$SOFI (+1,56 %) bringt Krypto zurück 🚀

- Adj EPS: $0.06 (Est. $0.04) ✅; +200% YoY

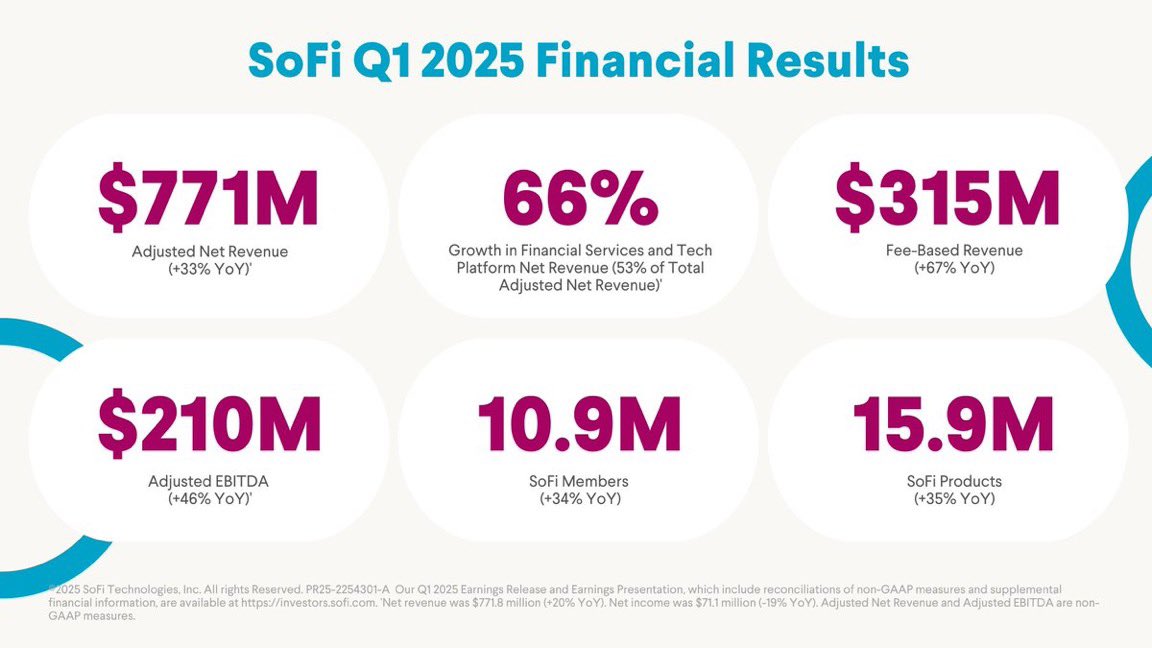

- Revenue: $771.8M (Est. $740.3M) ✅; +20% YoYQ1'25 Detailed Earnings Highlights:

- Adj EBITDA: $210.3M; +46% YoY

- Fee-Based Rev: $315.4M; +67% YoY

FY25 Guidance (Raised):

- Revenue: $3.235B–$3.31B (Prev. $3.200B–$3.275B; Est. $3.191B) ✅

- Adj EBITDA: $875M–$895M (Prev. $845M–$865M)

- GAAP Net Income: $320M–$330M (Prev. $285M–$305M)

- GAAP EPS: $0.27–$0.28 (Prev. $0.25–$0.27) ✅

- New Members Expected: +2.8M in FY25 (UP +28% YoY)

Q2'25 Outlook:

- Revenue: $785M–$805M

- Adj EBITDA: $200M–$210M

- GAAP EPS: $0.05–$0.06

Segment Performance:

Financial Services:

- Revenue: $303.1M; UP +101% YoY

- Net Interest Income: $173.2M; UP +45% YoY

- Noninterest Income: $129.9M; UP +321% YoY

- Contribution Profit: $148.3M; UP +299% YoY

- Contribution Margin: 49% (Prev. 25%)

- Interchange Fee Revenue: UP +90% YoY

- Total Financial Services Products: 13.79M; UP +36% YoY

- SoFi Money: 5.48M; UP +41% YoY

- Relay: 5.09M; UP +41% YoY

- Invest: 2.68M; UP +21% YoY

Technology Platform:

- Revenue: $103.4M; UP +10% YoY

- Contribution Profit: $30.9M

- Contribution Margin: 30%

- Enabled Client Accounts: 158.4M; UP +5% YoY

Lending:

- Revenue: $413.4M; UP +25% YoY

- Adjusted Revenue: $412.3M; UP +27% YoY

- Net Interest Income: $360.6M; UP +35% YoY

- Contribution Profit: $238.9M; UP +15% YoY

- Contribution Margin: 58%

- Total Loan Originations: $7.25B; UP +66% YoY

- Personal Loans: $5.54B; UP +69% YoY

- Student Loans: $1.19B; UP +59% YoY

- Home Loans: $518M; UP +54% YoY

Operational Highlights:

- 800K new members added in Q1; Total Members: 10.9M; UP +34% YoY

- 1.2M new products added; Total Products: 15.9M; UP +35% YoY

- Loan Platform Business: $1.6B in originations for third parties

- Net Interest Income: $498.7M; UP +24% YoY

- Net Interest Margin: 6.01% (UP +10bps QoQ)

- Deposit Base: $27.3B; 90% from direct deposit members

Credit Performance:

- Personal Loan Charge-off Rate: 3.31% (DOWN from 3.37% QoQ)

- Student Loan Charge-off Rate: 0.47% (DOWN from 0.62% QoQ)

- Delinquencies on Personal Loans: DOWN to 46bps (4th straight quarterly decline)

- SoFi estimates life-of-loan charge-off rates remain under 8% underwriting target

Strategic & Business Highlights:

- Expanded Loan Platform partnerships with Blue Owl, Fortress, Edge Focus

- Announced new SmartStart student loan refinancing and prime personal loan products

- Launched co-branded debit card with Wyndham Hotels & Resorts

- Signed new technology client Mercantil Banco (Panama)

- Launched SoFi Plus subscription: 90% sign-ups from existing users, 30% adopt a 2nd product within 30 days

- Completed SoFi-sponsored $698M consumer loan securitization—first since 2021

CEO Anthony Noto’s Commentary:

- "We are off to a tremendous start in 2025. Q1 delivered our highest revenue growth rate in five quarters, record member and product growth, and accelerating innovation."

- "These results reflect the strength of our strategy, product architecture, and financial discipline as we raise full-year guidance."