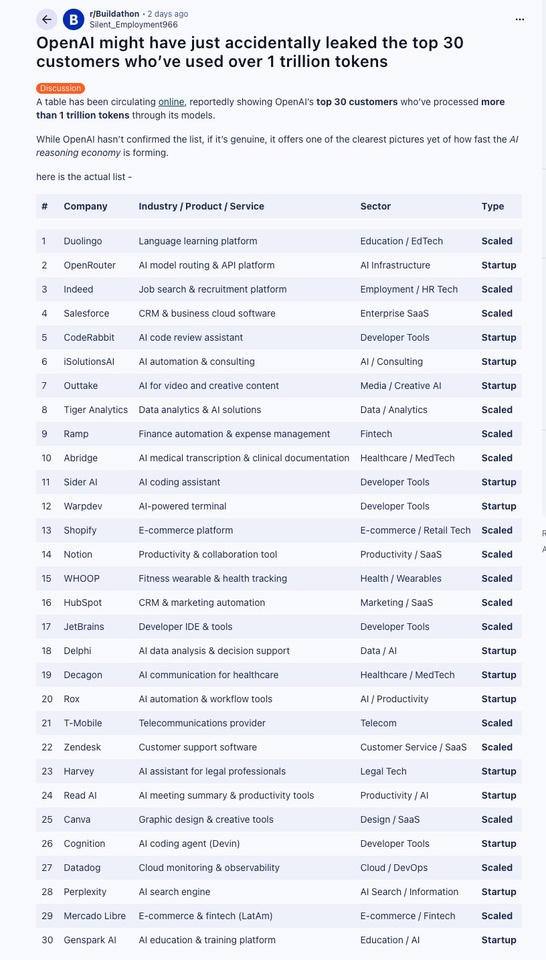

This week, an interesting detail has caused a stir in the AI world: An allegedly leaked table (OpenAI has not confirmed it) is said to show which 30 companies have processed the most tokens at OpenAI - in other words, put simply, who uses the models most intensively.

The table also includes a candidate that very few people would have expected: Duolingo.

More than one trillion tokens have been processed by the language learning app using OpenAI models - an indication of the extent to which AI is already shaping the company's product and processes. AI is not a short-term trend for Duolingo, but has long been part of its operational DNA.

What does this mean and why is it relevant for investors? Let's take a look.

From language learning game to global learning platform

With over 130 million monthly active users, Duolingo is today the world's leading language learning app. Globally, Duolingo accounts for an estimated 60% of all language learning app downloads. That is around 7 times more than the number 2.

The business model is simple but effective:

- Freemium model: Learning is free of charge. However, if you don't want to see ads or want additional premium features, you can use a paid subscription (starting at around €7 per month in Germany).

- Organic growth: A large proportion of users come without paid advertising, driven by great brand awareness, gamification and viral social media marketing (on TikTok, Duolingo has >16 million followers with its owl mascot).

- Scalability: Once lessons have been created, they can be replicated digitally for users an infinite number of times and the costs for Duolingo hardly increase with the number of users.

What many forget: Duolingo is no longer no longer just a language appbut is building on a "Learning Operating System" for everything that can be learned digitally.

In addition to languages, there are now math, music and chess - all based on the same infrastructure, similar design and the same gamification logic. Compared to language learning, these subjects are still in their infancy, but they are proof of how Duolingo could open up other areas of learning in the future.

A look at the founder helps to better understand this: Luis von Ahn (current CEO), who founded Duolingo in 2011 together with Severin Hacker (current CTO), is not a typical Silicon Valley entrepreneur, but a computer science professor. He has already sold two of his previous start-ups to Google, including reCAPTCHAthe tool that allows users to prove that they are not robots. Having grown up in Guatemala, von Ahn still pursues one mission today: "To make the best education in the world accessible to everyone."

1 trillion tokens: a look behind the scenes

The fact that Duolingo is one of the biggest OpenAI users is only surprising at first glance. In reality, the company has taken a radical step in the last 2-3 years: AI has gone from being an experiment to the central engine of the product.

Examples:

- Duolingo MaxThe premium subscription uses GPT models to chat with a virtual tutor and overcome the fear of speaking.

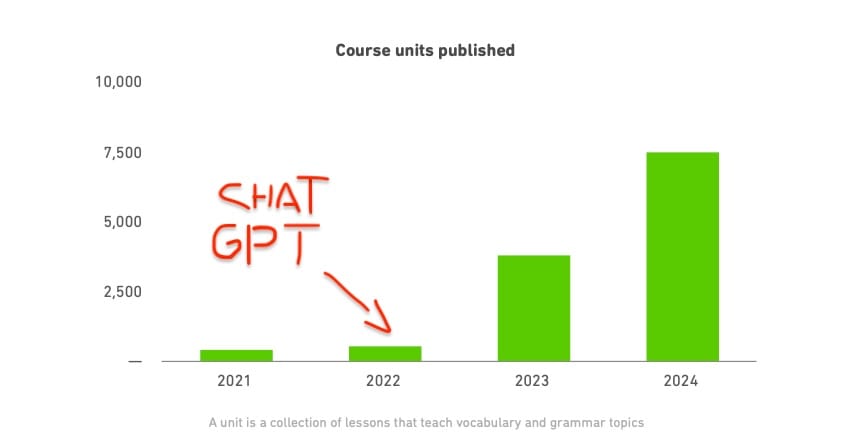

- Content automationnew exercises, lessons and translations are generated and tested with the help of AI. Duolingo was able to publish 148 new language courses last year alone. That's more than in the previous twelve years combined. The development of new course units also speaks for itself.

- PersonalizationThe app analyzes millions of learning paths and dynamically adapts the level of difficulty and sequence to the user's progress.

AI is therefore not just an incidental feature: the more users interact with the app, the more training data flows back and the better the system becomes, which promotes user loyalty and brings new users into the system.

This is doubly interesting for investors:

- On the product side This gives them an edge over smaller competitors who cannot afford expensive model integration or have lower user numbers.

- Financially AI acts as a lever: faster price development, lower content costs and possibly increasing margins through the use of technology. However, this is not yet the case: Duolingo recently had a slightly lower gross margin as it is still expensive to retrieve the tokens.

The share: AI momentum meets high expectations

Since the IPO in July 2021, the Duolingo share price has has more than doubled, but has been extremely volatile. After a 50% setback in the summer (including concerns about a slowdown in user growth, AI-first backlash / user criticism, technological risks), the share price has stabilized somewhat.

With a price/sales ratio of around 18x the valuation is very ambitious. The market is therefore already pricing in strong growth and sustainable profitability.

In fact, Duolingo is currently delivering solid figures:

- Sales growth: over 35% per year

- Free cash flow: over 300 million $ annually

- Balance sheet qualityaround 1 billion $ cash, virtually no debt

In the long term, however, the story depends less on short-term quarterly figures and more on whether Duolingo manages to use AI to make education better, cheaper and more scalable.

Because that is the real "token effect": every new user and every AI-generated lesson strengthens the platform. This creates a self-reinforcing cycle.

As impressive as Duolingo's progress is, the technological development is a double-edged sword. Because the same AI systems that Duolingo uses could eventually make it make it superfluous to learn languages at all.

Example: Apple has recently introduced a live translation function that translates conversations between two languages in real time, directly via AirPods.

If machine translation becomes ubiquitous, the incentive to learn could decrease, especially for occasional users. What is still considered useful today will quickly become a mere leisure activity.

Even AI-based language tutors (such as GPT-5-supported learning bots) can also put pressure on traditional apps such as Duolingo by providing individual, dialog-based and immersive teaching. Duolingo has a strong brand and data advantage, but not a monopoly on the technology itself.

In short: AI is both the biggest growth driver for Duolingo and the biggest potential risk.

Conclusion

While many companies in the education technology sector have failed in recent years, Duolingo has turned its niche into a fortress. The alleged OpenAI list shows: The company is not a classic app providerbut probably one of the largest industrial users of AI worldwide.

The next quarterly figures at the beginning of November will show to what extent Duolingo can use AI to its advantage, e.g. by further increasing growth, conversion of users to subscribers or profitability.

Are you already invested in Duolingo?