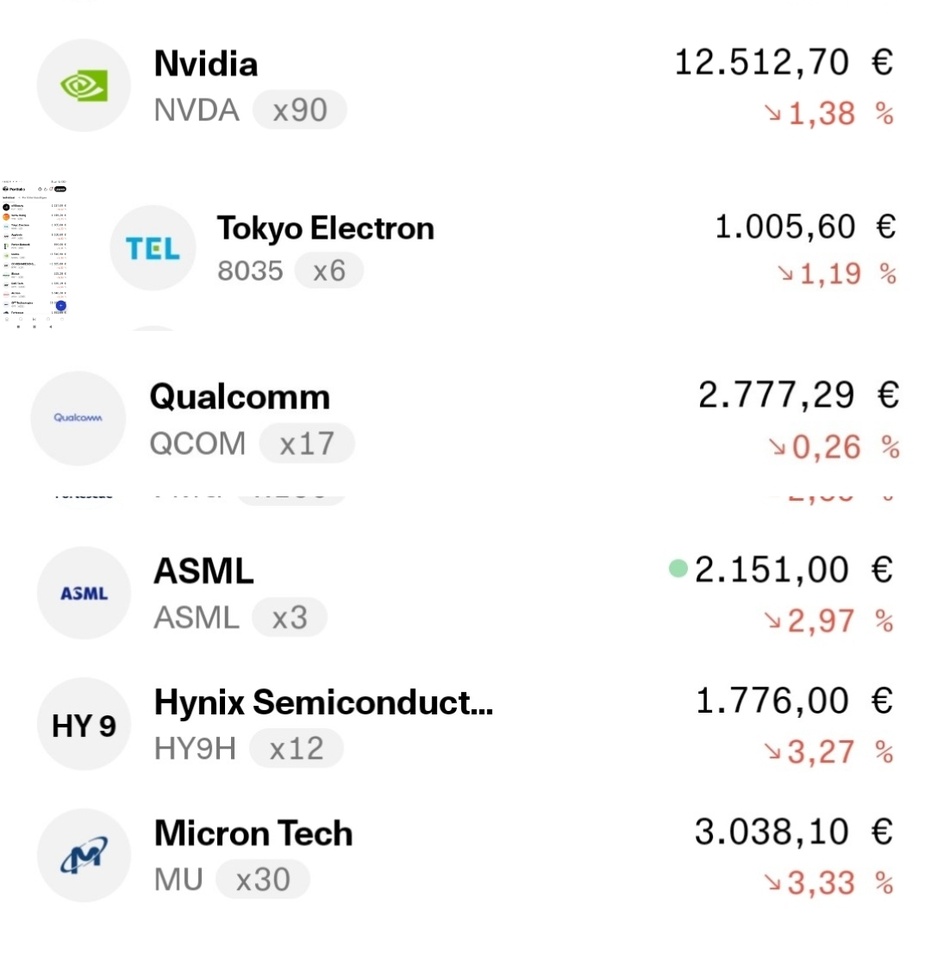

Today, my overweighting of the semiconductor sector is once again falling flat on its face.

Which stocks would you sell and why? Or would you stick with it everywhere?

$NVDA (-1,45 %)

$HY9H (-2,86 %) . $QCOM (-0,38 %) . $MU (-3,89 %)

$ASML (+0,64 %)

$8035 (+0,3 %)