Hello everyone

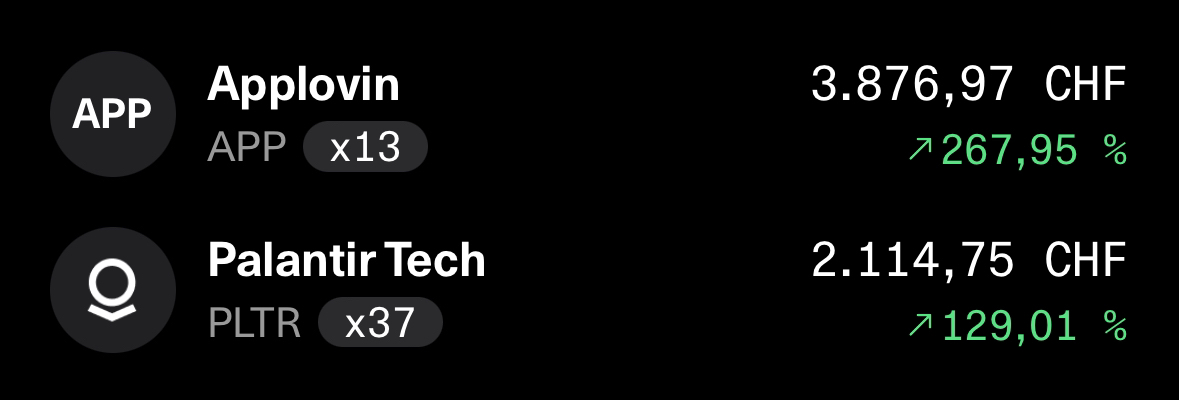

I wanted to know what you do when a stock in your portfolio has risen sharply. In my case it concerns the two shares$PLTR (+4,58 %) and$APP (+7,49 %) n, which have performed very well. As a result, the ratio between ETFs and shares in my portfolio has shifted somewhat.

How would you proceed in such a situation? I am looking forward to your opinions.

Thank you very much!