- $FUSD (+2,57 %) In principle, an S&P 500 consisting of around 110 stocks that "should" fulfill a few quality and dividend filters 🧐 TER 0.25%. An index ETF would most likely be the better choice here.

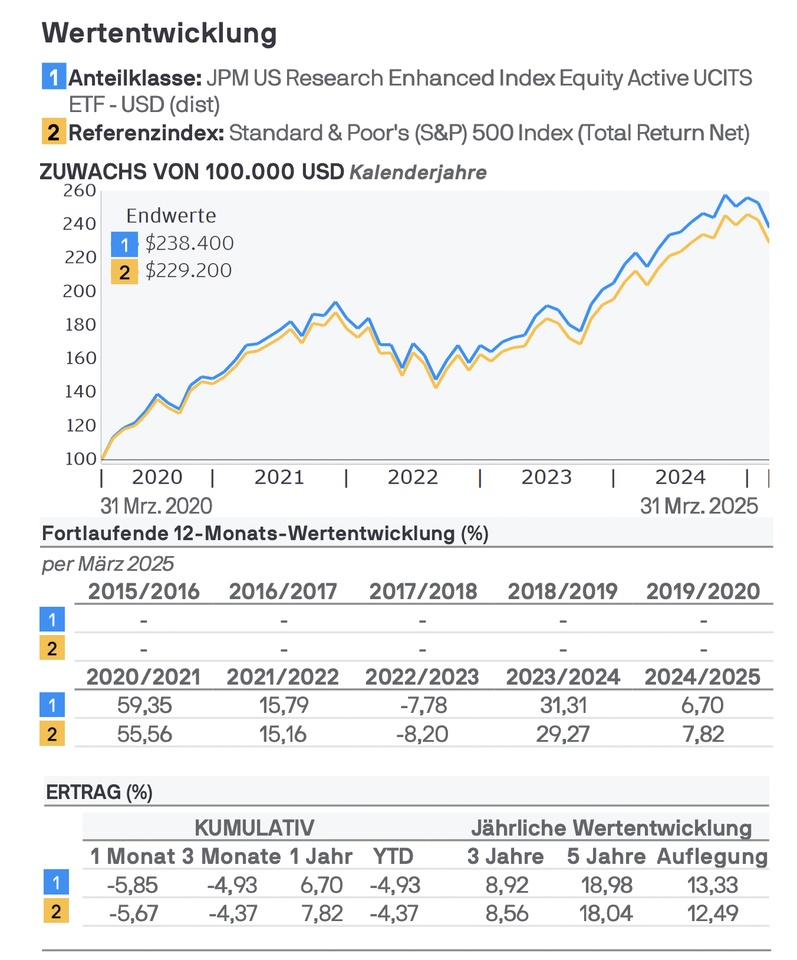

- $JRUD (+2,66 %) This is an actively managed ETF on the S&P 500 with currently around 250 positions and a TER of 0.2%. This fund has actually outperformed the benchmark index over longer periods of time. However, I see the risk here in the management (currently Raffaele Zingone and Piera Elisa Grassi) in the event of a change or a wrong decision. It is not for nothing that the specialist literature advises against actively managed funds🫣.

Both have the same reference index and therefore overlap. So what to do? Sell the Fidelity (possibly wait a few more weeks/months, as the tide is lifting all ships again) and keep JP Morgan or replace it with an S&P 500 Index ETF? In principle, the excess return is not phenomenal and the risk is relatively high.

For the sake of completeness, I would like to briefly mention the two other ETFs in my portfolio:

$TDIV (+1,77 %) The ETF "The European Dividend" focuses on high-quality dividend payers from industrialized countries with a focus on Europe. In my opinion, this has proved its worth in recent times as it has had less correlation with the overall market due to its defensive approach.

$GGRP (+2,79 %) This ETF is based on high-quality dividend-paying companies from industrialized countries around the world and also takes the momentum factor into account.

Fun fact: the combination of TDIV, GGRP and FUSD ensures monthly distributions😎 - but that shouldn't be a criterion 😆🫣