Hello my dears,

In these volatile times, I went looking for you outside the USA.

I found what I was looking for in Sweden. In my opinion, there is a robust industrial / tech stock here that should benefit from AI. @EpsEra

The exact company presentation can be found in another post. https://getqu.in/fod0eg/

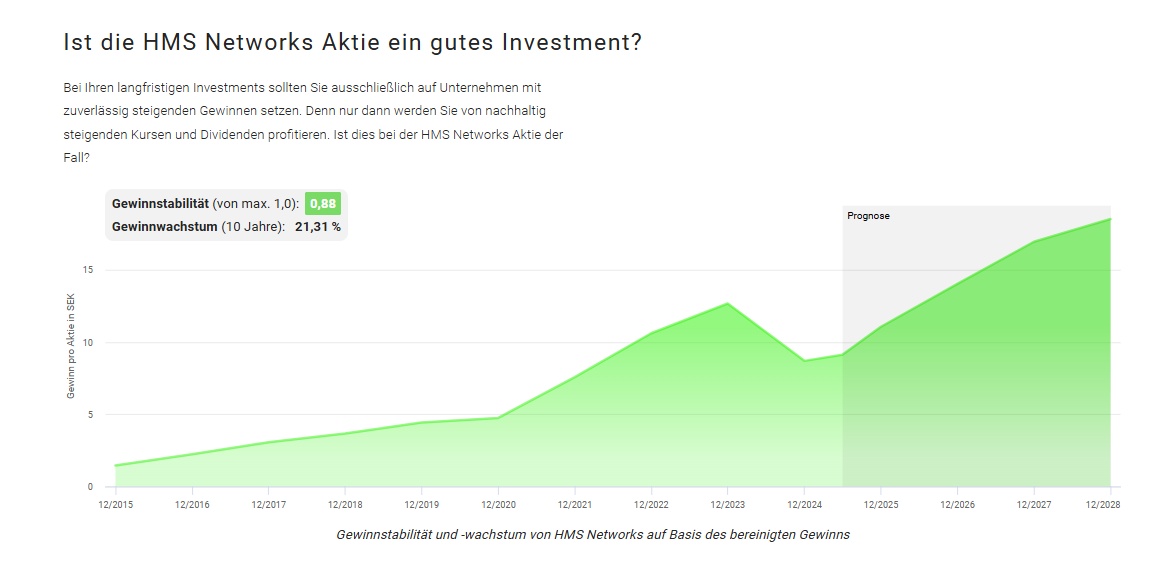

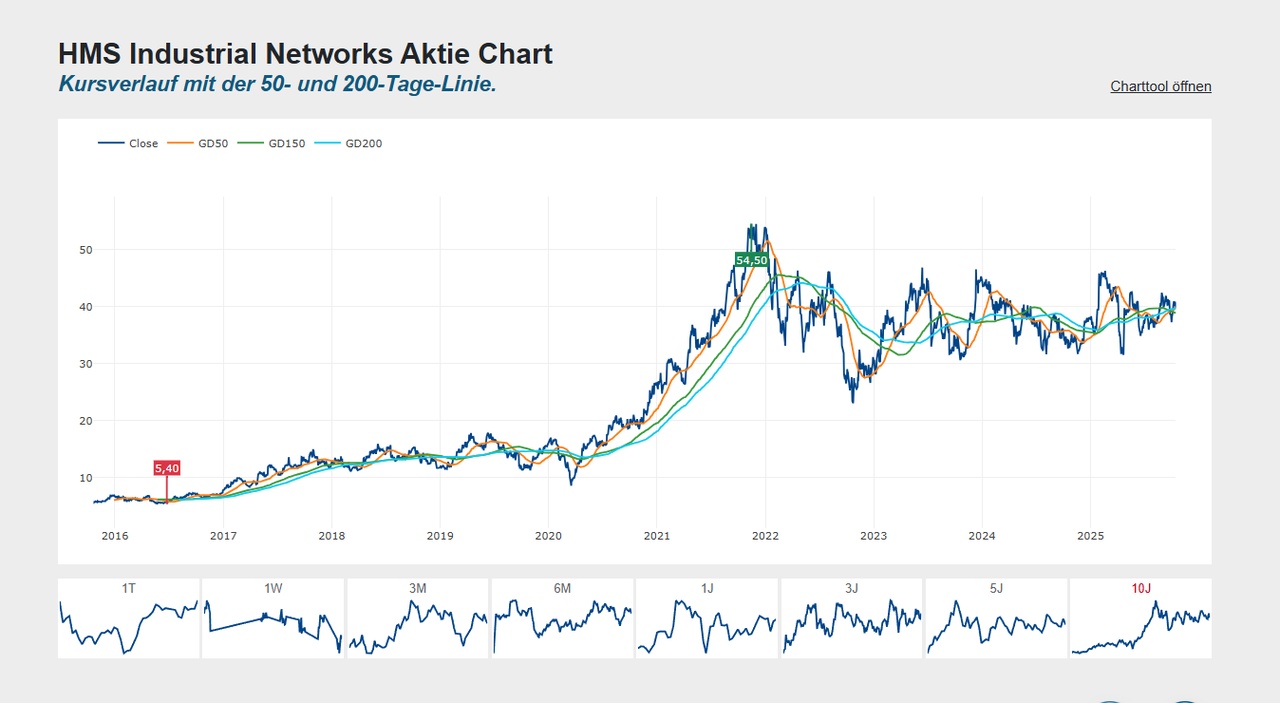

Due to the growth in profit and EBIT margin, I see potential for the share to move out of the sideways trend soon.

Added to this is the undervaluation according to the share finder.

Interested investors should take a look at the October 21 in the calendar. This is when the quarterly figures are published. Which could determine the direction.

Perhaps our dear man @TomTurboInvest take another look at the chart.

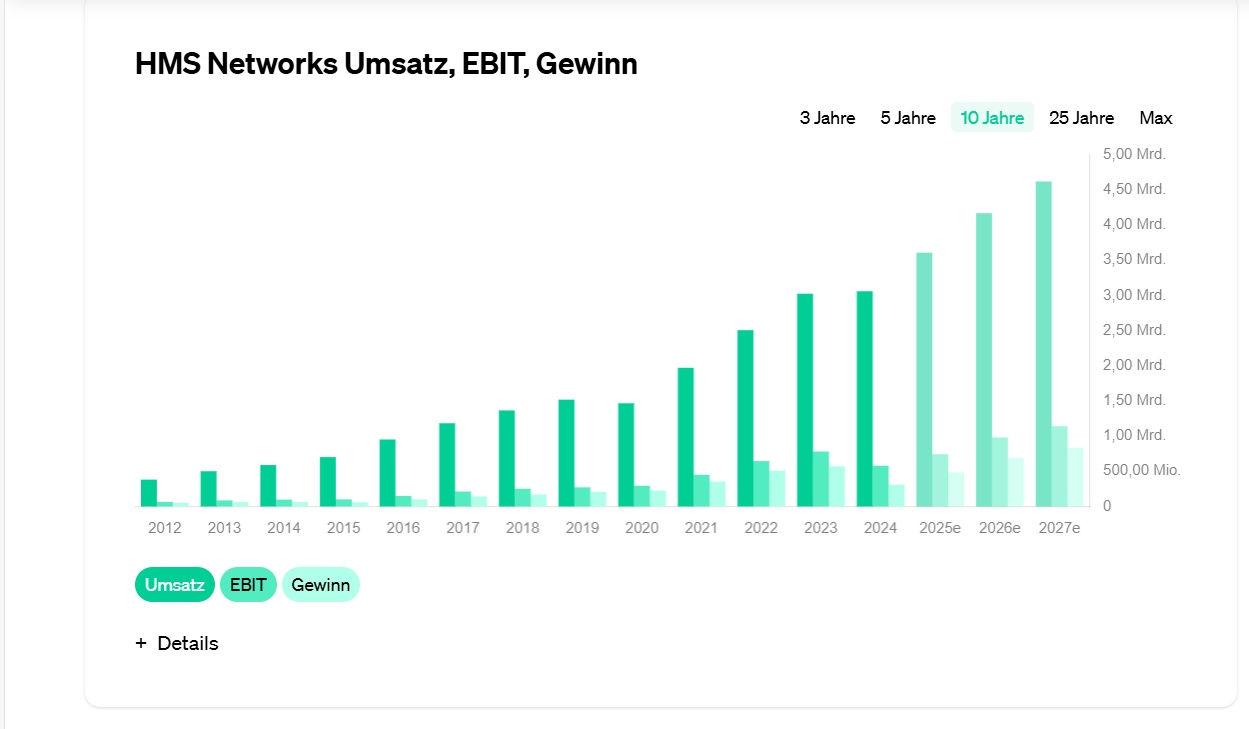

Ladies and gentlemen, I have also added the history to the key figures.

To show you why the share went into this long sideways consolidation. In 2024, there were several acquisitions which, among other things, caused the slump in profits. The fact that the share has only moved sideways and not into a downward trend could show us a certain robustness.

Margin pressure and impact of acquisitions in 2024

- Gross margin remained relatively stable, although down slightly, partly offset by product mix and cost control. HMS Networks+2HMS Networks+2

- The acquisitions (in particular Red Lion and PEAK-System) contribute to a more complex business portfolio and bring integration efforts and amortization costs that weigh on the operating result. HMS Networks+2EarningsCall+2

- In the annual financial statements for 2024, HMS reports an "Adjusted EBIT" of SEK 665 million compared to SEK 792 million in the previous year, which represents a significant decline. HMS Networks+1

- Operating profit (EBIT) fell even more sharply: SEK 503 million compared to SEK 753 million in the previous year

In the traderfox Monkey Indicator, the share also demonstrates enduring quality (perhaps also interesting for the @Simpson holding company)

HMS Industrial Networks (A2DYY7): Aktie Analyse: Kaufempfehlung & Alternativen

Year SALES (SEK billion)

2023 3,02

2024 3,06

2025 3,61

2026 4,17

2027 4,62

Year SALES GROWTH (%)

2023 20,67

2024 1,16

2025 17,95

2026 15,55

2027 10,82

Year GROSS TOMARGE (%)

2023 65,05

2024 62,60

2025 53,08

2026 45,93

2027 41,45

Year EBIT margin (%)

2023 25,84

2024 18,94

2025 20,60

2026 23,52

2027 24,68

Year INCOME (SEK m)

2023 570,00

2024 309,00

2025 485,00

2026 691,00

2027 833,00

Year PROFIT GROWTH (%)

2023 12,43

2024 -45,79

2025 56,96

2026 42,47

2027 20,55

Year P/E ratio

2023 40,66

2024 68,32

2025 40,78

2026 32,11

2027 26,61

2028 24,35

Year DIVIDEND YIELD (%)

2025 0,71

2026 1,11

2026 1,35

Performance:

15 years

+1.856,69 %

10 years

+753,51 %

5 years

+114,43 %

1 year

+16,96 %

Current year

+2,07 %

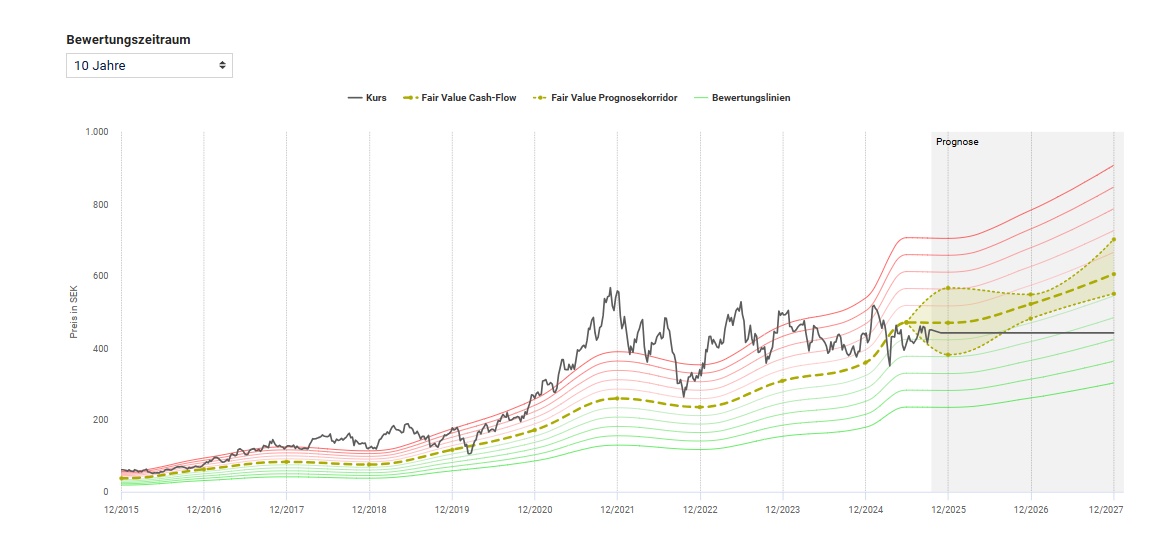

The fair value of the HMS Networks share is calculated over the 10-year valuation period selected above. The average KCV in this case is 30.62.

Multiplied by the operating cash flow per share of SEK 15.37 over the last 4 quarters, the fair value of the HMS Networks share is fair value of SEK 470.60. The current share price of SEK 441.44 is 6.2% below this fair value, making the share slightly undervalued. slightly undervalued appears to be slightly undervalued. (Source Share Finder)