Hello to the crypto experts my name is Levi I am 15 years old and have been investing since September 2023. Since I would say that I am quite advanced for my age, I would like to broaden my horizons in the field of crypto! Since I already have a plan of $BTC (+0.69%) I now wanted to try my hand at $SOL (+1.6%) to try it. I would be very happy if a few people with knowledge, an opinion about Solana could be found in the comments and explain it to me. Ps: of course I've already googled and had a rough look at the project, but maybe more opinions will help! Yours sincerely, Das Bürschchen

Discussion about BTC

Posts

2,666Ciao Bella Bitcoin: Italy's largest bank jumps on the crypto bandwagon 🧡

One of Italy's largest banks 🇮🇹 recently invested directly in Bitcoin for the first time $BTC (+0.69%) for the first time, signaling the increasing acceptance of digital assets in the traditional financial sector. This move joins a global trend of more and more banks and institutions worldwide incorporating crypto-assets into their strategies. Could this decision encourage other major European financial players to follow a similar path?

Michael Saylor and MicroStrategy buy another 2,530 Bitcoin

MicroStrategy $MSTR (+1.21%) has last week 2,530 Bitcoin for about $243 million acquired.

The average price per Bitcoin

$BTC (+0.69%) was $95.972.

-total holdings: MicroStrategy now holds 450,000 Bitcoin.

-Average price: $62,691 per Bitcoin.

Time for the price rocket 🚀

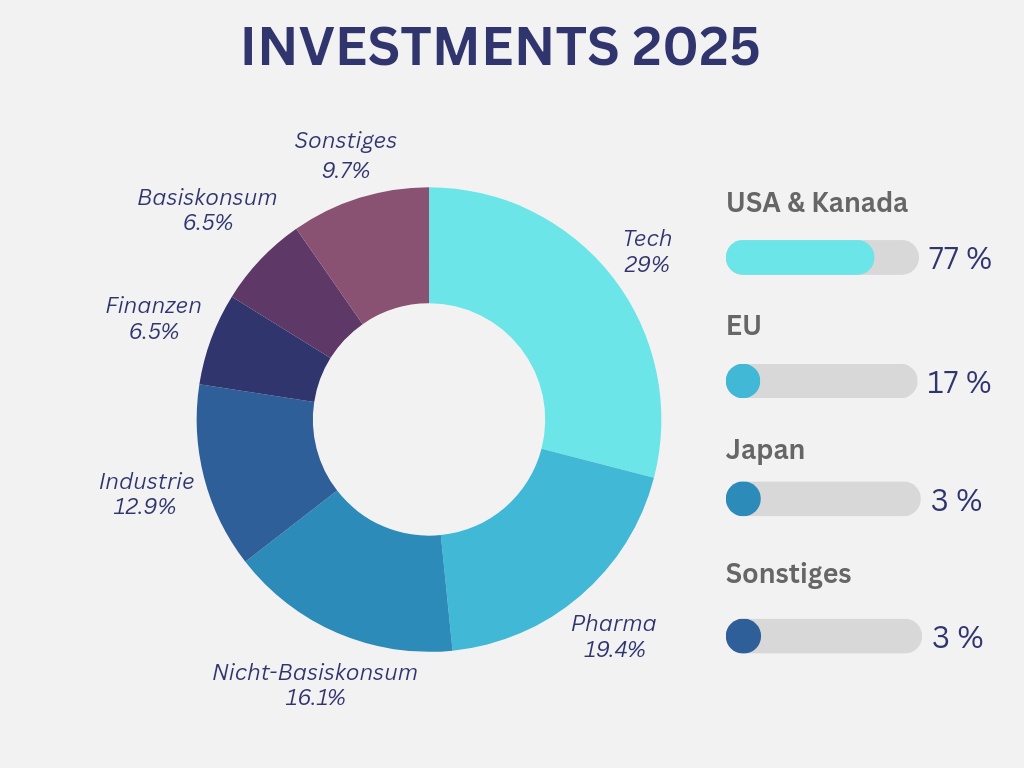

My investment strategy 2025

After two extremely good stock market years, the year 2025 is under particular scrutiny.

- After two years with price increases of over 20%, can it go any higher?

- How will Trump affect the stock market? Liberal policies vs. tariffs?

- Inflation and interest rate trends - will the central banks continue to lower rates or will inflation return?

What will not change is my basic investment strategy. I will continue to invest in dividend growth stocks and buy them every month via a savings plan - regardless of other influences and developments.

Investment amount:

In my private life, building a house is a big issue. My monthly savings will therefore be significantly lower in 2025 than in previous years.

In the last few years, my savings sum was usually between €1,500 and €2,500.

I will now reduce this significantly to approx. 700€ per month.

The rest will go into a call money account to save money for additional costs, kitchen, furniture and so on.

However, I am absolutely aware that €500-700 is still a very high investment amount per month.

Around half (€250) already comes from dividend income, which I will reinvest.

Investment breakdown:

This year, the majority of my investments will again be in individual stocks with the following allocation:

I will continue to overweight the USA and underweight Europe (especially Germany).

My main focus will also remain on the technology and pharmaceutical sectors with almost 50%. This is where I continue to see the greatest growth in the long term - both for sales, profits and dividends.

There will be no changes to the savings plans for the time being. I will not be adding any new shares to my savings plan for the time being.

In addition, I will continue to invest the net savings from private health insurance compared to statutory health insurance in the WisdomTree Global Quality Dividend Growth

$GGRP (+0.12%)

In total, that's around €90 per month + the one-off premium refund of over €2,000 for 2024.

The capital-forming benefits from my employer flow into an MSCI World

$XDWD (+0.43%) with finvesto.

In addition, €100 goes into two crypto savings plans every month. 65 flows into Bitcoin

$BTC (+0.69%) and €35 in Ethereum

$ETH (-0.07%)

Dividend expectation:

For this year, I also expect around 15-20% more dividends than in 2024.

This would mean total dividends of €3,300-3,500 for 2025.

What is your investment strategy for 2025?

i like your strategy very much as i have a similar strategy. about 70/30 dividend stocks, only one-off purchases, no savings plans and purely equities without ETFs. main focus also on the USA and mostly blue-chip companies.

just started investing much later. most of the money was invested at the end of 23/beginning of 24 so performance is still limited.

as a beginner I also sold too early/buy too late...

but after 1.5 years I received almost 20% and 3000€ dividends.

in year 25 i will collect over 5k in dividends.

with a portfolio value of just under 300k and an age of 35, i consider this strategy to be a good one for me, even with a view to prices that are no longer as profitable as the last two years, i have more or less decided on this mix in order to have a positive cash flow even in bad times.

Do crypto savings plans still make sense?

Does it still make sense to run my current savings plans in $BTC (+0.69%)

$ETH (-0.07%)

$SOL (+1.6%)

$XRP (+6.91%)

$ADA (+5.04%) or only in $BTC (+0.69%) to run?

Kind regards, Timur.

A simple Bitcoin savings plan will bring you the most joy in the long term :)

14.01.2025

Bitcoin briefly below $90,000 again + UBS launches CTS Eventim with 'Buy' and target of 100 euros + PORSCHE with declines in China business

The Bitcoin $BTC (+0.69%)continues recovery

- Bitcoin has continued its recovery from the previous evening, clearly rebounding from Monday afternoon's low.

- On the Bitstamp trading platform, the oldest and best-known cryptocurrency was trading at around 95,000 dollars on Tuesday morning.

- On Monday afternoon, the price had temporarily fallen to almost 89,000 dollars, but was already able to recover in the course of the evening.

CTS Eventim $EVD (-0.64%)with a target price of €100 (currently €86)

- The major Swiss bank UBS has issued a "buy" rating for CTS Eventim shares with a target price of €100.

- "The show can go on," said analyst Olivier Calvet on Monday evening in his buy recommendation for the event organizer and ticket retailer.

- Three years of strong recovery from the coronavirus pandemic made for ambitious comparative figures.

- However, the UBS Live Event Ticket Transaction Monitor continues to signal enormous demand for music events, especially in Germany.

- And prices are continuing to rise.

PORSCHE $P911 (+0.23%)with declines in business in China

- Parallel launches of several models and problems with suppliers are presenting the luxury sports car manufacturer Porsche with a massive cost problem.

- As Handelsblatt has learned from Group circles, Porsche had to save more than 1.5 billion euros in 2024 alone, originally estimated internally at 600 million euros.

- This enabled Porsche to absorb some of the additional costs, which according to insiders amounted to at least 4 billion euros compared to the previous year.

- Share price continues to rise

Tuesday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

Kering EUR 2.00

- Quarterly figures / company dates Europe

07:30 Südzucker quarterly figures | OMV trading update 4Q | Lindt & Sprüngli annual sales

11:00 VW sales figures 2024 and 4Q

18:00 Repsol annual results and trading statement 4Q

- Economic data

14:30 US: Producer prices December FORECAST: +0.3% yoy previous: +0.4% yoy Core rate (excluding food and energy) FORECAST: +0.3% yoy previous: +0.2% yoy

16:00 US: Fed President Schmid, speech at Central Exchange

21:05 US: New York Fed President Williams, speech at "An Economy That Works for All" event

I had to stop reading after the first bullet point...

Edit: Thanks :)

Bitcoin ₿ 🐍

First savings plan execution.

From now on, €50 will flow into the $BTC (+0.69%) ₿ per savings plan.

However, it has to be said that I was already heavily invested in Bitcoin beforehand - a never ending love story.

I don't think I need to explain "why?" and "wherefore?".

Trump plans executive orders on crypto regulation and banking guidelines

According to The Washington Post, Donald Trump 🇺🇸 will be elected first day of his presidency Executive Orders on Bitcoin $BTC (+0.69%) and cryptocurrencies on the first day of his presidency.

According to a source involved in the talks David Sacks and members of the Trump transition team are working closely with crypto executives to develop a legislative strategy.

On the first day of his presidency Trump is expected to issue executive orders that could address the following issues:

-De-banking: Measures to address discrimination against crypto companies by banks.

-Crypto accounting: Repeal the controversial directive requiring banks to carry digital assets as liabilities on their balance sheets.

Graphic: Grok 2 by 𝕏

My portfolio + "investment strategy"!

Hello folks

Next month my time as an apprentice will come to an end.

To mark the occasion, I've spent the last few weeks thinking about what my wealth accumulation strategy should look like...

I would like to share these thoughts/strategy with you to either gather inspiration or suggestions for improvement.

I invest in ETFs and crypto in a ratio of 70/30!

For the ETFs I use the $IWDA (+0.35%) as a basis and the $IUIT (-0.44%) for hopefully above-average returns.

Ratio 70/30.

With crypto, I'm going for $BTC (+0.69%) , $ETH (-0.07%) and $SOL (+1.6%) at a ratio of 50/30/20.

My goal is to have a portfolio value of €25,000 by the end of 2025!

I'm aware that the ratios don't match yet, but I'm currently working on it...

What is your opinion?

Trump's Treasury Secretary candidate Scott Bessent owns Bitcoin ETF

Donald Trump's nominee 🇺🇸 Treasury Secretary nominee

Scott Bessent announced that he would Bitcoin

$BTC (+0.69%)-ETFs worth up to 500,000 US dollars owns.

This commitment could indicate a growing interest in cryptocurrencies at the highest political level. -Bitcoin Magazine

Graphic: Grok 2 by 𝕏

Trending Securities

Top creators this week