A lot of time has passed since my introduction over a month ago and the one or other post. I was not satisfied with my smorgasbord and have once again taken a serious and intensive look at the subject of the stock market.

Thoughts, suggestions from some nice people here on GQ and also posts https://getqu.in/WB1phr/ have really helped me here.

Thank you for that. @DonkeyInvestor , @Mister_ultra , @Epi , @Ph1l1pp , @ShrimpTheGimp , @MoneyISnotREAL , @Staatsmann

After the introductory words, now to the presentation of my portfolio.

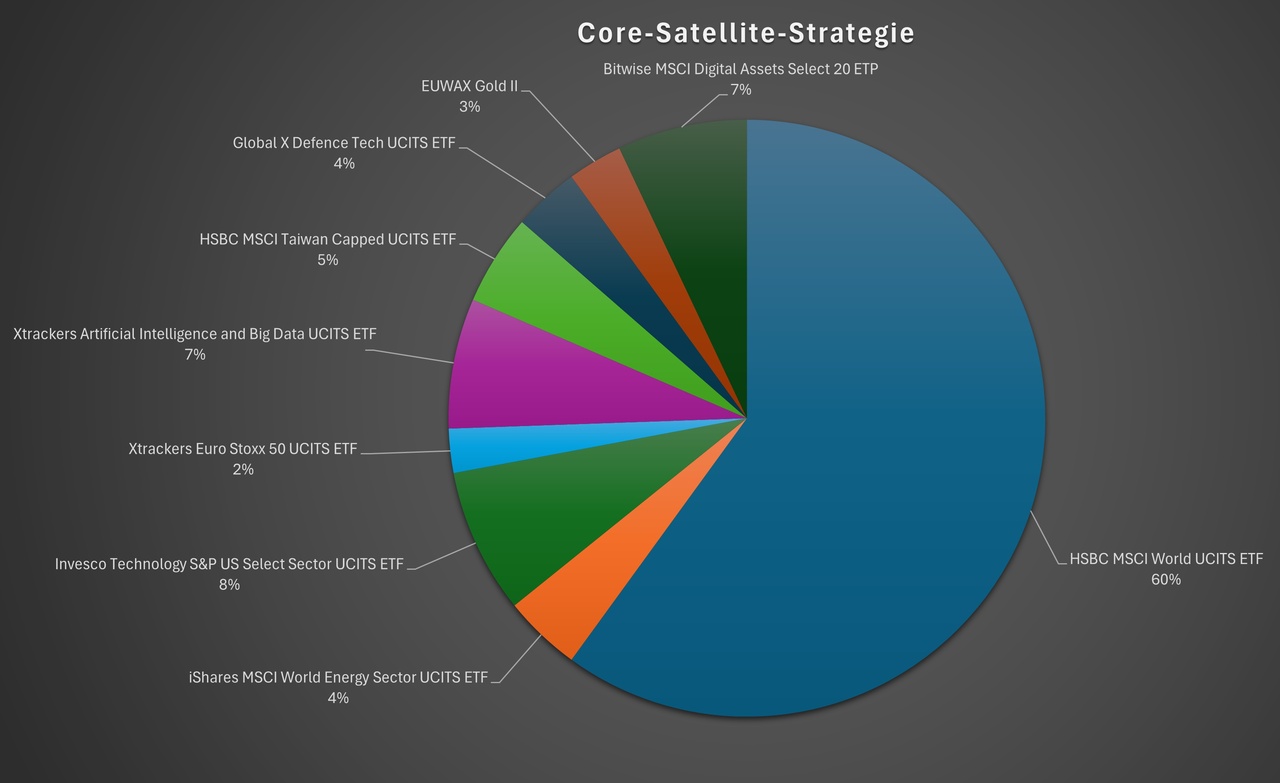

I have finally decided on a strategy that I find suitable for me. The core-satellite strategy. Investment period 20 years.

I will gradually reallocate my previous investments and save an additional 600 euros per month in the portfolio.

For me, the decisive point here was that I continuously build up the "core" and use the satellites to pursue my "ideas" and also generate dividend income.

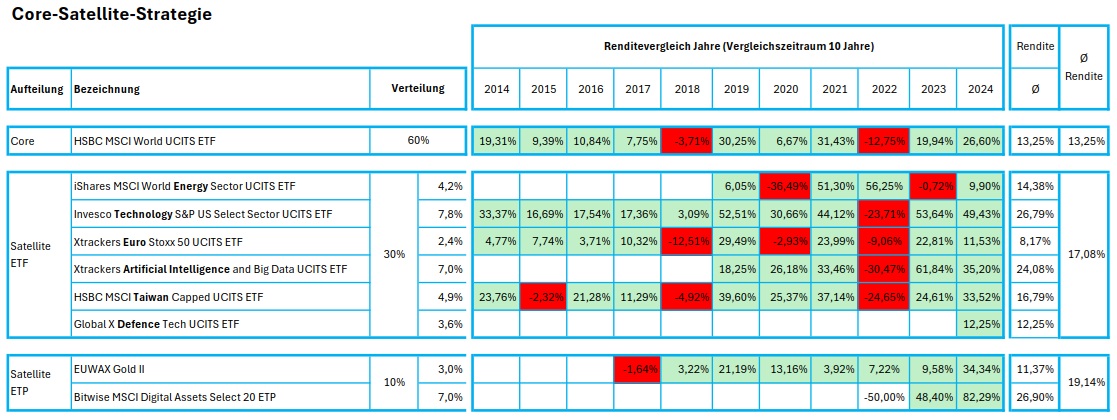

The percentage allocation of the investments to my individual satellites was based on the average return over the last 10 years.

Core (60%)

-----------------------------------------------------------------------

HSBC MSCI World UCITS ETF - $HMWS (-0,19 %) - Share 60.0%

Satellites (40%)

-----------------------------------------------------------------------

HSBC MSCI Taiwan Capped UCITS ETF - $HTWN (+1,74 %) - Share 4.9%

Xtrackers Euro Stoxx 50 UCITS ETF - $XESX (-0,44 %) - Share 2.4%

Invesco Technology S&P US Select Sector UCITS ETF - $XLKS (+1,61 %) - Share 7.8%

Xtrackers Artificial Intelligence and Big Data UCITS ETF - $XAIX (+0,8 %) - 7,0%

iShares MSCI World Energy Sector ETF - $WENS (-0,33 %) - Share 4.2%

Global X Defense Tech UCITS ETF - $ARMG (+0,05 %) - Share 3.6%

EUWAX Gold II - $EWG2 (+0 %) - Share 3.0%

Bitwise MSCI Digital Assets Select 20 ETP - $DA20 (-0,51 %) - Share 7.0%

Notes on the satellites:

An MSCI Emerging Markets would be a suitable addition to the core MSCI World. As most emerging markets ETFs rate China quite highly, but I am not convinced of this, I have picked Taiwan and chosen the MSCI index there. $HTWN (+1,74 %)

Technology $XLKS (+1,61 %) and AI $XAIX (+0,8 %) are still markets which, in my opinion, have a lot of potential. These two areas are also the reason why I invest in energy $WENS (-0,33 %) because the energy demand for AI, cloud, etc. is high.

I still see defense as a trend and have finally opted for the Global X Defense Tech $ARMG (+0,05 %) final decision. In my previous post on this, I was more interested in the HANetf Future of Defense $ASWC (-0,58 %) . As the European investment volume of the two ETFs (HanETF = 29.38%, Global X = 28.08%) is almost the same, but the Global X $ARMG (+0,05 %) invests more in the market leaders (Lockheed $LMT (+0,07 %) Northrop $NOC (+0,41 %)General Dynamics $GD (+0,12 %) etc.), it has now been included in the final selection.

I cover the currency sector with EUWAX Gold II $EWG2 (+0 %) and Bitwise MSCI Digital Assets Select 20 $DA20 (-0,51 %) . As you have seen from my previous posts, I am reluctant to invest in crypto. That's why it's "only" the Bitwise MSCI Digital Assets Select 20 ETP. This ETP tracks the 20 leading investable crypto assets and is therefore effectively the "MSCI World" for the crypto market.

PS: I have adjusted the crypto ETP slightly downwards in the percentage distribution with a minus of 50%.

downwards. If anyone actually looks at the table, -50% in 2022 is inserted by MIR for regulatory purposes 😉

I look forward to your feedback.

Best regards

Daniel