Is the share price loss due to the acquisition justified or is this a one-off opportunity?

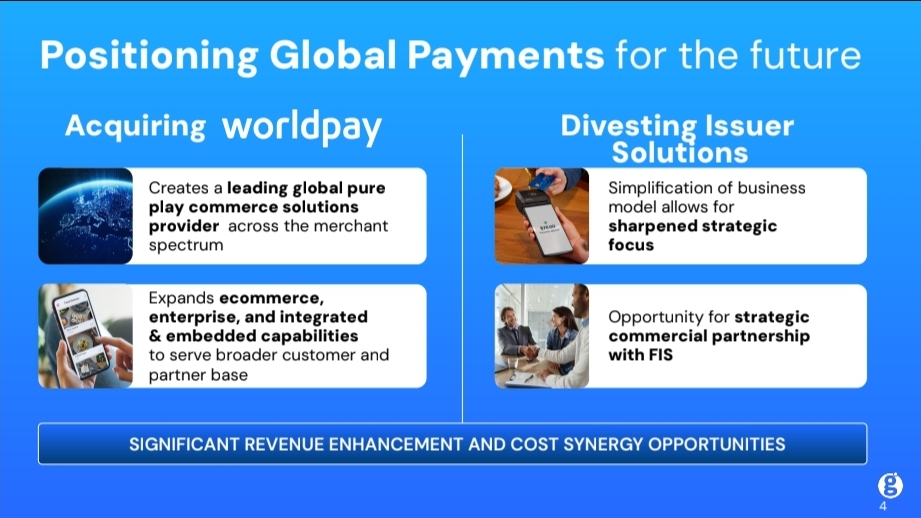

- Worldpay acquired for 22.7 billion dollars,

- Issuer Solutions sold

- Share price falls over 17 % despite strong quarterly figures

- 600m $ cost synergies and

- new focus business model expected

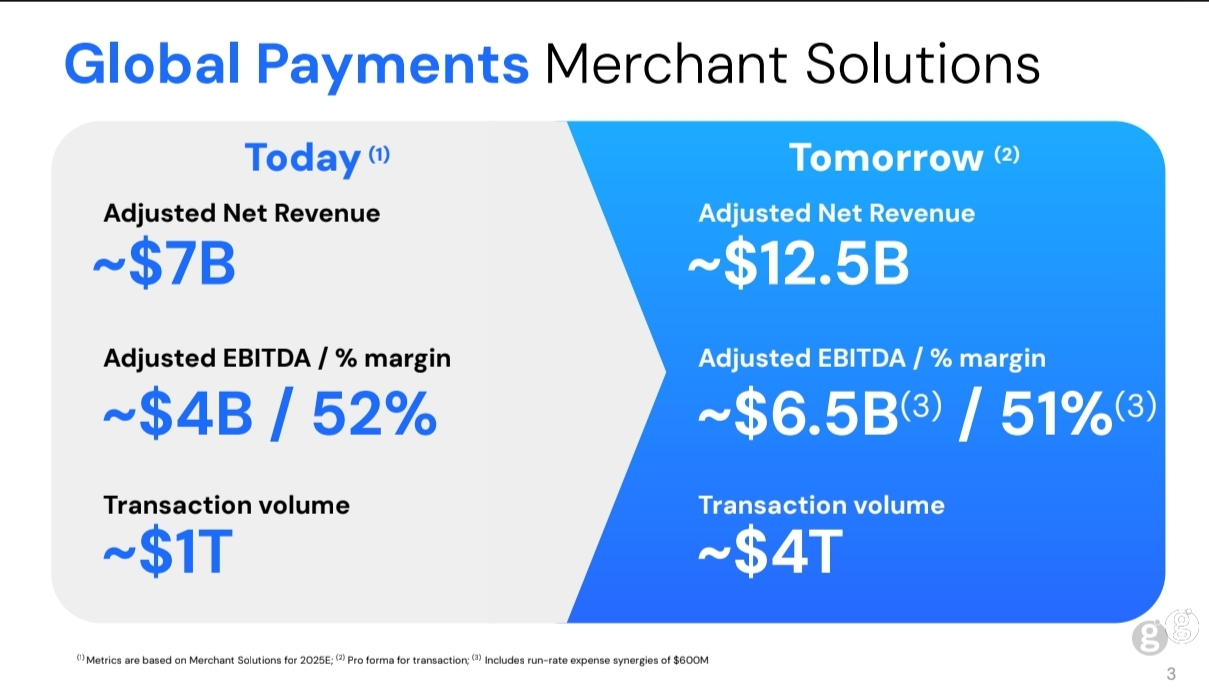

The acquisition is expected to generate 600 million dollars in cost synergies - and at least 200 million dollars in additional revenue. The new company is targeting an adjusted EBITDA of 6.5 billion dollars for 2025. The deal will be financed partly from the sale and partly with fresh debt. Net debt will rise to 3.5 times EBITDA in the short term, but is expected to fall again within two years.

Investors clearly punish this action and the share price falls significantly by almost 20%.

I stick to my guns and increase the position in Global Payments $GPN (-5,41 %) position.