Framework #8 Valuation

Now we understand what risk means, what drives long-term returns and how to build your portfolio. We should dive into how to value a businesses. There are many ways to do this, but I like to keep it simple as I think investing should be made as simple as possible.

For valuating a business I use a simple Discounted Cash Flow calculation. A DCF calculation is a valuation method used to determine the price of an investment based on its expected future cash flows. I try to use the most conservative estimates for the inputs of the DCF.

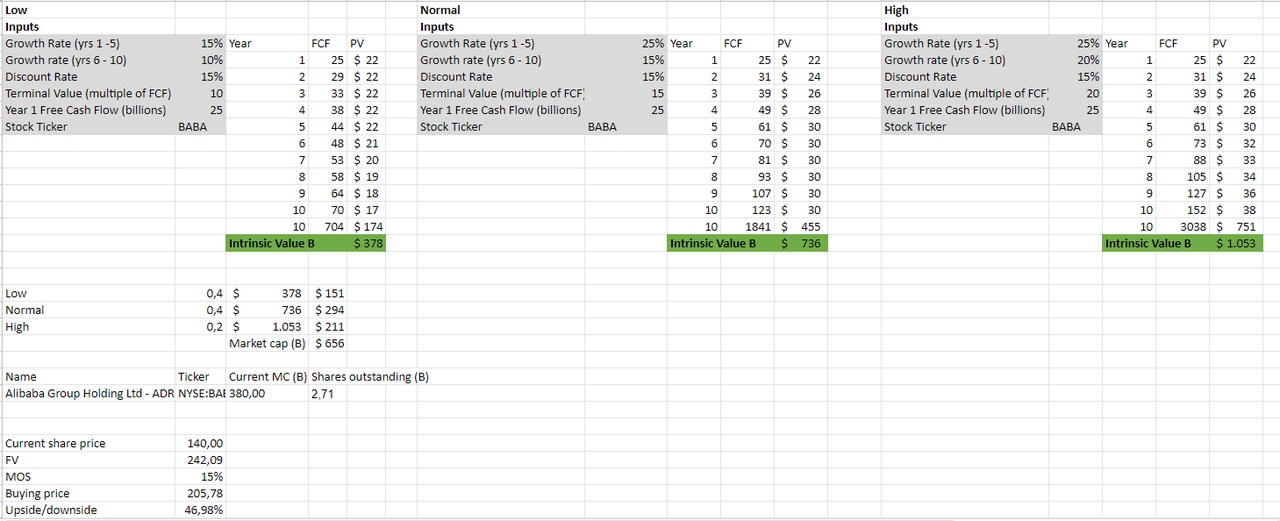

In the figure you can see my DCF calculation of Alibaba. Important inputs for a DCF calculation are:

- Free cash flow (you can find this on the financial statement)

- Growth rate (the amount of % you estimate the cash flows are going to grow)

- Discount rate (return you want on your investment, I use 15%)

- Terminal multiple (most important factor, this determines the multiplier you want to pay for the cash flows)

- Margin of safety (MOS) (Important factor which allows you to built in even more conservatism, should be as high as you feel comfortable with)

When I do the DCF calculation I want to built in as much safety as possible because the assumptions I've made can be wrong and in that way you build in an extra layer of safety. I use three scenarios and take the average of those three outcomes. As you can see with Alibaba, in my opinion it is a nobrainer with this margin of safety and upside potential. So I feel comfortable betting on Alibaba. However, keep in mind that this is just one way of valuing a business and that there are many different analysis for different type of companies.

Here is a link to my Intrinsic value calculator tool: https://docs.google.com/spreadsheets/d/1PmX8RLzRcnO3nMTcsIUMHLRv9ZprsrdR0N6unbdQmws/edit?usp=sharing

Please keep in mind you should do your own analysis and use this spreadsheet as a tool. Not as investment advice.

In the next article we are going to dive deeper in selling and taking profits.

Link to framework #7: https://app.getquin.com/activity/msQFxpvAwE