British American Tobacco $BATS (+0,7 %) performed better than expected in the first half of the year and confirmed its forecast for the year. The British tobacco company announced that it expects to reach the upper end of its forecast range for sales growth of 1 to 2 percent at constant exchange rates in 2025. For adjusted operating profit, BAT expects growth of 1.5 to 2.5 percent.

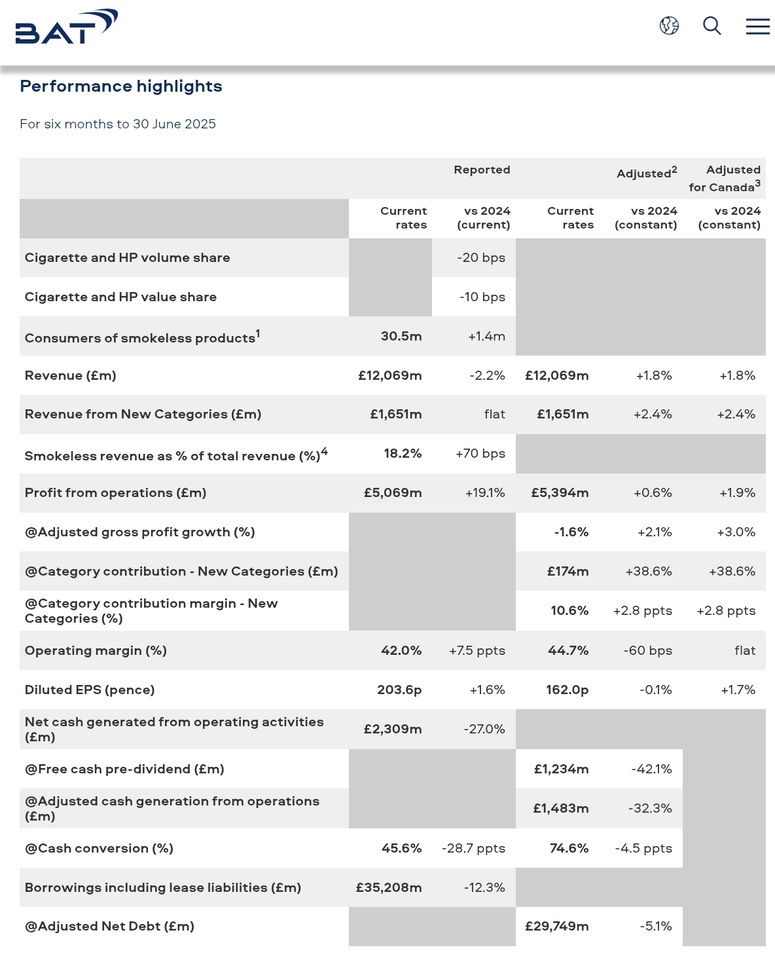

- Revenue down 2.2% (due to currency headwinds), up 1.8% at constant FX, driven by a return to growth in the U.S. (led by combustibles and Velo Plus), continued growth in AME, partly offset by APMEA

- New Categories revenue in line with 2024 at £1,651 million - an increase of 2.4% at constant FX

- Smokeless products now 18.2% of Group revenue, up 70 bps vs FY24

- Phased roll-out of innovations is expected to drive an accelerated H2 New Category performance

- New Categories contribution margin increased by 2.8 ppts to 10.6% at constant FX

- Improved combustibles financial performance (at constant FX), driven by price/mix

- Reported profit from operations up 19.1% (with reported operating margin up 7.5 ppts to 42.0%), partly due to the update of the Canadian settlement provision while the prior year was negatively impacted by non-repeating impairment charges

- Adjusted profit from operations (as adjusted for Canada) up 1.9% at constant FX, adjusted operating margin (as adjusted for Canada and at constant FX) flat at 43.2%

- Reported diluted EPS up 1.6% to 203.6p, with adjusted diluted EPS (as adjusted for Canada) up 1.7% at constant FX

- Increased 2025 share buy-back program by £200 million to £1.1 billion

On Track for Full-Year 2025 Guidance

- Global tobacco industry volume expected to be down c.2%.

- Revenue growth at the top end of 1.0-2.0% guidance range*, with mid-single digit New Category revenue growth*.

- 1.5-2.5% adjusted profit from operations growth (adj. for Canada)* including an expected c.1.0-1.5% transactional FX headwind.

- We expect a translational FX headwind of c.4% on adjusted profit from operations (adj. for Canada).

- Net finance costs expected to be c.£1.8 billion (adj. for Canada)*, subject to interest rate volatility.

- Gross capital expenditure in 2025 of approximately £650 million.

- Operating cash flow conversion that exceeds 90%.

- Continue to deleverage to our 2.0-2.5x adjusted net debt/adjusted EBITDA (adj. for Canada)* corridor by 2026.

Tadeu Marroco, Chief Executive:

"Our first half results are slightly ahead of expectations. 2025 is a year of execution and we are on track to meet our guidance for the financial year.

"We have added 1.4 million consumers (to 30.5 million) to our smoke-free brands. Our smoke-free portfolio now accounts for 18.2% of Group sales, an increase of 70 basis points compared to FY 2024.

"I am very pleased with our performance in the US. Sales and profit have increased for the first time since 2022, and in addition to the successful launch of Velo Plus, our sales volume and value share of combustible products have grown again. AME continued to perform strongly, while our performance in APMEA was impacted by tax and regulatory challenges in Bangladesh and Australia.

"Velo continues to perform very well in the fastest growing new category. Our focus on quality growth, which emphasizes investment in the largest profit pools, has resulted in higher returns, with the contribution from the new category increasing by 38.6% at constant exchange rates to £179 million, with further improvement expected for the financial year.

"Our continued strong cash conversion and the recent partial disposal of our ITC investment have improved our capital flexibility, while further financial discipline will deliver additional cost savings and smart reinvestment.

"I am confident that the investments we have made and the actions we have taken will help us return to our medium-term algorithm in 2026. In addition to rewarding our shareholders with strong cash returns, I am committed to delivering sustainable value to our shareholders."