DBS Group Holdings $D05 (-0,44 %) Southeast Asia's largest bank, has published its figures for the third quarter of 2025. Despite a slight decline in profits, the bank remained robust.

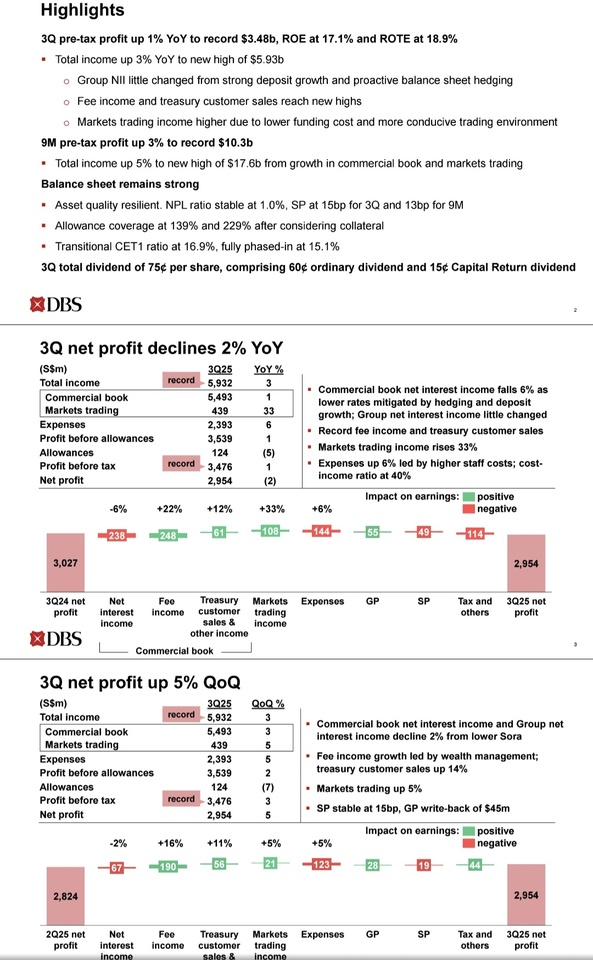

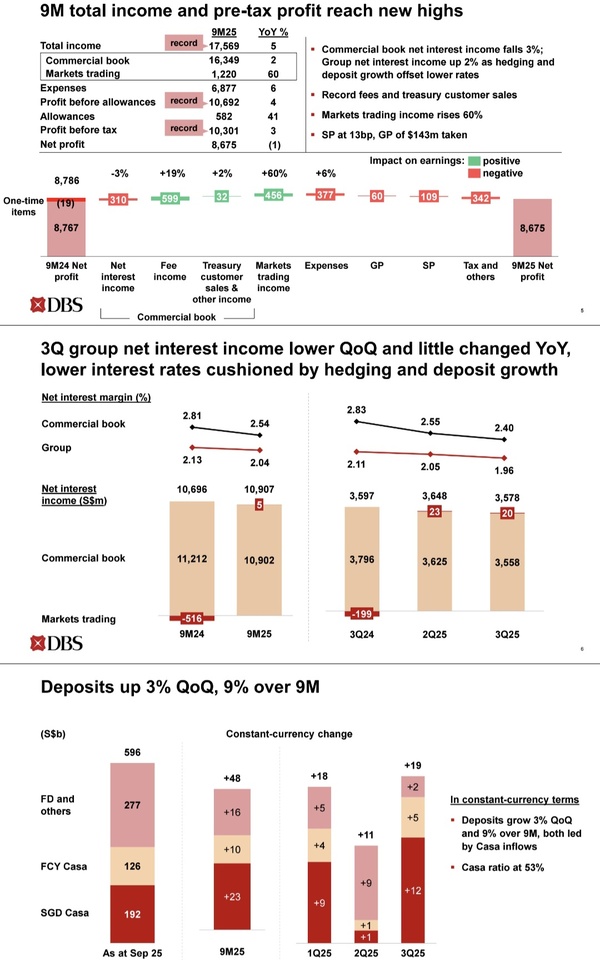

Net profit fell by 2% to SGD 2.95 billion, compared to SGD 3.03 billion in the previous year. Net interest income remained almost stable at SGD 3.58 billion. At SGD 8.68 billion, the profit for the first nine months is only just below the record figure of the previous year. Earnings per share also remained almost unchanged.

Despite the minimal decline, the market reacted positively: the share price rose by around 3.5% after the figures and reached a new record high of SGD 55.37. Analysts particularly praised the stable earnings situation and efficient cost management in an environment of increasing risks and slightly declining margins.

DBS has thus once again confirmed its reputation as a reliable dividend stock with a strong business model and solid balance sheet - a rock in the surf of the Asian banking sector.

Singapore 2025 🇸🇬