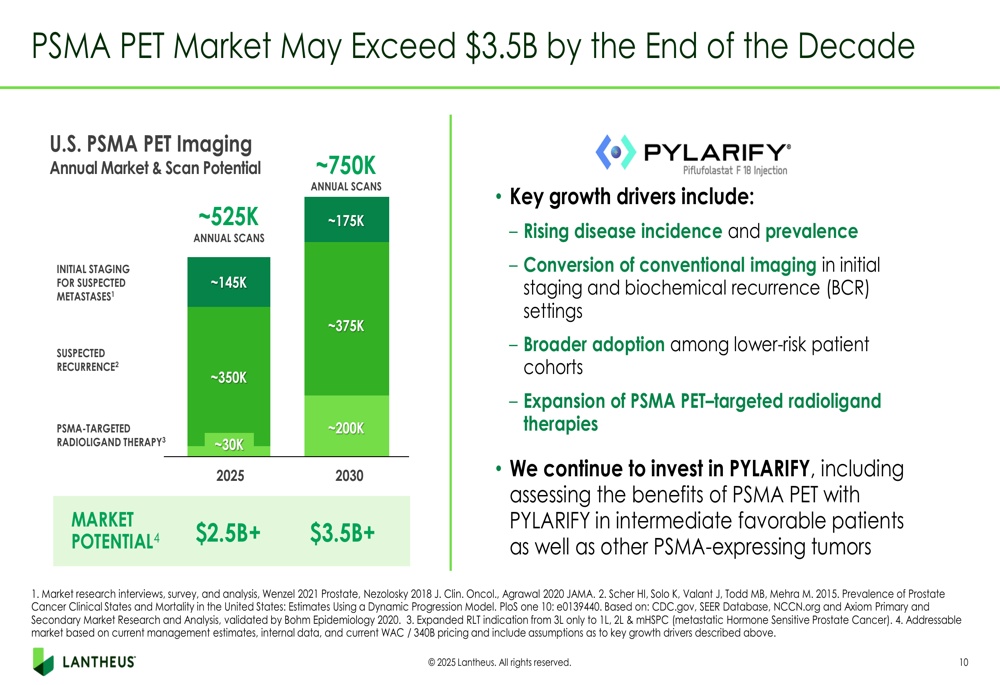

Lantheus $LNTH (-0,76 %) has undergone a decisive transformation over the last 12 months to become a broad-based radiopharmaceutical player. With a growing pipeline, strategic acquisitions and strong cash flow, the starting position in 2025 is promising - even if margins have been slowed and guidance reduced in the short term. In the long term, significantly accelerated growth can be expected from 2026.

Strong growth, but declining margins - due to expenditure on acquisitions, R&D and shifts in the business model.

For me, the company remains a clear buy and I would like to increase my stake to 150 - 200 shares this year.

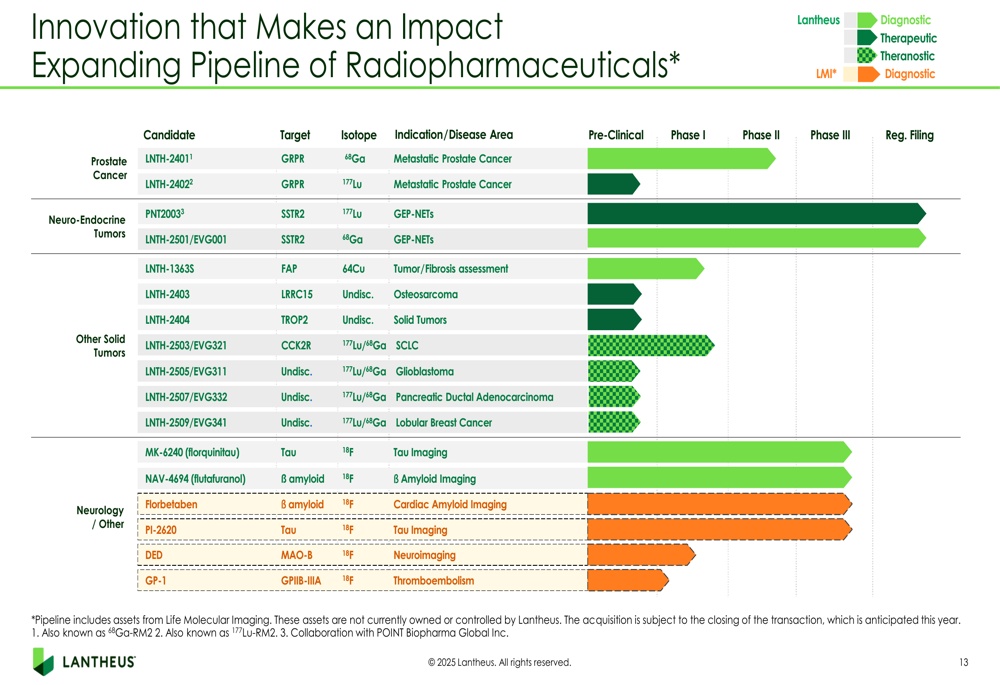

Acquisitions and portfolio structure in the last 12 months:

1. acquisition of global rights to NAV-4694 and RM2 (LNTH-2401/2402) - expansion in Alzheimer's & prostate cancer

2. life molecular imaging

3. evergreen Theragnostics

4. sale of the SPECT business (TechneLite, Neurolite, Cardiolite etc.) to Illuminated/SHINE

Massive investment in R&D (+116 % in 2024) to expand the portfolio.

Guidance 2025:

Sales USD 1.545-1.610 bn,

Non-GAAP EPS USD 7.00-7.20 (February).

In the current Q1 call, EPS guidance was lowered to USD 6.60-6.70 and sales slightly narrowed (USD 1.550-1.585 bn)