Forecasters are way off the mark again

Third-quarter earnings of USD 3.36 per share were well above expectations of USD 2.92. With sales of USD 9.23 billion, the company also exceeded analysts' estimates of USD 8.78 billion.

For the year as a whole, sales fell by 7.5% and profits by 18%. This is certainly not ideal, but the sector is a long way from a serious crisis. With an operating margin of 14.7% and a pre-tax profit of USD 1.4 billion, the company is still highly profitable.

There have been indications for some time that things are not quite so bad in the sector:

Toll Brothers: Crash oder Comeback? Krise oder nicht?

LGI Homes: Gelegenheit nach 50 % Kurssturz?

In the first nine months of the current financial year, D.R. Horton earned USD 8.53 per share. As the final quarter is usually particularly strong for D.R. Horton, earnings this year could trend towards USD 12 per share - far higher than the previous consensus estimate of USD 11.35 per share.

With earnings of USD 12 per share, D.R. Horton arrives at a forward P/E of 12.8, which is easily justifiable. However, the real potential arises from the fact that earnings are expected to rise significantly again in the coming financial year, which begins in October.

Consensus estimates are currently predicting an 8% jump in profits. In order to understand this, however, it is important to know that forecasters in this sector have been systematically too pessimistic for years. In some cases, annual profits have ended up being much higher than initially expected. This does not have to happen again, but it could.

Risks and side effects

The only thing that is somewhat dampening confidence is the tariffs. According to current estimates, building material prices are expected to rise by 6 to 10 % in 2025, mainly due to the tariffs introduced by the Trump administration.

These tariffs affect key building materials such as lumber, steel, aluminum and gypsum imported from countries such as Canada, Mexico and China. The US construction industry is likely to be particularly hard hit by these measures in the second half of the year, which could lead to a slowdown in the sector.

Added to this are potential supply chain problems and rising inflation, which will be fueled by the tariffs and at the same time prevent interest rate cuts

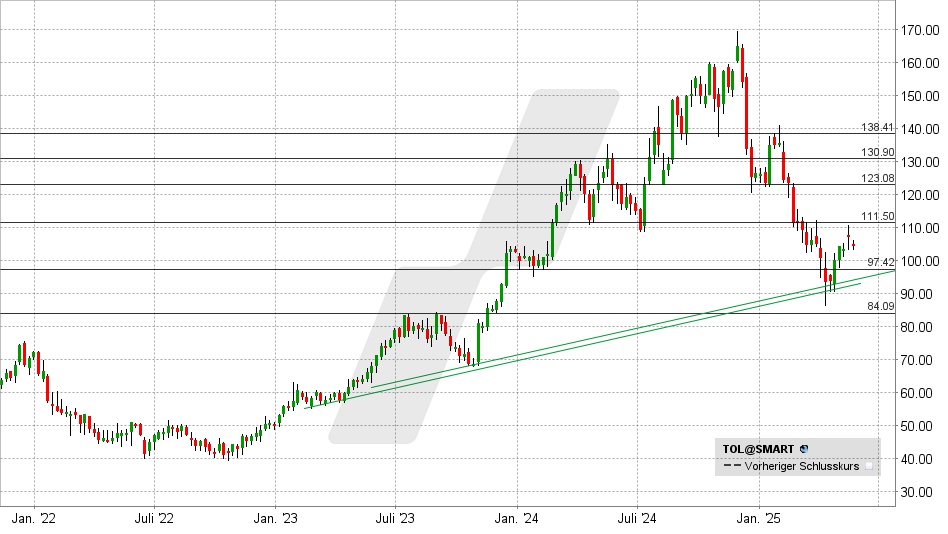

D.R. Horton share: chart from 23.07.2025, price: USD 153.50 - symbol: DHI | Source: TWS

The rise above USD 137 triggered a procyclical Kaufsignal was triggered. The first Kursziel at USD 154 was immediately cleared. Above USD 154, the path towards USD 166 and USD 179-182 would be clear.

If, on the other hand, the share returns to the USD 137-140 range, this could serve as an anticyclical Einstieg offer

Source