@All-in-or-nothing what I have found here and hope I may expand your contribution a little ✌️

$KULR (+2,82 %) develops thermal management and safety solutions for batteries.

NASA, the US military and major electric vehicle companies are already using their technology.

As electric vehicles become more widespread, battery safety will become even more important and $KULR (+2,82 %) is in a position to take a leading role in this area.

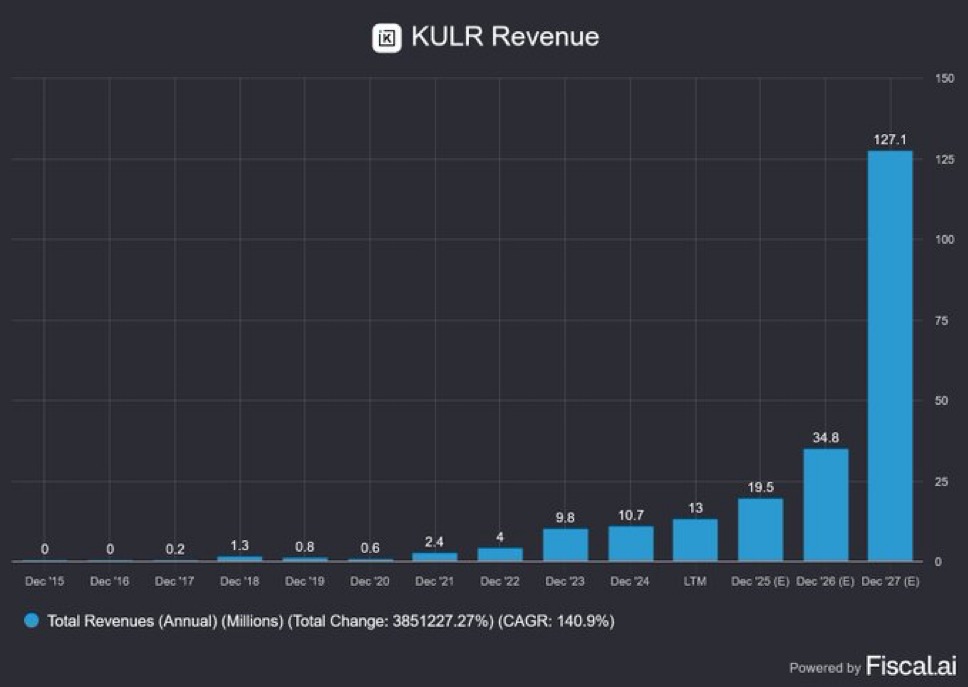

Expected sales growth until 2027:

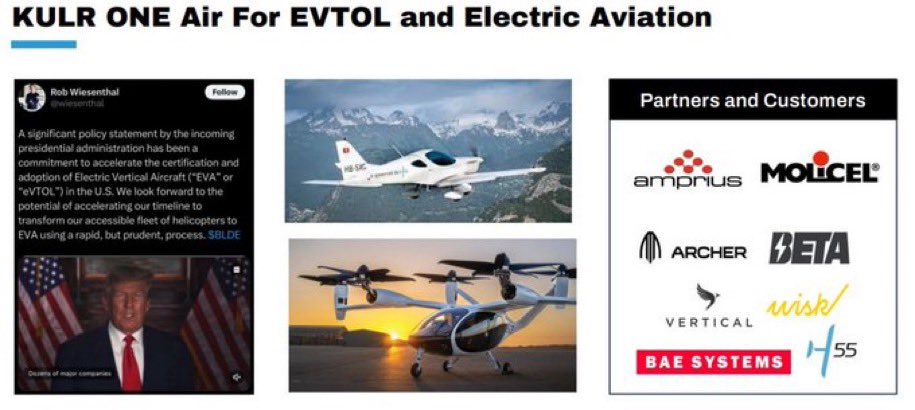

List of customers and partners:

( NASA, SpaceX and $LMT (-0,76 %) )

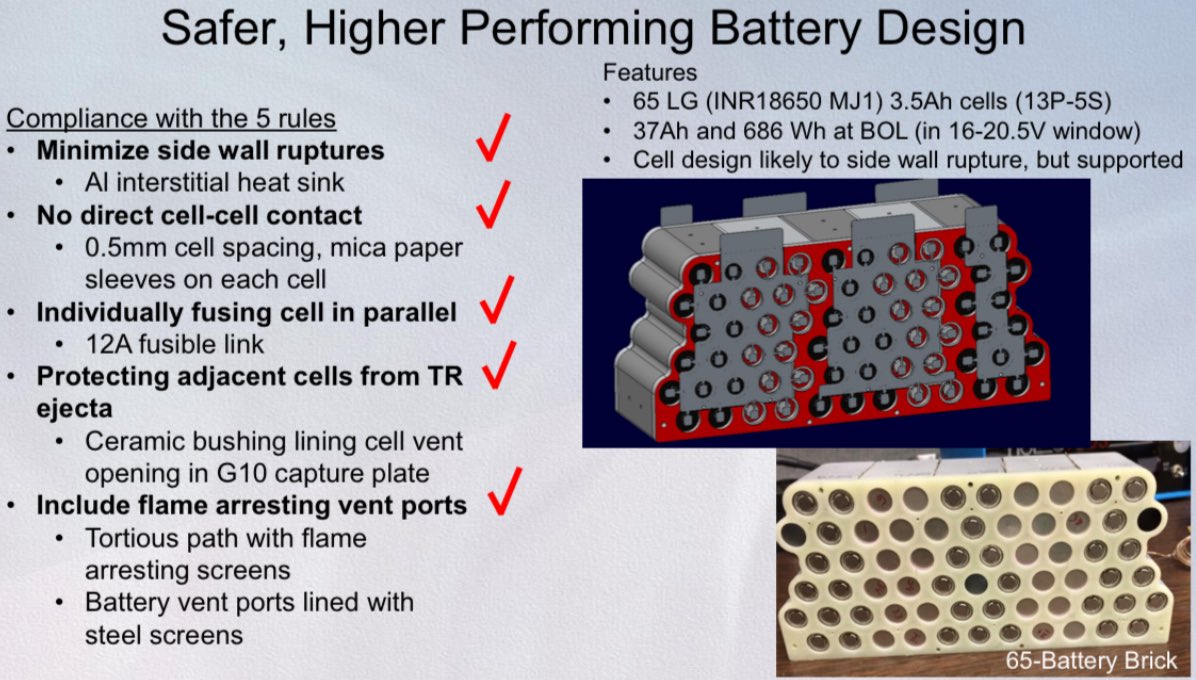

The K1-S battery:

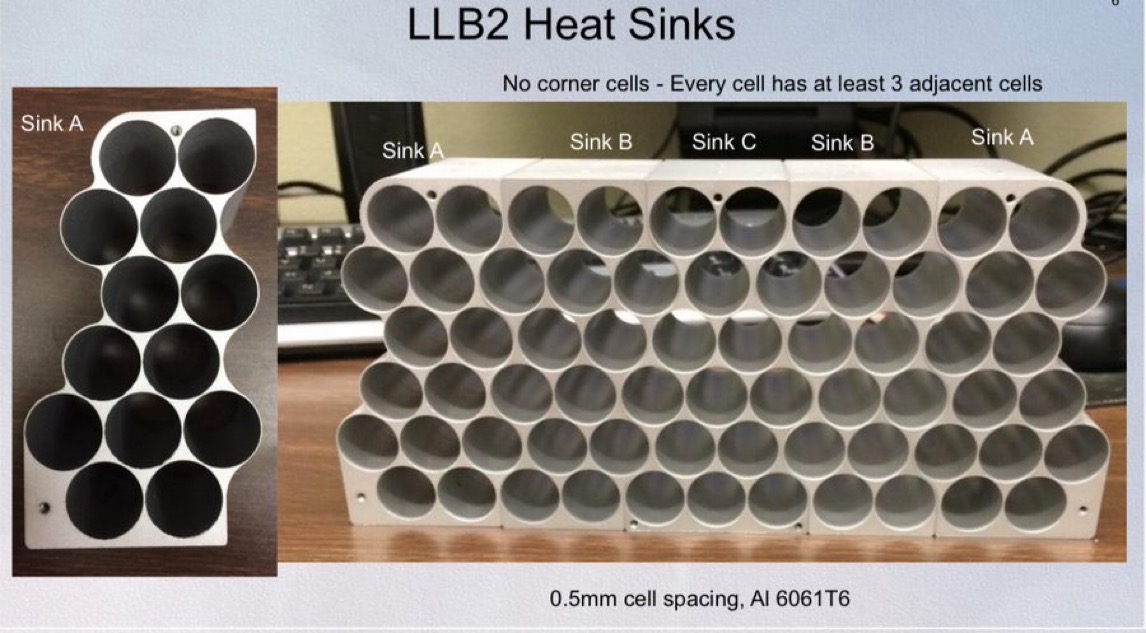

Aluminum intercoolers and flame arrestors prevent thermal runaway and keep the cells cool and safe. Together with the state-of-the-art battery management system, it is the ultimate power play.

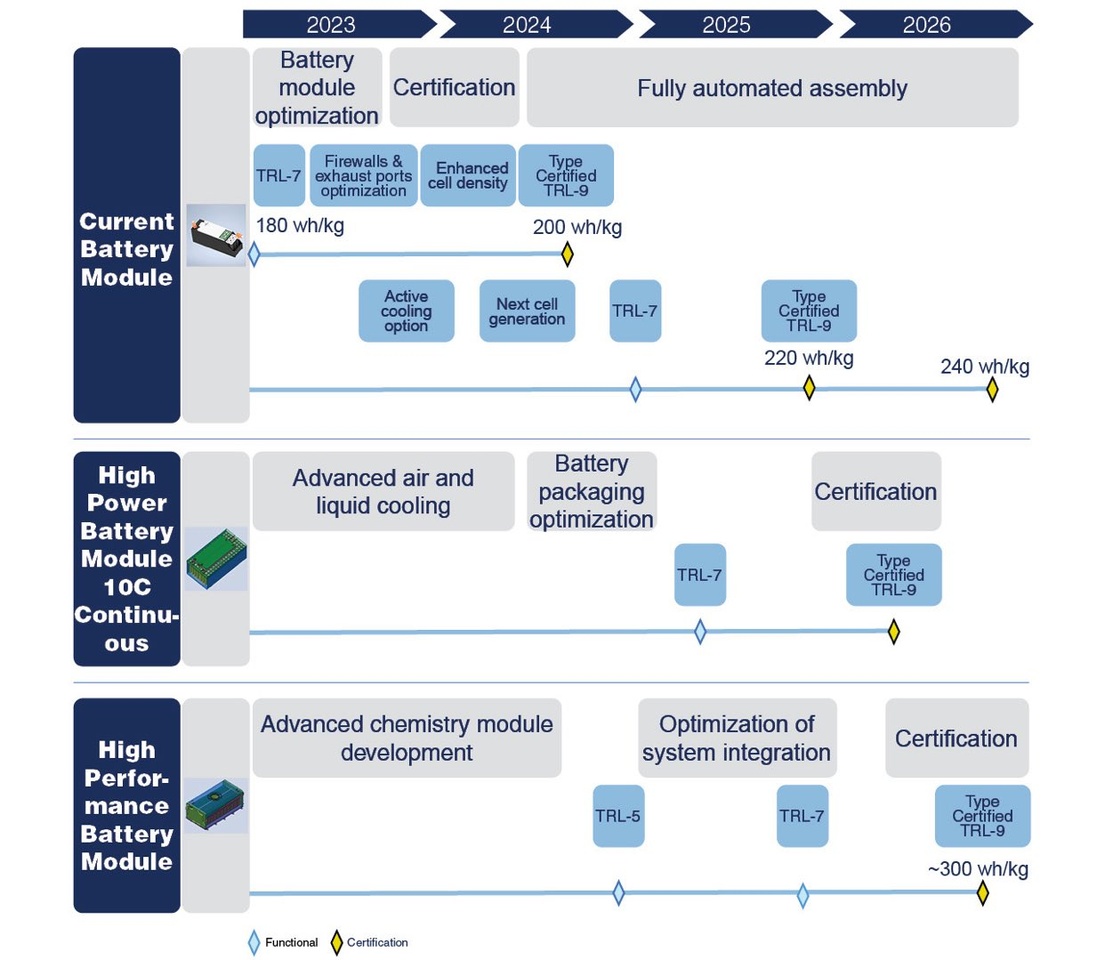

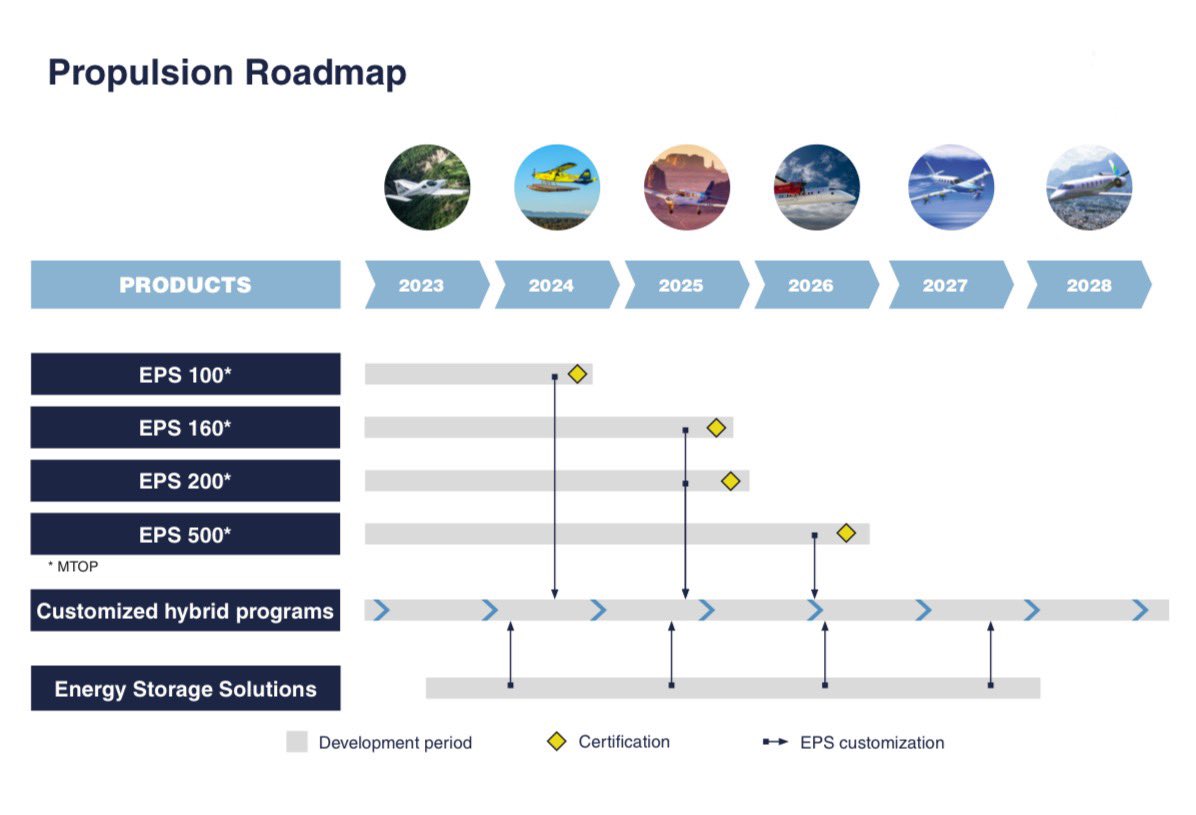

Roadmap- Pioneering electric drive and energy storage with cutting-edge thermal solutions that improve battery performance and safety.

Seems like an interesting company with a lot of growth potential, now you've made me curious @All-in-or-nothing 😂.

@Multibagger

@Tenbagger2024 We need to take a closer look, but I think the customer base is really exciting and can be expanded. Q2 might not have been good though. I'll have to see what else I can find, I'll add it to my watchlist. 🤔