Waste Management $WM (+0,17 %) is the third largest position in my portfolio with approx. 4.5%... and I feel quite comfortable with that.

The Q1 figures came out on 29.04. I have categorized the figures for myself.

With this post and my general classifications, I am also trying to provide a good, comprehensible overview to give all "shareholders" or future shareholders an adequate insight and ensure an understanding of the company.

SourcesQ1 Report [1] and Earnings Call [2]

WM presents a strong Q1, with double-digit sales growth and a solid operating performance. However, earnings per share are lower despite record sales. Find out why this is not necessarily a bad sign here. Have fun!

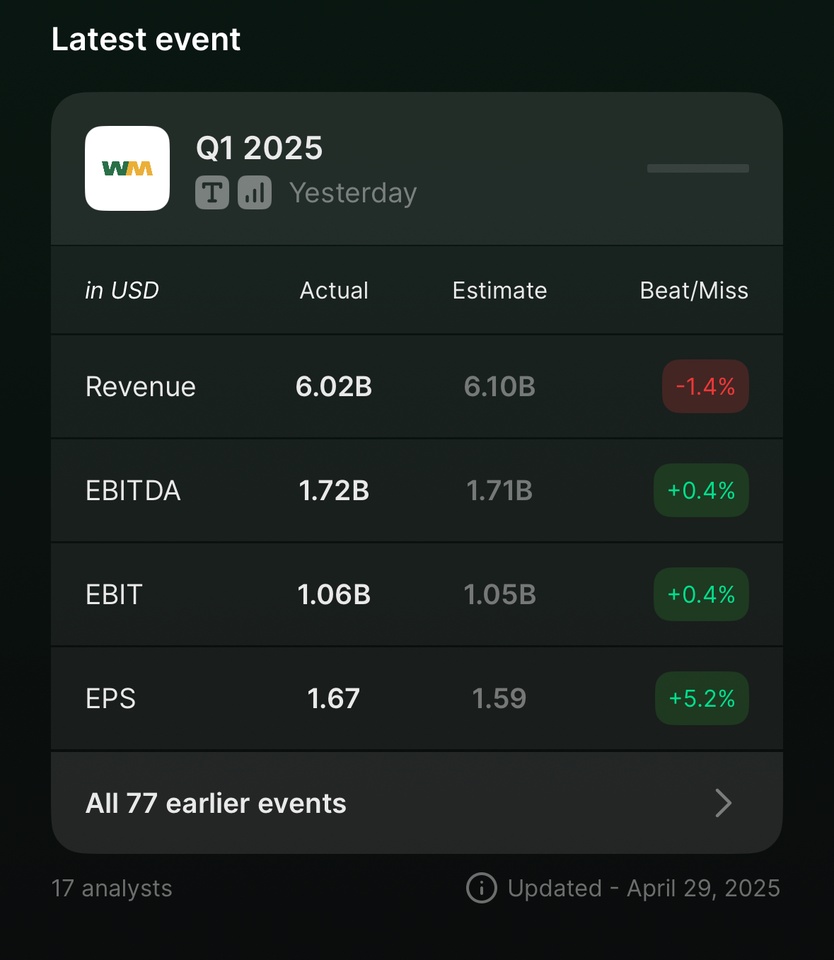

📊 ESTIMATES VS. REPORTED

📊 Q1 figures at a glance

- Turnover6.02 billion $ (+16.7 %)

- Adjusted EBITDA1.72 billion $ (+12.2 %)

- Adjusted EPS1.67 $ (previous year: 1.75 $)

Why is sales growing strongly but EPS falling?

In the first quarter of 2025, WM reported adjusted EPS of $1.67, compared to $1.75 in the previous year, despite a +16.7% jump in sales, does that sound alarming at first? But it's not...

1 . The Stericycle takeover has a double effect: (more context later)

Sales increase because Stericycle is now fully included in the balance sheet ($619m sales in Q1).

At the same time, however, costs are also rising:

- Interest payments on new debt that was used for financing

- Amortization of the purchase price

- One-off integration costs (e.g. system conversions, personnel)

All of this has a negative impact on earnings per share, even though the new division is already profitable.

2 . Special tax effects & discontinuation of subsidies

- In the previous year, WM benefited from tax credits for alternative fuels, which expired in 2025.

- This explains part of the decline compared to the strong Q1 2024.

3 . Higher capital costs put pressure on free cash flow

- Even though operating cash flow remained solid ($1.21 billion), free cash flow was only $475 million, leaving less room for buybacks or earnings growth.

Conclusion so far: The falling EPS is not a warning signal, but a consequence of...

- strategic growth (acquisition),

- temporary integration costs,

- expiring tax benefits and

- increased interest rate environment.

In the long term, EPS should improve again significantly as soon as synergies from the Stericycle integration and new RNG/recycling plants take effect.

🚛 What is the traditional core business doing?

The so-called legacy business includes:

- Collecting, transporting and disposing of waste

- Customers: Cities, households, companies

- Service: Planning, logistics, landfills, disposal & recycling

Q1 2025:

- Turnover5.40 billion $

- Adjusted EBITDA1.62 billion $

- EBITDA margin: 30 % (Q1 2024: 29,6 %)

- EBITDA growth: +5 % YoY

Growth driver:

- Core pricing +6.5 %

- Cost optimization:...

COO John Morris:

"We reduced operating costs for the sixth consecutive quarter, now at 60.5% of sales."

The reason for this:

- Focus on employee retention & process automation

- Route planning & resource deployment improved through digital tools

- Residential margin at 20% for the first time in 6 years due to targeted withdrawal from low-margin customers

- Withdrawal from residential (private households):

- A lot of effort, low margin

- Focus now on commercial & industrial = better cost/income ratio

Comment (COO John Morris):

"This was the fourth quarter in a row with a 30% margin and that despite a difficult basis for comparison and winter influences."

WM is concentrating on quality rather than volume, more income through targeted pricing and a focus on high-margin customers.

💊 WM Healthcare Solutions Stericycle takeover: between waste and medicine, WM reorganizes itself

WM acquired Stericycle, the leading provider of medical waste disposal, for $7.2 billion in 2024.

The business is less cyclical, fast-growing and in a regulated market.

Q1 2025:

- Turnover619 million $

- EBITDA95 million $

- EBITDA margin: 15,3 %

- Margin improvement compared to Q4 2024: +20 basis points

- Target synergies: $80-100 million in additional EBITDA by the end of 2025

- Target synergies: USD 250 million annually by 2027 (ongoing savings + efficiency gains)

-> e.g. through joint administration, logistics, location optimization

Comment (CEO):

"Our customers value our digital environmental platform and nationwide network - a clear competitive advantage."

♻️ Recycling & Renewable Energy

- Recycling: WM sorts & sells raw materials such as paper, plastic and metal

- Renewable Energy: Recovery of biogas (RNG) from landfills

Q1 2025:

- Combined EBITDA contribution18 million $

- Ø price for recycled raw materials88 $/ton (previous year: 84 $)

- Positive increase, but still below previous highs (e.g. 2022: approx. 120 $)

An EBITDA contribution of $18 million compared to total EBITDA of $1.72 billion?

That sounds vanishingly small? I asked myself the same question...

Why the amount seems low, but still fits

1 . Recycling & Renewable Energy are capital-intensive, long-term oriented

- These areas require high investments in advance (e.g. plants, automation, RNG projects).

- The returns come over years, not in the first or second quarter.

2 . Growth still in the start-up phase

- Many plants (especially RNG) are still under construction or have recently come online.

- CEO Jim Fish said: "8 new RNG plants are currently under construction, all of which are scheduled for completion in 2025."

- The full EBITDA impact will therefore only unfold later.

3 . Recycling margins are heavily dependent on raw material prices

- Prices for recycled raw materials were $88/tonne in Q1, which is well below previous highs (e.g. 2022: $120).

- Ergo: fluctuating contribution to EBITDA, but not a structural problem.

4 . Benchmark: 20% growth YoY

- EBITDA from Recycling & Renewable Energy increased by >20% compared to Q1 2024 .

- The trend is therefore positive, even if the absolute figure appears small.

➡️ It is a growing business area with long-term potential. EBITDA contributions will increase in the next quarters & years as soon as new plants are up and running.

💰 Further financial figures

- Adjusted EBITDA margin (total): 28.5% (previous year: 29.6%)

- Free cash flow: $475 million (previous year: $714 million)

- Investments in sustainability128 million $

- Cash position216 million (end of 2024: $414 million)

Further voices from the earnings call:

CFO Devina Rankin on financial strategy & risks

- Free cash flow in Q1 as planned: $475 million

- CapEx at $831 million, focus on sustainability & fleet ramp-ups

- Customs risks lowas WM pre-produced equipment at an early stage

- Share buybacks further paused, focus on deleveraging

- Leverage ratio: 3.58x, target by the end of 2025: ~3.15x

"Despite interest burden and investments, we are fully on track - operational strength and synergy potential remain intact."

CEO Jim Fish emphasized:

"I'm proud of the fact that we've become a predictably strong performer, quarter after quarter, over the past few years."

He sees WM in a strong strategic position, particularly thanks to three drivers:

- Growth in the core business (Collection & Disposal)

- strong contribution from Stericycle

- Sustainable investments in recycling & biogas (RNG)

Particularly exciting:

- The automated recycling centers achieved EBITDA margins twice as high as non-automated plants.

- 2 new plants went online in Q1, with 7 more to follow by the end of 2025.

- 8 new RNG plants are under construction, all with high yields and progressing according to plan.

"Our sustainability strategy is working, these projects are delivering strong, growth-oriented EBITDA."

The call once again showed how operational fine-tuning, automation and acquisitions go hand in hand and underlined the following points:

- Technology and pricing secure margins

- Sustainability is more than a buzzword, it delivers profit

- Stericycle brings new potential that is structurally anchored

P/E ratio & current valuation (personal assessment, no investment advice)

Current level: ~ 34,49

In recent years: between 25-30

➡️ the current P/E ratio signals that the market believes WM will continue to enjoy stable growth and security.

Are there any special effects in earnings that distort the P/E ratio?

Yes, the ones already mentioned. Nevertheless, explained again:

1 . EPS (earnings per share) is currently falling slightly due to:

- Interest costs due to Stericycle financing

- Depreciation & integration costs

- Elimination of tax credits for alternative fuels

➡️ This means:

- The "G" in the P/E ratio is currently under pressure, but not structurally weakened

- The P/E ratio appears artificially higher because earnings are temporarily lower

➡️ The current high P/E ratio is explainable and temporary

- WM remains a defensive quality stock with strong cash flow

- Not a bargain, but a solid investment for long-term strategists

- If you think long-term (3+ years, you will find a company with a clear strategy & growth path here

🔮 Conclusion & outlook

WM remains a fundamental long-term runner with vision.

Although the Stericycle financing is putting pressure on EPS and cash flow in the short term, the focus on high-margin areas, sustainability and healthcare opens up long-term potential.

- Positive: Strong legacy business, successful entry into healthcare disposal

- NeutralEPS slightly down, cash flow temporarily under pressure

- RisksInterest costs, margin pressure in recycling, political uncertainty regarding sustainability

My conclusion: WM delivers structurally, those who think long-term will find stability and perspective here.

I remain invested, position will not be increased for the time being.

________________

Thank you for reading 🤝

________________

Sources:

[1] https://investors.wm.com/static-files/00de6f79-f0b6-4b6a-af79-9e5f892c73f5

[2] https://investors.wm.com/static-files/9db3d0d5-0c4d-47fa-aab1-f0bf71a86859

_______________

$WM (+0,17 %)

$RSG (+0,36 %)

$WCN (+0,05 %)

$CLH (-0,08 %)

$CWST (-0,07 %)