+++ This stock is total garbage, and therefore a buy for me+++.

1. how did I find the stock?

2. general

3. operating business

4. finances

5. who is invested

6. dividend

1. how did I find the share?

"People always eat and drink". You often hear this phrase when talking to people who have a consumer goods company like Nestle in their portfolio. But not only food and drink are necessary for humans, hygiene is also important, because who wants to live with bugs and diseases. To ensure hygiene in industrialized countries, there is the classic garbage collection service that drives around all day, picking up our (avoidable) trash. It is also interesting to know that the amount of garbage in industrialized countries has been steadily increasing in recent years [1].

For those who don't know me yet, I'm still quite young (19years), and am currently building a solid dividend portfolio. I have already opened positions for the portfolio (portfolio is in GQ), and now I want a stock in the portfolio that is boring and crisis resistant. My choice is waste management, because waste management is relatively crisis resistant, besides consumer goods. So I started looking for the largest listed waste management companies, and compared a few candidates. The choices were Veolia, Waste Management and Republic Services. ($VIE (-0,52 %)

$WM (+0,38 %)

$RSG (+0,21 %) ).

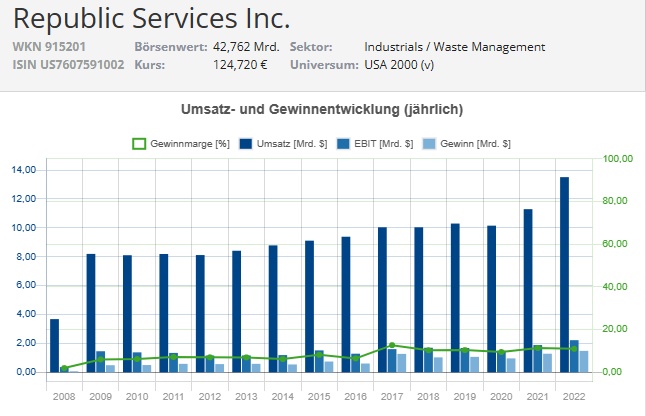

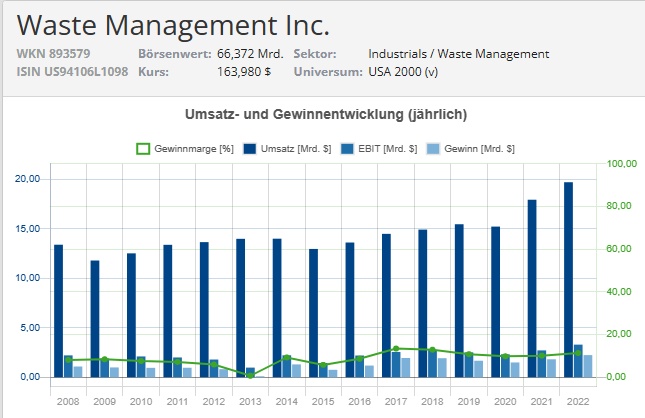

Veolia is the largest international waste management company [2], but is absolutely uninteresting for me in terms of price (cf. trading view excerpt). Waste Management and Republic Services look much better in this aspect. The two companies do not differ much in their operating business, but since WM has the better financial data in terms of dividends, I have decided in favor of this company.

2. general

- Foundation: 1968

- Founders: Wayne Huizenga, Dean Buntrock and Larry Beck

- Headquarters: Housten, Texas

- Employees: 49,500

- CEO: James C. Fish (CEO since 2016)

3. operating business

Waste Management makes its money from our waste. Waste disposal, makes up the largest part of the turnover. Waste disposal includes not only the classic garbage garbage can, but also the removal of bulky waste. In order to be able to store waste for a certain period of time, the company operates 254 landfills for solid waste and 5 landfills for hazardous waste. In addition to pickup and storage, the company also makes money from recycling. Americans don't take recycling, and waste separation, too closely as we do in Europe. The good thing is that WM makes a lot of money by recycling. That's why WM wants to significantly increase their recycling rate in the coming years, as they expect certain raw materials to become more expensive. [3]

Revenue distribution:

- Waste collection: 54.8%

- Landfill services: 19.2%

- Waste sorting, compaction and transfer: 8.9%

- Recycling services: 7.1%

- Other: 10%

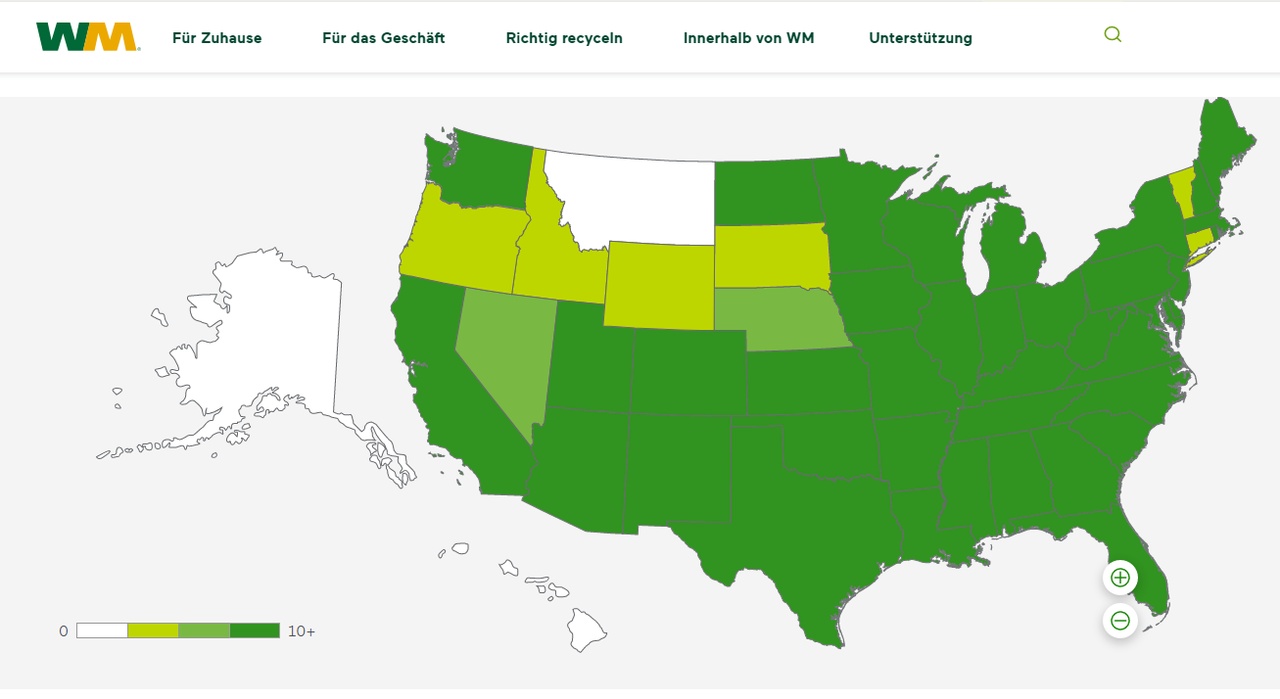

Waste Management operates primarily in the U.S. and Canada. USA (95.7%) / Canada (4.2%)

In the USA, most states have more than 10 WM sites (Cf. Fig.).

4. finance

- Shares outstanding: annual decrease of approx. 1% (Cf. chart).

- https://aktie.traderfox.com/visualizations/US94106L1098/EI/waste-management-inc

5. who is invested

The shares are mainly held by institutional investors: Top 3

- The Vanguard Group, Inc.: 8.78%

- Bill & Melinda Gates Foundation Trust (Investment Management): 8.63%

- Southeastern Asset Management, Inc.: 7.32%

6. dividend

- Current dividend yield: 1.4%

- Dividend paid in 2022: approx. €2.50

- Dividend continuity: 23 years

- Div. increase on 10 year view: approx. 6% p.a.

- Distribution on FCF: approx. 50% p.a.

Sources: (Pictures are from TradingView and TraderFox)

2: https://www.produktion.de/wirtschaft/das-sind-die-groessten-entsorgungsunternehmen-der-welt-108.html