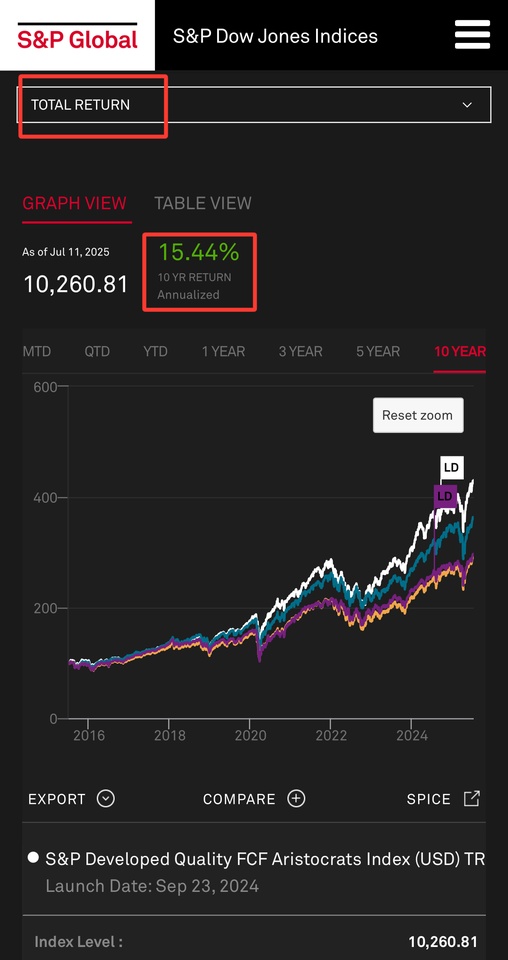

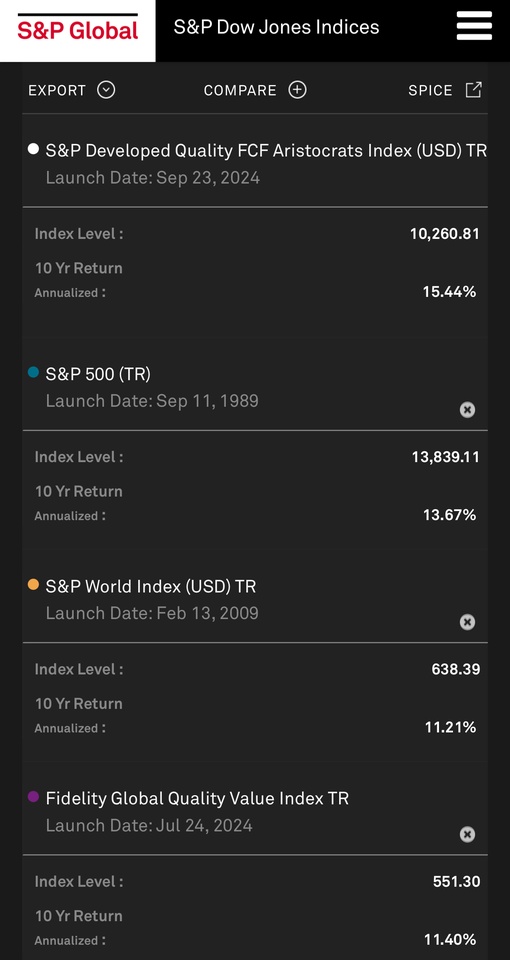

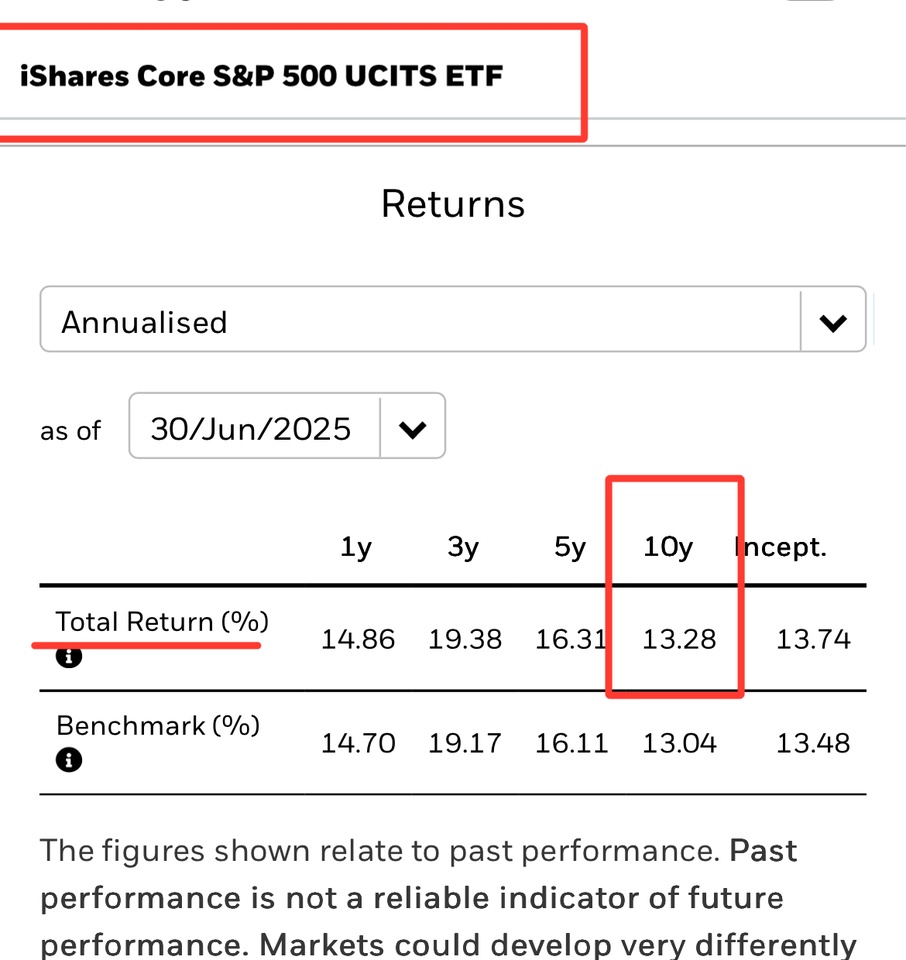

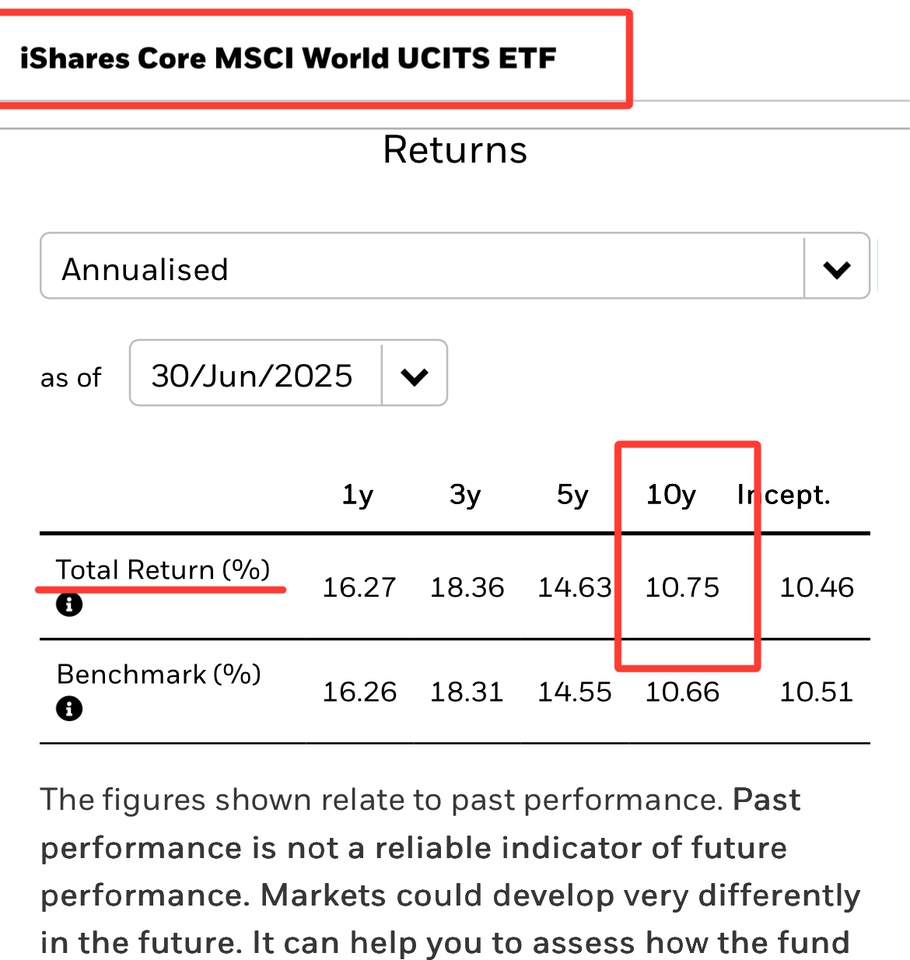

I took a few interesting screenshots comparing $QDEV (-0,24 %) with other popular indexes $IWDA (+0,51 %) , $CSPX (+0,64 %) , $FGEQ (+0,44 %) and $VWRL (-0,01 %)

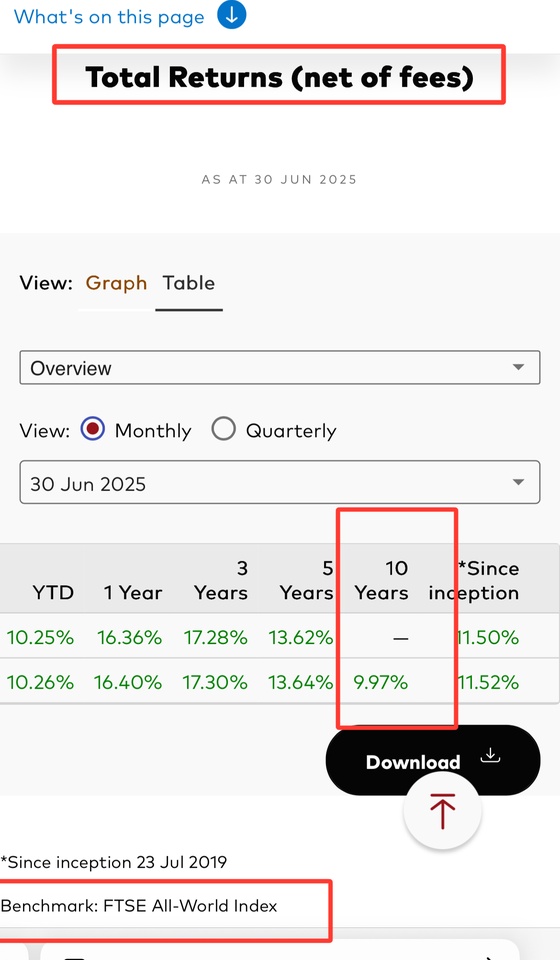

It is about the annualized 10-year total return (price + dividends)

World Quality Aristocrats: ≈15%

MSCI World: ≈11%

S&P500: ≈13%

FTSE All-World: ≈10%

Fidelity: ≈11%