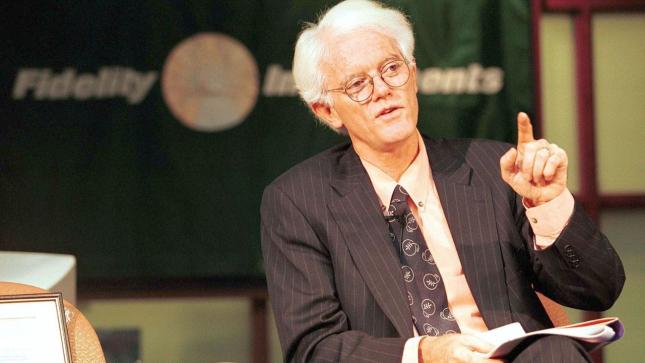

Peter Lynch was a star investor. When he retired in 1990, his fund assets had grown to 14 billion US dollars. Here are his five golden rules of success.

Hello my dears,

Can we learn anything from Peter Lynch's rules?

- Buy and hold strategy means a lot of discipline in these turbulent times.

Don't rush and keep calm.

- Invest in what you know and understand.

Even in a correction and bear market, it helps us to continue to believe in the company. And to hold on to the share. The same applies if we know the fundamental figures and know that a company will continue to operate successfully.

- I find the statement interesting:

"Companies are allowed to grow, but only at a pace that is sustainable in the long term. It excludes companies that grow too quickly.

I think this certainly includes hype stocks.

I often see great opportunities in such shares, but Lynch's statement also makes me think. Because you can see it in companies such as

- Elf Beauty $ELF (-0,74 %)

Here the share price rose rapidly when the company was growing at triple-digit rates. Now that the company is only growing in double digits. Investors are suddenly no longer satisfied. And a high P/E ratio is no longer acceptable. As you can see from the chart.

Maybe you can see it with Nvidia $NVDA (-1,98 %) Tesla $TSLA (-2,88 %) or $NOVO B (+0,19 %) similar developments? Because growth is slowing here. Or are they buy and hold stocks for you? Or what would be your current Peter Lynch shares?

Summarized for you

Invest in what you know and understand.

Apply a long-term buy-and-hold strategy.

Five rules: Growth, valuation, liquidity, profitability.

"Invest in what you know and understand". This is the famous saying of star investor and fund manager Peter Lynch.

In his book "One Up on Wall Street", he describes the principles of his investment strategy

Lynch's investment strategy is based on fundamental analysis and follows a long-term buy-and-hold strategy. It focuses on finding growing companies with reasonable to low valuations. Although this strategy contains some elements of growth investing, it leans more towards a value investing approach.

Pure growth investing strategies often include a technical analysis and market timing component. Lynch, however, does not use these. He recommends ignoring market volatility and focusing solely on building a long-term diversified portfolio that takes into account a company's valuation, profitability and overall financial health.

Companies are allowed to grow, but only at a pace that is sustainable in the long term. It excludes groups that grow too quickly.

Does that work? Well, it has certainly worked for him:

As manager of the Magellan Fund, Lynch achieved an average annual return of 29.2 percent between 1977 and 1990. That is almost three times the average annual return of the S&P 500.

According to Lynch, many good investment ideas can come from things you use, like or buy in your daily life. In line with the credo: "Invest in what you know and understand"

The company doesn't have to be in the next hot or growing area, but simply offer goods or services that are valued in their particular field. Companies can also be active in relatively boring areas. In fact, the more boring and understandable, the better.

The next step is to research the company. Before you actually buy, you need to do your homework and make sure you understand the company's business.

After buying shares in a company, the next step is patience. Lynch explained that you can't make a reasonable prediction about the price of the company or the market over the next 1 or 2 years, but over 10 or 20 years the price is more predictable. A portfolio of 10 to 30 well selected and diversified stocks should perform well over 10 to 20 years.

Lynch's investment rules

First rule: Earnings per share should have grown by at least 15 percent on average over the last 5 years. This growth should not exceed 30 percent, as such growth is not sustainable. In your research, it will be important to understand how and why this growth was achieved and to assess whether similar growth can be sustained in the future.

Second rule: The PEG (Price-to-Earnings Growth) ratio should be less than 1. The PEG ratio takes into account the P/E ratio. The PEG ratio is calculated by dividing the P/E ratio by the company's annual earnings growth (usually for the next 5 years).

Third rule: Pay attention to the debt/equity ratio. This ratio is a financial indicator that measures the ratio of debt capital (debt) to a company's equity. It is calculated by dividing the debt capital by the equity capital. This should not result in a value of more than 0.6.

Fourth rule: The current ratio (also known as the liquidity ratio) is a business ratio that measures a company's ability to cover its current liabilities with its current assets. It is calculated by dividing the current assets (i.e. all assets that can be converted into cash within one year) by the current liabilities (i.e. all liabilities that fall due within one year). The value should not be greater than 1.

Fifth rule: Pay attention to the ROE (return on equity). It measures the profitability of a company in relation to its equity. An ROE > 15 percent means that the company achieves a return of more than 15 percent on the equity invested. ROE is calculated by dividing a company's net profit by its equity.

Author: Krischan Orth, wallstreetONLINE editorial team.