Troubled Waters: Dry Bulk Market Challenges

The dry bulk market has been battling persistent turbulence in recent years, facing headwinds from a global economic slowdown, particularly in China. As the world’s largest importer of iron ore—accounting for 70% of global imports—and a major consumer of coal at 27.5% of global imports, China’s economic deceleration has had a profound impact on shipping demand. However, supply-side dynamics have compounded the situation. The market is grappling with a significant oversupply of vessels, which, despite steady demand, has driven freight rates downward and intensified competition across the industry.

Geopolitical conflicts have added another layer of complexity. The ongoing war between Russia and Ukraine has disrupted global grain shipments, further straining an already fragile trade environment. These pressures are clearly reflected in the Baltic Dry Index (BDI), which on February 18th stood at just 792 points—down 49.9% year-over-year and 20.6% since the start of 2025.

SBLK: A Strong Contender in a Challenging Market

Despite the industry-wide downturn, Star Bulk Carriers ($SBLK (-0,32 %)) continues to set itself apart with a combination of cost efficiency, fleet scale, and operational excellence. The company operates one of the lowest-cost fleets in the world, with a daily operating expense (OPEX) of just $5,056 per vessel per day in Q4 2024. This efficiency, paired with its 155-vessel fleet spanning various classes with an average age of 11.8 years, provides a solid foundation for long-term resilience.

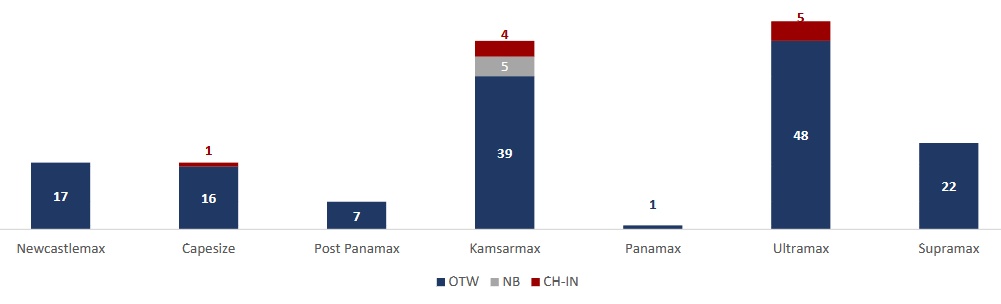

SBLK Fleet composition including 5 newbuilding vessels and

Sustainability is also a priority for SBLK, and the company has been proactive in meeting environmental regulations. By equipping its vessels with cutting-edge emissions technology, SBLK has earned a “B” score in environmental and water management from the 2024 Carbon Disclosure Project (CDP). This commitment to responsible shipping is further reinforced by an ESG risk rating of 18.4, making SBLK the top-ranked U.S.-listed dry bulk company in ESG performance.

Delivering Value to Investors

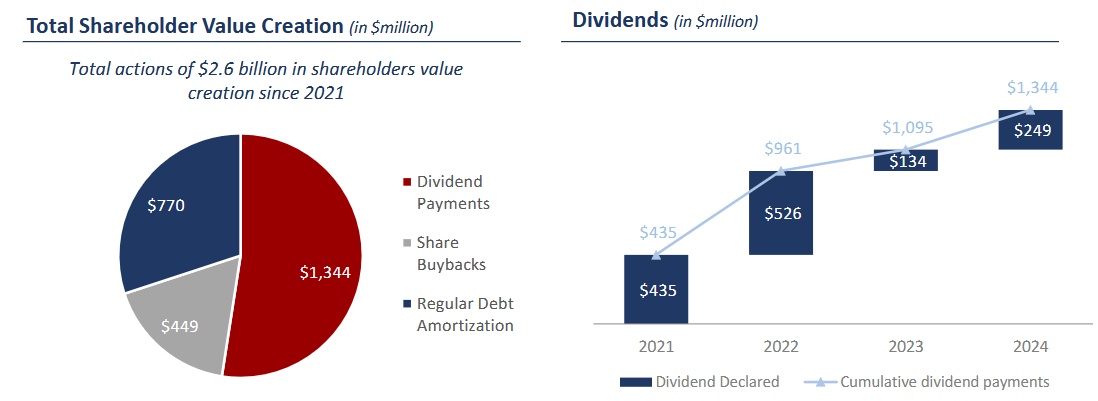

Through strategic financial management, SBLK has consistently prioritized shareholder value. Since 2021, the company has generated $2.6 billion in returns for investors. This commitment is evident in the recently announced $100 million share buyback program, which saw 900,000 shares repurchased in December and January at an average price of $15.08, largely financed by free cash flow and vessel sales.

Dividends remain a key pillar of SBLK’s strategy, with 60% of quarterly free cash flow allocated to payouts. The company also maintains a strong financial position, with $440 million in cash on hand post-Q4 2024. Over the past four years, net debt per vessel has been reduced by 54%, from $11.9 million to $5.4 million, while 13 ships are now fully debt-free, collectively valued at $250 million.

SBLK Shareholder commitment since 2021

Financial Performance: Growth Despite Market Conditions

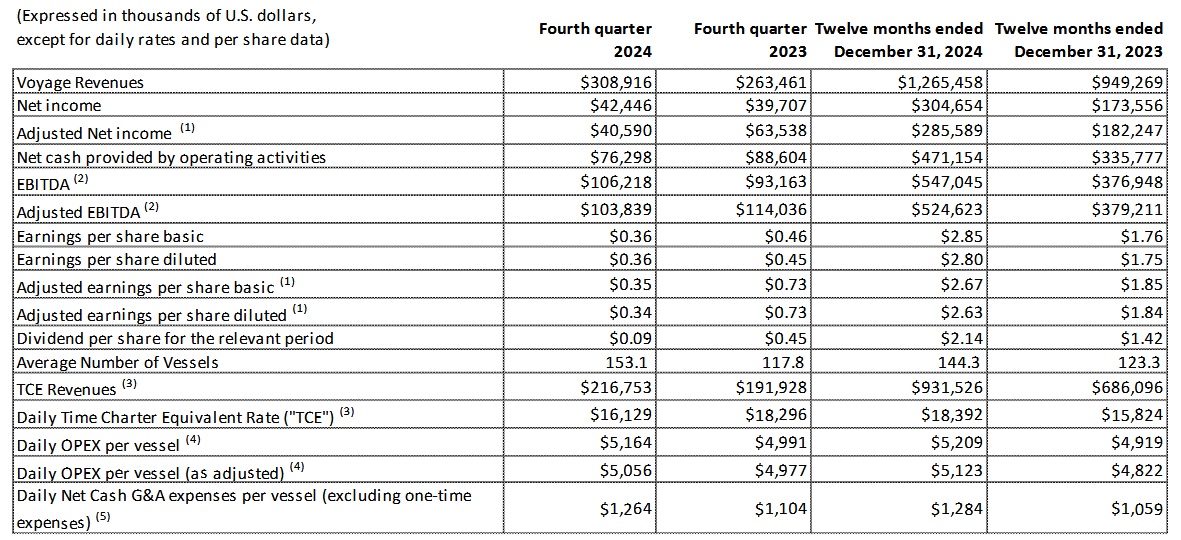

Even amid the broader market downturn, SBLK has continued to deliver strong financial results. In Q4 2024, the company reported total revenues of $308.9 million, marking a 17.25% year-over-year increase compared to Q4 2023. Earnings before interest, taxes, depreciation, and amortization (EBITDA) also rose by 14% YoY, reaching $106.2 million, up from $93.1 million in the same quarter the previous year.

A key driver of this growth has been the 2024 acquisition of Eagle Bulk, a strategic move that has strengthened SBLK’s market position and operational efficiencies.

Q4 24 SBLK Earnings + YOY + 2023 vs 2024

Eagle Bulk Integration: Unlocking Synergies

The integration of Eagle Bulk has been progressing smoothly, unlocking significant cost savings and operational efficiencies. By bringing crewing operations in-house and phasing out third-party management, SBLK has substantially reduced operating expenses. Further efficiencies have been achieved through the centralization of procurement for spare parts, bunkers, lubricants, and other vessel necessities.

Technical oversight of the former Eagle Bulk fleet has also been fully integrated into SBLK’s Athens headquarters, ensuring uniform maintenance protocols and enhanced marine safety standards. Additionally, the company’s scale and strong relationships with shipyards and service providers have led to significant reductions in dry dock costs for the Eagle fleet.

SBLK has also benefited from lower interest expenses following the Q2 2024 refinancing of Eagle Bulk’s debt, further strengthening its balance sheet. To date, synergies from the Eagle Bulk integration have resulted in more than $22 million in cost savings, with additional opportunities expected in 2025, particularly in OPEX and dry dock expenses.

Conclusion: Positioned for Long-Term Success

The dry bulk shipping industry continues to face turbulent waters, but SBLK has proven its ability to navigate through uncertainty with operational efficiency, financial discipline, and strategic growth initiatives. While market challenges persist, the company’s low-cost structure, commitment to sustainability, and shareholder-focused approach set it apart from its peers.

With the successful integration of Eagle Bulk, a disciplined financial strategy, and continued efforts to optimize costs, SBLK is not only weathering the current market downturn but also positioning itself for long-term success. As the industry eventually rebounds, SBLK stands ready to emerge stronger, leaner, and more resilient than ever before.

I rate for myself SBLK as a "BUY" on the long term with a 1Y price target of 23$.

The analysis provided in this post reflects my personal views and opinions on Star Bulk Carriers (SBLK) and the broader dry bulk market. I currently hold a position in SBLK, which may create a potential bias in my perspective. This analysis is for informational purposes only and should not be considered financial advice. Investors should conduct their own research and consult with a professional before making any investment decisions. I am not responsible for any financial losses or decisions made based on the information presented.