TLDR: while the numbers are not as impressive as Philip Morris, the company has exceeded general expectations, with a beat in revenue and EPS. In addition, the targets were largely met, even if VUSE in particular was rather disappointing. I remain confident and assume that a change of direction at GLO into the premium segment, as well as new Velo and VUSE products, will accelerate growth again. It is also important to note that the operating business was primarily weakened by the sale of the Russian subsidiary.

The weak euro is also weighing on the European business, which is performing very well.

My conclusion:

The figures look very disappointing at first glance, but in my opinion the management is making the right decisions and can also successfully turn them into sales (combustibles in the USA) and there are new products in the pipeline that should continue to drive RRP's growth, just like an environment that is expected to improve. RRP has grown very strongly for years now, even if it is disappointing, a small plateau is more than normal.

I welcome the share buybacks and the increased dividend and with the reduction in debt, this should increase in the future.

First a few words from Tadeu Marocco CEO of $BATS (+0,42 %)

- 2024 was an investment yearin which the company's performance was in line with forecasts. During this period, the number of adult consumers of smoke-free products grew by 3.6 million to 29.1 millionwhich now accounts for 17.5 % of total sales (+1 percentage point compared to 2023).

- In the second half of the year there was an acceleration in performance, driven by innovation in new product categories, investment in the US market and destocking in wholesale.

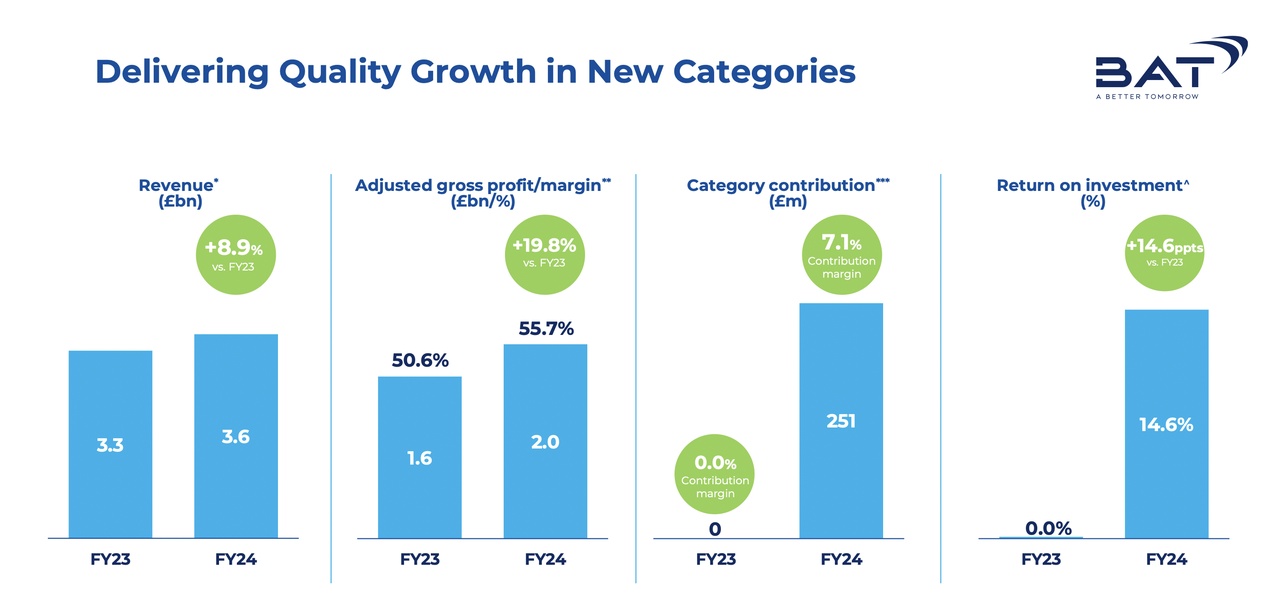

- The company is focusing on qualitative growthwhich has led to improved returns and increasing profitability in all new categories - particularly in the "Modern Oral" (modern oral tobacco products).

- In the USA targeted investments have strengthened the business despite economic challenges and the growing black market for disposable vape products. New growth opportunities, particularly in the Modern Oralsegment, were developed.

- In the AME and APMEA regions regions, performance remained strong and in line with medium-term expectations.

- The company remains on track, but will continue to make investments. It plans strong returns on capital for shareholdersincluding an ongoing dividend and share buybacks.

- Regulatory and tax challenges are expected for 2025 in Bangladesh and Australia which could impact the traditional tobacco business. Nevertheless, the company is confident that it will complete the transition from investment to implementation and return to 2026 to return to sales growth of 3-5% and operating profit growth of 4-6% (at constant exchange rates). (at constant exchange rates) from 2026.

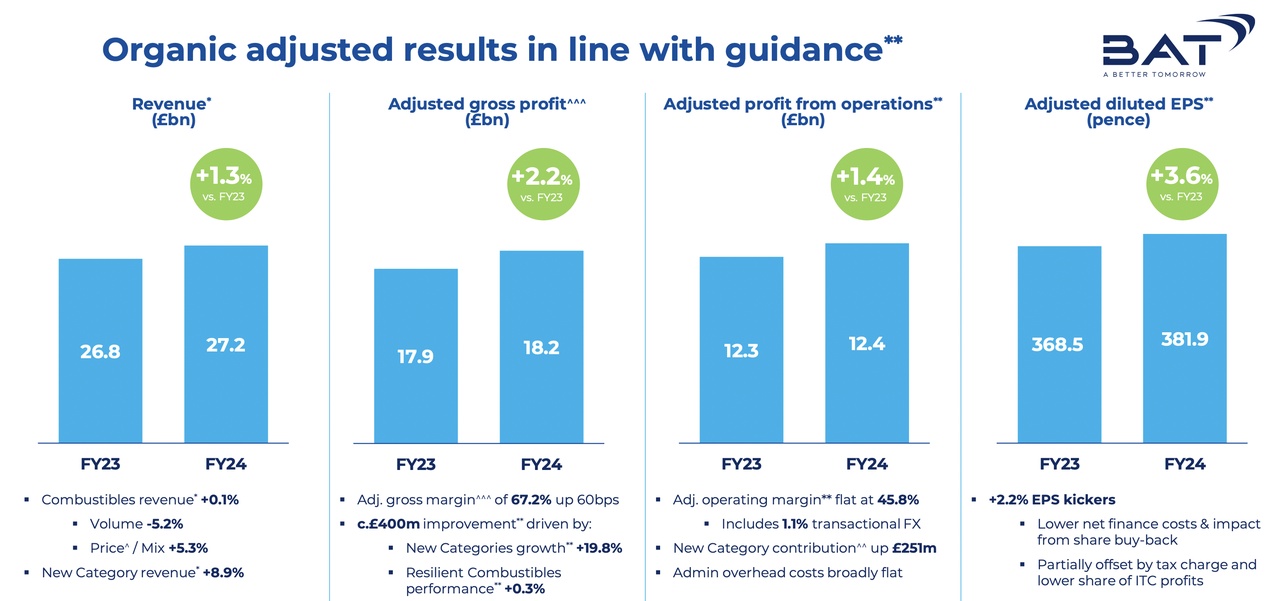

Sales in billion pounds

- Reported 25,867 -5,2%

- Adjusted 25,867 -0,5%

- AOCC 27,151 +1,3%

RRP sales in billion pounds

- Reported 3,432 +2,3%

- Adjusted 3,432 +6,1%

- AOCC 3,551 +8,9%

Combustibles

- Volume 518 billion sticks -9%

- Turnover 20.685 billion pounds -6.4%

VUSE

- Volume 616 mln units -5.9%

- Turnover 1.721 billion pounds -5.1%

Velo

- Volume 8.3 billion pouches +55%

- Turnover 790 man pounds +46.6%

Grizzly

- Volume 6.1 billion pouches -8.2%

- Turnover 1.09 billion pounds -6%

GLO

- volume 20.9 billion sticks -11.3%

- Turnover 921 man Pounds -7.6%

Profit in billion pounds

- Reported absolutely not usable, due to all impairments from 2023 & 2024

- Adjusted 11,890 -0,2%

- AOCC 12,439 +1,4%

- 251 Mln through RRP profitable for the first time in 2024

EPS

- Reported absolutely not usable, due to all impairments from 2023 & 2024

- Adjusted 362,5p +1,7%

- AOCC 381,9p +3,6%

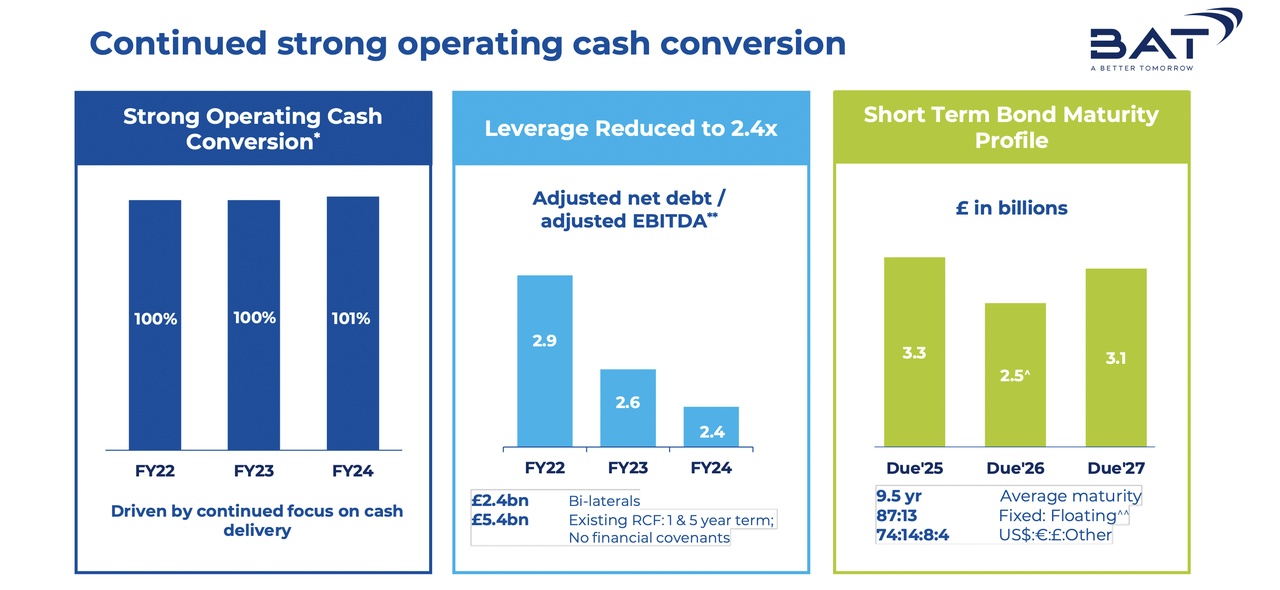

Free cash flow and debt reduction

- FCF (before dividend) 7.901 bn -5.5%

- Adjusted net debt / adjusted EBITDA = 2.44x -0.3x dams is now in the target range of 2.0x-2.5x

Dividend and share buybacks for 2025

- Dividend +2%

- 900 min for share buybacks

A few words from the CFO

- Financing the transformation: Optimal use of revenues from traditional tobacco business to generate cash flow.

- Targeted capital allocation: Investing in the most profitable segments with a focus on return on capital.

- Strengthen financial stability: Debt reduction to increase resilience.

- Balanced use of capital: Investing in transformation while ensuring an attractive dividend.

- Maintain sustainable share buyback program.

The company wants to use key performance indicators (KPIs) performance and expects a gradual gradual improvement by 2025 and a return to growth of 3-5 % turnover and 4-6% operating profit (on a constant currency basis) by 2026.

Five strategic pillars with 2024 highlights

Qualitative sales growth

- Goal: Maximize value of the traditional tobacco business & growth of new product categories.

- Sales decline by 5,2 % due to the sale of the Russian and Belarus businesses and currency effects.

- Price increases (+5.3 %) partially offset declining volumes (especially in the USA -10.1 %).

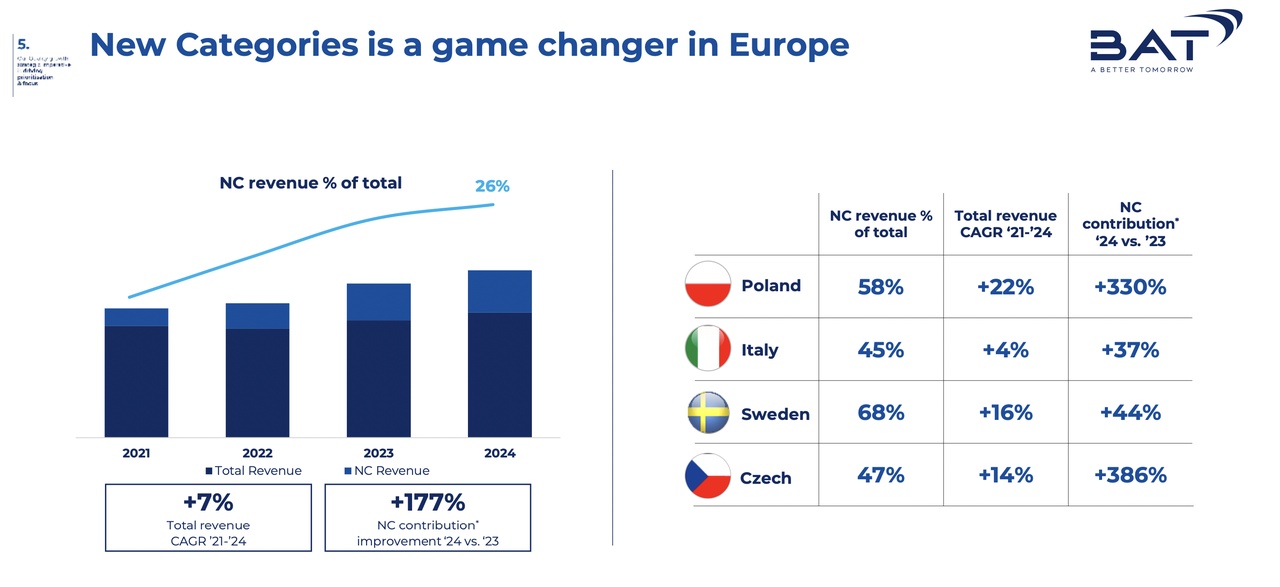

- New categories grew 8.9 % organic growth in all regions.

Increase in gross profit

- Adjusted gross profit grew by £396m (+2.2%).

- The traditional tobacco business remained stable (+0.3 %).

- New categories are the main driver with a +19.8 % gross profit growth.

Acceleration of new category contribution

- £251m additional profit contributionmargin in new categories to 7,1 % increased.

Sustainable profit growth

- Disciplined cost reductions: £402m savings in 2024 to offset increased costs (e.g. for tobacco leaf & production).

- By 2025 target £1.2bn cost savings to be realized, a further £2bn by 2030.

Cash flow generation of over £50 billion (2024-2030)

- 2024: £7.9 bn free cash flow (before dividends), with 101% cash conversion rate (above the 90% target).

- Expectation: £8bn free cash flow per year from 2025, despite potential legal costs (Canada).

- Return of £28bn to shareholders in the last 5 years through dividends & share buybacks.

- Debt reduction: Net debt to 2.44x EBITDA (2.75x incl. Canada reservations).

Combustibles

The company recorded different developments in the cigarette business:

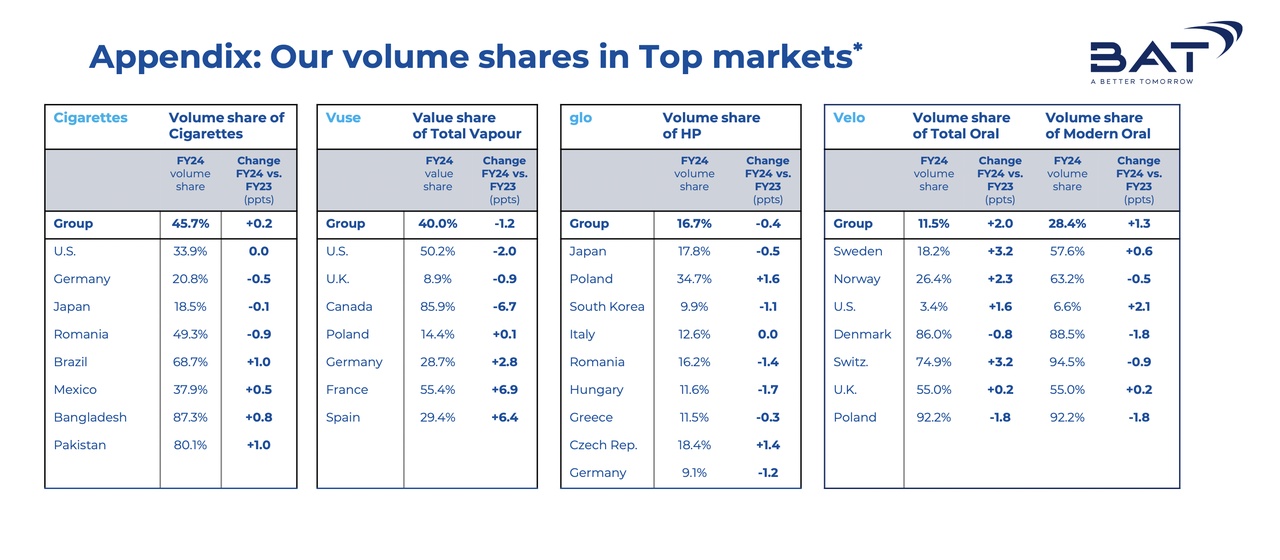

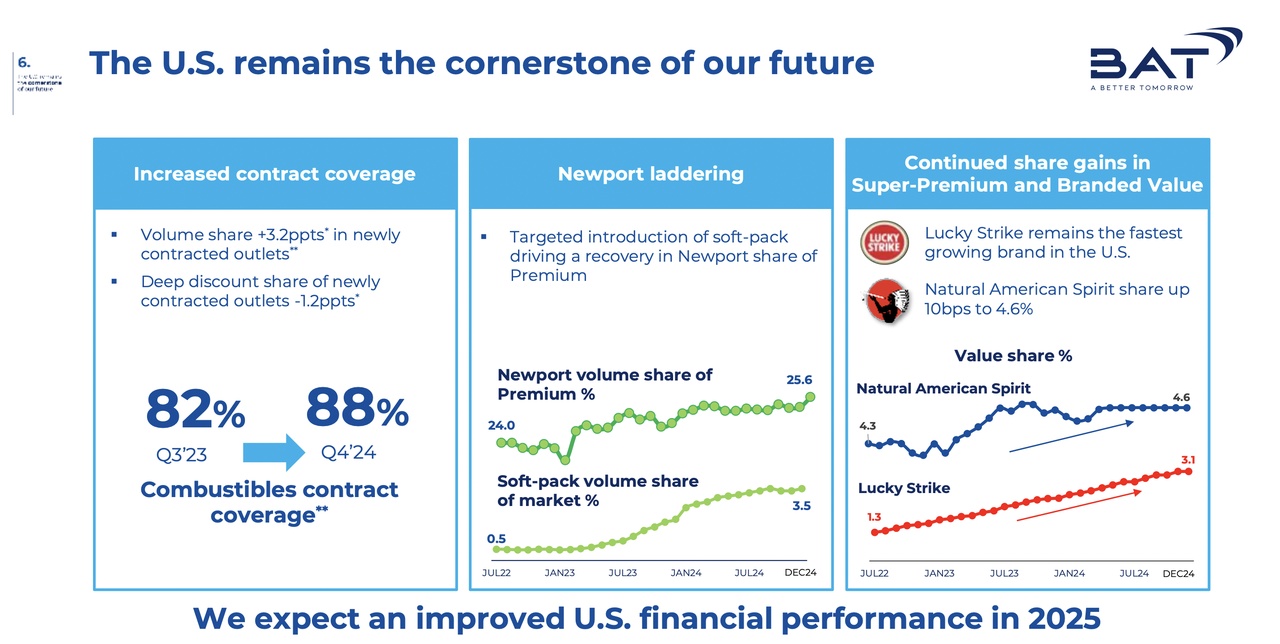

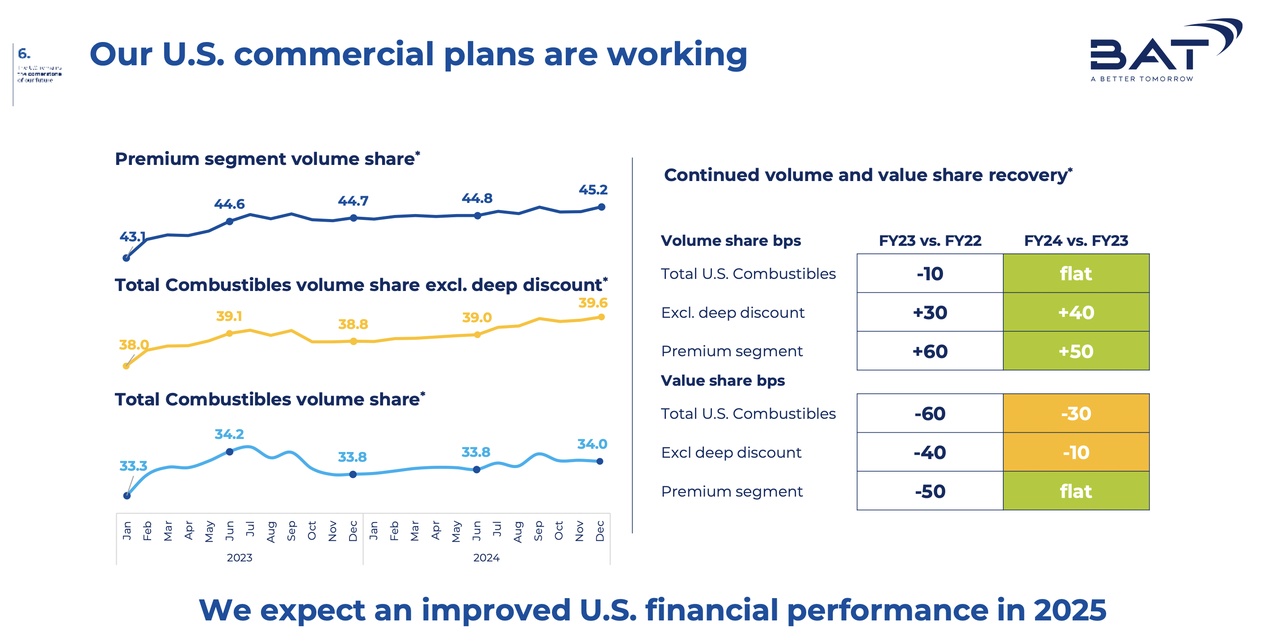

- Market share (volume) increased by 0.2 percentage points in the most important cigarette markets, driven by +0.4 pp. in APMEA and +0.2 pp. in AMEwhile the market share in the USA remained stable.

- Market share (value) fell by 0.2 pp.as declines in the USA (-0.3 pp.) the stable values in AME and APMEA offset the stable figures in AME and APMEA.

- US market remains difficultbut commercial measures led to sequential market share growth.

Volume & sales development

- Cigarette sales fell by 8.9 % (organically -5.0 %) to 505 billion units (2023: 555 billion).

- Reasons: Market exits (e.g. Africa), supply chain problems (Sudan) and declines in the USA & Bangladesh.

- Growth in Turkey, Brazil, Indonesia, Pakistan, Venezuela & Mexico could not compensate for this.

- Total sales from the tobacco business fell by 6.4 % to £20.7 bn.mainly due to lower volumes & currency effects (-4.8 %).

- Sales on a constant currency basis only -1.6 %even slightly positive excluding the sale of Russia/Belarus (+0,1 %).

- Price increases (+5.3 %) in Bangladesh, Brazil & Turkey were able to offset negative regional effects (particularly in the USA).

US market & regional developments

- USA: Sales fell by 10,1 % (stronger than the market decline of -8.4 %), as consumers opted for cheap brands(not in the portfolio) and illegal disposable vapes.

- Market share remained stablewhich shows that strategic measures are working.

- Lucky Strike is growing the fastestwhile the premium segment (Newport & Natural American Spirit) 0.5 pp. market share.

- AME: Sales +3.6 % (organic, constant currency) thanks to growth in Brazil, Turkey & Mexicobut decline in Canada due to illegal disposable vapes.

- APMEA: Sales +3.5 % (constant currency) due to higher prices in Pakistan, New Zealand, Bangladesh, Sri Lanka, Kenya, Nigeria & Saudi Arabiadespite declines in Bangladesh & Australia and supply problems in Sudan.

VUSE

Market share & growth

- Global market leadership in Vapour products was maintained, but the market share in the top vapour markets fell by 1.2 pp. to 40,0 %.

- Europe showed strong growth, although this was offset by declines in the USA & Canada were more than offset by declines in the USA & Canada.

- Vapour remains the largest category in the smokeless segmentwith 11.9 million adult consumers (+0.1 million in 2024).

- New product generation successful since Q4 2024with, among other things improved sensor technology & removable batteries in disposable products.

- Four of the seven top markets profitablethanks to economies of scale & efficient marketing.

Turnover & volume development

- Volume fell by 5.9 %sales -5.1 % to £1.72 bn.or -2.5 % on a constant currency basis.

- Main reasons:

- Illegal flavored disposable products in the USA (little regulation).

- Flavor ban in Québec (Canada) and lack of enforcement of regulation.

- USA (largest vapor market in the world):

- Market leadership in the segment closed system incl. disposable products with 50.2 % value share (-2.0 pp.).

- Turnover -0.8 % on a constant currency basis due to illegal products.

- 70 % of the market consists of illegal vapor products.

- Hope through better FDA controls (more warnings, seizures, penalties) & first successes in successes in Louisiana.

- BAT has filed two complaints with the US International Trade Commission (one ongoing, one under review).

Regional developments

- AME:

- Volume -11.5 %, sales -10.8 % (organically -8.6 %) due to illegal disposable products in Canada.

- Vuse Go Reload (rechargeable) grows strongly in Europe.

- Rechargeable systems segment grows again in Europe - BAT is market leader with 59.9 % value share.

- APMEA:

- Volume +19.1 %, sales +19.6 % (organic +23.7 %)strong growth in South Korea & New Zealand.

- Mexico:

- Following the ban on the sale of Vapour products will Vuse is no longer offered.

- BAT criticizes the ban because smoke-free products could promote the decline in smoking rates.

Outlook & challenges

- Illegal disposable products & lack of regulation remain a problem in the USA, Canada & UK.

- Better enforcement of regulations neededto protect the legal market.

- Greater focus on rechargeable products as a growth opportunity. as a growth opportunity.

GLO

Market & sales development

- glo volume fell by 11.6 %whereby the sale of the Russia & Belarus business and exchange rate effects had a negative impact.

- In organic terms (excluding sales & exchange rates), volumes fell by only 0.3%, while sales grew by 5.8%.

- Overall market for Heated Products (HP) grew by 12 % (slower than 2023 with 13 %), mainly due to lower growth in Europe.

- glo market share in the top markets fell by 40 basis points to 16.7 % (for comparison: -110 bp. in 2023).

- Market share gains in Poland & Czech Republicstabilization in Italy, but declines in Japan & South Koreadue to high competition & lower demand for super slim products.

Regional developments

- AME (incl. Europe):

- Volume -24.6 %but only -0.4 % without Russia & Belarus sales.

- Turnover -12.2 %, but +6.1 % organic due to growth in Germany, Poland & Italy.

- APMEA (Asia, Pacific, Middle East & Africa):

- Volume -0.2 %,

- sales -2.8 %but +5.6 % organically due to innovations & expansion in Japan.

Modern Oral Velo

- Volume +55 %, sales +51 % (at constant exchange rates)

- Fastest growing "New Category" with 7.4 million users (+54.2 %), increasing consumption per user.

- Market leadership in AME with 64.7 % volume share in the six top markets.

- Strong growth in the USA:

- Volume +234 %, sales +232 % thanks to Velo brand renewal & launch of Grizzly Modern Oral.

- Market share increased to 6.6 % (+2.1 bp.).

- Growth in AME (+50.2 % volume, +44.4 % sales), supported by expansion & new flavors.

- APMEA growth:

- Volume +16.8 %, sales +10 % (constant).

- Strong increase in Pakistan (+27.3%).

- Potential in emerging markets is seen as a future growth opportunity.

Traditional Oral Grizzly (chewing tobacco & snus)

- Volume -8.2 % to 6.1 billion units, sales -6 % (-3.4 % constant).

- Price increases (+4.8 %) could not compensate for the decline in volume.

- Declines mainly in the USA (-8.9 %) & AME (-3.3 %), as consumers switched to Modern Oral switch.

- USA accounts for 97 % of sales, decline there of 3.4 % (constant).

- Camel Snus devaluation by £646m. due to falling demand.

- From 2025: 20-year amortization with annual costs of approx. £23m.