As January draws to a close, the tanker market remains in flux, shaped by a combination of sanctions, shifting trade flows, and volatile freight rates. The surge in VLCC rates seen earlier this month, driven by new US sanctions on Russia’s shadow fleet, has now cooled as vessel availability has increased, the Chinese New Year slowdown has taken effect, and market uncertainty persists. However, the long-term fundamentals continue to suggest that renewed volatility is likely in the months ahead.

📉 VLCC Market Cools, But Volatility Looms

After spiking to seven-month highs following the implementation of new shipping sanctions, VLCC rates have since softened, reflecting a temporary lull in demand. The Chinese New Year holidays have slowed trading activity, particularly in the Middle East Gulf, where fewer cargo inquiries have put downward pressure on freight rates. Despite this short-term dip, the Atlantic VLCC market has remained active, with eastern buyers aggressively sourcing alternative crude supplies at discounted prices. The WTI/Dubai spread currently favors US crude, and with the March US Gulf export program expected to be substantial, rates could soon rebound. The thinning position list suggests that downside risk is limited, and market sentiment points to an eventual upward shift in rates once trading resumes in earnest.

1 Year T/C - VLCC ECO / SCRUBBER

🚢 Suezmax & Aframax: Market Divergence

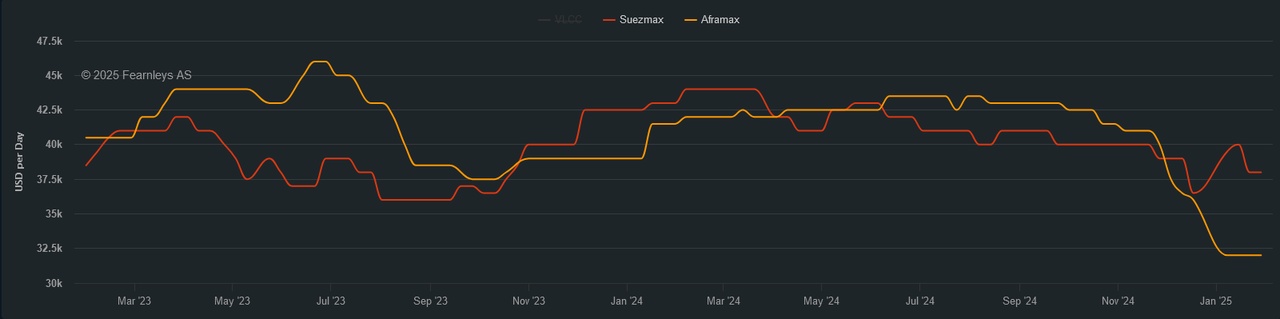

While VLCC dynamics have fluctuated, the Suezmax and Aframax segments have followed distinct trends. The Suezmax market continues to face oversupply, with an abundance of available vessels keeping freight rates subdued. The only exception has been the Black Sea, where increased forward fixture activity has allowed rates to hold steady. Meanwhile, the West African market has seen rates decline to WS 75 on the TD20 route due to muted demand, while the US Gulf has remained quiet with rates stuck around WS 65 for transatlantic voyages. In the Middle East Gulf, spot activity has been limited, keeping rates for eastbound cargoes just above WS 105.

Aframax markets, on the other hand, have seen significant disruptions following the latest US sanctions on Russian oil shipments. The cost of transporting ESPO crude out of Russia’s Pacific port of Kozmino has skyrocketed, with Aframax freight rates tripling to over $6.5 million. This spike has widened the price gap between buyers and sellers, stalling Asian trading for March-loading cargoes. In the North Sea, Aframax availability has tightened as vessels reposition to the Atlantic in response to growing demand for transatlantic voyages. Meanwhile, the Mediterranean market, which initially weakened following concerns over potential closures at Libya’s Es Sider and Ras Lanuf terminals, has since stabilized as operations at both ports resumed.

1 Year T/C - SUEZMAX AFRAMAX ECO / SCRUBBER

🛢 Sanctions & Supply Chain Disruptions

Beyond freight rate movements, Russian crude exports continue to face mounting challenges. At Ust-Luga, one of Russia’s key Baltic export terminals, tanker loadings have fallen to a four-year low of 350,000 barrels per day due to a combination of technical issues and the impact of US sanctions. Traders report that the port’s reduced throughput has added to Russia’s export difficulties, particularly as newly sanctioned vessels struggle to find buyers.

Meanwhile, Indian and Chinese refiners have encountered growing logistical hurdles as sanctioned tankers begin arriving at ports, leading to unexpected delays in cargo discharges. Indian refiners, in particular, have started to pivot toward alternative sources, increasing purchases from the Middle East, Africa, and the US to compensate for declining Russian volumes.

" Russian Shadow Fleet " by Grok

🌍 OPEC+, Oil Prices & Trump’s Energy Moves

Oil prices, which had recently surged to multi-month highs, have retreated following renewed political uncertainty surrounding US energy policy. Former President Donald Trump’s return to the global stage has introduced conflicting signals regarding future oil supply. On one hand, he has expressed a desire to refill the US Strategic Petroleum Reserve (SPR) “right to the top,” a move that would require sourcing large volumes of imported sour crude. On the other, he has called for increased domestic oil production, a policy that could put downward pressure on global crude prices. Analysts believe that any effort to replenish the SPR would likely support demand for VLCC and Suezmax tankers, as the US would need to import significant crude volumes from the Middle East.

At the same time, the OPEC+ alliance is preparing to meet on February 3 to review its supply curbs. Market expectations, according to ANZ, suggest that the group will maintain its current production cuts through the first quarter before potentially unwinding them in April. However, with Chinese demand still failing to deliver a meaningful recovery, it remains unlikely that OPEC+ will agree to any production increases in the near term.

By Grok

📈 Looking Ahead: Market Poised for Further Shifts

As the Chinese New Year holiday period comes to an end, tanker demand is expected to rebound, particularly as US crude exports ramp up and trade routes continue to evolve. Geopolitical uncertainties, from US sanctions enforcement to OPEC+ production policies, will remain key variables shaping freight market dynamics. Furthermore, with the global tanker fleet experiencing historically low supply growth and a tightening orderbook, freight rate volatility is set to persist through 2025.

💬 Let’s Connect!

What are your thoughts on the tanker market ? Feel free to share in the comments and don't forget to like and share this post! 🚢