Brief presentation of the company

- ISIN / Ticker: US78409V1044 $SPGI (-0,59 %)

- Sector / Industry: Finance - Financial Services / Data & Analytics

- Geographical positioning: Globally active

Business model

S&P Global is a leading global provider of financial information, ratings and analytical data. The company is best known for its credit ratings (Standard & Poor's Ratings), indices, including the well-known S&P 500, as well as extensive market data and software solutions.

Main business areas:

- S&P Global Ratings - credit ratings for companies, governments and financial products

- S&P Dow Jones Indices - operation and licensing of global indices ( (many S&P indices are not directly recognizable in name as they are licensed by third party providers such as iShares and marketed under their own names)

- S&P Global Market Intelligence - Financial data & tools for analysts, companies and investors

- S&P Global Commodity Insights - data and analysis for commodity markets

Following the acquisition of IHS Markit in 2022, the company was positioned even more strongly in the area of data and technology.

Fundamental metrics:

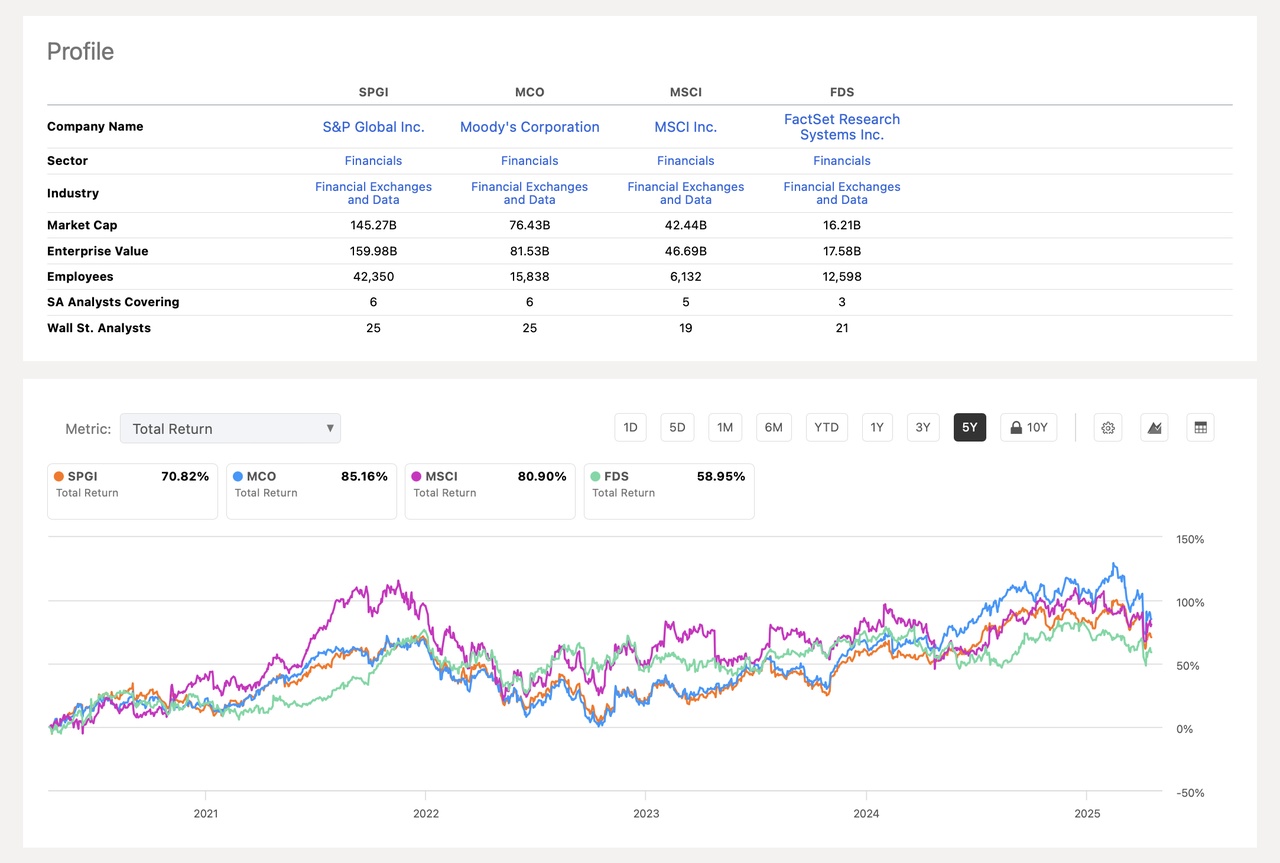

Market capitalization: approx. USD 142 billion

P/E ratio / forward P/E ratio: 37 / 31

Earnings per share (GAAP EPS):

- 2024: 12.35 USD

- 2025e USD 14.20-14.45

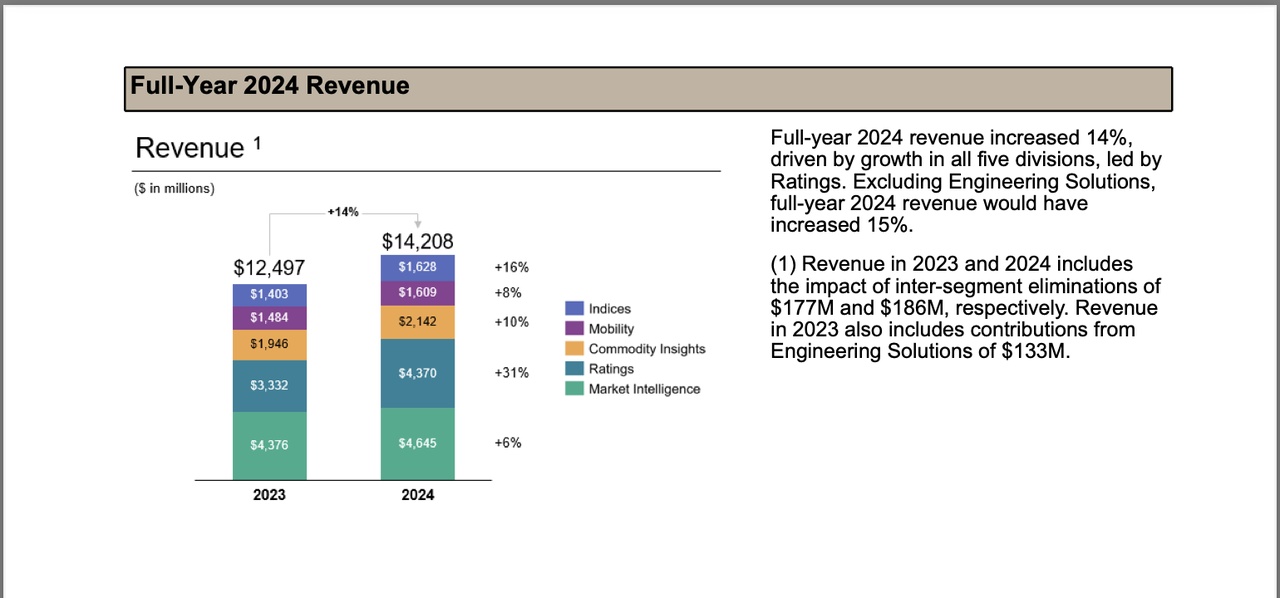

Turnover:

- 2024 USD 14.208 bn /

- 2025e USD 15 bn +5.7%

Sales growth: 14%

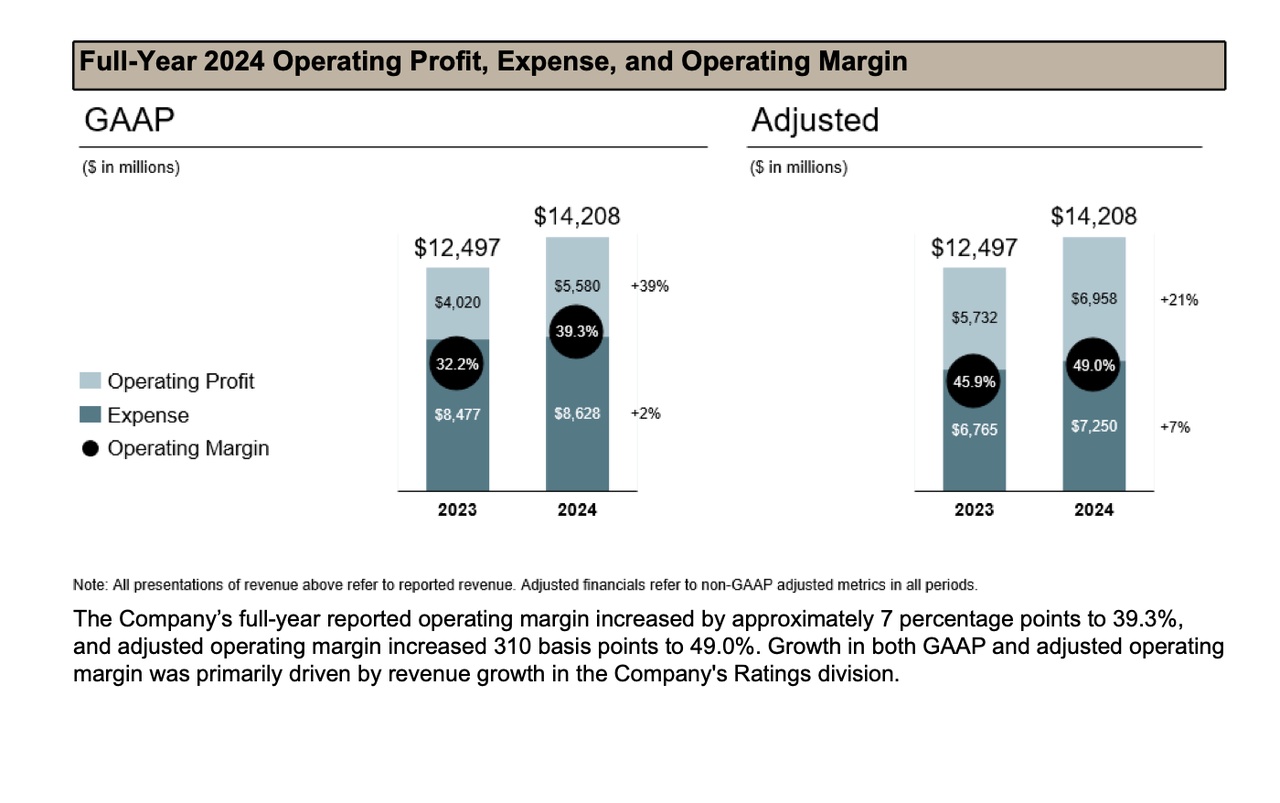

Profit growth: 13

Net margin 2024:

- 27.1% / USD 3,852 million (+47% on the previous year)

Operating cash flow:

- USD 5,689 million / cash flow margin 39%

Return on equity (ROE): 11.27%

Equity ratio: 62.3

Debt-equity ratio: 19%

Interest coverage ratio: 18.8

Dividend yield: approx. 0.85

Valuation & comparison

S&P Global typically trades at a valuation premium to traditional financials due to its monopoly-like business model, high scalability and stable and growing cash flows.

The average P/E ratio over the last

- 10 years at 41.3

- 15 years at 33.3

In my opinion, these figures reflect the confidence of the market, the pricing power and the growth profile of the company.

Comparable companies in the sector are Moody's, MSCI and FactSet. S&P Global is considered to be the broadest and most diversified provider with a leading market position across all segments.

Opportunities & investment thesis

Pro arguments:

- Monopoly-like market position: S&P has a quasi-oligopolistic position in the credit ratings sector

- Recurring revenues: License fees and subscription models ensure predictable revenues

- High scalability: Data & software business benefits strongly from margin leverage

- Global expansion: demand for financial data is growing worldwide

- Strong expansion of data analysis and AI expertise

Risks:

- Dependence on market activity, weak phases in the issuing market could burden the rating business

- High valuation and growth expectations

Chart technology

The S&P Global share is in a long-term uptrend and is currently trading approx. -21% below its all-time high.

In mid-2024, the share price emerged from an upward consolidation phase lasting several months. If the USD 470-480 range is sustainably overcome, new highs are possible. Support areas are located at around USD 444 and USD 404.

Personal assessment 🤓

S&P Global is a real quality stock with a castle moat and a data-based business model that is highly scalable. The valuation is ambitious 🧐, but justified by market position, growth and margins.

In my opinion, S&P is a potentially outstanding candidate for long-term investors who are betting on the digitalization of the financial sector.

Sources:

MarketScreener

Finance.net

Seeking Alpha

Fullratio

Times