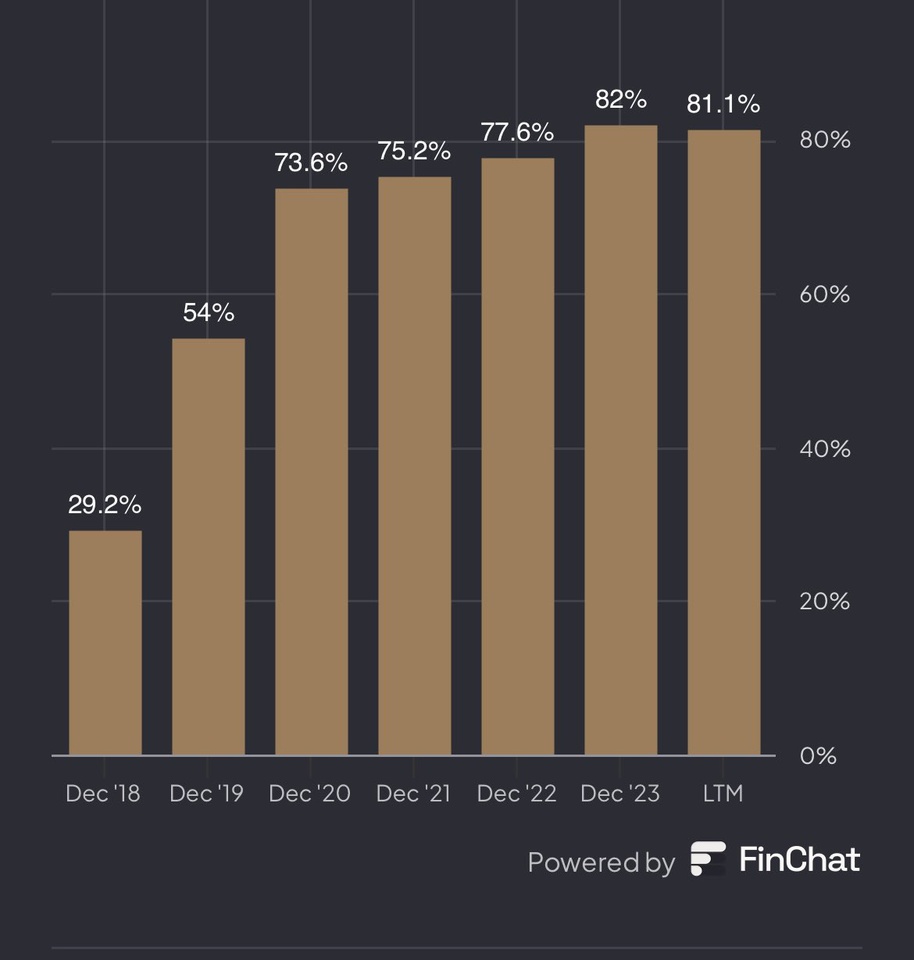

The gross margin of $HIMS (-10,02 %) has almost tripled since 2018.

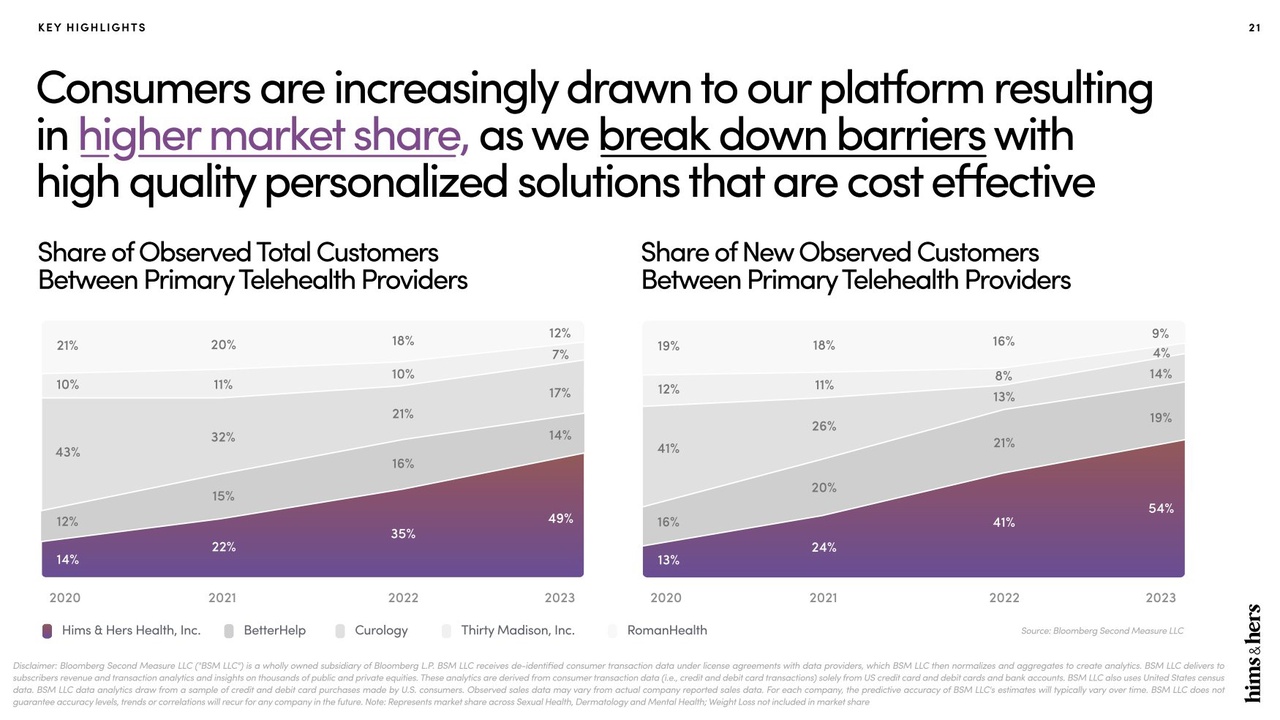

In 2020, the company was $HIMS (-10,02 %) a relatively small player in telemedicine, with a market share of just 14 %.

By 2023 was $HIMS (-10,02 %) the dominant force:

$HIMS (-10,02 %) Had 49% of all customers/market share.

And even more telling: $HIMS (-10,02 %) was able to acquire 54 % of all new customers.

I look forward to an update on these figures from management in the coming months

And it will be important to keep an eye on how this $AMZN (-13,35 %) impact on market share over time.

Company presentation and personal opinion: