Although it may be old news for Bitcoin OGs, this article by Jesse Myers offers valuable insights into Bitcoin's ($BTC) full potential valuation. It's definitely worth reading, particularly for newcomers to Bitcoin.

The core thesis is basically:

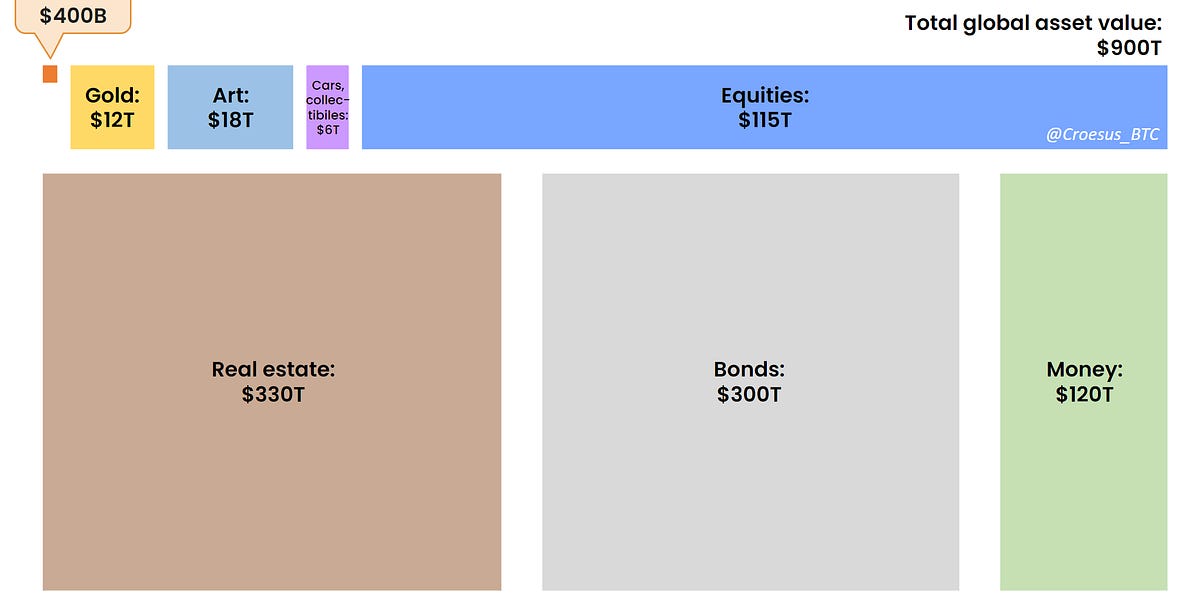

- Bitcoin isn’t competing with currencies or payment systems — it’s competing with value itself.

- It’s taking aim at gold, real estate, bonds, and fiat reserves — the traditional assets people use to store wealth.

- Bitcoin’s true market is the global store-of-value market.

The article is also the original source that Michael Saylor ($MSTR (-3,86 %) ) used for his calculations and projections.

Article: https://www.onceinaspecies.com/p/bitcoins-full-potential-valuation