At its core, a smart contract is nothing more than a piece of code that exists on a blockchain and is automatically executed as soon as predefined conditions are met - without intermediaries, without delays and without discretion. They form the building blocks of decentralized applications and enable everything from lending and borrowing to trading and beyond - in a permissionless and transparent way.

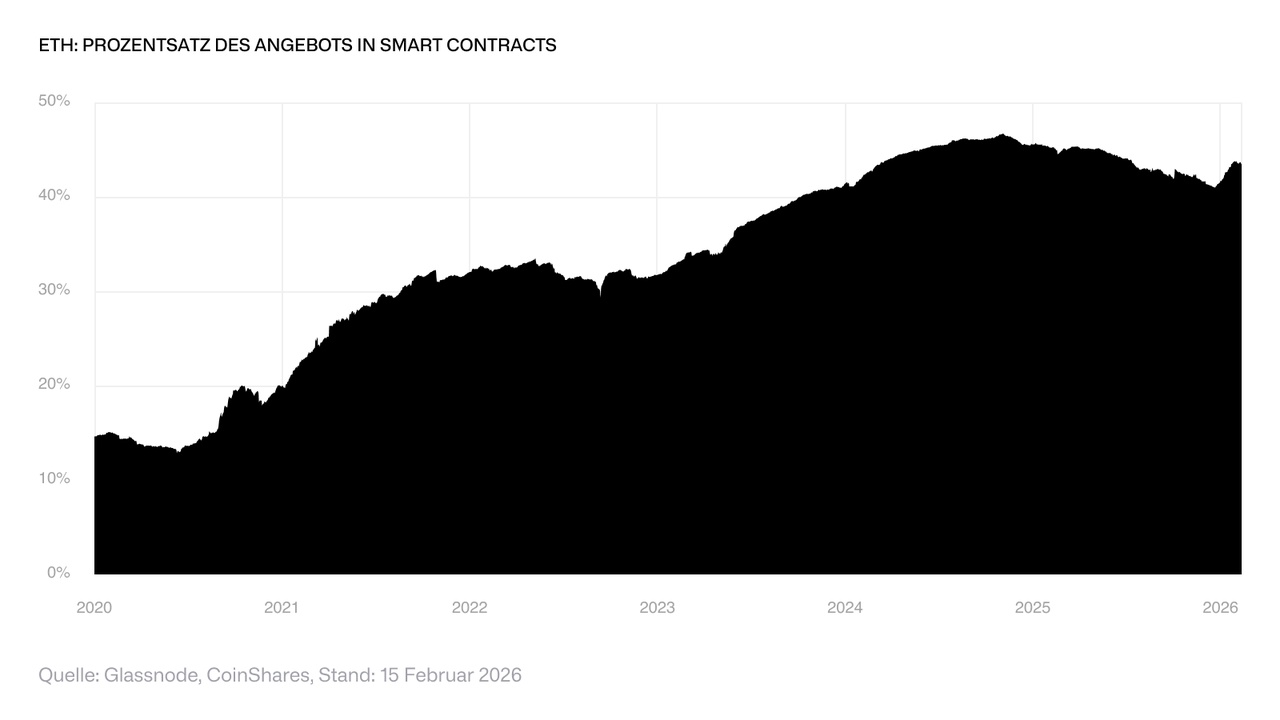

And they are growing. In the fourth quarter of 2025 $ETH (-0,1 %) set a record with 8.7 million newly implemented smart contracts - the highest quarterly figure in the history of the network. Today, around 43 percent of the total ETH supply is in smart contracts, a share that has risen steadily over the years. Staking accounts for a significant proportion of this, but DeFi activities are also a major contributor. DeFi (Decentralized Finance) refers to an ecosystem of blockchain-based financial applications that enables traditional financial services such as loans, trading or interest rate products without banks or central intermediaries. Ethereum currently holds 58 percent of the total capital locked in $DEFI (+0,48 %) locked capital (total value locked), which corresponds to around 55 billion US dollars.

Despite this growth, the use of smart contracts is still at a comparatively early stage. Much of what these platforms are intended to enable - from large-volume financial settlements to tokenized real-world assets - is still under construction. If the infrastructure continues to mature, future growth momentum could be significantly steeper than it has been to date.

$CSSC (+0,37 %)

$CETH (+0,72 %)