The most important rule on the stock market is simple:

The market punishes impatience and rewards perseverance.

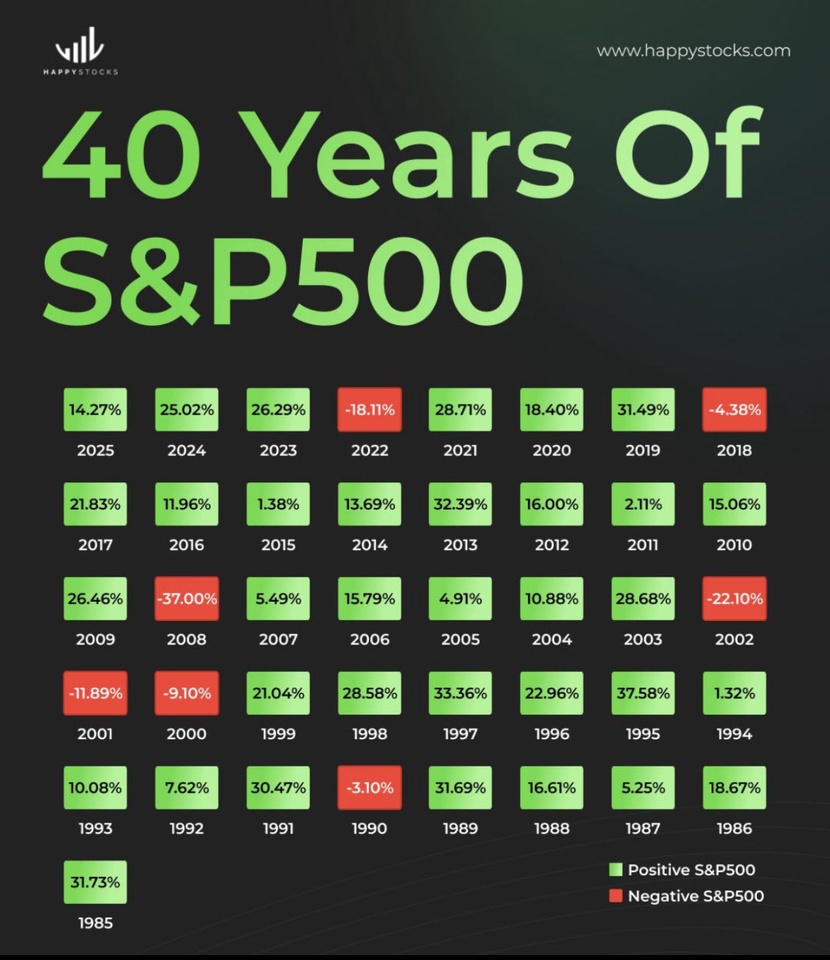

Take a look at the last 40 years in the chart:

- 31 years were "green" (positive).

- Only 9 years were "red" (negative).

That's a clear message: the odds are in your favor in the long term if you stick with it!

The strongest force is your staying

It didn't matter what was going on in the world:

- Wars

- Recessions

- High inflation

- Speculative bubbles

- Pandemics

The line always went up in the end - for all those who stayed invested.

Those who sold in panic missed the inevitable recovery afterwards.

What you really need to do:

You don't have to try to find the perfect time for buying or selling (market timing). That is almost impossible.

All you have to do is hold out longer than everyone else trying to time the market.

The boring path to success

An index fund like $SPY (+1,29 %) (which tracks the S&P 500) may feel "boring". And that's a good thing!

Because: "boring" has made more millionaires than any hype, quick tip or risky gamble ever could.

The S&P 500 is the engine of the world's largest economy. Trust in this engine, stay invested and let time work for you.

Bottom line: Time in the market beats timing the market.

My Youtube channel for more stock analysis: www.youtube.com/@Verstehdieaktie