What sounds like a Ponzi scheme has actually been a reality for over a year.

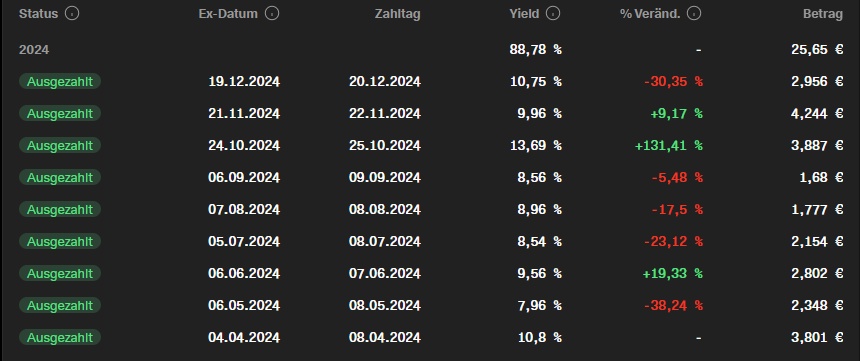

The $MSTY has been paying out 5-10% dividends every month (sometimes even more) - and has been doing so since the start of 2024:

But: What is the MSTY?

MSTY is an ETFthat is based on the share $MSTR (-1.17%) based on the stock. You probably all know the story of Strategy and Saylor by now, but in a nutshell:

Strategy launches financial products such as convertible bonds and preference shares with different terms and thereby buys as much as possible. $BTC (+0.08%) as possible.

In the meantime (as of now) they hold a whopping 597,325 Bitcoin.

This strategy has not only meant that the Strategy share has outperformed everything since the start of the strategy, but the share is also incredibly volatile.

And what exactly does this have to do with the MSTY?

This is an ETF from yieldmaxetfs, which has set itself the task of generating high monthly distributions for investors.

And they achieve this with a so-called covered call strategy.

The strategy is essentially as follows:

(1) Mapping of the strategy price development

The fund initially ensures that it mirrors Strategy's share price performance (synthetically or through corresponding positions). This allows investors to participate to a certain extent in changes in the MicroStrategy share price.

(2) Sell call options

At the same time, the fund sells (writes) call options on the Strategy share. A call option gives the buyer the right to buy the share at a fixed price until the end of a period. For this right, option buyers pay a premium to the fund.

The call options are always written on a weekly basis and the price is always between 0 and 15% higher than the current share price (on average a 7% premium on the current price).

Example: The share price is €100 per share. I issue an option on Monday to sell the share on Friday for €107 - regardless of the current share price. I charge a premium of €5 for selling this right.

If the share price rises above €107 by the end of the week, I still have to sell the share for €107. This means that I make a loss and the €5 premium that I have taken can only cushion part of the loss.

However, if the share price does not rise above €107, the option expires and I still receive the MSTR share + the €5 premium.

(3) Income from premiums

The option premiums mentioned are very high, as Strategy shares are extremely volatile and fluctuate strongly with the Bitcoin price. High volatility means that buyers are willing to pay high premiums for options. And these premiums represent the main income stream of the fund and are distributed to investors on a monthly basis. That's why MSTY can generate such dividend yields of 5-10% per month - it's essentially just the option fees collected from call sales.

Important to know: Even though MSTY is based on MSTR, the sale of call options forgoes a portion of the upside. If the MicroStrategy share price rises above the agreed option strike price, MSTY must pass this additional profit on to the option buyers. This means that participation in price gains is capped - the fund only retains gains up to a certain threshold (~7%), anything above this goes to the option buyer. This "capped participation in price gains" is the trade-off for the high premium income.

This means that if the MSTR share rises by 20% in a week, the MSTY rises by a maximum of 7%. However, if the MSTR share falls by 20%, the MSTY price also falls by approx. 20% -> and that is precisely the risk you are taking. The price growth is limited upwards on a weekly basis, but not really downwards.

Conclusion

In my opinion, the MSTY can be a great way to generate some additional cash flow. I am also toying with the idea of investing part of my assets (probably max. 5%) in it. But you shouldn't think that you can simply take a risk-free 5-10% return per month with you - of course that's not the case :D

PS: The MSTY is only tradable for professional investors in Germany. In the meantime, however, HanETF has launched a certificate that can be used to invest in the MSTY in Europe. It works a bit like typical ADR shares. You buy the certificate and HanETF invests the money directly in the MSTY - the dividends then go to HanETF, which pays out the money to the certificate holders.

https://hanetf.com/de/fund/msty-mstr-option-income-strategy/

Are any of you already invested in the MSTY or were you already familiar with the MSTY? And what do you think of it?