Depot review November 2024 - The depot is growing despite larger withdrawals 🚀

Before I continue with the second part of my investment story, I would first like to share my portfolio review for November.

The second half of November was almost quiet compared to what happened at the beginning of November. Trump was elected, triggering a veritable run on the stock markets. Germany was finally freed from the traffic lights and there were also some exciting topics in the private sphere. I sold a few shares back in October to generate the equity I needed to start building a house. This continued a little further in November.

Overall, my savings rate will also (have to) be lower over the next few months. Less into the portfolio and more into the "buffer account" for building the house. Nevertheless, around €500 per month will continue to be invested and this will be pushed up again as quickly as possible.

After selling 6 shares and an ETF in October, I sold parts of my MSCI World ETF for around €13,000.

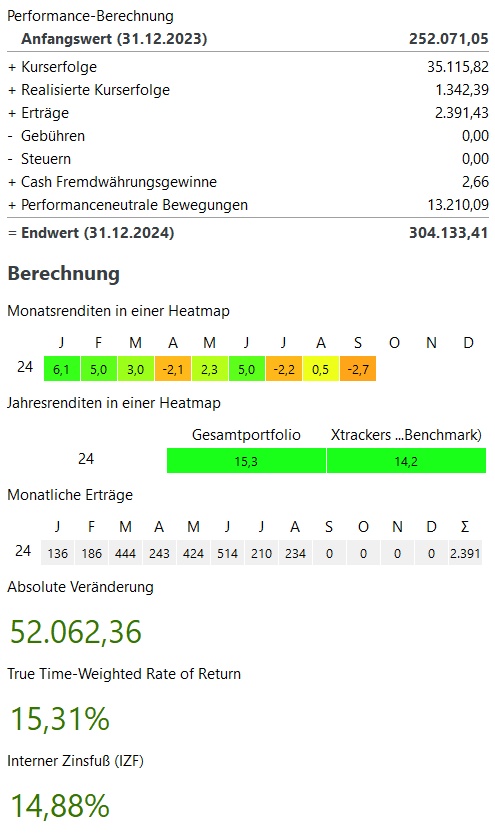

But now it's finally time to look at the hard figures:

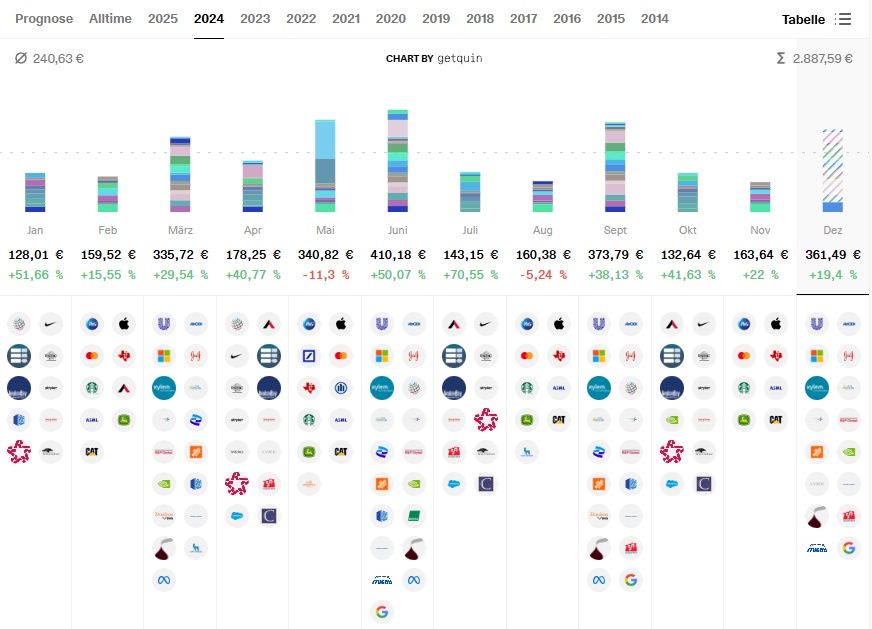

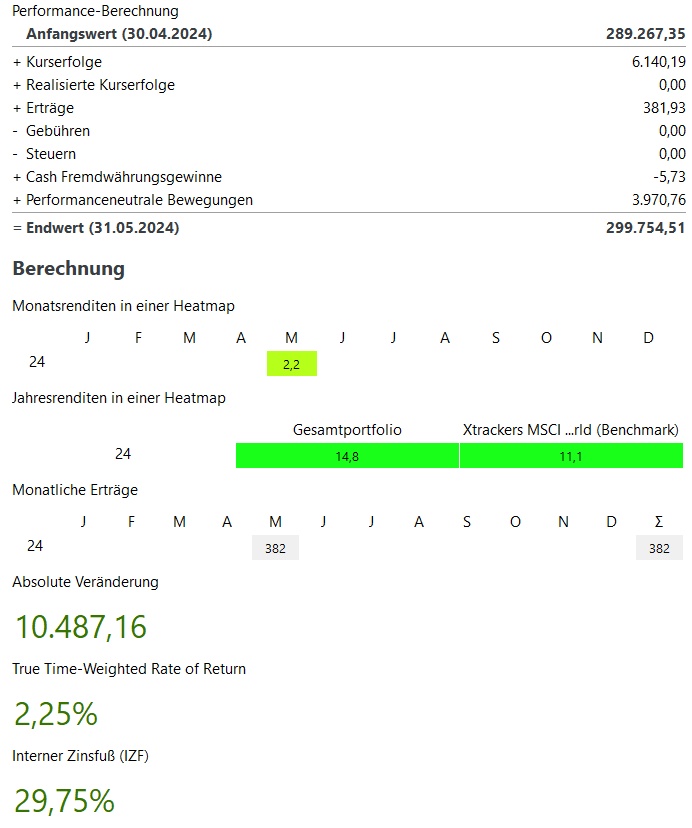

Monthly view:

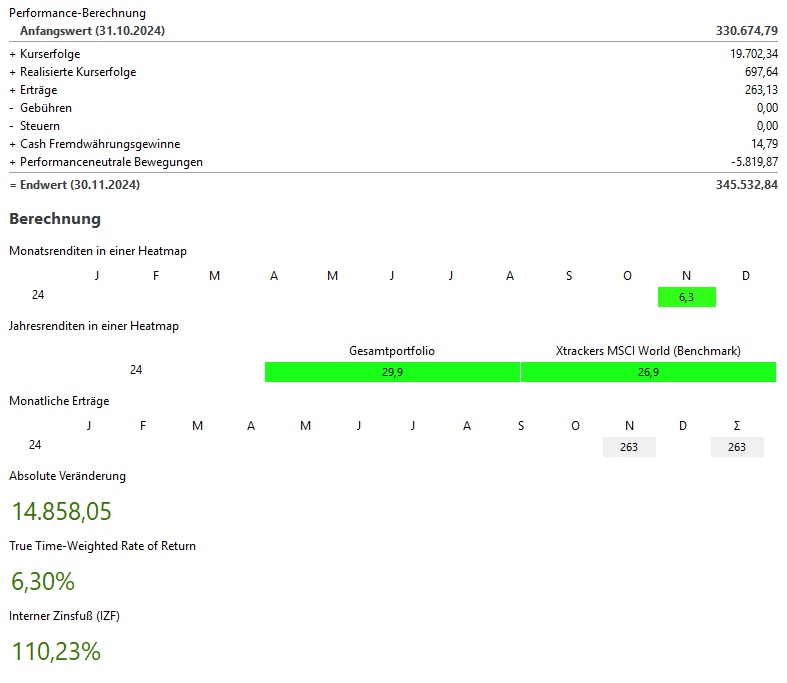

In total, November was +6,3%. This corresponds to price gains of ~20.000€.

The MSCI World (benchmark) was +7.3% and the S&P500 +5.1%

Winners & losers:

A look at the winners and losers is particularly exciting this month:

On the winning side with a total of almost €5,000 in price gains, my crypto investments in Bitcoin and Ethereum. This is followed by the long runner NVIDIA with price gains of just under €2,000. 4th and 5th place then goes to the cybersecurity sector with Palo Alto Networks and Crowdstrike.

On the loser side looks very quiet this month. Amgen is still the worst performer with losses of ~€600 due to a weight loss drug that failed to fully meet Wall Street's hopes. This is followed by Sartorius with share price losses of €200. Places 3-5 are then occupied by share price losses of less than €100. All in all, a month with almost no losers.

The performance-neutral movements in October amounted to just under € -6,000. Parts have already been removed here for private topics.

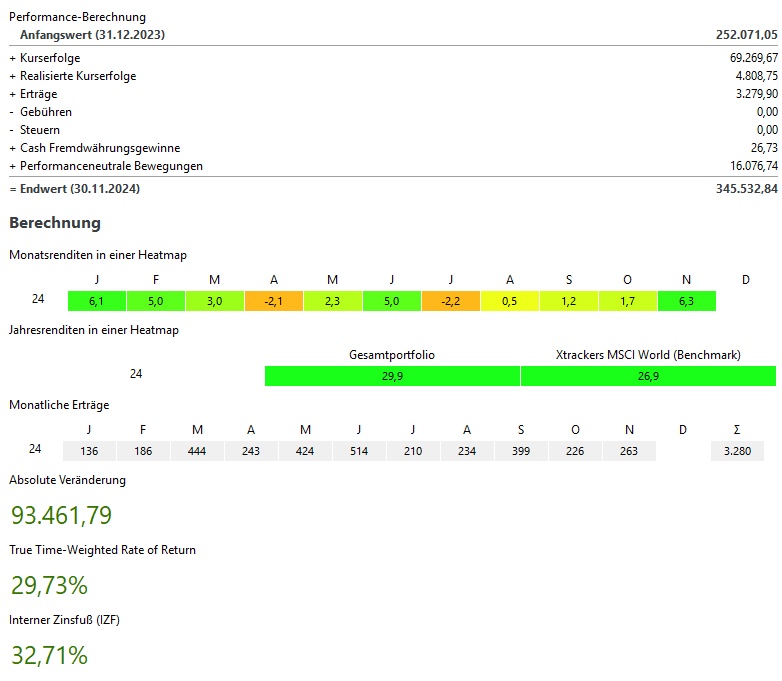

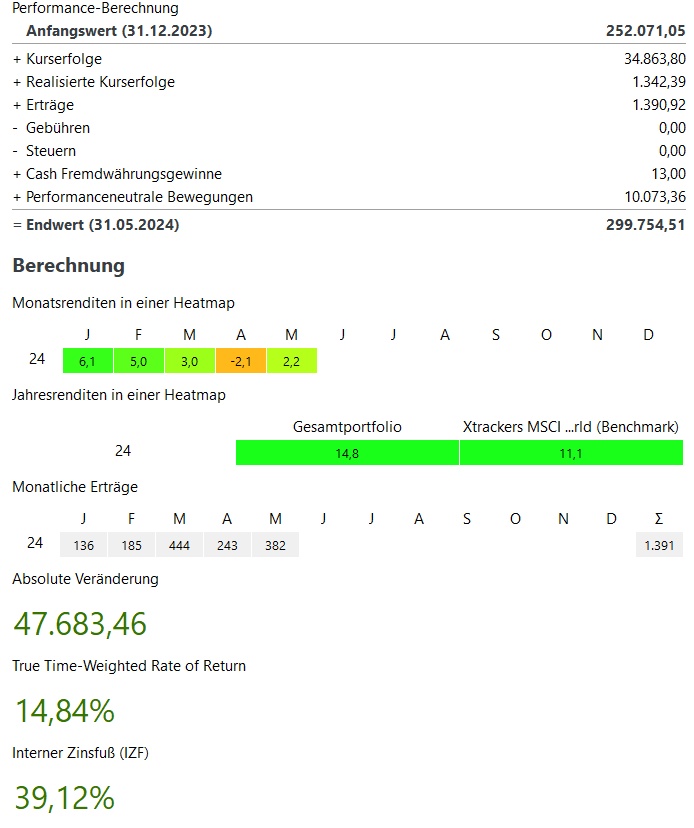

current year:

My performance in the current year is +29,9% and thus above my benchmark, the MSCI World with 26.9%.

In total, my portfolio currently stands at ~345.000€. This corresponds to an absolute growth of ~€93,000 in the current year 2023. ~72.000€ of this comes from price gains, ~3.300€ from dividends / interest and ~16.000€ from additional investments.

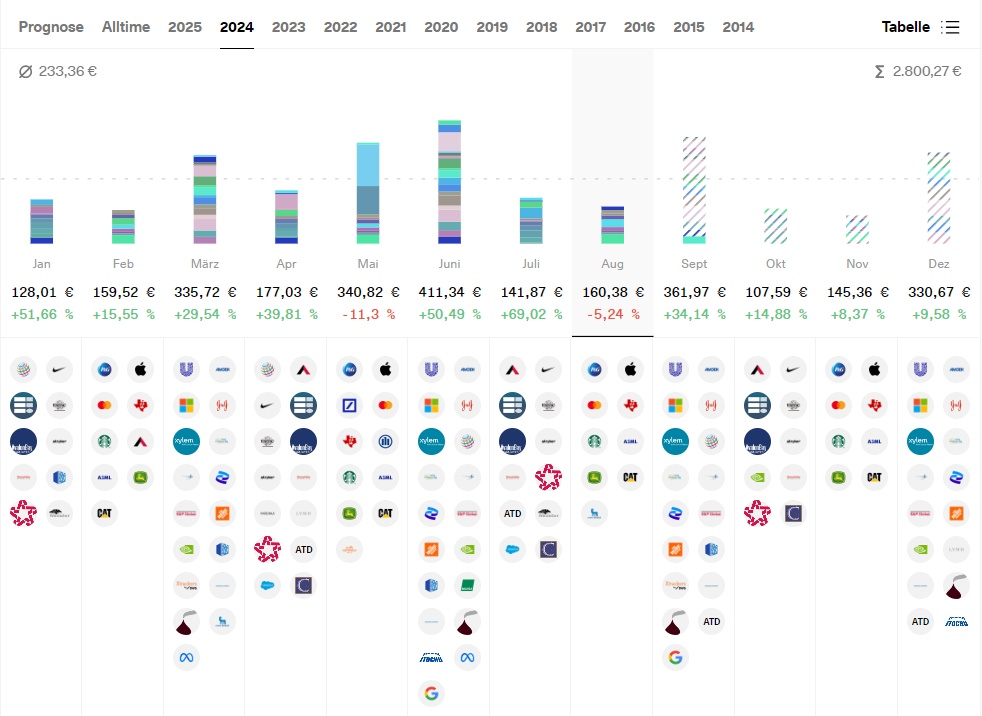

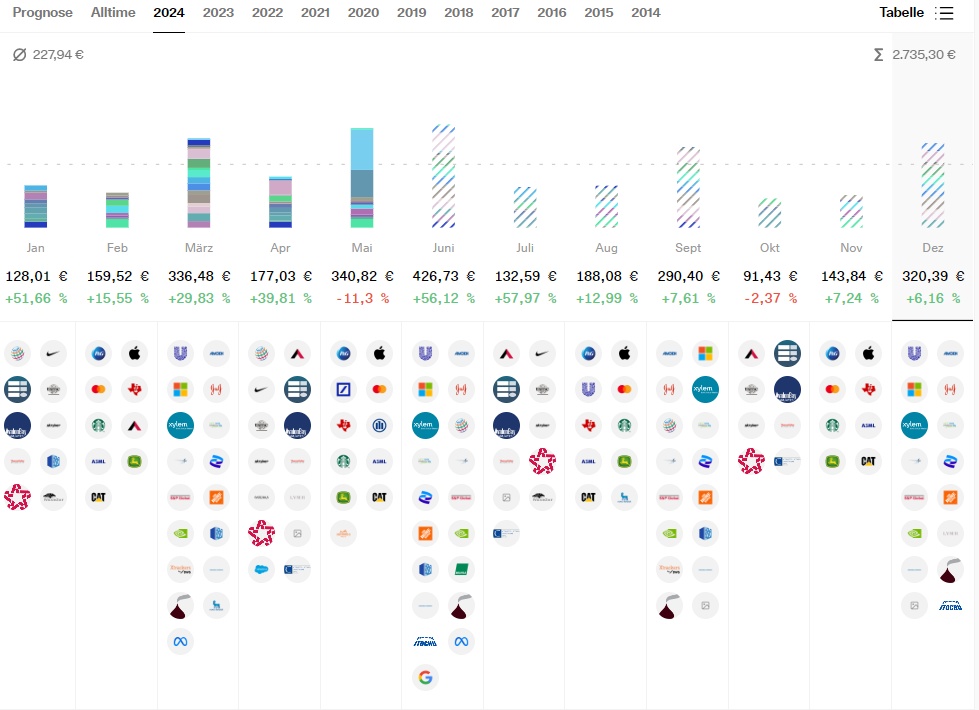

Dividend:

- Dividends in November were 21% above the previous year at ~€160

- Procter & Gamble is in the lead with a (gross) dividend of €50 every 3 months.

- In the current year, the dividends after 11 months are +25% over the first 11 months of 2023 at ~2.500€

Buying & selling:

- I bought in November for significantly reduced ~700€

- As always, my savings plans were executed:

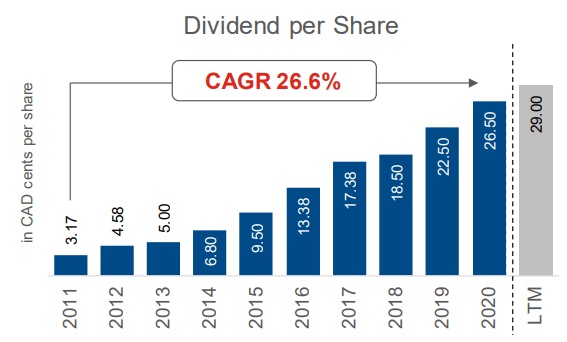

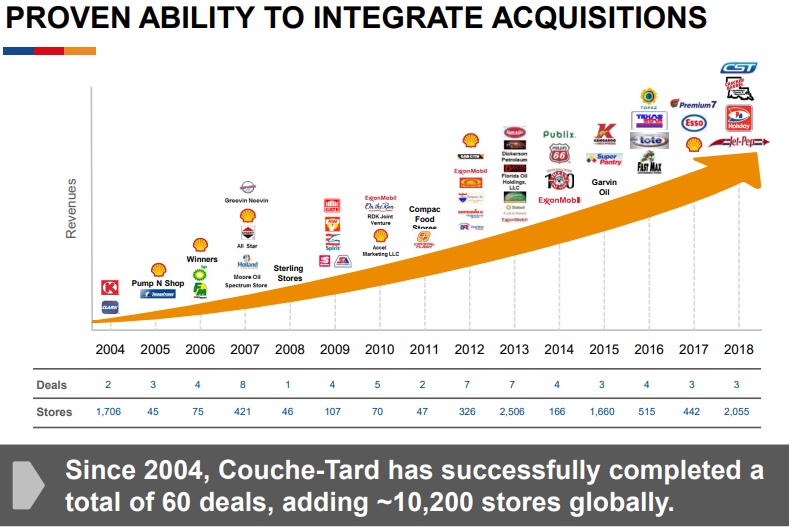

- Blue ChipsProcter & Gamble $PG (+0,98 %) TSMC $TSM (+2,62 %) S&P Global $SPGI (-0,01 %) Alphabet $GOOGL (+3,81 %) Johnson & Johnson $JNJ (-0,5 %) Amgen $AMGN (-0,16 %) Herhey $HSY (+0,76 %) Alimentation Couche-Tard $ATD (-0,55 %) Caterpillar $CAT (-0,15 %)

GrowthBechtle $BC8 (+0,91 %)

ETFsMSCI World $XDWD (+0,7 %) Nikkei 225 $XDJP (+0,07 %) and the WisdomTree Global Quality Dividend Growth $GGRP (+0,53 %)

CryptoBitcoin $BTC (-0,73 %) and Ethereum $ETH (-1,32 %)

Sales as mentioned at the beginning, there was a larger part of my MSCI World holdings in November

Target 2024 & outlook 2025:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market performance in the current year, my portfolio already stands at ~€345,000 at the end of November.

As is well known, one should not praise the day before the evening, but I am optimistic that my portfolio will not fall so far in December that I will not reach my target.

What will happen in 2025? The logical goal would of course be to reach €400,000. However, due to the upcoming house construction, part of the assets will be invested in the house construction. If I include the property in my statement of assets, the target of €400,000 would of course not change. However, as I am tracking my liquid assets here, I will probably refrain from doing so.

Therefore, my year-end target for 2025 will probably be closer to the final balance for 2024. So around €350,000 at the end of 2025.

How are things looking for you? Have you already thought about your plans for 2025?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy