While the world outside was drifting into the Christmas hustle and bustle and I was consciously spending more time with my parents, little dramas were unfolding at the markets. My class leader $AVGO (-0,7 %) lost value, as did the main share portfolio. But honestly? I only really noticed this at the end of the year. The second half of December had long since cast its spell over me, especially Christmas and the time between the years when everything slows down a little. Instead of rushing around, I reflected and did some soul-searching. Meanwhile, the automated systems continued to do their job. Savings plans were running and dividends were flowing.

At the end of the year $LTC (-0,67 %) Properties was the last buy of the year. Alongside $O (-0,56 %) and $MAIN (+0,02 %) this monthly payer should continue to grow. The business model has a future and I am building something here step by step.

And now enough of the quiet, time for a review.

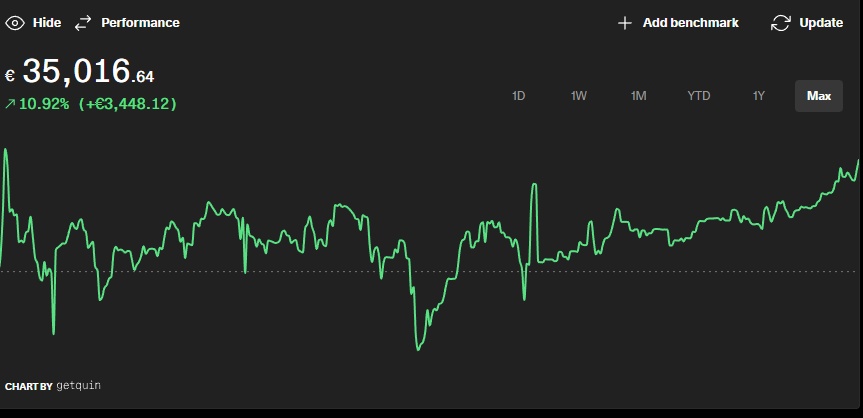

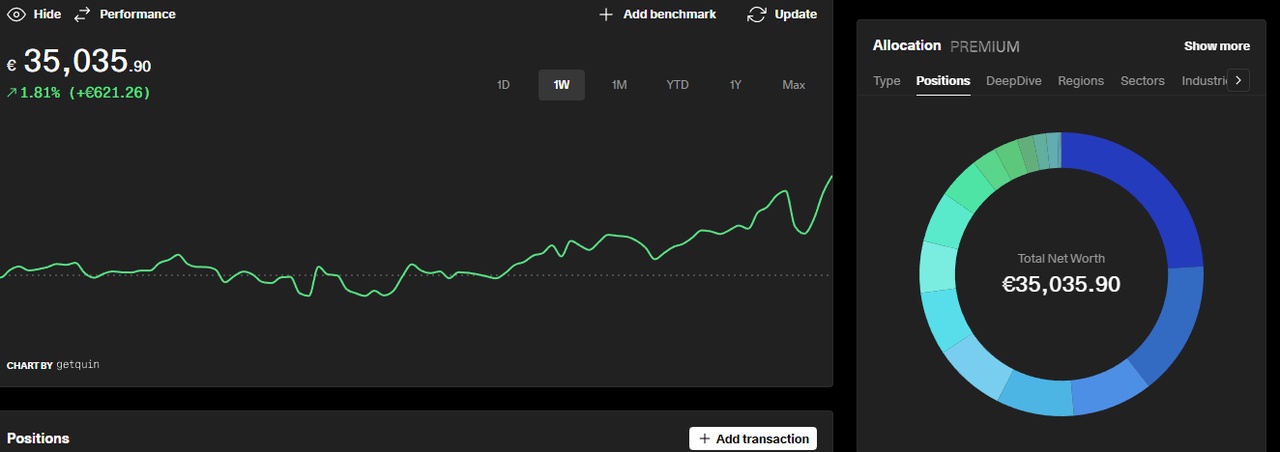

Overall performance

It was business as usual as I enjoyed the end of the year. Negative effects passed me by, that's just part of it.

My key performance indicators for my overall portfolio at a glance:

- TTWROR (month under review): -0.46% (previous month: +1.40%)

- TTWROR (since inception): +79,52%

- IZF (month under review): -5.23% (previous month: +18.54%)

- IZF (since inception): +10,81%

- Delta: -401.91€

- Absolute change: +616.54€

Performance & volume

$AVGO (-0,7 %) gives up 15% and also pulls ahead of other tech stocks such as $NFLX (+1,35 %) and $GOOGL (-0,68 %) my main stock portfolio down. The other portfolios rise, but cannot compensate for this. That's part of investing. When I look at the top 5, I notice that defensive stocks such as $BAC (+0,96 %) and $WMT (+0,95 %) are rising slightly again. I like that, it's a stinking boring business model, which isn't sexy at all, but provides me with steady share price growth and a nice cash flow.

The five red lanterns naturally go to the same weakening candidates (by performance). Well, if something is going well, something must be going badly.

Size of individual stock positions by volume in the overall portfolio:

Share of equities (%) in the total portfolio (and associated securities account):

$AVGO (-0,7 %) 3.06% (main share portfolio)

$WMT (+0,95 %) 1.76% (main share portfolio)

$GOOGL (-0,68 %) 1.51% (main share portfolio)

$BAC (+0,96 %) 1.50% (main share portfolio)

$NFLX (+1,35 %) 1.38% (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$NOVO B (-1,95 %) 0.48% (main share portfolio)

$BATS (-2,64 %) 0.54% (main share portfolio)

$GIS (-0,65 %) 0.55% (crypto follow-on deposit)

$MDLZ (-2,06 %) 0.56% (main share portfolio)

$CPB (+0,18 %) 0.58% (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$AVGO (-0,7 %) : +328% (main stock portfolio)

$NFLX (+1,35 %) +101% (main share portfolio)

$GOOGL (-0,68 %) +115% (main share portfolio)

$WMT (+0,95 %) +91% (main share portfolio)

$BAC (+0,96 %) + 81% (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$NKE (-1,95 %) : -35% (main stock portfolio)

$GIS (-0,65 %) -34% (main share portfolio)

$TGT (+7,34 %) : -33% (main share portfolio)

$CPB (+0,18 %) : -30% (main share portfolio)

$NOVO B (-1,95 %) -24% (main share portfolio)

Asset allocation

Equities and ETFs currently determine my asset allocation.

ETFs: 41.7%

Equities: 58.2%

Crypto: 0.0%

P2P: less than 0.01%

Investments and subsequent purchases

In December, I slightly increased the savings plans from my net salary and reinvestment. I invested the following amounts in savings plans:

Planned savings plan amount from the fixed net salary: €1,040 [previously: €1,030]

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: €1,060 [previously: € 1,040]

Savings ratio of the savings plans to the fixed net salary: 50.24% [49,75%]

In addition, there were the following additional investments from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: €40.00

Subsequent purchases/one-off savings plans as a cashback annuity from bonuses: € 0.00

Subsequent purchases from other surpluses: € 108.23

Automatically reinvested dividends by the broker: €7.03 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

Unscheduled purchases were made on various securities accounts outside the regular savings plans:

Number of unscheduled purchases: 9

40.00€ for $FGEQ (-1,05 %)

56.94€ for $ULVR (-2,57 %)

88.72€ for $LTC (-0,67 %)

After the Magnum spinoff at Unilever, I sold the booked position a few days too late in order to shift it into Unilever with some cash. It was sold:

37,43€ from $MICC (-1,89 %)

Magnum Ice Cream is neither in my freezer nor in my portfolio.

Passive income from dividends

I received € 132.75 in dividends (€ 152.20 in the same month last year). This corresponds to a change of -12.78% compared to the same month last year. The reason for the decline is that distributions from my three large Vanguard ETFs no longer arrived on time. Further key figures:

Number of dividend payments: 32

Number of payment days: 16 days

Average dividend per payment: €4.15

average dividend per payday: €8.30

The top three payers in the month under review were:

$ARCC (+0,68 %)

$UPS (-0,9 %)

$ULVR (-2,57 %)

My passive income from dividends (and some interest) mathematically covered 7.94% of my expenses for the month under review. Acceptable for a weak month with medium-high expenses (by my standards).

Crypto performance

I am currently completely on the sidelines here. It will be a while before I get back in.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows the TTWROR in the current month (and since the beginning):

My portfolio: -0.46% (since I started: +79.52%)

$VWRL (-2,36 %) +0.06% (since my start: 66.12%)

$VUSA (-0,39 %) +1.00% (since my start: 63.76%)

After outperforming the ETFs last month, I am underperforming this time. 2026 will catch up. 🤗

Key risk figures

Here are my risk figures for the month under review:

Maximum drawdown: YTD: 17.17% (month under review: 1.56%)

Maximum drawdown duration: 702 days [since inception] (reporting month: 26 days)

Volatility: YTD: 12.00% (in the month under review: 1.33%)

Sharpe Ratio: YTD: 0.48 (in the month under review: -3.92)

Semi-volatility: YTD: 9.35% (in the month under review: 0.98%)

The maximum drawdown of 702 days since the beginning is still reminiscent of the tough phase 2022-2023, before the year-end rally started at the end of 2023. In December itself, the decline of 1.56% was marginal and a sign that the major turbulence of the year was over.

My Sharpe Ratio has improved to 0.48 YTD, showing that for every unit of risk, I get almost half a unit of return above the risk-free rate. Volatility has fallen from a wild 28% over the course of the year to a reassuring 12% YTD, while semi-volatility is down to just 9.35%. That shows: My portfolio does fluctuate, but the risk of loss is lower than the overall volatility would suggest. December was particularly quiet with a semivolatility of 0.98%.

What remains? Confirmation of my strategy: think long-term, keep calm and buy when things get cheap. 2025 ends solidly despite weakness.

Outlook

Back in the November review, I announced my investment of the Christmas bonus. Of course, I wasn't talking about money from my employer, but simply what I received for Christmas plus a few pennies I had lying around at home. I posted the reinvestment on the same day in the week between the years.

I also donated a few dividends, the fourth and final donation was made in December. You can read more about this in the Instagram Story. I think donations are important, because those who have should also give something.

I'll end this review with another personal point, which I already covered in the August and November reviews.

Loyal readers of my reviews will know that in the summer I was diagnosed with an aneurysm of the ascending aorta near my heart as a result of a bicuspid and insufficient aortic valve. It was an accidental finding that took some of the danger out of this ticking time bomb thanks to close monitoring, but it is still ticking. When I look back on the year 2025, I realize how this thing has permanently changed my thinking and my approach. Of course, it's an ongoing process, but I'm less likely to fall back into old patterns. Even though the cardiology appointment in December found that the thing hasn't grown any further, which will give me a little more time before surgery, I know the day will come. It's unclear when, but like a meteoroid hurtling towards the earth, there is something on the horizon. You just don't know when it's going to hit. The fact that the 43-44mm has remained stable (and no more) is a gain of time for me that I want to use. I have a lot of plans to develop new sources of income, significantly expand my social media presence, implement new habits, continue to work on my fitness and focus on life and the positive. Despite the diagnosis, 2025 will be a great year for me. And I'm going to go one better in 2026.

Thank you for reading. I wish you all the best for 2026!

👉 You can also read my portfolio review for December on Instagram from January 8, 2026 (and budget review from 9.1.26).

📲 In addition to the portfolio and budget review, there are currently three posts a week: @frugalfreisein

!!! Please pay close attention to the spelling of my alias. Unfortunately, there are too many fake and phishing accounts on social media. I have already been "copied" several times. !!!

👉 How was your month in the portfolio? Do you have any tops & flops to report? Leave your thoughts in the comments!