I loved seeing all the recaps being shared on this platform, so I decided to share mine as well this year.

Last year I crossed the 100k mark with a return of 30%. My goal for this year was to get close to that return. My average return is around 15% per year so it would have been a great year. This year I started with a portfolio of 114.000. It took me 7 years to get to the 100k mark, so I was expecting it to take several years to get to 200k.

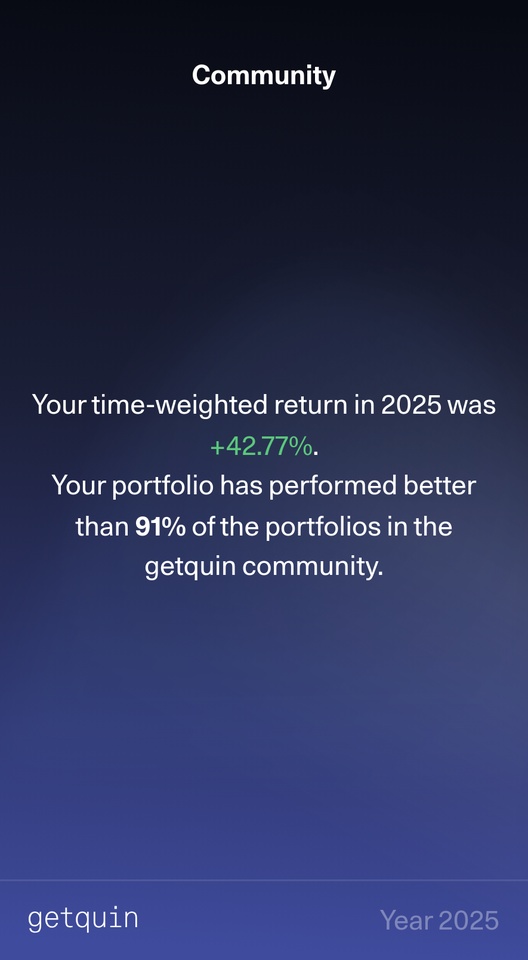

My goal was absolutely crushed with a 42% return! This is mainly because of the base of my portfolio consisting of Gold, Silver and Platinum. They all had a great year. With a huge month in December. The portfolio almost touched 200k already. This is way sooner than expected.

My etfs $V3AL (+0,93 %) and $TDIV (-0,05 %) also performed well.

Ive been held back a bit by my REITs. Some have performed well like $WPC (+0,79 %) but most had a mediocre year. With the absolute worst being $ARE (+5,78 %) .

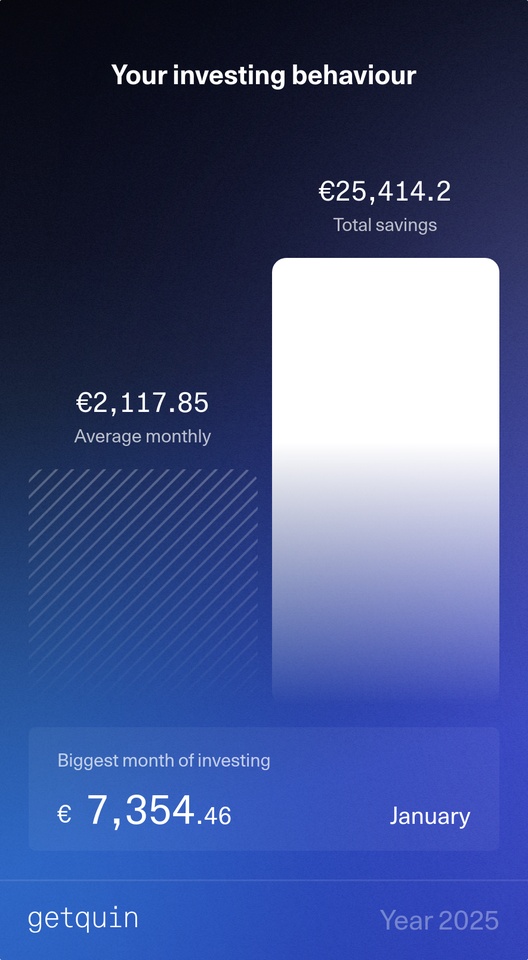

I was also able to investment more than last year, with an average of over 2100 per month. This took a lot of effort as my savings rate is now well into the 60%. I live frugally (no car, no eating out, no new laptops or phones, shared rental home). I work 40 hours as a software developer.

My goal for next year is of course to get close again to this year's return. I hope to touch the 200k mark soon. I expect the metals to perform well again so I haven't sold any yet. If silver continues to rise sharply I might take some profit to put into a deposit for a mortgage.

If you have any questions about my portfolio or long term goals, I'm open to share more!

Thanks for reading and have a prosperous 2026. Happy holidays!