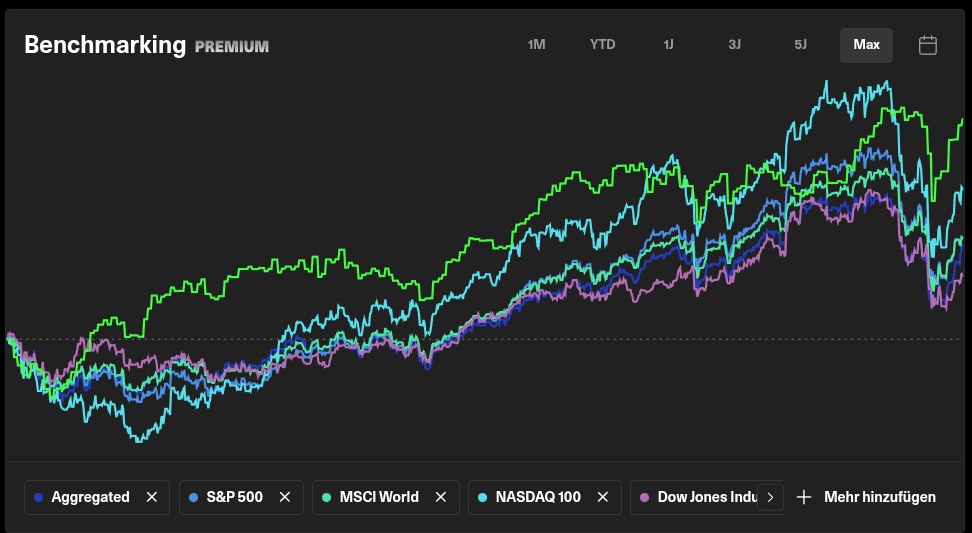

The premium function enabled me to benchmark my portfolio. Apparently I am only at the level of the S&P 500, everything else has outperformed me. Special attention should be paid to the Stoxx Europe 50 $EUE (-0,46 %) (green in the chart), which performed best and completely outperformed me.

What do I learn from this? I'm not as good as I thought and in the all-time period (beginning 14.08.22 to 10.05.25) I'm just keeping up with the S&P 500 $CSPX (+0,46 %) with.

---

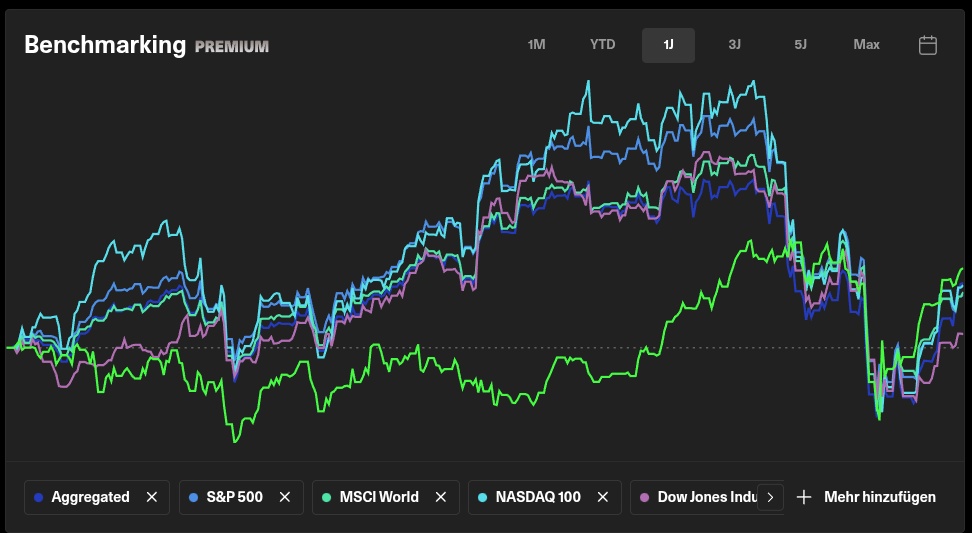

In the 1Y view I was also outperformed several times, but towards the end I was just able to keep up with the Stoxx Europe 50.

---

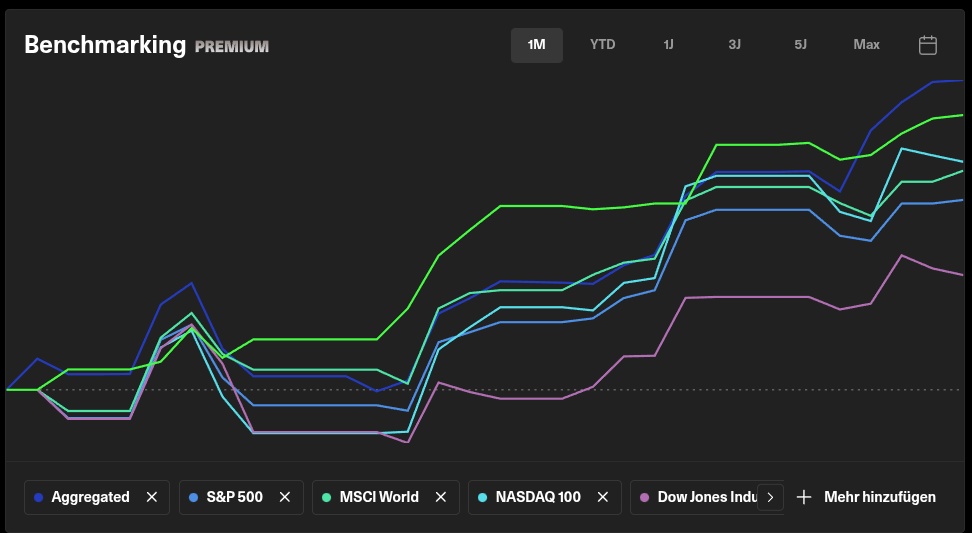

In the short term (1M), however, I outperformed them all.

---

In summary, I am happy that I am on a par with the S&P 500 in the long term. A goal that many investors do not manage to surpass. Nevertheless, I could have invested directly in the S&P 500 from the start.

If relevant: My TTWROR is 23%. While I have only made 22% in just under 3 years, the DAX has made 85% in the same time. Apparently the USA is the yield brake and not Europe, as I thought 3 years ago.

I will now pay more attention to Germany and Europe and try to reduce my 75% US share to 50%.