Tomorrow at 2.30 p.m. Coca-Cola will $KO (+2,3 %) will present its quarterly figures.

👉 Webcast: https://investors.coca-colacompany.com

The competitor PepsiCo $PEP (+3,26 %) has recently disappointed and missed sales expectations.

Sales fell to USD 27.78 billion in Q4 2024, which put the share under pressure.

Pepsi Q4 - 2024 from 04 Feb, 2025

One problem: consumers are turning less to soft drinks and snacks, which could be partly related to rising sales of GLP-1 drugs such as Ozempic and Wegovy [1].

💊 GLP-1 drugs and the soft drink crisis?

These drugs, which are used for weight loss, reduce appetite, especially for sugary drinks [2].

PepsiCo has already noticed that this trend is influencing purchasing behavior.

The question now is: will this also affect Coca-Cola?

2024 was a mixed year for Coca-Cola. Although the share price rose by over 20 % in the meantime, rising market interest rates led to a correction as defensive dividend stocks were sold in favor of more attractive US government bonds. The valuation was also high at times, but the valuation ratios have now returned to a historically fair level [3]

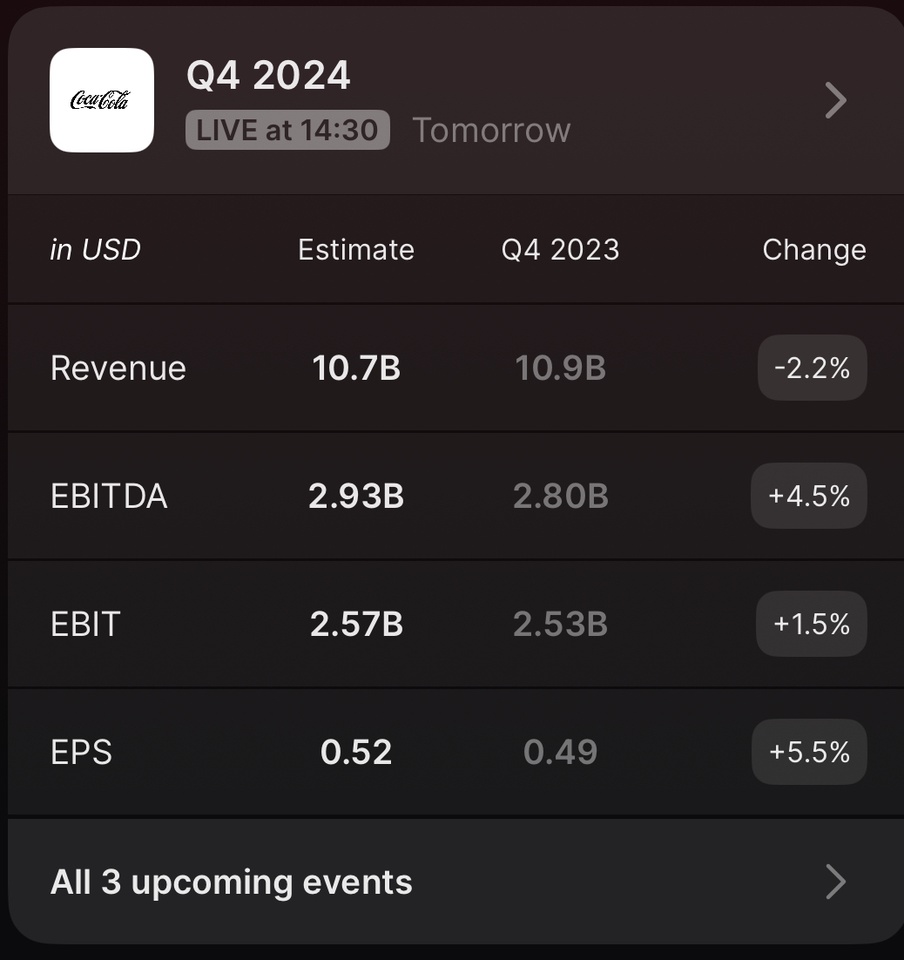

Warren Buffett remained loyal to Coca-Cola, while reducing other positions such as Apple and Bank of America. Expectations for tomorrow's quarterly figures are moderate:

While sales are expected to come in below the previous year's figure at USD 10.7 billion, earnings per share are expected to rise to USD 0.52.

Coca Cola Estimates Q4 - 2024

Despite Pepsi's recent disappointment in the market, a majority of options market participants are betting on a positive reaction: 56.1% of the options expiring on Friday are calls [3].

Does Coca-Cola have the better strategy against current market trends? 🚀📉

🥤 Coca-Cola's strategy against change

In recent years, Coca-Cola has invested heavily in low-calorie and sugar-free alternatives. Products such as Coca-Cola Zero Sugar and expansion into other beverage categories (e.g. energy drinks) should ensure that the company is less affected by soft drink declines [4].

📉 Tomorrow will decide whether Coca-Cola has cushioned the GLP-1 effect better than PepsiCo.

Coca Cola has a share of just under 2.35% in my portfolio. So I'm looking forward to the figures and the reaction tomorrow.

_________

Sources:

[1]

[3]

[4]