Today I'm doing something very special - my first and probably last "stock analysis" 🥳 Since there are generally a lot of misunderstandings and misconceptions about the stock market here and on social media, I thought I'd take the trouble to explain it from my personal perspective. $MSTR (+5,21 %) I thought I would take the trouble to present this from my personal perspective. I don't know anything about equity analysis, but I do know something about $BTC (-0,16 %) and I think this is quite helpful to understand what kind of game Michael Saylor and Strategy are actually playing :)

MicroStrategy - official since this year "Strategy₿" - has transformed itself since 2020 from a rather inconspicuous software company for BI solutions to a pioneer of a completely new type of corporate strategy. The company now holds an immense amount of Bitcoin on its balance sheet (currently 601,550) and uses various financing instruments to steadily expand this position.

At the same time, critics (rightly) raise questions about the sustainability and seriousness of this strategy - quite a few even compare it to a Ponzi scheme.

I will therefore introduce you to Strategy's "business model" and then, at the end, we will answer the question of whether Strategy is operating a Ponzi scheme or whether it is actually a new, innovative business model.

What is Strategy actually doing?

In August 2020, CEO Michael Saylor (then CEO, now Executive Chairman) initiated the transformation. When the FED simply printed almost a third of all the dollars that had ever existed out of thin air in order to survive the coronavirus crisis, Saylor made a momentous decision. At the time, the company was sitting on around 500 million US dollars in cash - a "melting ice cube", as Saylor called it. Instead of letting the money sit idly in the bank or putting it into assets such as bonds, Strategy became the first listed company to decide to use Bitcoin as its primary treasury reserve asset reserve asset. Saylor even offered to buy back shareholders' shares if they did not want to support this move.

Michael Saylor and the management were (and are) convinced of Bitcoin's long-term potential. They see Bitcoin as a superior store of value in a world where fiat-based assets are losing purchasing power.

Saylor put it like this: 'Everyone in the fiat system loses sooner or later - that's the nature of the system. Bitcoin, on the other hand, offers an alternative, especially for those who are disadvantaged by the traditional financial system. Strategy has taken this belief to a corporate level. It expects Bitcoin to gain significantly in value over the long term (Saylor speaks of 30-60% growth per year for the next 20 years). Since then, the company's strategy has been to accumulate as much Bitcoin as possible and hold it for the long term.

The primary goal is to increase the value per share in the long termmeasured measured in Bitcoin. Saylor has made an explicit commitment that the number of Bitcoin per share may only increase. Every capital measure is checked to see whether it increases the proportion of BTC per share. If this is successful, the shareholders receive a net increase in their Bitcoin stake - the so-called Bitcoin Yield.

In other words, Strategy wants to generate more Bitcoin for its shareholders than they lose through dilution (issue of new shares). This key figure - the percentage increase in Bitcoin per share - has become the most important internal performance indicator.

In 2024, for example, MicroStrategy generated around 74% Bitcoin yield - i.e. each shareholder owned 74% more BTC per share at the end of the year than at the beginning. This was achieved through massive acquisitions financed by issuing shares and bonds.

If you buy the share, you are therefore "hoping" that Bitcoin will perform well. Strategy is therefore a high-conviction bet on Bitcoin.

A role model for other companies

Strategy's strategy has had a knock-on effect in the corporate sector. Saylor and his company serve as a blueprint for other companies that want to follow their example. In recent years, a number of (mainly smaller) companies have indeed announced and implemented similar Bitcoin treasury plans. This has gained significant momentum, especially in recent months. Here, for example, is a list of the 60 companies with the largest Bitcoin holdings:

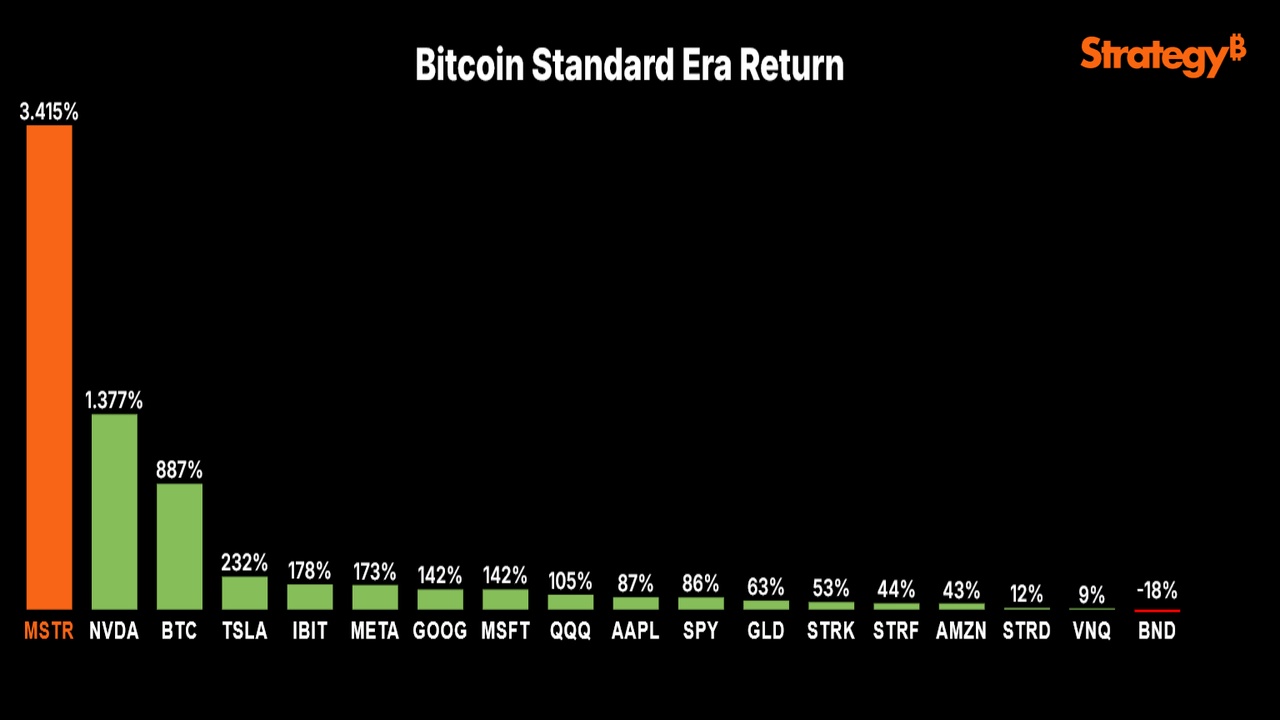

It is often reported that the decision-makers at these companies were directly inspired by Saylor. Strategy's success has shown the potential of such a focus. Since the start of Bitcoin Strategy 2020, the company has outperformed every other company, including Bitcoin itself:

To summarize, Strategy's Bitcoin strategy is:

Maximize Bitcoin holdings per share, funded by capital market instruments, to participate disproportionately in the expected long-term appreciation of Bitcoin.

Strategy's capital raising

In order to be able to continuously buy Bitcoin, Strategy needs fresh capital on an ongoing basis - be it equity or debt capital. Since the company's operational software business itself generates little free cash flow (it generates some profit, but not nearly enough for billion-dollar purchases of BTC), Strategy has a toolbox of financing instruments developed. To date, this includes common stock, convertible bonds and preference shares.

Below we take a closer look at each method, how it works and the risks involved:

(1) Financing through ordinary shares (share issues)

The most straightforward method of raising capital is to issue new ordinary shares. In recent years, Strategy has repeatedly used at-the-market (ATM) offering programs to sell new shares directly on the stock exchange. This involves selling shares in small tranches on the open market, without a fixed issue price, at current market prices. This procedure allows equity to be raised flexibly and relatively cheaply. The proceeds are then used almost entirely to buy more Bitcoin.

New share issues are very advantageous from the company's point of view, as long as the share price is significantly higher than the value of the BTC held. In this case, they earn more Bitcoin per dollar of share sales than was previously deposited in an existing shareholder's stake - which increases the Bitcoin per share.

Example:

If you own 10 machines and a shareholder owns 10% of them (1 machine), you could dilute the shares to 5%, but at the same time increase the machine holdings to 25. 5% of 25 is 1.25 - the shareholder would have more shares in machines despite the lower percentage.

Strategy consistently follows the rule of only issuing new shares if it is beneficial for the existing shareholders - i.e. if the company receives more Bitcoin for the shares issued than the loss of shares caused by the new shares. As Strategy's market capitalization is usually significantly higher than the pure Bitcoin book value, this has been the case in recent years.

The issuance of shares has no direct repayment risk for MicroStrategy like debt capital. It is equity and does not have to be "serviced" - no interest costs, no repayment. The management therefore describes this approach as practically risk-free for the company. The challenge lies more with the shareholders, as they have to agree to the dilution, i.e. trust that the management will invest the money sensibly (in Bitcoin) and thus create value per share.

However, the main advantage - no interest or redemption obligation - does not mean that equity financing is without risk. The biggest risk here is a loss of the premium (more on this later).

If the share price falls to or below the pure Bitcoin NAV (i.e. <1x premium), new issues would be disadvantageous for shareholders (dilute the BTC stake per share) and practically no longer feasible. In such a scenario, Strategy would see no point in selling shares at these low prices for the time being - it would wait until the market value recovers or switch to other instruments.

Should Strategy one day urgently need capital (e.g. to pay off debt) and the stock is trading below 1×BTC value, the company might still have to issue shares at poor conditions - which could trigger a breach of promise to shareholders and a vicious circle of falling Bitcoin-per-share value and further loss of confidence. That would be the first major risk I see with Strategy.

(2) Financing through convertible bonds

The second important source of financing was convertible bonds. Strategy borrows money from investors, typically with a term of several years, and grants the bondholders the right to convert the bonds into Strategy shares at a fixed price. These instruments therefore combine features of debt and equity.

The convertible bonds issued to date can be seen here:

As can be seen, Strategy has been able to raise a nominal total of approx. 8.214 billion dollars at just 0.421% interest - crazy!

Investors lent Strategy several billion dollars in this way and demanded virtually no interest. If the share price exceeds the "conversion price" at maturity, the creditors can convert the bond into shares - and thus reap high profits. If the share price does not reach this level, Strategy would have to repay the loan, including interest, in cash at the end of the term.

The fact that Strategy was able to push through such advantageous conditions is due to the high volatility of the share, which makes the convertible bonds attractive to investors. For bond buyers, the conversion option is valuable if there is a certain probability that the share will rise far above the strike (conversion price). Strategy is extremely volatile. This implied volatility of the share gives the call option (which is in the convertible bond) a high value.

In short, investors could speculate that Strategy would rise so much in a Bitcoin bull market that the conversion would become lucrative. At the same time, they could use convertible arbitrage hedge. Many buyers hedged their position by shorting the share at the same time. This allowed them to profit with relatively little risk - regardless of whether the price rises (in which case they exchange the bond for shares and cover the short, making a profit through interest and conversion) or falls (in which case they keep the bond, collect interest if necessary, and the short makes a profit).

As a result, there was huge demand for the convertible bonds. Every issue was oversubscribed, even those issued at 0% interest.

Of course, issuing convertible bonds is not risk-free either. The convertible bonds have maturities.

Until that time, one of two things happens: Either the share price is at least at the fixed conversion price - in which case the creditors will most likely exchange for shares. Or the share price remains below it - in which case Strategy would have to redeem the bondsi.e. repay the nominal amount in cash.

If this happens, the question is of course how the money is to be repaid.

Where would you get so much money if not by selling the BTC? However, this is where Strategy's equity strategy comes into play again. The convertible bonds are equity-linked and can be indirectly repaid in new shares, even if the target price is not reached. Management has emphasized that if in doubt, they would issue additional shares to settle the debt instead of selling Bitcoin. Such a payout in shares would be dilutive for existing shareholders (Bitcoin per share would decline unless new BTC is bought - which actually contradicts Saylor's promise), but the company avoids the cash outflow. Ideally, however, Strategy will ensure that the share price is high enough by maturity for the conversion to be voluntary.

The convertible bonds provide Strategy with leverage. They increase Bitcoin holdings immediately without fully diluting shareholders at the time of issue (because initially there are no new shares, only a liability on the balance sheet). Only when the conversion takes place - usually when the share price is significantly higher - are additional shares issued. If successful (Bitcoin and the share price rise sharply), this leverage is of course great.

The company has bought Bitcoin with borrowed money, but never has to pay the money back in cash, instead issuing a few shares at a much higher price.

Nevertheless, the convertible bonds represent a liability that could force repayment in cash in the aforementioned scenario (weak share price). If we see a prolonged Bitcoin bear market in which Strategy's share price remains far below expectations and hundreds of millions to billions of convertible bonds have to be repaid at the same time, this could be a real challenge.

(3) Preferred stock financing

The third, and most recent, category in the financing mix is preferred stocks. Since late 2023/early 2024, MicroStrategy has issued several series of preferred stocks, all of which have high fixed dividends dividends and some with conversion rights. These preferred shares - each with its own ticker such as STRK, STRF, STRD - are aimed at different investor groups than ordinary shares or convertible bonds and are used to raise additional capital from investors looking for fixed income, for example. Let's take a look at the well-known series:

- Series A Perpetual Strike Preferred (Ticker: STRK) - introduced in January 2025: This is a perpetual cumulative preferred stock with an 8.0% dividend p.a. (based on the par value of $100). Important: The dividend can be paid quarterly either in cash or in Class A shares. STRK also has a conversion right - holders can exchange their preferred shares for common shares at any time (at an initial price of $1,000 per common share, or 0.1 share per pref). This high conversion price means that conversion only becomes attractive if MSTR's share price rises very sharply. Strategy itself has a buyback right for STRK if less than 25% of the originally issued prefs are still outstanding or in the event of certain tax events. Due to the cumulative dividend, unpaid dividends accumulate and must be paid in arrears, whereby a compound interest effect takes effect. Unpaid dividends bear interest at an initial rate of 10%, increasing by 1% per quarter up to a maximum of 18% for as long as they remain outstanding. This creates a strong incentive for Strategy to pay dividends regularly - otherwise the burden would become ever greater.

- Series A Perpetual Strife Preferred (STRF) - introduced in March 2025: also perpetual and with an interest rate of 10,0% fixed coupon. In contrast to STRK, this series does not intended for conversion into ordinary shares. STRF dividends are cumulative and payable in cash only. Strategy can call STRF in much the same way as STRK (repayment at par plus accrued dividends) if, for example, <25% of the securities are on the market or in the event of changes in tax law. STRF is therefore in principle a classic high yield preferred security, which is serviced in priority to the ordinary shares and has no direct equity upside. It was structured in such a way that it senior senior to other prefs - i.e. in the event of dividend suspensions or liquidation, STRF has priority over STRD, for example). Due to this seniority and the fixed 10% dividend that is guaranteed to be made up, STRF typically shows less price volatility - it is more akin to a perpetual bond.

- Series A Perpetual Stride Preferred (STRD) - introduced June 2025: Also 10.0% dividendbut not cumulative. This means that if MicroStrategy decides to suspend the dividend once, investors are are not entitled to a subsequent payment later - the payment is simply canceled. STRD was issued at $85 per $100 par value and raised nearly $1 billion in proceeds. STRD has no conversion option (i.e. pure income preference share) and is subordinated in rank subordinated to STRF (and probably pari passu with STRK). It is also not callable before maturity. According to Strategy, this series is explicitly aimed at investors who are looking for high returns without management fees - for example income funds, pension funds, etc., who find a 10% fixed distribution attractive. However, because the dividend is not guaranteed to accumulate, the investor bears a higher risk - accordingly, STRD is considered the riskiest security in Strategy's capital stack, but it also offers the highest yield.

Why preferred shares?

These constructs allow Strategy to raise capital from investors who are not (allowed or willing to) buy common stock or bonds. Many institutional investors have strict investment guidelines. For example, certain conservative funds are not allowed to hold volatile tech stocks such as $MSTR (+5,21 %) but would be interested in a double-digit coupon. Or hedge funds that focus on arbitrage prefer convertible instruments in order to pursue long/short strategies.

Strategy "builds products for the financial world"to offer a wide range of investors access to Bitcoin or Bitcoin-based income.

The side effect: companies that are not allowed to buy Bitcoin directly themselves (for regulatory or governance reasons) can hold Strategy preference shares instead of BTC, for example, and thus participate indirectly.

Role in the overall concept

Preferred shares - just like shares and bonds - ultimately finance the purchase of Bitcoin. The difference is that preference shares incur ongoing dividend costs. Strategy must manage this burden. However, as the company generates little or no operating profit, the question arises: What are the dividends paid from?

To be honest, the only answer I can come up with is: From the same pot as the bitcoin purchases - namely by spending more capital.

Strategy could, for example, place USD 600 million in new shares, put 80% of it into Bitcoin and use 20% to pay dividends. As long as Strategy keeps raising new capital, the dividends can be co-financed "Ponzi scheme style".

The company itself communicates that it wants to keep the debt ratio (debt + prefs in relation to Bitcoin assets) in a moderate range of 20-30%. It is currently around ~16%, which reflects the current "leverage", so to speak. This suggests that Strategy could probably soon announce further capital measures to raise the leverage to the desired range of 20-30%.

But that also means:

Bitcoin's value exceeds its financial obligations many times over.

Risks of the preference shares

- Unlike shares, which do not promise fixed dividends, Strategy has to make regular payments, which could potentially become a risk.

- The prefs are perpetual, i.e. they run indefinitely. There is no fixed record date as with a bond, but in a way this also makes them infinite in their obligation. Strategy has thus permanently tied itself to a liability. Theoretically, the company could let these preferred shares run forever - which may even be smart in a dollar-inflation environment, since 10% in devalued dollars will hurt less in real terms in ten years than it does today. But if the strategy fails, the dividends represent a steady cash outflow that can make things worse.

- In case of doubt, preference shareholders always come before ordinary shareholders. If Strategy were to get into difficulties, the preference dividends would first have to be paid before dividends could be distributed to ordinary shareholders again. Although this is not a corporate risk, holders of ordinary shares should be aware of it.

Premium, Bitcoin yield and share valuation

A central phenomenon at Strategy is the share premium compared to the Bitcoin held on the balance sheet. The premium is the ratio of the stock market value to the pure value of the Bitcoin holdings (less debt).

Strategy's premium is currently 1.83. This means that the market values Strategy at ~1.8 times what its Bitcoin is currently worth.

But why are investors paying this premium?

Because they expect Strategy to continue to accumulate Bitcoin in their favor. In other words, the BTC/share will continue to increase. With Strategy, you get a box that is automatically filled with more and more Bitcoin over time - without you having to do anything. And this is precisely the reason why Strategy is not traded 1:1 to the holdings like a Bitcoin ETF.

If the Bitcoin price and the Bitcoin/share now rise, there is a double leverage effect for the share. Saylor calls this an "asymmetric upside":

Is Strategy a Ponzi scheme or not?

Short answer: No, it is not. But let's briefly go through the characteristics of a Ponzi scheme:

(1) Old investors are paid with money from new ones

Strategy invests the money raised in a real asset (Bitcoin). The money does not disappear into pockets and is not passed on from person A to person B. So there is something of value that belongs to all shareholders. Previous shareholders are not "paid out".

Strategy publishes every single Bitcoin purchase officially and promptly (most recently on Mondays for the week before) and is therefore absolutely transparent. Everyone can see where the money goes.

(2) Income only through new money / promised returns

Strategy does have a business activity with its BI solution, but admittedly this is pretty marginal. The "returns" for shareholders are supposed to come from the increase in the value of Bitcoin.

And here's the thing: this increase in value is market-driven, not artificially generated. In a snowball system, for example, you would say "we generate 10% returns per month through leveraged trades", which is a lie - you simply pay 10% from the new money. There is no guaranteed return promise with Strategy. There is volatility and potentially high profits, but also losses. No investor is automatically paid money just because they have invested.

(3) Collapse if new money fails to materialize

One of the most important things is that Strategy will not implode as soon as it stops raising money. What would happen if Saylor said tomorrow, "We're not raising any more money"? Well, the company now holds over 600k Bitcoin and has some debt. It could just hold and wait to see how Bitcoin performs. There would be no liabilities due immediately (interest and dividends could be paid for a while from cash reserves held, or small parts of the BTC could be borrowed/sold if absolutely necessary). The valuation would then of course converge to a premium of 1.0 or probably even fall slightly into negative territory, because the advantage of the increase in BTC/share would then be nullified and there would no longer be any reason to buy Strategy instead of Bitcoin.

There is no BTC price at which Strategy is liquidated, as is often claimed in the social media.

Innovative business model?

Many in the Bitcoin community and increasingly in the financial world see Strategy not as a fastball system, but as an innovative pioneering achievement. The company has shown how Bitcoin can be used as a corporate strategy to create shareholder value at a time when the core business was stagnating. Saylor has thus created a "corporate Bitcoin standard" that others (want to) follow or have already followed.

Strategy describes itself as a bitcoin treasury company and argues that it creates added value for investors who are only allowed to buy certain financial products - in other words, it actually performs a bridging function between the traditional capital market and the Bitcoin world. This creative use of the financial markets in favor of an asset play is completely new. The fact that the share is trading well above the pure Bitcoin value shows that the market recognizes the business model.

Conclusion

Strategy is no longer a conventional software company, but a de facto Bitcoin investment vehicle. It is a bet on Bitcoin and on the "financial engineering skills" of Michael Saylor. In my view, Strategy is clearly not a Ponzi scheme, but it is also definitely not for conservative investors. The various capital measures all have different risks, which Strategy must have well under control. It will be interesting to see how Strategy (and all the imitators) will behave in the next bear market. In other words, whether they can continue to accumulate Bitcoin at favorable prices or whether they will even have to sell some of their holdings to pay off debt. That will definitely be exciting. I currently have a small position in Strategy shares, but I will sell them as soon as I think that Bitcoin is slowly but surely overheating. So for me, the share is currently more of a short to medium-term speculation.

I look forward to hearing what you think of my "stock analysis". Feel free to leave any questions in the comments. What do you think about Strategy?