$META (+1,37 %)

#quartalszahlen

#earnings

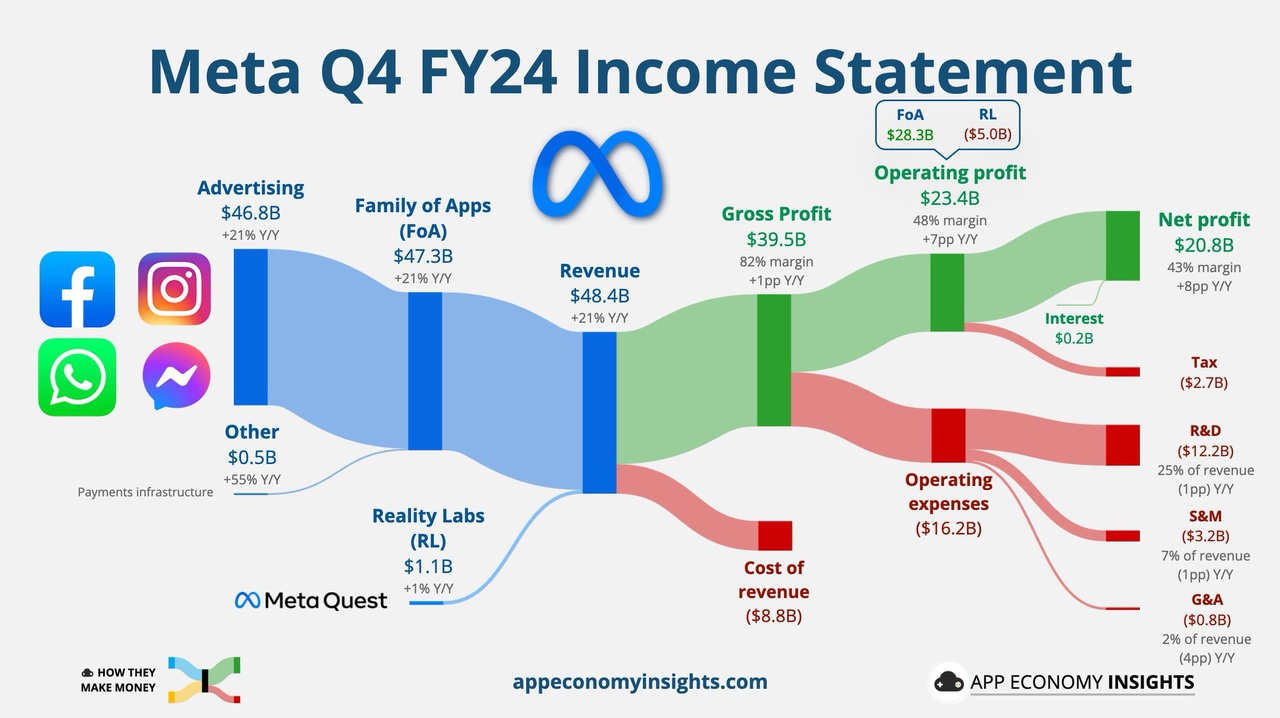

- EPS: $8.02 (Est. $6.78) ; UP +50% YoY

- Revenue: $48.39B (Est. $46.98B) ; UP +21% YoY

- Sees Q1'25 Revenue: $39.5B-$41.8B (Est. $41.67B)

- Family Daily Active People: 3.35B; UP +5% YoY

Full Year FY25 Outlook:

- Capital Expenditures: $60B-$65B (Est. $52.41B)

- Total Expenses: $114B-$119B (Est. $108.01B)

- Revenue Growth Opportunity: Strong expected throughout 2025

Segment Revenue:

- Advertising Revenue: $46.78B (Est. $45.65B) ; UP +21% YoY

- Reality Labs Revenue: $1.08B (Est. $1.11B)

- Family of Apps Revenue: $47.30B (Est. $46.08B)

Profitability & Margins:

- Operating Income: $23.37B (Est. $20.09B) ; UP +43% YoY

- Operating Margin: 48% (Prev. 41%)

- Net Income: $20.84B (Est. $17.46B) ; UP +49% YoY

- Free Cash Flow: $13.15B (Est. $10.29B)

Reality Labs Performance:

- Operating Loss: $4.97B (Est. Loss $5.1B)

Family of Apps Performance:

- Operating Income: $28.33B (Est. $25.3B)

Key Business Metrics:

- Ad Impressions: UP +6% YoY

- Average Price per Ad: UP +14% YoY

- Cash & Marketable Securities: $77.81B

- Long-Term Debt: $28.83B

- Headcount: 74,067; UP +10% YoY

Key Business Highlights:

- Foreign currency expected to be a ~3% revenue headwind in Q1 FY25.

- Regulatory landscape in the EU & U.S. could impact business operations.

- Infrastructure & AI investment will drive increased CAPEX and expenses.

- Strong revenue growth expected throughout 2025, driven by core business investments.

Kommentar von CEO Mark Zuckerberg:

- „Wir hatten ein großartiges viertes Quartal mit Rekordumsätzen und starkem Engagement. Wir konzentrieren uns weiterhin auf Investitionen in KI und Infrastruktur, um langfristiges Wachstum aufrechtzuerhalten.“

Kommentar von CFO Susan Li:

- „Wir sehen weiterhin eine Dynamik in der Werbung, aber regulatorische und makroökonomische Faktoren könnten im Jahr 2025 zu Herausforderungen führen. Unsere CAPEX-Investitionen konzentrieren sich auf KI-Fortschritte und den Ausbau von Rechenzentren.“