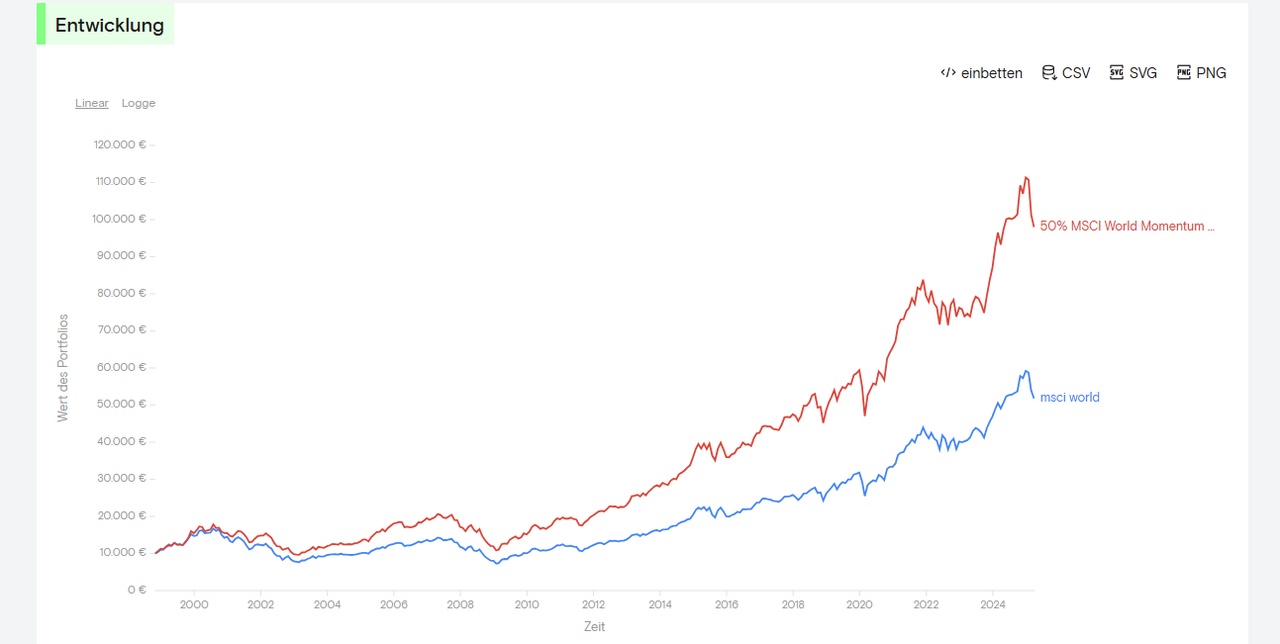

What do you think about factor investing? Based on personal preferences and research, I have created a simple sample portfolio to illustrate the potential of this strategy. I compared it with the MSCI World Index $IWDA (+1,3 %) index.

The results are quite convincing - the factor-based portfolio outperforms the benchmark in terms of both return and risk-adjusted performance:

Annualized Return:

- Factor portfolio: 9.02%

- MSCI World: 6.42 %

Volatility (standard deviation):

- Factor portfolio: 14.76

- MSCI World: 14.48

Sharpe Ratio:

- Factor portfolio: 0.55

- MSCI World: 0.39

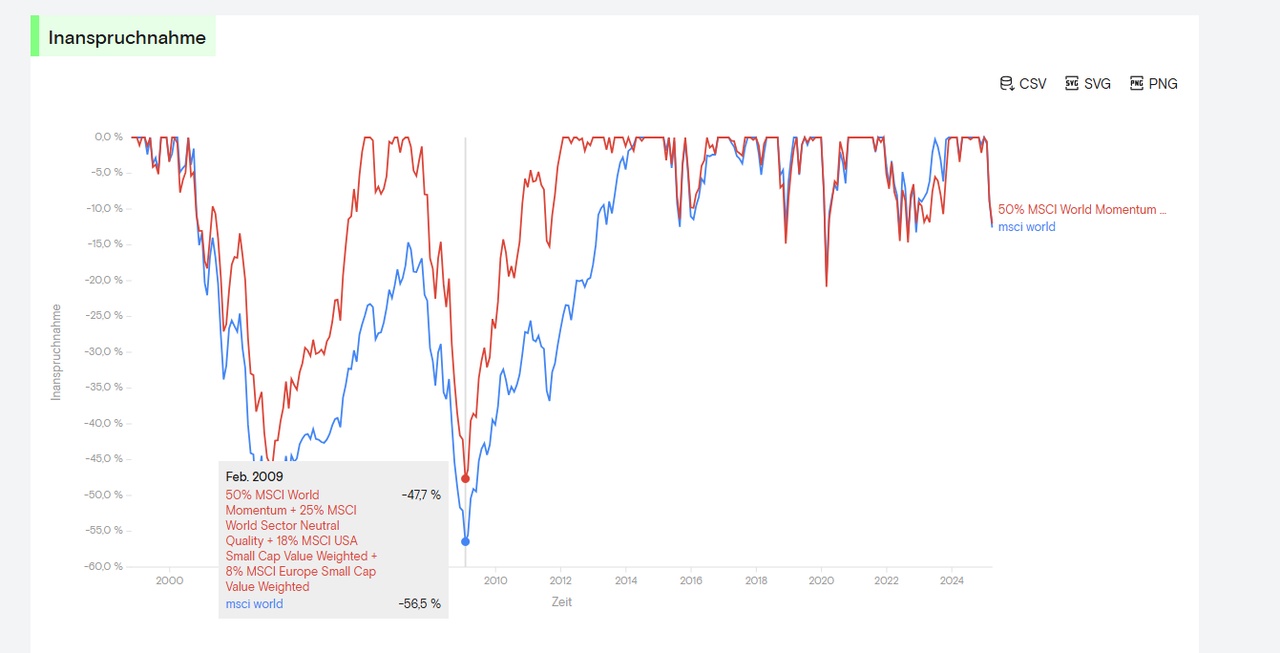

Maximum drawdown (during the 2008 financial crisis):

- Factor portfolio: -47.7%

- MSCI World: -56.5%

Value at risk (VaR, 95% confidence, 1 year):

- Factor portfolio: -14.5

- MSCI World: -16.5 %

This suggests that a well thought-out factor portfolio can achieve higher returns and at the same time manage downside risk better than a broad benchmark such as the MSCI World.

I look forward to hearing your opinions or how this compares to strategies you are currently pursuing.