$RDC (-8,46 %) The Shopapotheke is already just as nice to trade as the $OMV (-2,78 %) 😅🇦🇹

Fits well for my investment horizon (weeks - months) for my "risk capital".

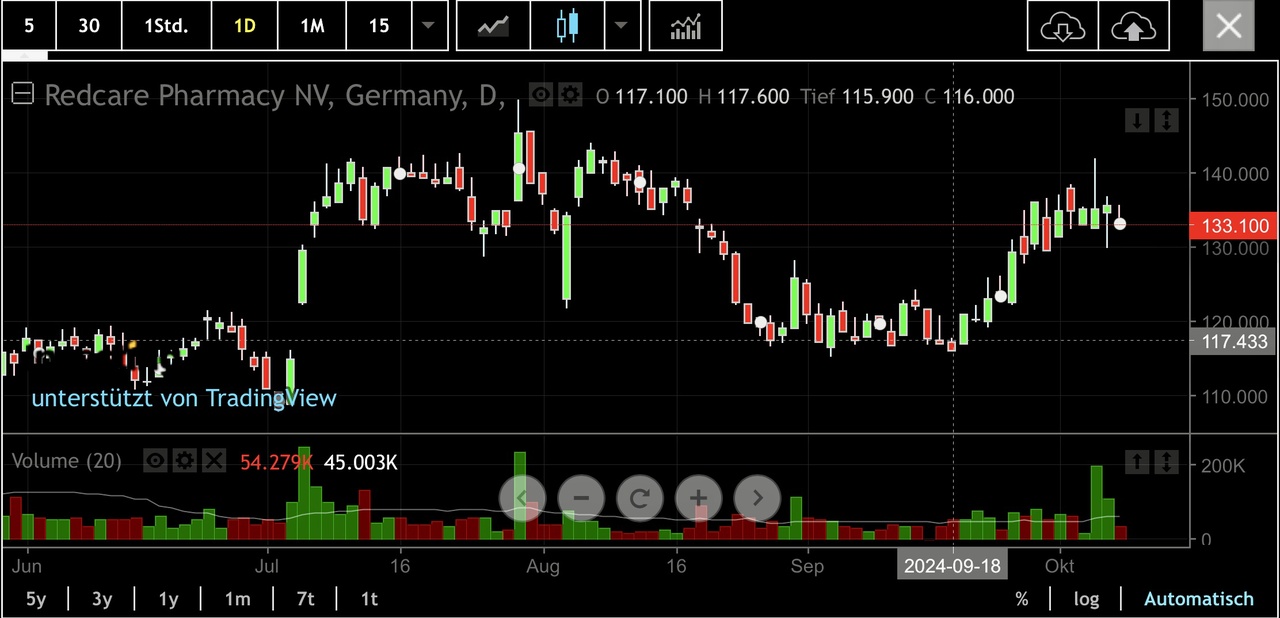

Re-entered in the price range of the gap from July in September. And now the trailing SL has done its job again.

Edit: and what do you do if the price doesn't go back into the range downwards, but breaks out upwards shortly after the stop loss?

Then you can set an entry point with a stop buy. In this case, in addition to a new limit for entry at €116 on the downside, I also set a stop buy on the upside. I placed it in the €139 range. This was my exit level from the previous trade.