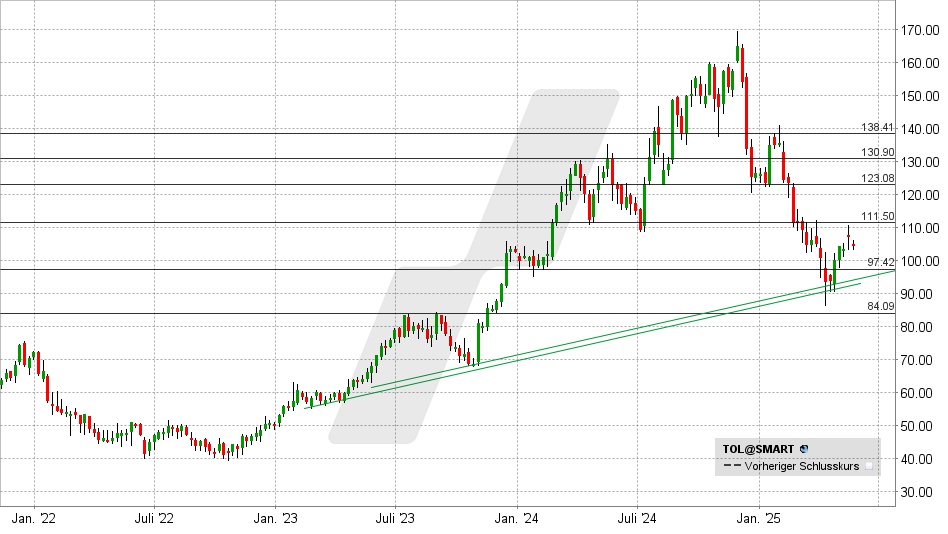

Toll Brothers share: Chart from 21.05.2025, price: USD 104.51 - symbol: TOL | source: TWS

If a breakout above USD 111 now succeeds, a procyclical upward trend Kaufsignalwith possible Kursziel at USD 123 and USD 131.

If, on the other hand, Toll Brothers falls back below USD 105, the bulls will have missed their chance. In this scenario, a renewed setback towards USD 97.50 or the Aufwärtstrend must be expected.

Analysts too pessimistic again

One thing should be clear in any case: Forecasters have been systematically off the mark for Toll Brothers and the other US homebuilders for years.

Declining earnings and problems in the sector have been expected every single year since 2021. In reality, earnings have gone through the roof, with Toll Brothers increasing earnings from USD 6.63 to USD 15.01 per share in that time.

The most recent quarter is exemplary, the figures were presented on May 20. nachbörslichpresented.

At USD 3.50 per share, earnings were well above expectations of USD 2.86. With turnover of USD 2.74 billion, the company also significantly exceeded analysts' estimates of USD 2.50 billion.

As usual, the forecasters were too pessimistic.

However, I don't want to sugarcoat the situation unnecessarily: sales and profits were down for the year, but to a much lesser extent than expected.

The order backlog fell by 7% over the year to USD 6.84 billion, but this means that capacity utilization is still good and the company is well able to bridge a temporary lull.

Not so dramatic

Moreover, in my view, this lull has already been priced in by the fall in the share price from USD 170 to USD 105. The blended P/E has fallen from 11.1 to 7.3 as a result.

Toll Brothers has confirmed its forecast for the current financial year, which ends in October.

The company continues to assume that 11,200 - 11,600 residential units with an average price of USD 965,000 - 985,000 will be completed and handed over.

The gross margin is expected to be 27.25 % and the tax rate 25.5 %.

All in all, Toll Brothers should therefore achieve sales of USD 10.89 billion and a profit of USD 1.44 billion.

This roughly corresponds to earnings of USD 14.40 per share, which is significantly more than the current consensus estimate of USD 13.70 per share.

Toll Brothers therefore has a forward P/E of 7.3 and an operating margin of around 17.8%.

There can be no question of a crisis and Toll Brothers is therefore doing the only sensible thing - taking advantage of the low valuation to buy back shares.

In the past 12 months, the number of outstanding shares has been reduced from 105.8 to 100.6 million