Hello my dears,

in keeping with the very great and extensive contribution from @EpsEra .

I'd like to give you another brief introduction.

This is about the Japanese supplier THK. Where a growing part of the business consists of industrial robots.

Robots take over the fast and exact positioning of workpieces in the most diverse branches of industry. Some robots are not limited to orthogonal movements, but are equipped with multi-axis joint mechanisms that are modeled on the human arm. The rigidity and positioning accuracy of these joints must be such that the programmed travel path is maintained even with strong positive and negative accelerations. THK's unique products are powerful and compact enough to meet such requirements.

THK manufactures linear guides, shaft guides, crossed roller bearings, ball screws and ball joints.

THK is a blade supplier for the following robots with various components.

Industrial robots

- Robots with 5-joint polygonal arm

- Arc welding robots

- Scalar robots

- Double-arm robots

Medical and technical aids

- Robotics in surgery

THK is a Japanese company specializing in the development and manufacture of components for linear motion, in particular linear guides. It was founded in 1971 and has become a global leader in this field. THK is known for its innovative products, which are used in various industries such as mechanical engineering, robotics and automation.

THK products are used in many fields, including machine tools, industrial robots, semiconductor manufacturing, LCD production, medical devices, railroad technology and even earthquake protection.

Locations:

THK has production facilities worldwide in Japan, Europe, North and South America and Asia.

THK stands for:

Toughness (stability), high quality and THK know-how.

My dears,

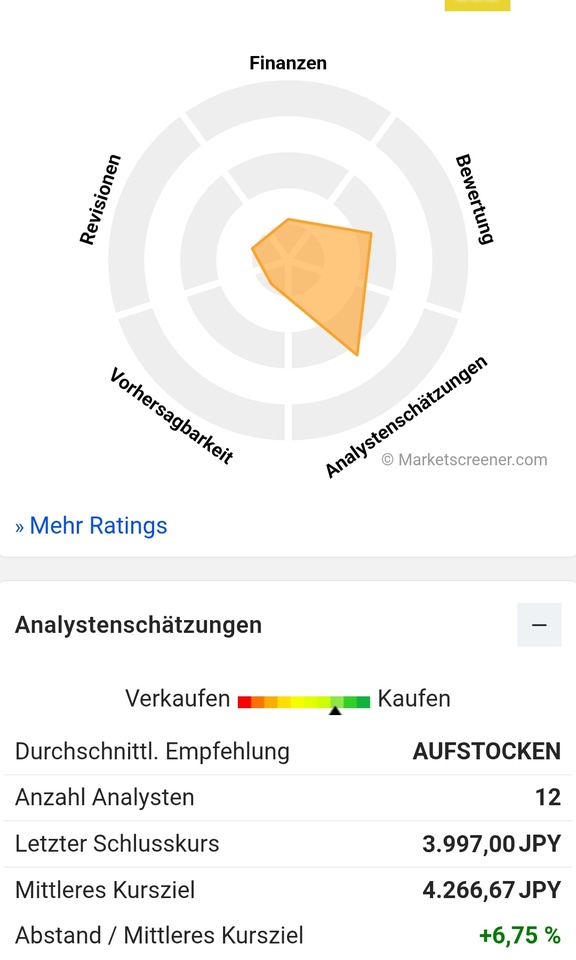

I am thrilled that THK is a growth stock in a future-oriented sector that shines with a dividend yield of 6%.

Here our dividend investors can also find a growth stock. My dear @Max095 maybe interesting for you.

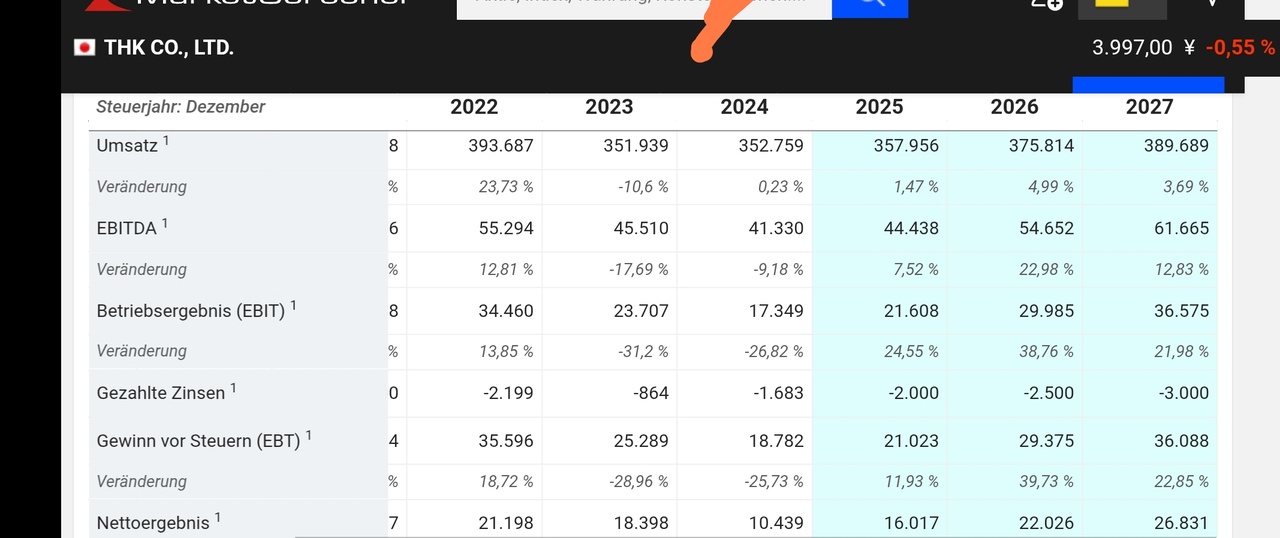

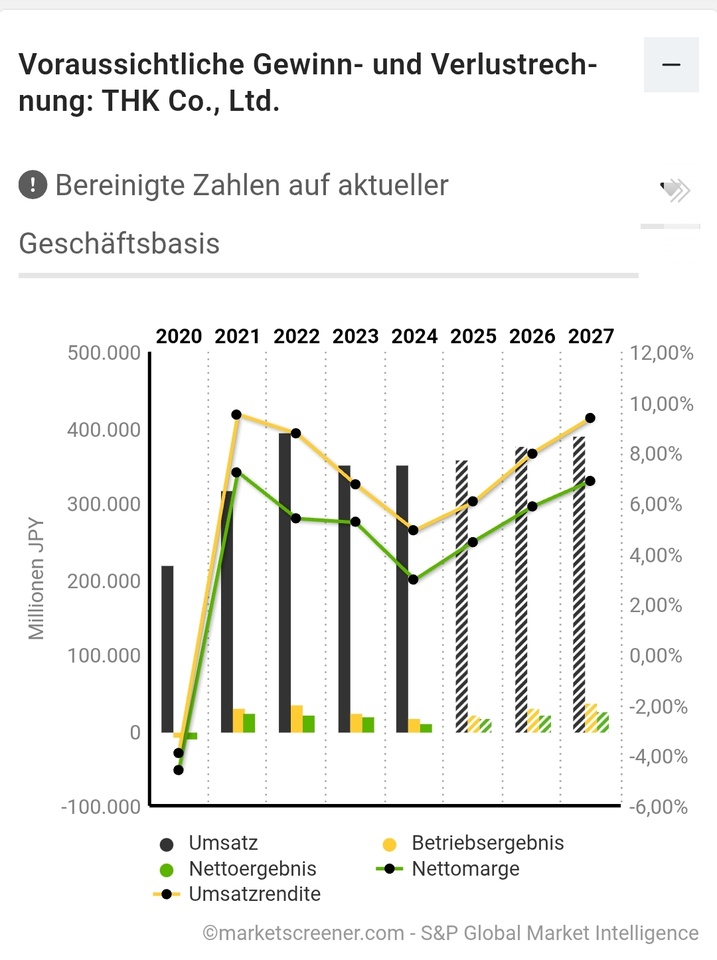

Earnings growth 2026: + 71 %

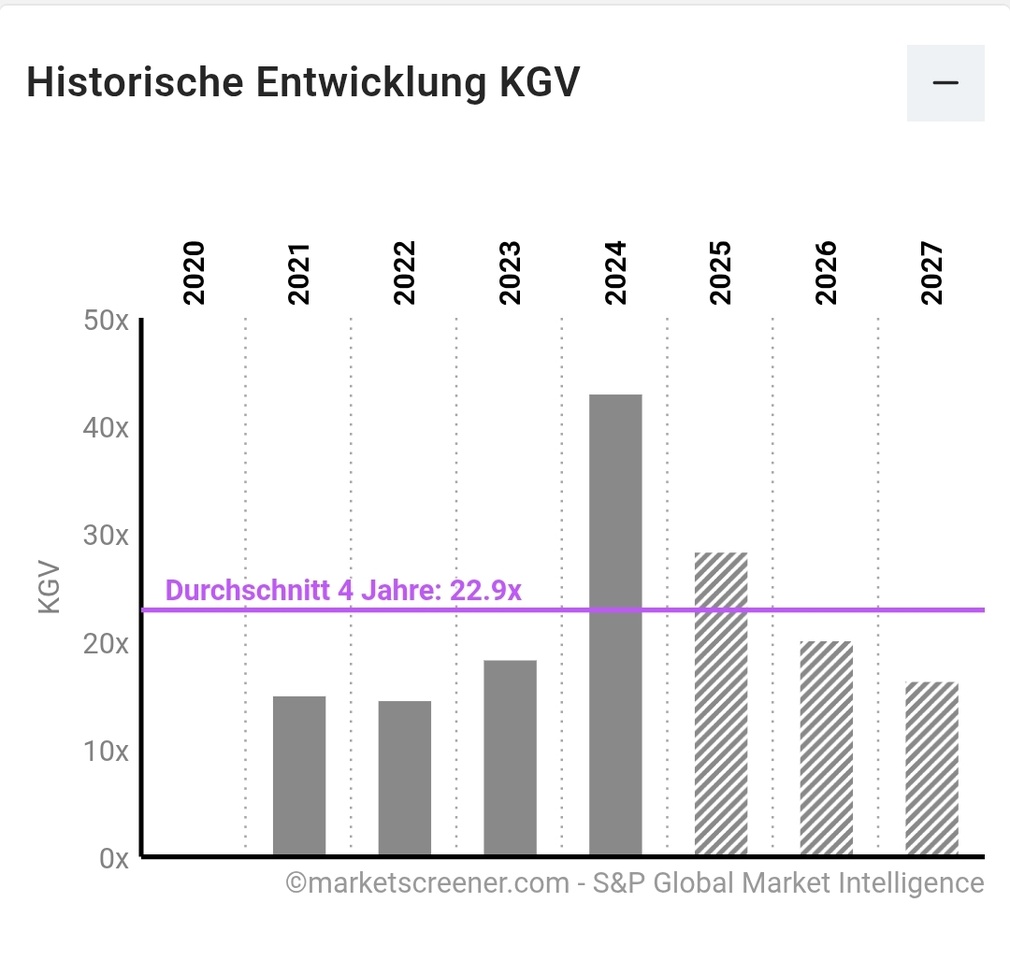

This reduces the P/E ratio to 18.46

I like the PEG of 0.49

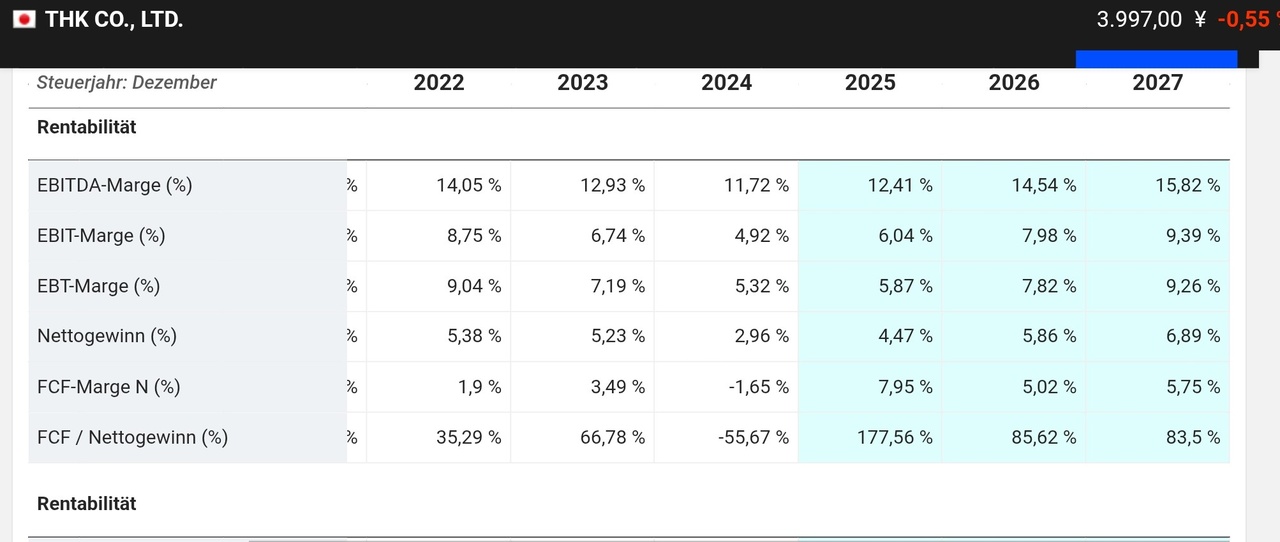

The EbiT margin rises from 5.87% to 7.82% and to 9.26% in 2027.

I look forward to your opinion on THK, write comments diligently.

Enclosed are the multiples: