Goldman Sachs alumnus as CEO - the billionaire turned crypto wizard: Mike Novogratz.

At first glance, everything appears to be $GLXY (-1,29 %) a crypto relic - the share price hovers around €26 and is largely ignored by the wider market. But beneath the surface, the company is quietly transforming into a key player in the field of AI infrastructure in North America.

This is not just empty talk, but a fundamental growth story that is now gaining serious momentum.

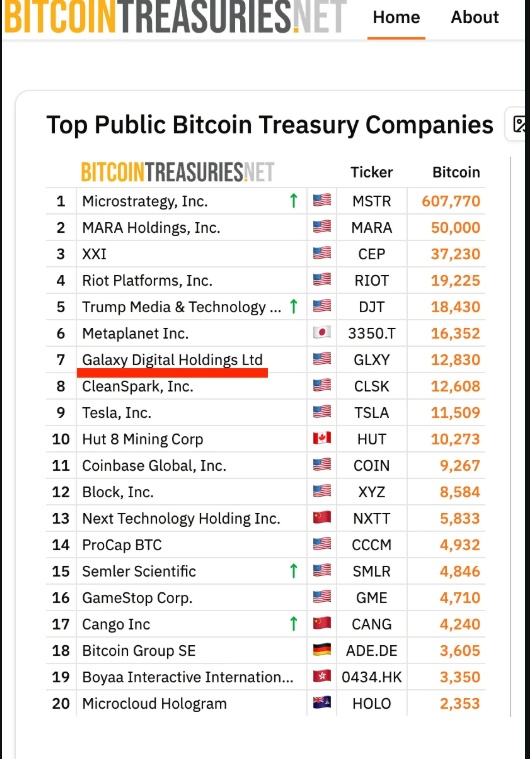

- Already huge BTC treasury. Ranked 8th globally and growing.

Crypto remains part of Galaxy's DNA, managing billions in assets and investing in AI startups, but it is now an optional upside factor rather than the main story.

At its core is a high-margin, low-capital AI infrastructure platform that generates stable, contractually secured cash flows - a value that the market is just beginning to recognize.

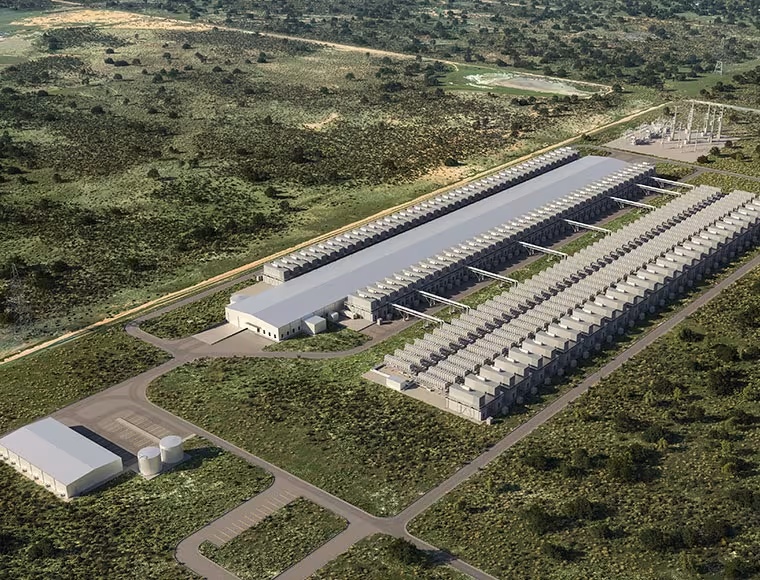

The linchpin of Galaxy's transformation is Helios, a massive AI data center campus in West Texas.

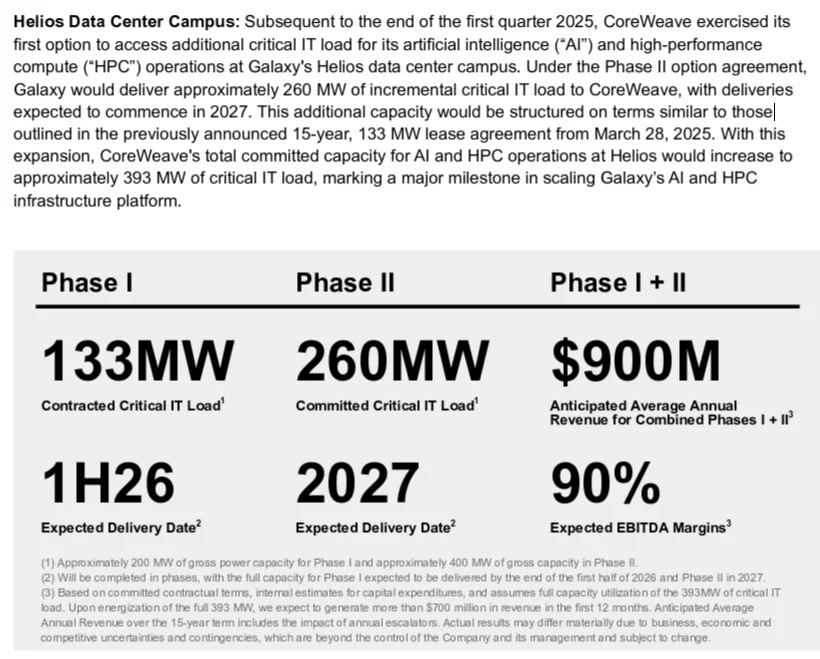

Originally built for crypto-mining and then decommissioned, Galaxy has transformed Helios into a next-gen AI compute hub and signed a 15-year contract with $CRWV (-2,77 %) a leading AI cloud provider.

Phase I will deliver 133 megawatts of computing power by 2025 - fully leased.

Phase II will triple the capacity to 393 megawatts by 2027 - also fully contracted.

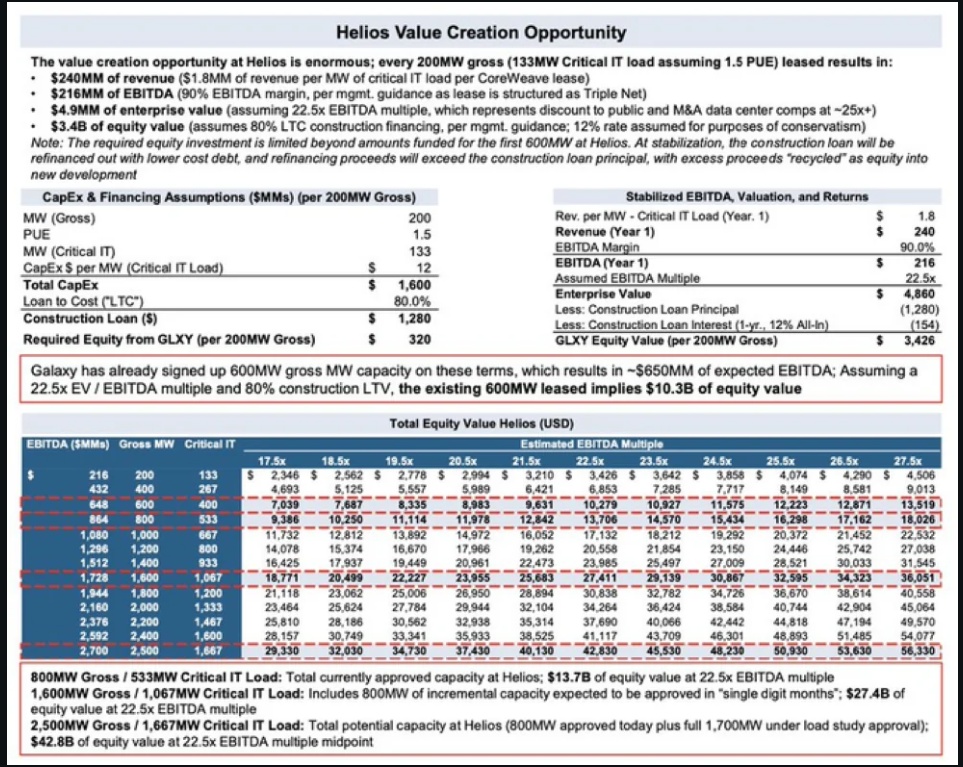

Helios alone is expected to generate around $700 million in recurring annual revenues with EBITDA margins of over 85%, which corresponds to around $600 million EBITDA. A comparison with competitors suggests that Helios is worth just under $10 billion.

But Galaxy is not standing still. With a pipeline volume of over 1.7 gigawatts of additional AI data centers already in permitting or under contract - i.e. multiple Helios-sized sites - Galaxy could be on track to generate $2 to $2.5 billion in EBITDA annually. This would establish them as the dominant landlord in the AI infrastructure real estate segment.

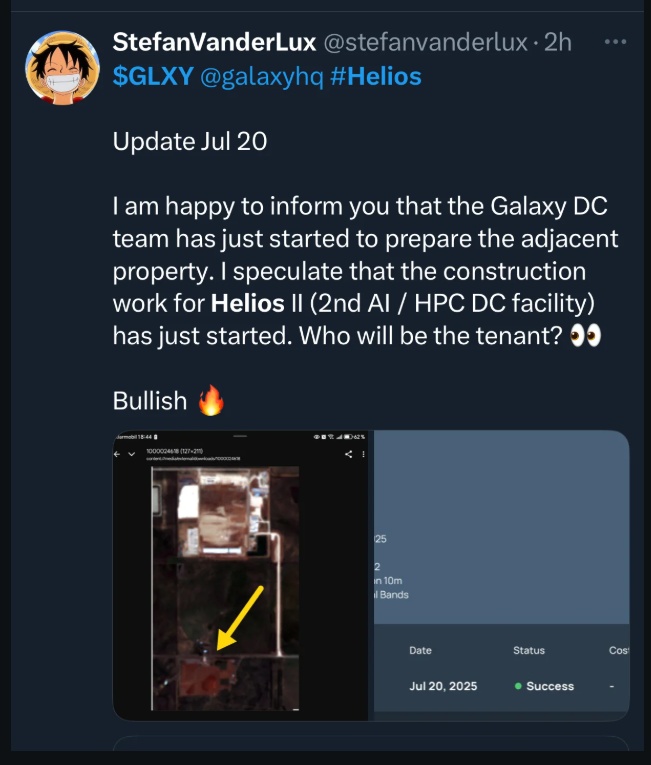

- A genius on Twitter bought satellite imagery - which all but confirms that they are developing the adjacent HELIOS space into more AI data centers. More data centers = potentially billions more in revenue.

(Credit u/stefanvaderlux on Twitter)

Increased power requirements for their AI data centers have already been applied for in 2022 - putting them ahead of the AI wave and giving them first mover advantage once approval comes.

Value creation opportunity: if maximum capacity is approved, this could create $42 billion in enterprise value for their data center business alone.

- First quarter earnings coming up: they have pushed back the date to August 5 - a very positive sign that they are beating expectations and/or making big announcements.

- Investors are jumping on the Novo bandwagon so much that their most recent venture funding round was crowded: https://www.galaxy.com/newsroom/galaxy-announces-final-close-of-galaxy-ventures-fund-i

- They're a big player in market-making. A Satoshi-era Bitcoin wallet moved 40,000 BTC and sent shockwaves. You can't just sell that much Bitcoin. These were sent for management and sale to $GLXY (-1,29 %) sent to https://cointelegraph.com/news/bitcoin-whale-moves-last-btc-galaxy-digital

This man is so trusted that he is trusted with literally billions.

- There is a very obvious crypto hype cycle going on right now. Just from this alone, we could see movement.

Today, Galaxy is trading at a market capitalization of around $10 billion. With the successful execution of the pipeline, a valuation of $100bn is achievable in the next two to three years - accordingly, the price would be around $260, almost ten times the current level.

GLXY is also already showing technical strength: the breakout above resistance in the € 23-24 range took place on rising volumes.

At a price of ~€26, Galaxy Digital offers an exceptional risk/reward profile - solid long-term prospects combined with exciting short-term momentum drivers. For investors looking to profit from the AI infrastructure boom beyond pure chip manufacturers, Galaxy Digital is a rare insider tip.

Sources:

- https://investor.galaxy.com/news/news-details/2025/Galaxy-Announces-Commitment-with-CoreWeave-to-Host-Additional-Artificial-Intelligence-and-High-Performance-Computing-Infrastructure-at-Helios-Data-Center-Campus/default.aspx

- https://www.galaxy.com/newsroom/building-the-infrastructure-for-an-ai-powered-future

- https://www.sec.gov/Archives/edgar/data/1859392/000185939225000007/glxy-20250331xpressrelease.htm

- https://www.datacenterdynamics.com/en/news/coreweave-leases-another-260mw-capacity-from-galaxy-in-texas

- https://chainbroker.io/funds/galaxy-digital

- www.galaxy.com/newsroom/galaxy-announces-final-close-of-galaxy-ventures-fund-i

- https://cointelegraph.com/news/bitcoin-whale-moves-last-btc-galaxy-digital

- https://www.tradingview.com/symbols/NASDAQ-GLXY