker Hughes($68V (-0,18 %)), Equitrans Midstream ($37W), Realty Income Corporation ($RY6 (-0,26 %)), Shell Midstream Part ($SHLX), 1st Source ($SRCE) and Vereit ($50A) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

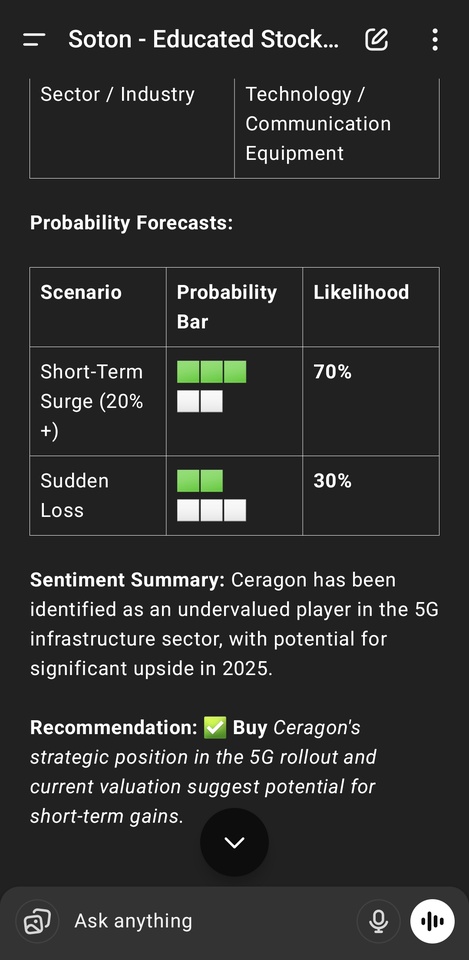

Today, among others, Addex Therapeutics ($ADXN), Arista Networks, Inc. ($117), Asahi Glass ($SHJ (+1,25 %)), Ceragon ($GGN (-0,51 %)), Clorox ($CXX (-2,27 %)), Eisai ($EII (+1,24 %)), Kyocera ($KYR (-1,75 %)), Leggett & Platt ($LP1 (-0,22 %)), McKesson ($MCK (+1,31 %)), NXP Semiconductors ($VNX (-1,14 %)), Ryanair ($RY4C (+0,9 %)), Simon Property ($SQI (-1,22 %)), Shionogi Seiyaku ($SH0 (-2,64 %)), Tata Motors ($TATB), TDK ($TDK (-1,77 %)), Transocean ($RIG (+2,35 %)), Williams ($WMB (+0,28 %)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

G20 - Global minimum tax to come in 2023. In this, every company that exceeds an annual turnover of 750,000 euros is to pay 15% tax on its profits. The large digital corporations must have a turnover of at least 20 billion euros and generate a pre-tax profit margin of at least 10% to also be affected by the global sales tax. Amazon ($AMZ (-0,67 %)) would then be spared its 5% margin, while Apple ($APC (+0,21 %)) would be asked to pay. Tax havens would also become less attractive, as the tax burden would not fall on the home countries - as it does now - but on the market countries, i.e. where most of the revenue is generated.

Ryanair ($RY4C (+0,9 %)) - The airline has finally been able to report a profit again since the start of the pandemic. In the quarter July to September this year, the profit was 225 million euros. In comparison, Ryanair made a loss of 225.5 million euros in the same quarter last year.

However, a loss of 100 to 200 million euros is expected for the year as a whole, as airline tickets have to be offered at discounts.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Bitcoin ($BTC-EUR (+1,46 %)) - After Bitcoin's strong October 2021 gain, there are eager hopes for an even stronger price increase. Predictions vary between a $50,000 and $100,000. Next month's result could be significantly influenced by the fact that many investors are in a celebratory mood and expect a continued strong increase. On the other hand, a throttling of the markets is expected after an announcement by the Fed.

Follow us for french content on @MarketNewsUpdateFR