$HIMS (-3,22 %) has gained 150% in one month, but in my opinion they are undervalued in the long term.

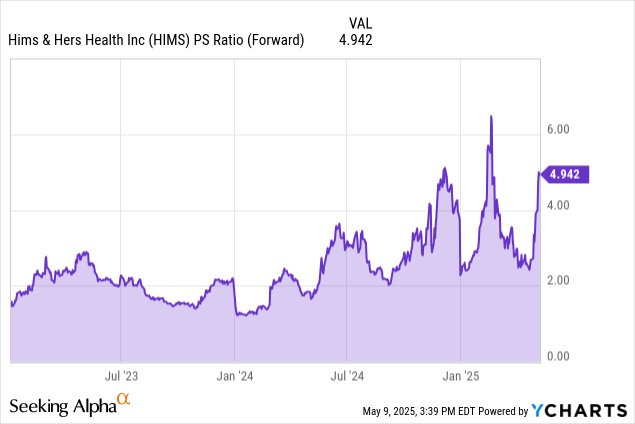

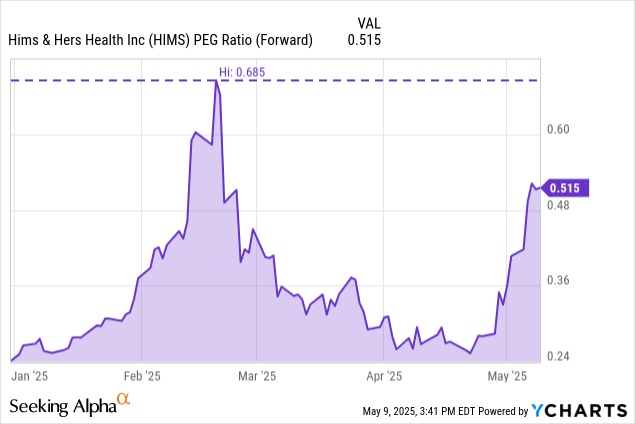

If we look at the PS / PEG ratio we hardly find such favorable companies with the growth...

With an unbelievable GROWTH...

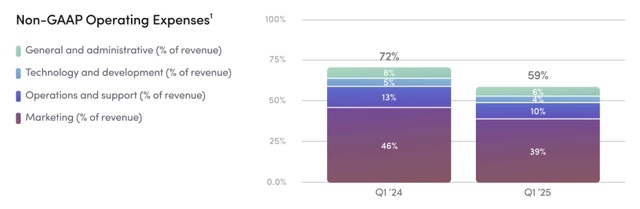

And, if we look at the costs and problem points, these are no longer present at the last ATH, there was fear due to a termination of Semaglutide (now a co-op with $NOVO B (-1,5 %) ) and that marketing expenses would continue to rise, the opposite has happened...